Optical Transceiver Market Size Analysis

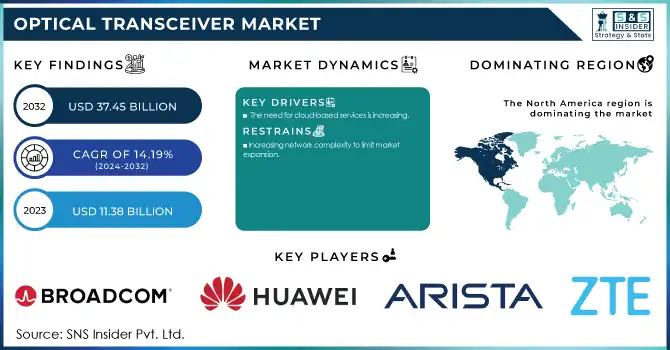

The Optical Transceiver Market size was valued at USD 11.38 in 2023 and is expected to grow to USD 37.45 Billion by 2032 and grow at a CAGR of 14.19% over the forecast period of 2024-2032.

A computer's electrical data streams are converted into optical data signals using an Optical Transceiver, or OT.or convert them into signals that are specific to a laser's wavelength before sending those signals through an optical fiber. They also perform a variety of other tasks, such as modulation transfer, signal detection, optical power control, IV conversions, regeneration of the limiting amplifier decision, and more.

Optical Transceiver Market Size and Forecast

-

Market Size in 2023: USD 11.38 Billion

-

Market Size by 2032: USD 37.45 Billion

-

CAGR: 14.19% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2022–2022

Get more information on Optical Transceiver Market - Request Free Sample Report

Optical Transceiver Market Trends:

-

Surging data center traffic and cloud adoption are driving demand for high-speed optics, with 400G/800G transceiver shipments growing over 35% annually.

-

Expansion of 5G networks is increasing fronthaul and backhaul fiber needs, contributing to over 25% rise in optical transceiver deployments in telecom networks.

-

Rapid growth in hyperscale data centers is fueling demand, as more than 60% of new data center interconnects use high-speed optical modules.

-

Adoption of AI and high-performance computing workloads is boosting need for low-latency optics, improving bandwidth requirements by 40%+ in large clusters.

-

Shift toward energy-efficient and compact pluggable optics (QSFP-DD, OSFP) is accelerating, delivering 20–30% lower power consumption per transmitted bit.

Optical Transceiver Market KEY DRIVERS:

-

Increased need for modern communications

-

The need for cloud-based services is increasing

As 5G technology develops and base stations are deployed, the bearer network is projected to advance and upgrade, leading to an increase in demand for optical communication network equipment. According to the Ericsson mobility report, fixed broadband subscription penetration and LTE network penetration have both grown significantly since 2019 and are expected to continue in the foreseeable future. The fixed broadband connection is expected to increase by 3% annually by 2024, according to the research. Over the forecast period, this is then anticipated to boost the growth of the worldwide Optical Transceiver market.

Optical Transceiver Market RESTRAIN:

-

Increasing network complexity to limit market expansion

Laser diodes and signal decoders are frequently used with Optical Transceivers. The optical pulses produced by laser diodes and the electric signals that the signal decoder converts between the receiver and transmitter are what allow transceivers to function. This procedure works with fiber optic devices and lines, however numerous data centers include copper-based networking equipment that is incompatible with fiber optic transmission. As a result, networks become more complex, which is projected to further impede the growth of the worldwide Optical Transceiver market throughout the forecast period.

Optical Transceiver Market OPPORTUNITY:

-

Growing Innovation

-

Demand for digital services.

During the anticipated period, there are expected to be numerous potential prospects in the global Optical Transceiver market due to the steadily increasing demand for digital services. A key component of modern advanced civilization is data communications. To meet the continuously increasing demand for digital services around the world, optical fiber networks have shown to be promising in carrying data over long distances and delivering it on a massive scale.

Optical Transceiver Market CHALLENGES:

-

Network complexity is increasing

-

Negative effects of the COVID-19 pandemic

-

Applications for big data and cloud computing are expanding quickly

Data centers are managing a sizable quantity of traffic as big data and cloud computing applications continue to rise. Increasing Optical Transceiver speeds has become essential to meet the increased demand for high-bandwidth data transmission while retaining the same power usage, data center space, and cost. Silicon-photonic technology is being used by market players to address this issue since it reduces the size of transceivers and makes design and production simpler by integrating numerous optical components into a single silicon photonic chip. This is boosting the demand for Optical Transceivers, which will likely sustain market expansion in the years to come.

IMPACT OF COVID-19

The COVID-19 outbreak has had a large effect on the world economy, which includes the Optical Transceiver business. Due to the rise in internet usage for remote work, online education, and leisure during the pandemic, Optical Transceivers are now more in demand. However, The total market growth has been impacted by supply chain disruptions, production halts, and logistical difficulties. Due to factory closures, import and export bans, and reduced manufacturing capacity brought on by the COVID-19 epidemic, there is a shortage of vital parts needed to make Optical Transceivers. The epidemic has also impacted the distribution of finished goods and the availability of skilled labor, which has caused delayed shipments and longer lead times.

KEY MARKET SEGMENTS:

By form factor

-

SFF & SFP

-

QSFP

-

CFP

-

XFP

-

CFP

By Data Rate

-

Less than 10 Gbps

-

Gbps to 40 Gbps

-

Gbps to 100 Gbps

-

More than 100 Gbps

By Fiber Type

-

Single-mode fiber

-

Multimode fiber

By Distance

-

Less than 1 km

-

1-10 km

-

11-100 km

-

More than 100 km

By wavelength

-

850 nm band

-

1310 nm band

-

1550 nm band

-

Others

By application

-

Telecommunication

-

Data centers

By connector

-

LC connector

-

SC connector

-

MPO connector

-

RJ-45

Optical Transceiver Market REGIONAL ANALYSIS

-

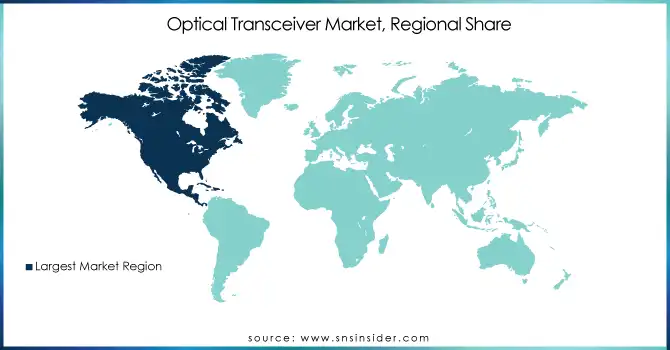

North America is among the areas that is anticipated to obtain a significant market share for Optical Transceivers worldwide,Over the projection period.This may be caused by the enormous internet penetration and the changing communication landscape. Improved connectivity is in high demand as a result of these changes, which also increases the demand for Optical Transceivers in the area. Additionally, as businesses throughout the world adjust to a post-pandemic future, major investment in network infrastructure transformation in the region is also anticipated to boost market expansion in the region.

-

Asia Pacific is predicted to have significant expansion in the worldwide Optical Transceiver market over the course of the forecast period. Due to the region's consistently developing communication technologies, In this region, telecom network operators are building fibre.

Need any customization research on Optical Transceiver Market - Enquiry Now

REGIONAL COVERAGE:

North America

-

USA

-

Canada

-

Mexico

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

Asia-Pacific

-

Japan

-

South Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

Latin America

-

Brazil

-

Argentina

-

Rest of Latin American

KEY PLAYERS

The major players are ZTE Corporation, A Arista Networks Inc., Huawei Technologies Co., Ltd., Fujitsu Optical Components Limited, Broadcom Inc., Juniper Networks, Inc., Sumitomo Electric Industries Ltd, Cisco Systems, Inc., NEC Corporation, Lumentum Operations LLC, and other players are listed in the final report.

RECENT DEVELOPMENTS

-

NeoPhotonics, a top creator and manufacturer of optoelectronic and laser systems, was purchased by Lumentum Operations LLC in November 2021 for US$ 16.00 per share in cash, or roughly US$ 918 million in total equity.

-

Fujitsu Optical Components Ltd. announced the creation of the 400Gbps DWDM open systems CFP2-DCO coherent transceiver in March 2022 and started to increase sales in the second half of 2021.

-

Smiths Interconnect unveiled their LightCONEX optical plug-in and backplane module connectors in February 2022. For VPX systems, integrating an Optical Transceiver into the plug-in module connection is probably a ground-breaking approach.

-

The enhanced portfolio of 100Gb, 200Gb, 400Gb, and 800Gb electro-optic platform solutions for cloud networks was released by Broadcom Inc. in June 2021.

| Report Attributes | Details |

| Market Size in 2022 | USD 11.38 Billion |

| Market Size by 2032 | USD 37.45 Billion |

| CAGR | CAGR of 14.19% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By form factor (SFF & SFP, QSFP, CFP, XFP, CFP) • By data rate (Less than 10 Gbps, Gbps to 40 Gbps, Gbps to 100 Gbps, More than 100 Gbps) • By fiber type (Single-mode fiber, Multimode fiber) • By Distance (Less than 1 km, 1-10 km, 11-100 km, More than 100 km) • By wavelength (850 nm band, 1310 nm band, 1550 nm band, Others) • By Application (Telecommunication, Data centers) • By connector (LC connector, SC connector, MPO connector, RJ-45) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ZTE Corporation, A Arista Networks Inc., Huawei Technologies Co., Ltd., Fujitsu Optical Components Limited, Broadcom Inc., Juniper Networks, Inc., Sumitomo Electric Industries Ltd, Cisco Systems, Inc., NEC Corporation, Lumentum Operations LLC |

| Key Drivers | • Increased need for modern communications • The need for cloud-based services is increasing |

| Market Opportunities | • Growing Innovation • Demand for digital services. |