HYPERSCALE DATA CENTER MARKET SIZE:

To get more information on Hyperscale Data Center Market - Request Free Sample Report

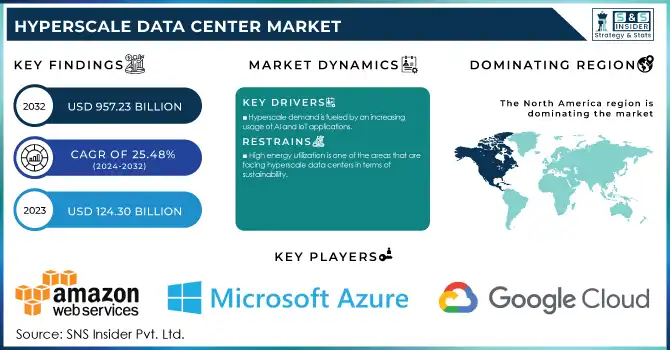

The Hyperscale Data Center Market Size was valued at USD 124.30 Billion in 2023 and is expected to reach USD 957.23 Billion by 2032 and grow at a CAGR of 25.48% over the forecast period 2024-2032.

Hyperscale data center market witnessed phenomenal growth due to the ever-increasing demand for data storage and processing power as digital transformation continues across the world. The growth of the market is also backed by the government policies of countries like Japan, China, USA, France, Germany, and India as they brought forth initiatives for improving digital infrastructure and ensuring better data security. For instance, Japan has put forth cloud solution adoption policies, forcing corporations to hyperscale data solutions. In China, such initiatives as the New Infrastructure Plan by the government boost investments in data centers and cloud computing as well as AI technology, accelerating its hyperscale data growth dramatically. The United States is at the top for hyperscale development. For this, the United States has adopted the federal policy on data center sustainable use of energy. The latter is expected to bring the carbon emission to 50% by 2030. France and Germany also caught up by developing green policies in the field of data center construction in order to push for more hyperscale data center constructions with better energy efficiency.

Technology advancements are also instrumental in forming the landscape of the hyperscale of the data center. According to the International Energy Agency internet traffic rose 600%, and data center workloads surged 340%. In 2024, innovations such as modular data center designs and advanced cooling technologies - including immersion cooling and liquid cooling - have emerged and are helping data centers scale up and become more eco-friendly. Multi-hyperscale data centers came into operation in 2023 in policy-friendly states, such as India with its Digital India initiative encouraging data center growth to promote local enterprises. Cloud vendors and tech behemoths like Amazon Web Services, Microsoft Azure, and Google Cloud are increasing their hyperscale facilities to accommodate emerging demands in technologies such as AI and IoT.

Enormous future prospects in the hyperscale data center market globally and in different regions by wide-ranging initiatives to open access to advanced hyperscale solutions with the advent of artificial intelligence, green data centers, and 5G. According to some reports, incentives on green building constructions are being increased massively; as an example, not just in the EU and also within the US, to put operators into a sort of compulsion towards renewably powered hyperscale centers. Low latency, very-high-performance computing will enhance rapidly as edge computing popularity becomes widespread.

Hyperscale Data Center Market Dynamics:

KEY DRIVERS:

-

Global digitization increases demand for hyperscale data centers.

Hyperscale data centers are highly important for managing huge amounts of data as the global digitization is in an increasingly adopting phase, which also involves smart cities, cloud applications, and big data analytics. World Economic Forum states that digital transformation will add USD 100 trillion to the world economy. In Japan, it is the government's policies on digitization and good investments in smart infrastructure, which are compelling enterprises to shift to the cloud. In India, initiatives under the Digital India program are making major technology players build hyperscale data centers supporting the growing online ecosystem. Similarly, the EU's aspiration to make the economy digital has also promoted increased reliance on data centers, forcing companies to implement hyperscale facilities to process vast data loads in highly efficient and secure ways.

-

Hyperscale demand is fueled by an increasing usage of AI and IoT applications

AI and IoT are evolving at a great speed, and hence, an enormous amount of data is being processed and stored which can only be served through hyperscale data centers. AI is increasingly being integrated into healthcare, manufacturing, and finance sectors, increasing data center workloads. A report shows that AI investments globally have grown 30% year over year in 2023. The number of IoT devices is expected to increase to almost close to 30 billion in 2030, generating enormous volumes of data that demand efficient and scalable storage. AI applications in public safety and transportation have resulted in the increase of 20% data traffic in China, therefore, it is demanding hyperscale data solutions to back smart city projects. In the United States, this trend has been witnessed in the same manner in which over 80% large enterprises rely on AI and IoT technologies with the support of hyperscale data centers, creating huge demand in the segment.

RESTRAIN:

-

High energy utilization is one of the areas that are facing hyperscale data centers in terms of sustainability.

Deployment of data centers with new AI applications has been one of the prominent drivers for near-term electricity demand growth. According to estimates of the Electric Power Research Institute, data centers will take an up to 9% share of the total US generation of electricity per annum by 2030. Data centers, in 2023, constitute just 4% of total load. The strict rules around energy use that various governments are implementing - specifically across Europe - force companies in the sector to curb data centers' carbon footprint: Europe's commission made carbon-neutral data centers by 2030 a necessity. Meeting the above needs will involve enormous investments in energy-efficient technologies, renewable energy sources, and solutions to cooling, which will imply raise operational costs.

For instance, liquid and immersion cooling technologies are costly and complex to implement. The U.S government guidelines for energy efficiency also encourage data centers to embrace renewable energy sources, which will be tough to source necessarily.

Hyperscale Data Center Market Key Segment

BY COMPONENT

Solutions led in 2023, accounting for 61% of the market due to the basic requirement for sophisticated, reliable infrastructure within hyperscale facilities. Key areas such as power and cooling, which are critical to maintaining optimal operating conditions, drove significant investment from data center operators in these foundational solutions. As loads on data increase, and demand for efficient cooling and networking increases, the solutions continue to be needed to keep hyperscale centers stable and scalable.

In contrast, Services are going to experience the highest growth rate at a CAGR of 25.99% between 2024 and 2032 because growing market demand continues to be sought by the data center in search of specialized expertise in deploying and maintaining complex environments.

BY END-USE

Cloud Providers continued to lead the hyperscale data center market in 2023 with a strong 62% market share. This segment is primarily impacted by the data of the global cloud majors, including Amazon Web Services, Microsoft Azure, and Google Cloud, which are constructing hyper-scale facilities to meet growing applications and data stored through cloud. As businesses continue to shift towards cloud computing for better scalability and flexibility, hyperscale data centers in the cloud will likely increase.

However, Colocation Providers will grow the fastest from 2024 to 2032. With enterprises seeking economical, scalable solutions, the popularity of colocation is increasing, especially among small companies and regional businesses that do not have the resources to build their own facilities.

Hyperscale Data Center Market Regional Analysis

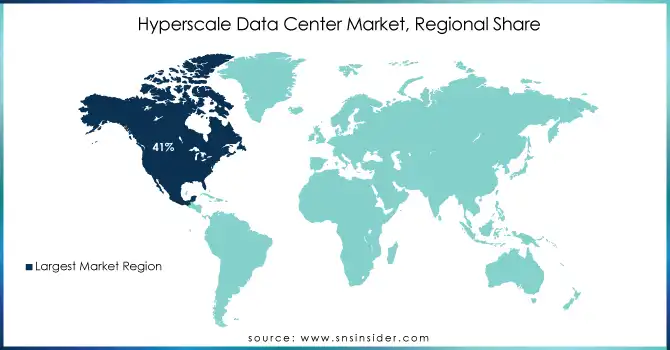

In 2023, North America dominated the hyperscale data center market, accounting for 41% share. Its dominance is seen in high levels of key technology firms and cloud providers that have shown immense interest in making investments, due to encouraging government policies. The US has dominated this space and has shown incredible growth and development through tremendous investments into sustainable technologies and advanced data management systems.

Asia Pacific would be the fastest-growing at 26.80% cagr over the forecast period of 2024 to 2032, mainly driven by the intensified digitization strategies in such countries as China, Japan, and India.

As both governments call for significant investments in the cloud, as well as data centers, China's New Infrastructure Plan and the Digital India initiative by Indian government triggered demand for hyperscale facilities. With further growth of the Asia Pacific economies, the hyperscale market is expected to grow exponentially, with such increased adoption of technology and rising demand for high-performance data storage solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Hyperscale Data Center Market Companies

Some of the major players in the Hyperscale Data Center Market are

-

Amazon Web Services (AWS) (Compute, Storage)

-

Microsoft Azure (Virtual Machines, Storage)

-

Google Cloud (BigQuery, Cloud Storage)

-

IBM (Cloud Servers, Network Services)

-

Facebook (Networking Equipment, Storage Solutions)

-

Alibaba Cloud (Elastic Compute Service, Storage)

-

Oracle (Autonomous Database, Compute Infrastructure)

-

Tencent Cloud (Server Hosting, Database Services)

-

Baidu (Cloud Storage, Compute Resources)

-

Cisco (Data Center Switching, Security Solutions)

-

HPE (Rack Servers, Storage Solutions)

-

Dell Technologies (PowerEdge Servers, Data Storage)

-

Huawei (Network Hardware, Storage Solutions)

-

Equinix (Interconnection, Colocation Services)

-

Digital Realty (Data Center Hosting, Interconnection)

-

Iron Mountain (Data Center Solutions, Colocation Services)

-

Rackspace Technology (Cloud Hosting, Migration Services)

-

Fujitsu (Data Center Solutions, Network Services)

-

Lenovo (Data Center Servers, Storage Solutions)

-

Hitachi (Compute Solutions, Storage Systems)

MAJOR SUPPLIERS (Components, Technologies)

-

Intel (Processors, Storage Solutions)

-

AMD (CPUs, GPUs)

-

Nvidia (GPUs, Networking Components)

-

Broadcom (Networking Chips, Fiber Optics)

-

Samsung Electronics (Memory, Storage)

-

Micron Technology (Memory, Storage Solutions)

-

SK Hynix (Memory Chips, SSDs)

-

Seagate (Storage Devices, HDDs)

-

Western Digital (SSDs, Storage Devices)

-

Arista Networks (Switches, Network Equipment)

-

Juniper Networks (Routers, Switches)

-

Eaton (Power Management, UPS Systems)

-

Schneider Electric (Cooling Systems, Power Solutions)

-

Vertiv (Power Management, Cooling Systems)

-

CommScope (Cabling, Connectivity Solutions)

-

Corning (Optical Fiber, Cables)

-

Sumitomo Electric (Fiber Optics, Cables)

-

Finisar (Optical Transceivers, Fiber Optics)

-

Lattice Semiconductor (FPGA Solutions, Connectivity)

-

TE Connectivity (Cabling, Data Center Interconnects)

MAJOR CLIENTS

-

Apple

-

Netflix

-

Salesforce

-

Zoom

-

Spotify

RECENT TRENDS

June 2024: Microsoft announced availability of its first datacenter region in Mexico: Mexico Central, for any and all organizations around the world, providing local access to scalable, highly available and resilient cloud services while confirming its commitment to promoting digital transformation and sustainable innovation in the country, providing cutting-edge technology for companies like Binaria ID y DocSolutions, among others. According to IDC Mexico Microsoft Cloud Dividend Snapshot, over the next four years, Microsoft, its partners, and cloud-using customers will together generate globally about USD 70.7 billion in new revenues above the 2024 level. This will drive investment in local economies and will create more than 300,000 jobs in different industries in Mexico.

October 2024: HyperSCALE and Edge data center provider Cologix secured some USD 1.5bn debt and equity financing for funding plans on growth. The operating firm, with locations over North America, has setup its USD 1 billion Multi-Audit Development Debt facility whilst raised USD 500M, by new and existing investor funding. According to this owner of Stonepeak firm Cologix said; it will offer "flexibility in adding new sites to meet demand over time…enabling the quickness capital available to fund projects from need."

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 124.30 Billion |

| Market Size by 2032 | US$ 957.23 Billion |

| CAGR | CAGR of 25.48 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions (Cooling, Power, Networking Equipment, DCIM, LV/MV Distribution), Services (Installation and Deployment, Maintenance and Support, Consulting)), • By End-Use (Cloud Providers, Colocation Providers, Enterprises), • By Industries (BFSI, IT and Telecom, Government and Defense, Entertainment and Media, Others), • By Data Center Type (Hyperscale Self Build, Hyperscale Colocation) • By Enterprise Size (Large Enterprises, SMEs), • By Infrastructure (Electrical Infrastructure, Mechanical Infrastructure, Cooling System, Cooling Technique, General Construction) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon Web Services, Microsoft Azure, Google Cloud, IBM, Facebook, Alibaba Cloud, Oracle, Tencent Cloud, Baidu, Cisco, HPE, Dell Technologies, Huawei, Equinix, Digital Realty, Iron Mountain, Rackspace Technology, Fujitsu, Lenovo, Hitachi. |

| Key Drivers |

|

| Restraints |

|