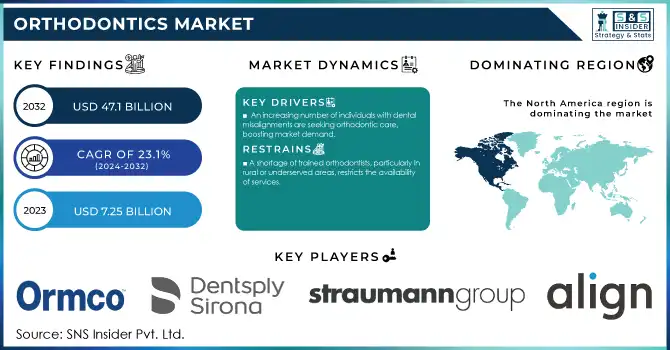

Orthodontics Market Size & Overview:

The Orthodontics Market Size was valued at USD 7.25 billion in 2023, is projected to grow at a CAGR of 23.1% to reach USD 47.1 billion by 2032 over the forecast period 2024-2032. The global orthodontics market is witnessing substantial growth. The key factors responsible for the growth include the increasing incidence of dental malocclusion and other oral diseases. The World Health Organization estimates that 60-70% of the population has some form of malocclusion, so there is a huge potential for orthodontic treatment. In the United States, the Centers for Disease Control and Prevention (CDC) reports that over 60% of adolescents have experienced tooth crowding or misalignment, further emphasizing the need for orthodontic interventions. Consumer awareness towards aesthetic and oral hygiene, especially amongst the geriatric population, has also supplemented the growth of the market. The American Association of Orthodontists notes that adult patients now comprise more than 25% of all orthodontic treatments, a significant increase from previous decades.

To get more information on Orthodontics Market - Request Free Sample Report

Orthodontics market growth is mainly attributed to innovations in orthodontic products and methods. The introduction of clear aligners, 3D printing for customized appliances, and digital treatment planning has revolutionized the field, offering more comfortable and aesthetically pleasing options for patients. Increased awareness regarding oral health due to government initiatives has further fuelled the growth of this market. For example, the National Oral Health Program by the Indian government aims to increase awareness of oral health, and access to dental care which in turn would also indirectly boost the orthodontics market. The European Federation of Orthodontic Specialists Associations (EFOSA) is a pan-European federative network for the promotion of orthodontic education and research in Europe directly supporting market expansion. The COVID-19 pandemic initially caused a temporary setback but has since led to increased demand for orthodontic treatments, as more people focus on self-improvement during remote work and social distancing periods.

Orthodontics Market Dynamics

Drivers

-

Innovations such as 3D printing, digital imaging, and AI-driven treatment planning have enhanced the precision and efficiency of orthodontic treatments, leading to increased adoption.

-

An increasing number of individuals with dental misalignments are seeking orthodontic care, boosting market demand.

-

A heightened focus on dental aesthetics, especially among adults, has led to a surge in demand for discreet orthodontic solutions like clear aligners.

Rapid advancements in technology, especially in digital & AI-powered treatment solutions are a major growth factor for the orthodontic market. These advances redefine orthodontic care around the world, allowing orthodontists to provide both greater precision and efficiency while also improving the delivery of care and the patient experience. As an example, 3D printing has changed the way we produce orthodontic devices (clear aligners, retainers, etc.). Invisalign and other companies utilize a sophisticated 3D printing method to print aligners and according to Align Technology Number of Aligners Printed in 2024 report more than 500,000 unique sets of aligners are generated every day. Cone beam computed tomography and other digital imaging systems are allowing orthodontists to obtain high-resolution, three-dimensional images of the patient's oral anatomy. Such accuracy helps us develop individualized treatment plans and forecast the outcomes. As per the study by the American Orthodontic Society 2024, there are around 30% of time savings for diagnosis made possible by the use of traditional imaging when compared to the CBCT systems.

A significant role is also being played by artificial intelligence (AI). OrthoFX and Dental Monitoring are other AI software powered items that need little to no clinic visits through algorithms powered analysis to track how your treatment is going at a distance. According to a 2023 survey of U.S. orthodontists, 42% of respondents are using AI solutions to optimize workflows and enhance patient communication. Such technological advances not only improve the overall efficiency of orthodontic care, but also increase its convenience and attractiveness to patients, and are responding to some of the demands of the changing landscape regarding convenience and accuracy in dentistry.

Restraints:

-

The significant expenses associated with orthodontic procedures can deter potential patients, limiting market growth.

-

A shortage of trained orthodontists, particularly in rural or underserved areas, restricts the availability of services.

The high price of orthodontic treatments and appliances presents the main obstacle to their wide acceptance, especially in middle- and low-income populations. Braces, aligners, and surgical procedures cost a lot of money these include consultation charges, diagnostic tests, and follow-up appointments. Technologies such as clear aligners or bespoke lingual braces are available but can increase costs significantly because they require digital printing and specialist materials.

This financial burden is compounded in regions lacking comprehensive dental insurance coverage or government subsidies for orthodontic care. Regardless, most patients are discouraged from pursuing treatment by high out-of-pocket expenses or partial reimbursements, even in insured populations. Furthermore, the long-time that orthodontics typically takes ranging from months to even years increases the cost greatly, so cost is a huge concern. Consequently, a sizable portion of the market is unable to work towards a solution, leading stakeholders in the ecosystem to seek out low-cost solutions or subscription-based payment options for access.

Orthodontics Segmentation Insights

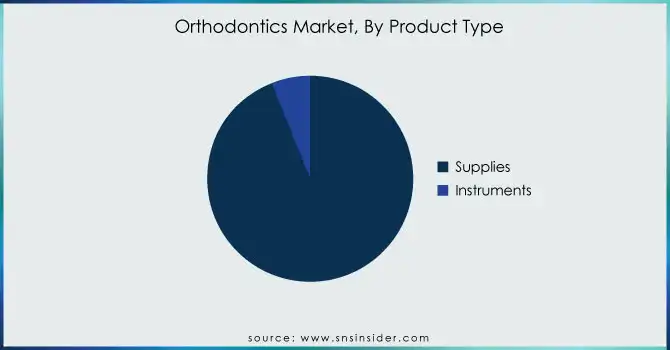

By Product Type

In 2023, the supplies segment held the largest share of the global orthodontics market. There are many reasons for this trend, starting with the fact that orthodontic products are disposable, so regular replacements are required. Orthodontic supplies, such as brackets, wires, bands, and elastics, are critical for the majority of therapies and are regularly replaced during the treatment process. According to the American Dental Association, the average orthodontic treatment duration is 22 months, necessitating multiple supply replacements. The majority market share of supplies is also attributable to rising patient size and increasing adoption of orthodontic treatments, worldwide. Employment of orthodontists is projected to grow 5% from 2019 to 2029, according to U.S. Bureau of Labor Statistics, reflecting growing demand for orthodontic services, and by extension, supplies.

The instruments segment is anticipated to exhibit a faster growth trajectory due to technological developments in orthodontic instruments. Use of digital scanners, 3D printers, and CAD/CAM systems is being more frequent in orthodontic practice. These high throughput orthodontic instruments have gained traction in the market owing to high-end approvals in recent years by the U.S. Food and Drug Administration (FDA) which has opened up a wider scope of adoption.

By age group

The adults segment accounted for the most significant share of the global orthodontics market in 2023. This trend marks a substantial change in the demographic of orthodontic patients and is driven by several factors. Particularly, adults have become more aware of oral health and the beauty of a straight smile. According to the American Association of Orthodontists, the percentage of adult patients seeking orthodontic treatment has increased 40 percent over the past decade. This increase is also the result of finding more discreet methods of treatment, including clear aligners and lingual braces, attractive options for adult patients. Moreover, workers and parents finally have a little extra spending money for orthodontic services. In the past years, the U.S. Bureau of Labor Statistics data reflects that median weekly earnings for full-time workers aged 25 and over have steadily risen, thereby allowing more adults to afford to take care of their oral health. In addition, the growth of social media and the increased importance placed on personal appearance in the work environment have affected adults seeking for orthodontics treatment. A study published in the Journal of Clinical Orthodontics found that 75% of adults believe that an improved smile would boost their career prospects. Secondly, some governmental campaigns to make the population aware of oral health have also influenced adult orthodontic therapy. For instance, the Centers for Disease Control and Prevention's Division of Oral Health has implemented various programs to improve oral health across all age groups, indirectly benefiting the adult orthodontics market.

By End user

The dentist & orthodontist-owned practices segment accounted for a larger share of the market in 2023. Orthodontics are specific types of treatments and care that people wish to have direct and individual expertise, and this must be a major part of their preferences leading to this eventual scenario. The U.S. Bureau of Labor Statistics reported that about 26% of dentists, including orthodontists, were self-employed in 2020, indicating a strong presence of privately owned practices in the market. Bigger patient bases are attracted to these specialty practices that provide comprehensive orthodontic services, leverage the latest technologies, and deliver individualized treatment plans. Approximately 26% of dentists, such as orthodontists, were self-employed in 2020, according to the U.S. Bureau of Labor Statistics, showing that privately owned practices are prevalent in the market. A survey of 1,000 adults from the American Association of Orthodontists found that 78% of those patients prefer their orthodontic treatments to be provided by a specialist rather than a general dentist. Additionally, government regulation and insurance policies support specialist-owned practices. For example, in the US many plans require referrals to orthodontic specialists for specific procedures, leading patients to these offices. Furthermore, the implementation of the Affordable Care Act has increased access to dental care, including orthodontic care, possibly benefiting practices owned by specialists.

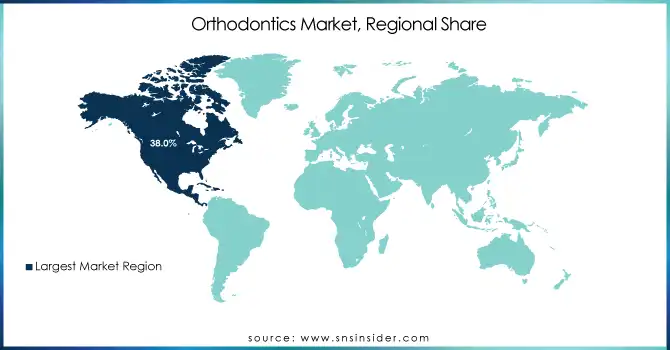

Orthodontics Market Regional Analysis

The global orthodontics market was led by the North American region with a 38.0% share of the market in 2023 A combination of reasons such as better healthcare infrastructure, high oral hygiene awareness, and higher expenditure on dental care contribute to this dominance. Despite the pandemic, the American Dental Association estimated that dental spending in the U.S. was $142.4 billion in 2020. Further, the market is led by the region and supported by the presence of key market players, providing new innovative technologies/gadgets for orthodontic treatments.

During the forecast period, the Asia-Pacific region is expected to grow at the highest CAGR. This sharp expansion with volatile growth in disposable income, rising awareness towards oral health, and a huge base population. In China, the National Health Commission reported that the prevalence of malocclusion among 12-year-olds was 72.92% in 2020, indicating a vast potential market for orthodontic treatments. The orthodontics market is also growing fast in India, as the Indian Dental Association estimates that around 20-30% of the population needs orthodontics treatment of one type or another. This is expected to further enhance the market growth in the region, owing to various government initiatives in these countries, including China's Healthy China 2030 plan and India's National Oral Health Program.

Get Customized Report as per Your Business Requirement - Enquiry Now

Recent Developments

-

In January 2024, Henry Schein, Inc. launched the Carriere Motion Pro bite corrector for Class II and III occlusion treatment to reduce the time taken in orthodontic procedures.

-

Koninklijke Philips N.V. in February 2023 joined Candid Care Co. to offer the company's extended line of oral care products, including orthodontic and teeth whitening solutions.

Key Players

Key Service Providers/Manufacturers

-

Align Technology (Invisalign, iTero Scanner)

-

Straumann Group (ClearCorrect Aligners, Orthocaps)

-

Dentsply Sirona (SureSmile Aligners, In-Ovation Braces)

-

3M Oral Care (Clarity Aligners, Incognito Braces)

-

Ormco Corporation (Damon Braces, Spark Aligners)

-

Henry Schein Orthodontics (SLX Clear Aligners, Carriere Motion Appliance)

-

American Orthodontics (Empower Braces, Radiance Plus Brackets)

-

G&H Orthodontics (Titanium Orthodontic Wires, Aligner Chewies)

-

Rocky Mountain Orthodontics (Mini Sprint Brackets, RMbond Adhesives)

-

TP Orthodontics (Inspire ICE Brackets, TruForce Archwires)

-

Great Lakes Dental Technologies (ASTICS Retainers, MiniScope Appliances)

-

DynaFlex (ClearFusion Aligners, Hyrax Expanders)

-

Forestadent (Quick Brackets, BioStarter Springs)

-

Dentaurum (Discovery Brackets, rematitan Wires)

-

Adenta GmbH (Evolution Brackets, EasyFit Bands)

-

Shinye Orthodontic Products (Ceramic Brackets, Niti Archwires)

-

JJ Orthodontics (Lingual Buttons, Molar Bands)

-

Tomy Inc. (Incognito Lite Braces, TWINLOCK Brackets)

-

Hubit Co., Ltd. (Clear Aligner System, Orthodontic Mini Screws)

-

BioMers Products (SimpliClear Braces, Fiber Reinforced Composites)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.25 Billion |

| Market Size by 2032 | USD 47.1 Billion |

| CAGR | CAGR of 23.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Age Group (Teens, Adults) • By Product Type (Instruments, Supplies {Fixed [Brackets, Bands & Buccal Tubes, Archwires, Others]}, {Removable [Aligners, Retainers, Others]}) • By End-user (Dentist & Orthodontist Owned Practices, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Align Technology, Straumann Group, Dentsply Sirona, 3M Oral Care, Ormco Corporation, Henry Schein Orthodontics, American Orthodontics, G&H Orthodontics, Rocky Mountain Orthodontics, TP Orthodontics, Great Lakes Dental Technologies, DynaFlex, Forestadent, Dentaurum, Adenta GmbH, Shinye Orthodontic Products, JJ Orthodontics, Tomy Inc., Hubit Co., Ltd., BioMers Products |

| Key Drivers | • Innovations such as 3D printing, digital imaging, and AI-driven treatment planning have enhanced the precision and efficiency of orthodontic treatments, leading to increased adoption. • An increasing number of individuals with dental misalignments are seeking orthodontic care, boosting market demand. |

| Restraints | • The significant expenses associated with orthodontic procedures can deter potential patients, limiting market growth. • A shortage of trained orthodontists, particularly in rural or underserved areas, restricts the availability of services. |