Ostomy Care and Accessories Market Size Analysis:

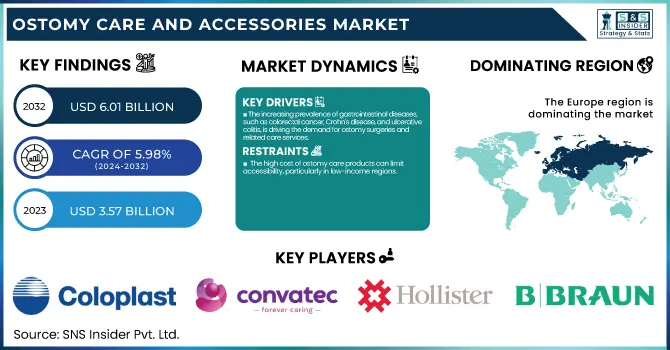

The Ostomy Care and Accessories Market Size was valued at USD 3.57 billion in 2023 and is expected to reach USD 6.01 billion by 2032, growing at a CAGR of 5.98% over the forecast period 2024-2032.

To Get more information on Ostomy Care and Accessories Market - Request Free Sample Report

The Ostomy Care and Accessories Market report helps an understanding of the key trends and developments in the Ostomy Care and Accessories Market and also highlights the increasing incidence and prevalence rates of ostomy-related conditions such as colorectal cancer and IBD, across regions. It analyzes prescription trends for ostomy supplies, flagging regional adoption and patient compliance. The report also studies volume and demand growth in the market, along with production and sales trends analysis. It covers healthcare spending patterns, and what governments and insurers spend. The report also covers technology developments such as smart ostomy devices and analyzes the regulatory landscape shaping their approval and compliance. This analysis provides a comprehensive overview of market dynamics, aiding stakeholders in strategic decision-making. Factors such as the growing prevalence of gastrointestinal diseases and government initiatives to optimize the healthcare infrastructure are driving the growth of the ostomy care and accessories market. The U.S. held a 15% revenue share of the global market in 2023, reflecting its advanced healthcare system and high incidence of conditions requiring ostomy procedures.

Ostomy Care and Accessories Market Dynamics

Drivers

-

The increasing prevalence of gastrointestinal diseases, such as colorectal cancer, Crohn's disease, and ulcerative colitis, is driving the demand for ostomy surgeries and related care services.

The increasing disease incidence rate around the world, especially gastrointestinal diseases such as colorectal cancer, Crohn's disease, and ulcerative colitis is an ED driver for the ostomy care & accessories market. Colorectal cancer (CRC) ranked as the third most prevalent human malignancy worldwide in 2020, with more than 1.9 million new cases and over 930,000 deaths. By 2040, however, incidence is predicted to jump to 3.2 million new cases per year (a 63% increase), and deaths are estimated to rise 73% to 1.6 million per year. Inflammatory bowel diseases (IBDs) like Crohn's disease and ulcerative colitis are increasingly common at the same time. It is estimated that 180,000 Australians have IBDs, making this one of the countries with the highest IBD rates globally. This spike is caused by factors like the intake of ultra-processed foods and changes in lifestyle. The rising frequencies of those GI diseases need surgical treatments such as ostomies, during which a stoma is fashioned to minimize waste. This, in turn, increases the need for ostomy care products and accessories such as pouches, skin barriers, and customized clothing to improve the quality of life of patients following surgery. The projected increase in colorectal cancer cases and the rising cases of IBDs highlight the high contrast of the need for appropriate ostomy care solutions, which in turn is expected to fuel the ostomy care market industry growth.

Restraint:

-

The high cost of ostomy care products can limit accessibility, particularly in low-income regions.

The high cost of ostomy care products remains a significant barrier to accessibility, particularly in low- and middle-income regions. However, the rising costs associated with these advanced products can limit their affordability for many patients. While this growth is a positive reflection of the market, it also highlights the increasing costs of ostomy care. In high-income countries, insurance coverage often offsets these costs, but in low- and middle-income countries, patients may not have adequate insurance, leaving them with prohibitively expensive out-of-pocket costs. This economic challenge may cause patients to use the products longer than their recommended duration, or turn to inferior products that can cause health problems such as skin irritation or even infections.

Opportunity:

-

Investing in technological innovations and product development tailored to the needs and preferences of patients can drive market growth and satisfaction.

The ostomy care and accessories market offers lucrative growth opportunities for players who invest in technological innovations and product development as per the needs and requirements of patients. Recent developments have resulted in smart ostomy devices like Coloplast's Heylo, incorporating digital technology to monitor for leaks and send alerts, thus reducing patient anxiety and contributing to an improved quality of life. Also, the stoma-based health sensor products introduced as smart healthcare monitors by some companies including ConvaTec improve patients' health promptly.

The shift towards home-based care is another area ripe for innovation. The home healthcare services sector emerged as the leading end-use segment, with a market share of over 46% This trend is due largely to an increasing consumer preference for personalized, non-hospitalized care and the availability of trained nurses specializing in ostomy care management. This shift can be further supported through the development of products that enhance self-care and remote monitoring, thus granting patients more autonomy and convenience. In addition, the adoption of telemedicine and remote care solutions presents enormous growth opportunities. Telehealth and digital health solutions are becoming more common, enabling patients to receive specialized care and support from the comfort of their home through remote monitoring and virtual consultations, which is increasing access to ostomy care services. Technology like telemedicine also can make it easier for patients to stay connected to clinicians and to maintain treatment regimens.

Challenge:

-

Limited access to specialized ostomy care services and trained healthcare professionals poses barriers to optimal stoma management and patient outcomes.

The global shortage of specialist nurses is a major challenge for the ostomy care community. A World Health Organization (WHO) report in 2020 indicates that we need to generate at least 6 million new nursing jobs by 2030, mainly in low- and middle-income countries, to counterbalance projected shortages as well as to remedy the maldistribution of nurses globally. This imbalance is particularly pronounced in places such as Southeast Asia and Africa, where the healthcare infrastructure is often underdeveloped. The lack of trained ostomy care nurses in these regions affects the proper treatment of stoma patients, resulting in poor patient results and higher complication risk. The absence of specialized treatment can lead to lengthy hospital stays and escalating healthcare costs, putting further pressure on scarce resources.

In developed countries, although the situation is relatively better, the aging population along with the increasing prevalence of diseases requiring ostomies (e.g., colorectal cancer, inflammatory bowel disease) is leading to the growing need for specialized care. However, it remains a significant challenge to meet this growing demand with inadequate numbers of trained professionals. This problem must be treated with the same urgency and sense of validation that are given to physician shortages. Tailored nursing curricula that not only highlight the critical need for specialists in fields like ostomy care but also offer incentives to pursue these interests are fundamental in alleviating this pressing issue inflicted upon the field.

Ostomy Care and Accessories Market Segmentation Analysis

By Product

The ostomy bags segment held the largest share 83% of the market in 2023. The dominance in this market can primarily be accounted for by the high requirement for these products due to their critical obligation of managing stoma care. Ostomy bags are essential for the collection of bodily waste post-surgery and are in demand due to the large number of ostomy surgeries that are done worldwide. According to the U.S. Census Bureau, in 2022, 92.1% of Americans had health insurance, which helps provide access to important medical supplies such as ostomy bags. Innovative features in bag design like waterproofing and odor-free have also made them even more attractive. According to government statistics, roughly one in 500 Americans needs an ostomy drainage bag, creating a demand for these types of products. Ostomy bags come in a range of sizes and varieties, which has contributed to their widespread use in the medical community. These factors, coupled with a rising awareness surrounding ostomy care, have contributed to greater adoption of such products. In addition, according to the Crohn’s and Colitis Foundation of America, 30% of people with ulcerative colitis will need ostomy bags, which further increases demand. The dominance of ostomy bags in the market reflects broader trends in healthcare, where patient comfort and ease of use are increasingly prioritized. As OEM technology advances, these products will likely continue to be an essential aspect of ostomy management. The segment is also anticipated to witness robust growth owing to innovative materials and design to improve patient outcomes.

By Application

In 2023, the colostomy segment held the largest market share of 43%. This is largely because of the relatively high incidence of diseases such as colorectal cancer and inflammatory bowel diseases (IBDs), which frequently lead to colostomy procedures. Reimbursement policies for simplified segment colostomy in developed countries are comparatively better, leading to the availability of these procedures through major healthcare systems. Colorectal cancer is one of the most common cancers in the world and the second most common cause of cancer death according to GLOBOCAN data, highlighting the importance of colostomy care. For example, the fourth most common type of cancer in Germany is colorectal cancer and thus increasing in demand for colostomy services.

The colostomy segment's overwhelming share will also be driven by the fact that it is sometimes used as an intermediate step when a definitive surgical treatment of a disease require the healing of the gastrointestinal tract. The fact that it can be applied in a variety of ways contributes to its considerable market share. Furthermore, increased awareness about colostomy care and advancements in ostomy products for this group also ushered in its dominance. Notable growth is also anticipated in the ileostomy and urostomy segments due to advancements in product designs and an increase in relevant surgeries. Factors such as the high prevalence of diseases leading to colostomy procedures are anticipated to continue to drive the growth of this segment. With the advancement of healthcare systems, the emphasis on enhancing patient outcomes via effective colostomy care will continue to be a focus area. The rise in awareness and support for ostomy patients, particularly through organizations like the United Ostomy Association of America (UOAA), will also contribute to sustained demand in this segment.

By End-use

The home care settings accounted for the largest share of 45% in 2023. This is because of the rising preference for home care owing to its affordability and comfort for the patients. Government efforts to improve home healthcare services also contributed. For instance, the U.S. is witnessing an increase in home healthcare attributable to its aging population and the demand for affordable healthcare services. This trend is further reinforced by the increasing awareness about ostomy care & workability of optimized products for home use. The move to at-home care mirrors the larger trends in health care toward patient convenience and fewer days in the hospital. With the increasing trends of advancement of technology, home care settings are expected to dominate the market in the upcoming years. The U.S. Department of Health and Human Services has highlighted the significance of home-based care, pointing out that it can lead to better patient outcomes and help lower healthcare costs. This ongoing support for home care is projected to continue propelling growth within this segment.

The dominance of home care settings in the market highlights the importance of patient-centric care models. However, as healthcare systems are shifting, high-quality care in home settings will be a priority. The trend is backed up by improvements in medical technology and the greater availability of products specifically designed for at-home usage.

Regional Insights

Europe held the largest revenue share in the ostomy care and accessories market in 2023. The ostomy care and accessories market in Europe accounted for a 46% revenue share. The European region's dominance is due to the high elderly population, rising prevalence of diseases like colorectal cancer and inflammatory bowel diseases (IBD), and advanced healthcare infrastructure. Crucial markets in Europe such as Germany, France, and the UK greatly impact this position because of their mature healthcare systems and better awareness about ostomy care. Its product range, emphasis on individualized treatment, and use of digital health technologies help cement its place at the forefront of the market.

North America accounted for a significant share of the ostomy care and accessories industry. The global outcome ostomy industry is due to its well-established healthcare infrastructure and high prevalence of conditions requiring ostomy procedures. The U.S. accounted for a significant portion of the global market, driven by its developed healthcare system coupled with progressive reimbursement policies. On the other hand, The Asia Pacific region is also anticipated to scale at the largest CAGR with countries such as China and Japan driving the growth. The Asia Pacific region accounted for a major share of the market owing to the population size, with increasing expenditure on health. The growth in these countries can be highly attributed to government initiatives for the development of healthcare infrastructure and the knowledge of ostomy care. For example, the ever-increasing public healthcare expenditures in India are aiding in easy access to ostomy care products.

Get Customized Report as per Your Business Requirement - Enquiry Now

Ostomy Care and Accessories Market Key Players

Key Service Providers/Manufacturers

-

Coloplast (SenSura Mio, Brava Protective Seal)

-

ConvaTec Inc. (Esteem+ Flex Convex, Natura+ Ostomy System)

-

Hollister Incorporated (CeraPlus Skin Barrier, New Image Two-Piece Pouching System)

-

B. Braun SE (Flexima Active, Proxima+ Ostomy Pouches)

-

Marlen Manufacturing & Development Company (UltraLite Two-Piece System, ComfortWear Pouch Covers)

-

Perma-Type Company, Inc. (Perma-Type Ostomy Pouches, Perma-Type Skin Barriers)

-

Nu-Hope Laboratories, Inc. (Nu-Form Support Belts, Nu-Hope Ostomy Pouches)

-

Perfect Choice Medical Technologies (PCMT Ostomy Pouches, PCMT Skin Barriers)

-

Fortis Medical Products (Fortis Ostomy Pouches, Fortis Skin Barrier Wafers)

-

Safe n' Simple (StomaWipe Adhesive Remover, No-Sting Skin Barrier Film)

-

AdvaCare Pharma (AdvaCare Ostomy Bags, AdvaCare Skin Barriers)

-

Schena Ostomy Technologies, Inc. (Schena Stoma Guards, Schena Ostomy Belts)

-

Cymed (MicroSkin Adhesive Barrier, Cymed Ostomy Pouches)

-

Eakin (Eakin Cohesive Seals, Eakin Wound Pouches)

-

Alcare (Alcare Ostomy Pouches, Alcare Skin Barriers)

-

Welland Medical Limited (Aura Convex, Flair Active Ostomy Pouches)

-

Essity (TENA Ostomy Care Products, Leukoplast Barrier Cream)

-

Kimberly-Clark Corporation (Depend Ostomy Products, Huggies Little Snugglers Diapers)

-

Attends Healthcare Products, Inc. (Attends Ostomy Pads, Attends Skin Protectant Cream)

-

ABENA A/S (ABENA Ostomy Pouches, ABENA Skin Care Products)

Recent Development

-

In January 2024, Hollister Incorporated received Global Dermatological Accreditation from the Skin Health Alliance (SHA) for its CeraPlus ostomy products, such as the skin barriers and accessories.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.57 Billion |

| Market Size by 2032 | USD 6.01 Billion |

| CAGR | CAGR of 5.98% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Bags, Accessories) • By End-use (Hospitals, Home Care Settings, Others) • By Application (Colostomy, Urostomy, Ileostomy) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Coloplast, ConvaTec Inc., Hollister Incorporated, B. Braun SE, Marlen Manufacturing & Development Company, Perma-Type Company, Inc., Nu-Hope Laboratories, Inc., Perfect Choice Medical Technologies, Fortis Medical Products, Safe n' Simple, AdvaCare Pharma, Schena Ostomy Technologies, Inc., Cymed, Eakin, Alcare, Welland Medical Limited, Essity, Kimberly-Clark Corporation, Attends Healthcare Products, Inc., ABENA A/S |