Outdoor Furniture Market Report Scope & Overview:

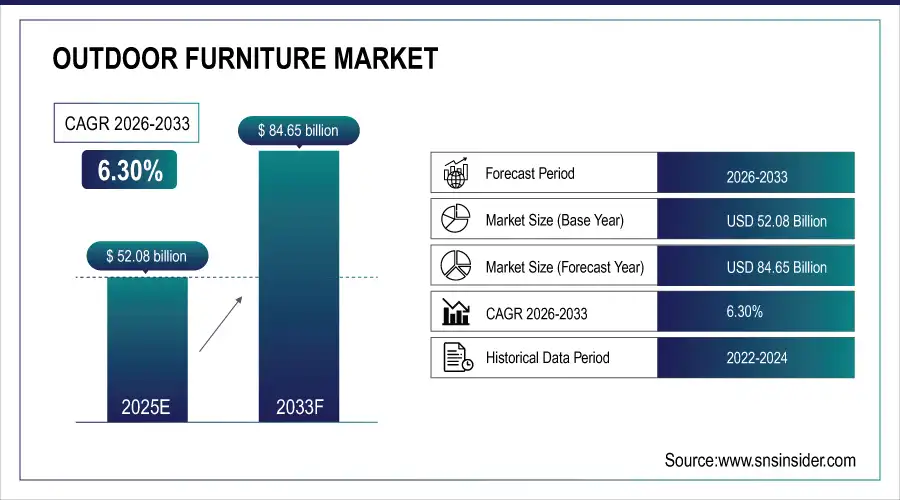

The Outdoor Furniture Market size was valued at USD 52.08 Billion in 2025E and is projected to reach USD 84.65 Billion by 2033, growing at a CAGR of 6.30% during 2026-2033.

The Outdoor Furniture Market Analysis highlights the change in consumer preference towards product and services. Increasing demand from residential and commercial landscaping projects, and increasing adoption of e-commerce are driving the industry growth worldwide.

Outdoor furniture shipments hit 45M units, with seating sets at 40%. Wood and metal types grew 18% YoY, while e-commerce surged 25%, driven by IKEA, Home Depot, and Ashley Furniture.

Market Size and Forecast:

-

Market Size in 2025: USD 52.08 Billion

-

Market Size by 2033: USD 84.65 Billion

-

CAGR: 6.30% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Outdoor Furniture Market - Request Free Sample Report

Outdoor Furniture Market Trends

-

Increasing consumer preference for sustainable and eco-friendly materials in outdoor furniture drives innovation in recycled wood, metal, and synthetic options.

-

Rising urbanization and apartment living boost demand for compact, multifunctional, and space-saving outdoor furniture solutions for balconies and terraces.

-

Growing trend of smart outdoor furniture with integrated lighting, speakers, and charging stations enhances convenience and luxury in outdoor spaces.

-

Expansion of e-commerce platforms enables easy access to diverse outdoor furniture styles, promoting online customization and direct-to-consumer sales.

-

Seasonal outdoor living and wellness lifestyle trends increase demand for weather-resistant, durable, and aesthetically appealing garden, patio, and poolside furniture.

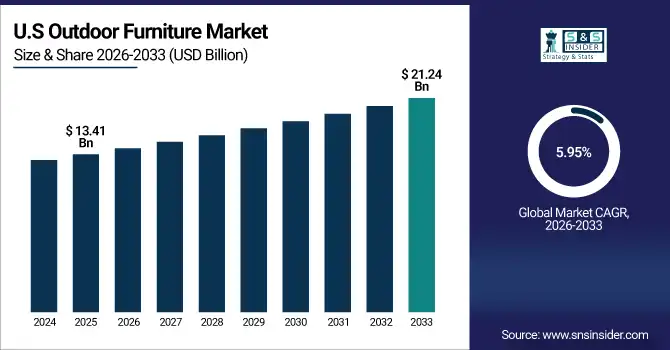

The U.S. Outdoor Furniture Market size was valued at USD 13.41 Billion in 2025E and is projected to reach USD 21.24 Billion by 2033, growing at a CAGR of 5.95% during 2026-2033. Growing preference for premium furniture with multiple features is encouraging the sales among consumers in urban areas. Product lines are being reshaped as the way people shop is shaped by trends like sustainable materials, modular designs and smart outdoor creations.

Outdoor Furniture Market Growth Drivers:

-

Rising Demand for Durable, Weather-Resistant, and Premium Outdoor Furniture Drives Residential and Commercial Market Expansion

The increasing demand for long-lasting, weather-resistant and highest quality furniture in both residential and commercial sector's acts as a primary growth factor for the outdoor furniture market. As consumers demand products that can withstand all the elements without scrimping on style, manufacturers are obliged to provide superior more-robust alternatives. To satisfy this demand is landscape gardens, urban housing developments and the pursuit of al fresco living spaces; driving innovation and premiumisation in outdoor design offer.

By 2025, nearly 60% of homeowners in urban and suburban areas invested in premium outdoor furniture to enhance balconies, patios, and rooftop spaces for al fresco living.

Outdoor Furniture Market Restraints:

-

Fluctuating Raw Material Costs and Supply Challenges Pose Significant Restraints on Outdoor Furniture Market Growth

The major limiting factor for outdoor furniture market is the instability of raw material price. The demand for essential materials, like wood, metal and synthetic fibers, vary over time causing manufacturers to alter their pricing accordingly or swallow the costs. These swings are all influenced by global dynamics, including geopolitical tensions and trade restrictions, as well as increasing transportation costs. This can make it difficult for companies to maintain even profit and price stability that results in sluggish growth of the overall market.

Outdoor Furniture Market Opportunities:

-

Rising Residential Demand and the Transformation of Outdoor Spaces into Stylish, Functional Living Areas Drive Market Growth

The integrated market offers some key opportunities, such as increasing demand from residential customers in the outdoor furniture market. Homeowners are spending more and more time on outdoor patios, balconies and gardens looking for that extra bit of comfort, style and functionality. These trends are in turn driving product manufacturers to produce new designs, utilizing high-quality materials and providing custom options to appeal to home owners who want to maximize their outdoor living experience. Consequently, housing adoption is emerging as a significant market growth driver.

By 2025, outdoor living upgrades accounted for nearly 25% of total residential home improvement budgets, with furniture representing the largest single category within that segment.

Outdoor Furniture Market Segment Analysis

-

By Product, Seating Sets dominated the market, accounting for 38.10% share in 2025, while Loungers are the fastest-growing segment, projected to expand at a CAGR of 5.2%.

-

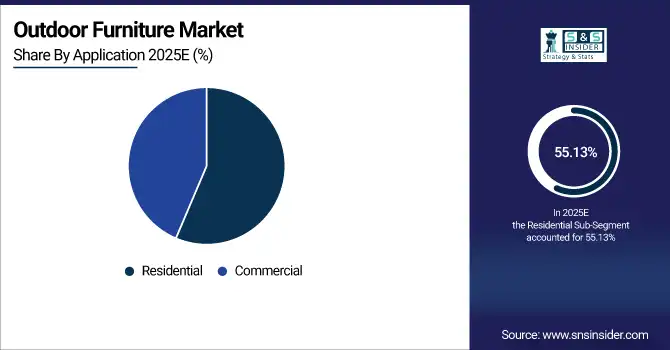

By Application, Residential dominated the market, accounting for 55.13% share in 2025, while Commercial is the fastest-growing segment, projected to expand at a CAGR of 5.35%.

-

By Type, Wood dominated the market, accounting for 42.31% share in 2025, while Metal is the fastest-growing segment, projected to expand at a CAGR of 5.62%.

-

By Distribution Channel, offline dominated the market, accounting for 60.01% share in 2025, while online is the fastest-growing segment, projected to expand at a CAGR of 6.3%.

By Product, Seating Sets dominate, while Loungers grow fastest

In 2025, Seating sets leads the market and it is the most common type of outdoor furniture available, but they aren’t your only option for furnishing outdoor living spaces. Great for Family Get Together patio backyards. The Loungers segment is growing fastest and most promising as today’s consumer invests in relaxation outdoor furniture, especially for luxury decks, poolside and wellness area are some of the key areas where consumers are constantly in search for furnishings that promote a better way of living outdoors. Increasing consumer preference for comfort and leisure is also driving demand for these products.

By Application, Residential leads, while Commercial grows fastest

By application residential segment is dominating the market due to overwhelmingly residential as homeowners consider patios, balconies and gardens as an extension of their living space. The demand is mostly arising from side houses, landscaped homes and premium villas involving practical yet decorative outdoor furniture. Commercial application is the fastest-growing segment, driven by demand from hotels, resorts, cafes and offices looking to make outdoor guest/employee time more enjoyable. Government action to encourage tourism and alfresco dining is also boosting business demand.

By Type, Wood dominates, while Metal grows fastest

The wood furniture type leads the market due to its timeless qualities, strength and overall aesthetic that goes great with greenspace in residential and commercial spaces. Meanwhile, metal furniture type projected to grow the fastest due to benefiting from modern design trends that call for industrial and weather-resistant styles. The fact that it is hardwearing, low-maintenance and can be made into modern designs makes it popular in urban dwellings and hospitality projects. Metal finishing and corrosion-resistant coating developments are also driving the adoption.

By Distribution Channel, Offline leads, while Online grows fastest

Offline channels lead the market in 2025 due to people can see and touch the furniture they’re buying, check out quality and pick it up on the spot in traditional brick-and-mortar store. Although the online mode has emerged as a fastest expanding channel, however, convenience of the internet and delivery along with personalized product offerings are responsible for driving majority sale in total retail. Consumers value the convenience, price competitiveness and wider range of designs available from buying outdoor furniture online. Online adoption is being driven by promotional campaigns and social media marketing.

Outdoor Furniture Market Regional Analysis:

North America Outdoor Furniture Market Insights:

The North America Outdoor Furniture Market holds the largest share, accounting for approximately 34.06% of the market. North America is the largest market for outdoor furniture, with high demand for luxury, long lasting and stylish outdoor furniture. Homeowners increasingly consider outdoor spaces extensions of their living areas, and that is spurring residential growth. There is also great demand from the commercial sector, such as hotels, resorts and restaurants.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Outdoor Furniture Market Insights:

US is the North American market leader owing to high consumer expenditure and robust urban housing developments. Homeowners place more emphasis on developing outdoor entertainment as well as relaxation spots. Retailers and online marketplaces are deepening their offerings of high-end custom furniture.

Asia-Pacific Outdoor Furniture Market Insights:

Asia-Pacific outdoor furniture market is growing rapidly at a CAGR of 6.81%, driven by urbanization, rising disposable incomes, and increasing interest in lifestyle and leisure-oriented outdoor living spaces. Heavy demand for both residential and commercial outdoor furniture meanwhile is being seen in countries including Japan, India, China and South Korea. Rising investments into real estate and hospitality projects are contributing to demand.

China Outdoor Furniture Market Insights:

China leads the Asia-Pacific market, it is witnessing huge residential construction activities, and growing demand for premium outdoor furniture through commercial spaces. Sleek patio, balcony and garden furniture is catching on among urban middle-class consumers.

Europe Outdoor Furniture Market Insights:

Europe is demonstrating positive growth on the back of government efforts for urban beautification and a surge in industrial hospitality projects. Eco-friendly, sustainable and modular outdoor furniture is in demand from consumers. There is much demand in residential areas as balconies, terrace and garden. Rising disposable income and lifestyle-driven consumers are impacting the market.

Germany Outdoor Furniture Market Insights:

Germany’s demand Excellent contribution from Germany Excellent performance in Europe with a high requirement of sustainable and high-quality outdoor furniture. Residential projects in the city and commercial spaces, with landscaping, are driving the growth. Durability-weather, and multipurpose designs are popular with consumers wanting products.

Middle East & Africa (MEA) and Latin America Outdoor Furniture Market Insights:

Latin America and Middle East & Africa increasing disposable incomes and a growing tourism sector support residential and commercial demand. More and more consumers demand for strong, stylish piece with various functions furniture. Hospitality and resort projects were also big contributors. Sales from e-commerce channels are helping to cover remote areas. Durable and weather-proof materials are becoming more of a concern.

Outdoor Furniture Market Competitive Landscape:

IKEA provides low-cost competitive outdoor furniture products to residential customers around the world. Its modular construction, weather-resistant fabrics and ecological focus seem to attract lifestyle-conscious buyers. Retailing point of selling together with a large presence in E-commerce offers wide market coverage. IKEA keeps extending their range of outdoor furniture to cater for increasing demand for home and balcony living solutions.

-

In March 2025, IKEA launched its “Circular Home” pilot in Germany and Sweden, introducing fully modular, repairable furniture lines with embedded QR codes for disassembly guides and spare part ordering accelerating its 2030 circularity commitment.

Ashley Furniture Industries offers a range of outdoor furniture sets, one for each and every occasion. The company was focused on durable materials of the highest quality, from wood to metal to synthetics. All of these focus on comfort, design and functionality help to create customer retention. Ashley uses a combination of retail and online offerings to drive market expansion targeting cities homeowners, throughout the world on hospitality projects.

-

In October 2025, Ashley Furniture expanded its international retail footprint with the opening of a new showroom in Curaçao, supporting its goal of reaching new homeowners and hospitality markets worldwide.

Brown Jordan is a luxury brand outdoor furniture manufacturer and world leader in innovation, craftsmanship and design of both residential and commercial outdoor furniture. A maker of superior, highly innovative designs and three kinds of durable resistance to the weather: this is a company which puts as much effort into variety as into robust construction. Its offerings serve the upscale homeowner as well as resorts and hospitality.

-

In April 2025, Brown Jordan unveiled its first carbon-neutral outdoor furniture collection in April 2025, crafted from 100% recycled aluminum and ocean-bound plastics, certified by Climate Neutral and debuting at Milan Design Week.

Outdoor Furniture Market Key Players:

Some of the Outdoor Furniture Market Companies are:

-

IKEA

-

Ashley Furniture Industries

-

Brown Jordan

-

Agio International

-

Keter Group

-

Century Furniture

-

Lloyd Flanders

-

Homecrest Outdoor Living

-

POLYWOOD

-

Treasure Garden

-

Dedon GmbH

-

Kettal Group

-

TUUCI

-

Fermob SA

-

Gloster Furniture

-

Roda Srl

-

Royal Botania

-

ScanCom International

-

B&B Italia

-

RH (Restoration Hardware)

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 52.8 Billion |

| Market Size by 2033 | USD 84.65 Billion |

| CAGR | CAGR of 6.30% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Seating Sets, Loungers, Dining Sets, Chairs, Table and Others) • By Application (Commercial and Residential) • By Type (Wood, Plastic and Metal) • By Distribution Channel (Online and Offline) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | IKEA, Ashley Furniture Industries, Brown Jordan, Agio International, Keter Group, Century Furniture, Lloyd Flanders, Homecrest Outdoor Living, POLYWOOD, Treasure Garden, Dedon GmbH, Kettal Group, TUUCI, Fermob SA, Gloster Furniture, Roda Srl, Royal Botania, ScanCom International, B&B Italia, RH (Restoration Hardware) |