Autonomous Mobile Robots Market Report Scope & Overview:

Get More Information on Autonomous Mobile Robots Market - Request Sample Report

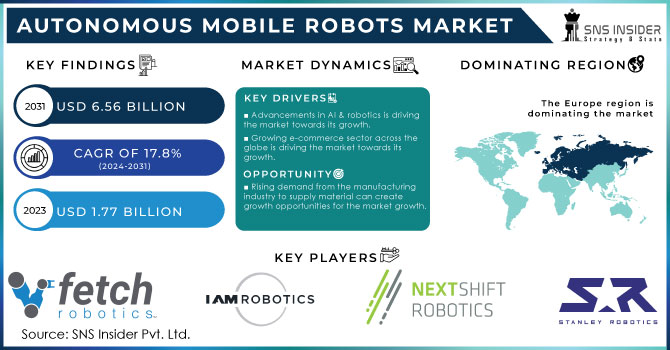

The Autonomous Mobile Robots Market size was valued at USD 1.77 Billion in 2023 and is now anticipated to grow to USD 6.56 Billion by 2031, displaying a compound annual growth rate (CAGR) of 17.8% during the forecast Period 2024-2031.

The Autonomous Mobile Robots Market is growing at a significant rate because of variety of factors. The key factor that is driving the market towards its growth is the rising adoption of robots in various industries apart from warehouse, manufacturing to retail, healthcare, etc. Another key driver is the growth e-commerce sales, with mobile robots the sales grew by 19% and at the end of 2022 e-commerce had a share of 20.8% of the total retail sales. Also, the increased workplace safety by the adoption of AMR is growing market towards its growth. According to the Occupational Safety and Health Administration (OSHA) and the US Department of Labor, over 11% of forklifts used within a warehouse likely to be involved in an accident but with the usage of AMR the number of accidents reduced significantly. Moreover, the shortage of labor and price hike has caused problems across various industries but with acquisition, installation, and maintenance of AMR are comparatively affordable. All these factors are driving to the growth of the Autonomous mobile robot market.

Autonomous Mobile Robots Market Dynamics

Drivers

-

Advancements in AI & robotics is driving the market towards its growth.

-

Growing e-commerce sector across the globe is driving the market towards its growth.

The rapid growth of e-commerce sector is mainly because of rising demand for AMR in logistics sector. Another factor for the growth is rising cost of labor compared to acquisition, installation and maintenance is helping in increasing the use of AMR. For example- Walmart’s online sales increase by 300% at the beginning of Covid-19 Epidemic. The use of AMR in fulfilling online order is thus made path towards its markt growth.

Restraints

-

High cost associated with autonomous mobile robot can create a restraint in the growth of the market.

-

Specific application requirements for AMR can be a hinderance in the market growth.

The restraining factor is that robots operating in different sectors and with different roles & specifications. For example-A robot operating in distribution centers cannot replace a surgical robots in hospitals. Robots can be single purposes machines because they are made for specific tasks and robots are built on specific needs and functionalities that it cannot be deployed elsewhere will be a restraint.

Opportunities

-

Rising demand from the manufacturing industry to supply material can create growth opportunities for the market growth.

-

Emergence of industry 4.0 tools & techniques is helping in creating growth opportunities.

Challenges

-

Complexity towards integrating Autonomous mobile robots into existing workflows and systems can be a challenge in the market growth.

-

Limited flexibility & adaptability in unforeseen situations might be a challenge in the market growth.

Autonomous Mobile Robots Market Impact Analysis

Impact of Russia-Ukraine War

The Russia-Ukraine war has a huge impact on the autonomous mobile robot market. The supply chain disruption has caused a dip in the demand for the robots making it hard to gather the components required for the manufacturing of AMR. The war has affected the warehouse capacity with hold in the containers because of trade restrictions because of Russia & Ukraine which complicate matters. The destruction of Ukraine’s agriculture has impacted the exports of grains with food stock shortages. On the other side, there has been a shift in the government expense towards war related investments like reconnaissance, transportation, supply of ammunition, food safety stocks. The increased automation in AMR among industries with fulfilling labor shortage can help in the growth of the market. Moreover, increasing focus towards local manufacturing of AMR can help in fulfilling the demand, reducing reliance with imports and withstanding the wartime.

Impact of Economic Slowdown

The economic slowdown has a huge impact on the autonomous mobile robot market. The slowdown has caused financial burdens & they prioritize over essentials & foregoing of investing in new equipment’s and this will affect the growth of market if demand goods and services slows down. As the inflation increases promotions and discount campaigns have become less valuable and effective, this in turn limits the usage of robots for supply chain & logistic activities. But on the other side, this slowdown can act as a catalyst in the adoption of Automatic mobile robots looking over benefits like improve efficiency and reduce expenses in the long run. The properties of AMR like Automated tasking, error minimization & reduced labor costs can help in adoption of AMR even in this slowdown. Also, the shortage of labor can help in filling the gaps of labor scarcity by automation of repetitive tasks and allowing workers to focus on much higher value work.

KEY MARKET SEGMENTATION

By Component

-

Hardware

-

Software

-

Services

The hardware component is dominating the market with a share of around 68.65% of the total market. Because of the high demand for spare parts used in AMR. The hardware comprises of sensors, actuators, mobility systems, chassis, and power source. The dominance is because of increasing AMR adoption in industries. Like sensors captures live data, actuators take action to that stimulus.

By Type

-

Goods-to-Person Picking Robots

-

Self-Driving Forklifts

-

Autonomous Inventory Robots

By Battery Type

-

Lead Battery

-

Lithium-Ion Battery

-

Nickel-Based Battery

-

Others

By End Use

-

Manufacturing

-

Automotive

-

Aerospace

-

Electronics

-

Chemical

-

Pharmaceuticals

-

Plastics

-

Defense

-

FMCG

-

Others

-

Wholesale & Distribution

-

E-commerce

-

Retail Chains/Conveyance Stores

-

Others

The manufacturing sector is dominating the market with a share of around 76.5% of the total market. The manufacturing sector is further divided into FMCG, automotive, aerospace, electronics, chemicals, medicines and plastics. The dominance is because of the rise in process automation inside manufacturing sector and the increasing demand of commodities, consumer goods, pharmaceuticals, gadgets is growing industries thus making AMR grow too in the manufacturing sector.

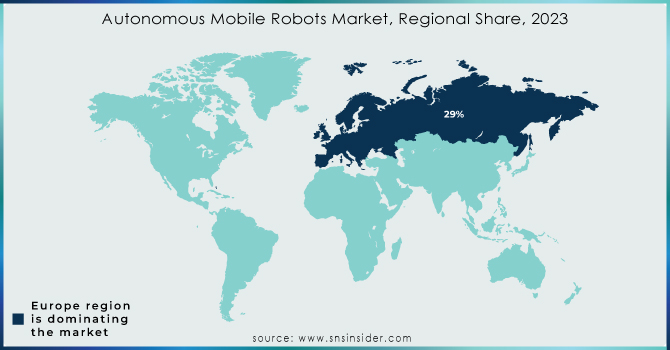

Regional Analysis

Europe is dominating the market with a share of around 29% of the total market. The reason for its dominance is because of increasing need for material handling tools in warehouse inventory management fueled by process automation across the region. The increasing electronic appliances market in the region is helping in the use of AMR to cut the time to deliver the products to the consumers.

Asia-Pacific is the fastest growing region in autonomous mobile markets because of expansion of e commerce sector & automotive industry.

Get Customized Report as per your Business Requirement - Request For Customized Report

Regional Outlook

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major players are Fetch Robotics Inc, IAM Robotics, NextShift Robotics, Stanley Robotics, Robotnik, SESTO Robotics, HAHN Robotics GmbH, Vecna Robotics, AutoGuide Mobile Robots, SoftBank Robotics and others.IAM Robotics,

Autonomous Mobile Robots Market Recent Developments

-

In May 2023, OTTO Motors announced the launch of the OTTO Certified Dealer program to provide high-quality service and support locally throughout North America. The program introduces over 215 regional offices and 2,000 technicians to the rapidly-growing AMR industry.

-

In March 2023, Geek+ showcased its most recent automation solutions at ProMat2023. The upgraded M200C moving robot was displayed at the Geek+ booth. The M200C is a highly flexible mobile robot connecting various production line parts. The M200C has a built-in lift and can be configured to move bins or shelves. It uses a hybrid navigation system with cutting-edge safety features.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.77 Billion |

| Market Size by 2031 | US$ 6.56 Billion |

| CAGR | CAGR of 17.8% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Type (Goods-to-Person Picking Robots, Self-Driving Forklifts, Autonomous Inventory Robots, Unmanned Aerial Vehicles) • By Battery Type (Lead Battery, Lithium-Ion Battery, Nickel-Based Battery, Others) • By End Use(Manufacturing, Wholesale & Distribution) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fetch Robotics Inc, IAM Robotics, NextShift Robotics, Stanley Robotics, Robotnik, SESTO Robotics, HAHN Robotics GmbH, Vecna Robotics, AutoGuide Mobile Robots, SoftBank Robotics |

| Key Drivers | • Advancements in AI & robotics is driving the market towards its growth. • Growing e-commerce sector across the globe is driving the market towards its growth. |

| Restraints | • High cost associated with autonomous mobile robot can create a restraint in the growth of the market. • Specific application requirements for AMR can be a hinderance in the market growth. |