Outdoor Vacation Market Report Scope & Overview:

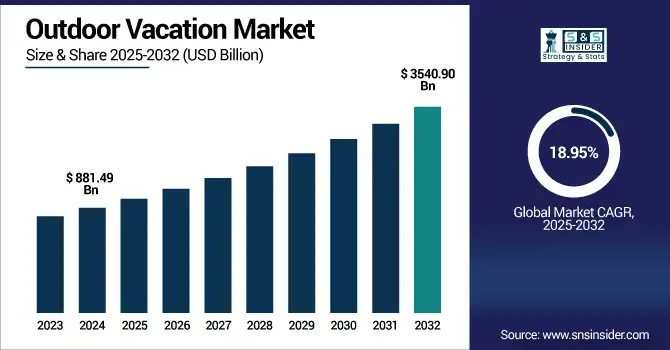

Outdoor Vacation Market was valued at USD 881.49 billion in 2024 and is expected to reach USD 3540.90 billion by 2032, growing at a CAGR of 18.95% from 2025-2032.

To Get more information on Outdoor Vacation Market - Request Free Sample Report

The Outdoor Vacation Market is witnessing robust growth due to rising consumer interest in nature-based experiences, wellness tourism, and adventure travel. Increasing awareness about physical and mental health benefits associated with outdoor activities, coupled with growing disposable incomes, is encouraging more people to explore natural destinations. Post-pandemic lifestyle shifts have further boosted demand for open-air, socially distanced travel. Government initiatives promoting eco-tourism and infrastructure development in remote regions are also enhancing accessibility. Additionally, social media influence and digital platforms are making outdoor travel more appealing and easier to plan, accelerating participation among younger, experience-driven travelers across the globe.

-

Data Axle and Overseas Adventure Travel (O.A.T.), which targets travelers aged 50 and above, have enhanced engagement using AI-driven data for personalized marketing across email, social, and direct mail channels to boost customer acquisition.

-

Meanwhile, Backroads expanded its Women’s Adventures program for 2025, adding over 40 new walking and hiking itineraries with more than 125 departures worldwide.

U.S. Outdoor Vacation Market was valued at USD 221.99 billion in 2024 and is expected to reach USD 866.83 billion by 2032, growing at a CAGR of 18.56% from 2025-2032.

The U.S. Outdoor Vacation Market is growing due to rising health consciousness, increasing demand for adventure and nature-based experiences, and strong domestic travel trends. Technological ease in planning trips and expanding eco-tourism infrastructure also contribute to market expansion.

Market Dynamics

Drivers

-

Growing demand for nature-based experiences is fueling the rise in outdoor vacations among urban and millennial populations worldwide.

Urban fatigue, increased mental health awareness, and the growing preference for digital detox are pushing travelers toward immersive nature-based outdoor vacations. Millennials and Gen Z travelers, in particular, are increasingly valuing meaningful travel experiences like hiking, camping, or eco-tours over luxury or conventional holidays. As wellness and sustainability trends influence travel preferences, national parks, trails, beaches, and mountains are seeing unprecedented interest. Governments promoting eco-tourism and improved access to remote outdoor locations further bolster market growth, driving the outdoor vacation segment upward globally.

Restraints

-

Unpredictable weather conditions and climate change impacts are limiting outdoor vacation planning and affecting traveler confidence significantly.

Extreme weather events, rising temperatures, wildfires, floods, and unseasonal storms are increasingly disrupting outdoor vacation plans and deterring potential tourists. Activities like hiking, camping, or skiing are directly impacted by environmental volatility, which not only reduces travel demand but also strains local tourism operators. Climate change has led to temporary closures of national parks, trail systems, and coastal destinations, limiting availability. This unpredictability makes planning and insuring such trips more difficult for both consumers and providers. As environmental risks grow more frequent, weather-related concerns stand as a formidable barrier to consistent outdoor vacation market expansion.

Opportunities

-

Rising focus on sustainable tourism presents major growth opportunities for eco-conscious outdoor vacation providers and destinations worldwide.

The increasing global emphasis on environmental preservation, conservation travel, and low-impact experiences is aligning well with the outdoor vacation sector. Eco-lodges, carbon-neutral tours, and community-based travel models are gaining traction among consumers. Travelers now prefer destinations that promote leave-no-trace policies, waste management systems, and wildlife protection. Governments and NGOs are investing in sustainable tourism frameworks, offering incentives for green infrastructure. This paves the way for local businesses and tour operators to expand offerings that cater to responsible travelers. Embracing eco-certification, low-emission transport, and regenerative tourism can open new markets for the outdoor vacation industry.

Challenges

-

Safety concerns and lack of preparedness for outdoor emergencies deter tourists from engaging in remote adventure travel.

Outdoor vacations often involve remote terrain, unpredictable weather, and physical challenges that can result in accidents or medical emergencies. Many travelers lack proper training or underestimate risks associated with hiking, rafting, or wildlife encounters. Limited access to medical services, emergency communication gaps, and inadequate guiding standards further heighten the danger. This leads to lower participation from cautious segments such as families, older adults, and solo travelers. Liability concerns and rising insurance costs also disincentivize operators. Unless safety infrastructure, traveler education, and preparedness improve, safety fears will continue to hinder broader adoption of outdoor vacations.

Segment Analysis

By Age Group

Millennials dominated the Outdoor Vacation Market in 2024 with a 48% revenue share due to their strong preference for experiential and wellness-driven travel. Their financial independence, work flexibility, and desire for digital detox experiences fueled demand for hiking, camping, and eco-tourism. Social media influence and a strong inclination toward sustainable, meaningful getaways made this segment the most active and high-spending group in the outdoor travel landscape.

Generation Z is projected to grow at the fastest CAGR of 20.81% from 2025 to 2032 owing to their early adoption of adventure travel and digital-first planning behavior. This tech-savvy group seeks unique, off-the-beaten-path outdoor experiences driven by social influence and climate consciousness. Their growing disposable income and prioritization of values-driven travel, such as sustainability and inclusivity, are making Gen Z an emerging powerhouse in the outdoor vacation market.

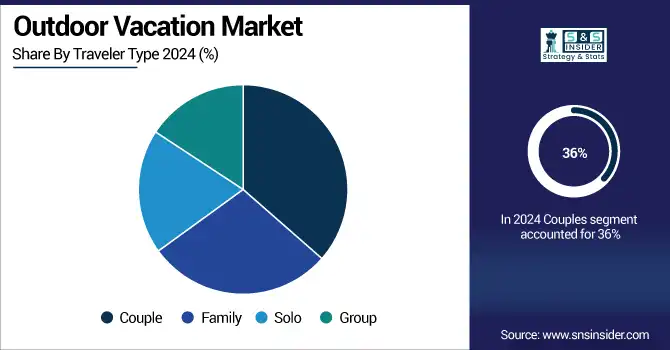

By Traveler Type

Couples held the highest revenue share of 36% in the Outdoor Vacation Market in 2024 due to rising demand for romantic and adventure-filled getaways. Popular choices include glamping, trekking, and wellness retreats that offer seclusion, scenic beauty, and bonding experiences. With higher discretionary income and interest in short, frequent outdoor escapes, couples increasingly seek personalized and luxury-based outdoor vacations that blend nature with comfort and emotional connection.

Families are expected to grow at a CAGR of 20.76% from 2025 to 2032, driven by increased interest in multigenerational outdoor experiences. Parents seek nature-based vacations to disconnect from screens and foster active lifestyles for children. National parks, guided camping tours, and nature-based learning programs attract this segment. Additionally, safety-focused offerings and improved accessibility are encouraging more families to opt for outdoor vacations as a wholesome bonding experience.

By Tour Type

Leisure tour segment dominated the Outdoor Vacation Market in 2024 with a 41% revenue share due to the rising preference for relaxing, scenic, and rejuvenating getaways. Tourists increasingly seek slow-paced outdoor experiences like nature walks, lakeside stays, and countryside retreats for stress relief and digital detox. This segment appeals to diverse age groups, especially working professionals and retirees. From 2025 to 2032, it is expected to grow at a CAGR of 19.55% as wellness tourism, scenic exploration, and sustainable travel become core lifestyle preferences among global travelers.

By Mode of Booking

OTA segment captured the highest revenue share of 66% in 2024 in the Outdoor Vacation Market due to its convenience, price transparency, and wide choice offerings. Online travel agencies provide streamlined booking, real-time information, and customer reviews, empowering travelers to plan personalized outdoor vacations with ease. Their mobile-friendly platforms and integrated itineraries attract tech-savvy millennials and Gen Z travelers. From 2025 to 2032, this segment is projected to grow at the fastest CAGR of 19.64% as digital adoption, contactless booking, and dynamic packaging continue transforming outdoor travel planning globally.

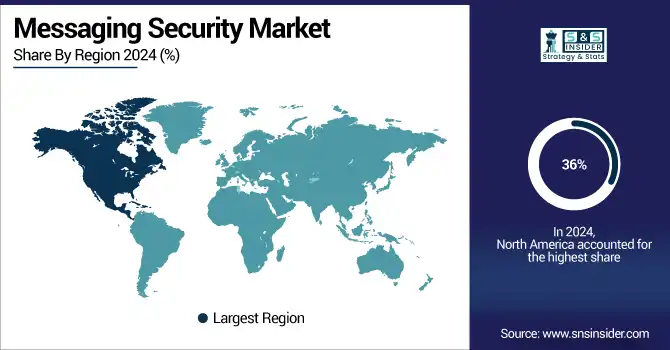

Regional Analysis

North America dominated the Outdoor Vacation Market in 2024 with a 36% revenue share due to its vast natural landscapes, well-developed tourism infrastructure, and strong outdoor culture. National parks, coastal routes, and mountain trails attract millions of domestic and international travelers. High disposable incomes, strong participation in adventure tourism, and government investment in eco-tourism further boosted North America's position as the leading outdoor vacation destination globally.

The United States is dominating the Outdoor Vacation Market due to its vast natural parks, advanced infrastructure, and high domestic travel participation across all age groups.

Asia Pacific is expected to grow at the fastest CAGR of 21.41% from 2025 to 2032, driven by rising middle-class income, increasing interest in adventure tourism, and expanding tourism infrastructure. Countries like India, China, and Southeast Asian nations are seeing growing demand for outdoor travel among younger populations. Government campaigns promoting domestic tourism and nature-based experiences are accelerating growth, along with better digital connectivity and accessibility to previously untapped natural destinations.

China is dominating the Outdoor Vacation Market in Asia Pacific due to its vast natural landscapes, rising middle-class travel demand, and strong domestic tourism infrastructure.

Europe plays a significant role in the Outdoor Vacation Market, driven by rich natural diversity, strong cross-border travel, and government-supported eco-tourism initiatives. Countries like Germany, France, and the UK lead due to their developed infrastructure and outdoor travel culture.

Germany is dominating the Outdoor Vacation Market in Europe due to its strong domestic tourism, outdoor culture, and well-connected national parks and nature reserves.

The Middle East & Africa and Latin America are emerging in the Outdoor Vacation Market, supported by growing adventure tourism, unique landscapes, and cultural heritage. Improved infrastructure, eco-tourism efforts, and increasing international arrivals are boosting regional outdoor travel growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Outdoor Vacation Market companies are Tauck, Inc., TUI Group, JTB Americas, Ltd., Scott Dunn Ltd., Butterfield & Robinson, Travel Leaders Group, Travcoa Corporation, American Express Travel, Thomas Cook India Ltd., Carlson Wagonlit Travel (CWT), Cox and Kings Ltd., Expedia Group, World Travel, Inc., Abercrombie & Kent USA LLC, Kensington Tours, Priceline (Booking Holdings Inc.), Micato Safaris, G Adventures, Intrepid Travel, REI Adventures (REI Co-op)

Recent Developments:

-

2025 – Expedia launched its Island Hot List, showcasing top global islands based on verified traveler data with interest rising ~30%, including Koh Samui, Jamaica, Fiji, Paros, and Sardinia

-

2024 –Expedia, Hotels.com, and Vrbo released Unpack '25 travel trends: Detour Destinations, JOMO Travel, One‑Click Trips, guiding nature‑driven and less crowded outdoor travel in 2025.

-

2024 – Tauck partners with Approach Guides to launch enhanced Content Experiences, enabling travel advisors to customize co‑branded marketing pages with group‑specific itinerary, pricing, and messaging to boost river cruise group sales.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 881.49 Billion |

| Market Size by 2032 | USD 3504.90 Billion |

| CAGR | CAGR of 18.95% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Tour Type (Volunteering Trips, Culinary Tour, Leisure Tour, Heritage Trip, Others) • By Traveler Type (Couple, Family, Solo, Group) • By Age Group (Generation Z, Millennial, Baby Boomers) • By Mode of Booking (Travel Agent, OTA) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

| Company Profiles | Tauck, Inc., TUI Group, JTB Americas, Ltd., Scott Dunn Ltd., Butterfield & Robinson, Travel Leaders Group, Travcoa Corporation, American Express Travel, Thomas Cook India Ltd., Carlson Wagonlit Travel (CWT), Cox and Kings Ltd., Expedia Group, World Travel, Inc., Abercrombie & Kent USA LLC, Kensington Tours, Priceline (Booking Holdings Inc.), Micato Safaris, G Adventures, Intrepid Travel, REI Adventures (REI Co-op) |