Precision Forestry Market Report Scope & Overview:

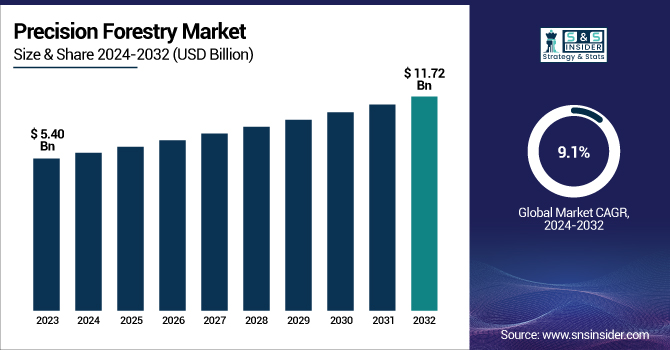

The Precision Forestry Market Size was valued at USD 5.40 billion in 2023 and is expected to reach USD 11.72 billion by 2032 and grow at a CAGR of 9.1% over the forecast period 2024-2032.

To Get more information on Precision Forestry Market - Request Free Sample Report

The Precision Forestry Market is advancing rapidly with technologies like GPS, LiDAR, AI, and drone surveillance, driving efficient and sustainable forest management. Over 35% of logging in developed regions now uses semi-autonomous equipment, and forest inventory times have dropped by 40% due to remote sensing tools. More than 60% of large forestry enterprises adopt GIS-based platforms, while AI integration has improved yield predictions by up to 30%. Optimized harvesting has cut timber waste by 20%, and real-time data has boosted workforce productivity by 15–20%. Additionally, nearly 50% of commercial operators are investing in ESG-focused precision tools for carbon and biodiversity tracking.

The U.S. Precision Forestry Market size was USD 1.36 billion in 2023 and is expected to reach USD 2.40 billion by 2032, growing at a CAGR of 6.59% over the forecast period of 2024–2032.

The U.S. Precision Forestry Market is witnessing notable advancement, fueled by the adoption of cutting-edge technologies like GIS mapping, data analytics, and remote sensing to enhance forest management efficiency.

In 2023, remote sensing alone contributed around 20% of the market share, emphasizing its growing importance in the sector. Efforts toward sustainability are evident, with the USDA Forest Service allocating USD 188 million in June 2023 to protect more than 245,000 acres of vital forestlands across 22 states.

Additionally, industry leaders such as Deere & Company are expanding their precision forestry portfolios through acquisitions, including the July 2023 purchase of Smart Apply, Inc., aimed at improving the precision of pesticide and fertilizer use.

Precision Forestry Market Dynamics

Key Drivers:

-

Rising Adoption of Advanced Technologies in Forest Management Enhances Precision Forestry Market Growth.

The integration of advanced technologies such as LiDAR, GPS, remote sensing, and AI is significantly transforming forest operations by enabling real-time monitoring, predictive analysis, and efficient resource management. These tools are helping forestry professionals improve timber yield, reduce waste, and mitigate risks related to forest fires and pest outbreaks.

For example, AI-based yield prediction has improved forecasting accuracy by up to 30%, while drone surveillance has reduced inventory assessment time by nearly 40%. The ability to make data-driven decisions through GIS-based platforms has also increased operational efficiency.

Furthermore, the use of autonomous machinery in logging is on the rise, with semi-autonomous systems now active in over 35% of forestry operations in technologically advanced countries. As sustainability gains traction, smart forestry practices powered by these technologies not only optimize production but also ensure compliance with environmental standards—paving the way for continued market growth.

Restrain:

-

High Initial Investment and Equipment Costs Limit Adoption in Budget-Constrained Forestry Operations.

Despite the clear benefits of precision forestry, the high cost of initial implementation acts as a major barrier, especially for small to mid-sized forestry companies. Equipment such as LiDAR systems, drones, and autonomous harvesting machines involves significant capital expenditure. Additionally, integrating these technologies requires skilled labor, system training, and software upgrades, adding further to operational costs. Many forest operators, particularly in developing regions, find it difficult to justify these upfront investments without guaranteed short-term returns.

Moreover, the maintenance and calibration of precision equipment incur recurring expenses, making it financially strenuous for low-budget operations. This financial barrier often leads to a slower adoption curve in underdeveloped markets, thereby restraining the overall market expansion. While government subsidies and pilot programs have helped in certain regions, widespread affordability remains a critical challenge for mass adoption.

Opportunities:

-

Government Initiatives and ESG Mandates Offer New Growth Avenues for Precision Forestry Market.

The increasing push from governments and regulatory bodies for sustainable forest management practices is creating a favorable environment for precision forestry solutions. Environmental, Social, and Governance (ESG) mandates are also prompting forestry companies to invest in technologies that track carbon sequestration, biodiversity, and responsible land usage. These evolving standards are making precision tools not just optional but essential for regulatory compliance.

Furthermore, global reforestation initiatives and carbon credit markets are opening up economic incentives for smart forestry practices. As companies align with sustainability goals, the demand for tools that offer accurate monitoring and environmental reporting is rising, presenting significant opportunities for vendors in the precision forestry space.

Challenges:

-

Data Integration, Connectivity Issues, and Terrain Variability Pose Implementation Challenges in Precision Forestry.

The precision forestry market is the seamless integration of data from multiple devices and platforms across diverse and often rugged terrains. Forest environments are typically remote and lack consistent internet connectivity, which impedes real-time data transmission and monitoring.

Moreover, combining datasets from drones, ground sensors, GPS tools, and weather stations into a cohesive and actionable dashboard remains technically complex. Terrain variability also affects the accuracy of sensor-based readings, making calibration and customization crucial but difficult.

In addition, legacy systems used by traditional forestry operators often lack compatibility with modern platforms, complicating data migration. These technical and logistical issues delay full-scale implementation and often require custom solutions, which increase costs and resource demands. Addressing these interoperability and connectivity challenges is essential for unlocking the full potential of precision forestry across varied geographic and operational landscapes.

Precision Forestry Market Segment Analysis

By Application

In 2023, the Harvesting segment held the largest revenue share in the Precision Forestry Market due to the increasing deployment of technologically advanced harvesting equipment and systems. The use of real-time data analytics, GPS-enabled machinery, and IoT-based tools has revolutionized the way timber harvesting is planned and executed. Modern harvesters equipped with automation features allow for improved efficiency, reduced timber waste, and minimized environmental impact. Companies such as Komatsu Forest and John Deere have continued to innovate, introducing advanced harvester models that enable precision cutting and optimized fuel usage.

For instance, many new machines now integrate terrain-adaptive control systems, ensuring safe and effective operations in challenging landscapes. The segment's dominance is also supported by rising demand for sustainable forestry practices, which precision harvesting directly enables by reducing damage to surrounding vegetation and soil. The integration of cloud-based systems further allows forestry managers to monitor performance, yield, and productivity remotely, enhancing operational outcomes.

By Component

In 2023, the Hardware segment accounted for 52% of the total Precision Forestry Market revenue, primarily due to the critical role played by equipment such as LiDAR sensors, GPS systems, drones, and automated forestry machinery. These hardware components form the backbone of precision forestry operations, enabling data collection, site analysis, and machine guidance in harvesting and silviculture activities.

These technological advancements are essential for forest operators seeking to increase yield accuracy and reduce labor costs. As forests vary widely in terrain and vegetation density, rugged and high-precision hardware solutions are indispensable for effective operations. The segment's dominance highlights the foundational nature of physical tools in executing precision strategies.

The Software segment is projected to grow at the highest CAGR of 10.5% over the forecasted period, driven by the increasing need for advanced analytics, data visualization, and centralized management systems in forestry operations. Software platforms are becoming integral to planning, monitoring, and optimizing forestry processes, enabling stakeholders to make data-informed decisions in real time. Leading companies are releasing platforms that consolidate satellite imagery, drone footage, sensor inputs, and weather data into interactive dashboards.

For example, several cloud-based GIS and forest inventory management tools now offer predictive modeling to forecast yields and identify disease or fire risk zones. These innovations allow for precise planning and resource allocation, thereby increasing profitability and sustainability.

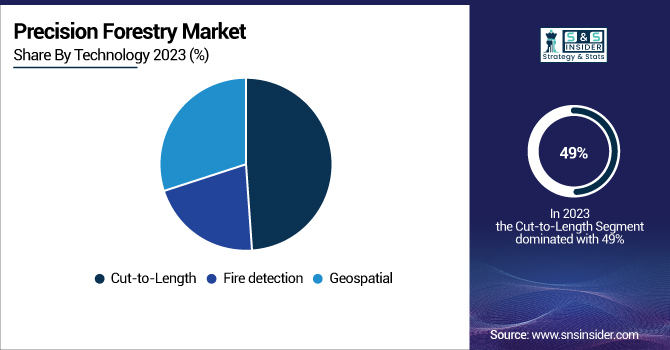

By Technology

In 2023, the Cut-to-Length (CTL) segment dominated the Precision Forestry Market with a 49% revenue share, reflecting its widespread use in modern, sustainable logging practices. CTL technology involves the use of harvesters and forwarders that cut and process trees at the stump, which significantly reduces ground impact and eliminates the need for large teams of manual workers. This method is gaining traction in regions focused on minimizing environmental disruption during timber extraction.

CTL systems are also easier to automate and integrate with telematics, making them ideal for operators implementing precision forestry techniques. In addition, the technology supports selective harvesting, aligning with sustainable forestry standards. As demand grows for efficient and environmentally responsible logging, the CTL segment continues to set the benchmark for technologically advanced forest harvesting solutions.

The fire detection segment is anticipated to register the highest CAGR of 11.1% during the forecast period, owing to increasing concerns over forest fire outbreaks exacerbated by climate change. Advanced fire detection systems are now integrating satellite monitoring, AI-powered image recognition, and IoT-enabled ground sensors to deliver real-time alerts and predictive fire modeling. The use of drones equipped with thermal imaging cameras allows for early detection of heat anomalies, which is critical in vast and remote forest areas.

The rising frequency and intensity of wildfires across North America, Australia, and Southern Europe have accelerated investments in smart fire management solutions. As precision forestry increasingly focuses on sustainability and risk mitigation, the fire detection segment is emerging as a critical technology area supporting ecosystem protection and operational resilience.

Regional Analysis

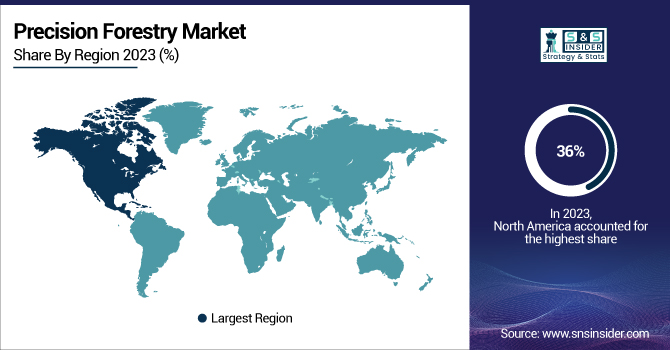

In 2023, the North American region dominated the Precision Forestry Market with an estimated market share of approximately 36%, supported by its advanced technological ecosystem, mechanized forestry operations, and strong focus on sustainability. The region has witnessed widespread integration of GPS-guided machinery, autonomous harvesters, and cloud-based forest management platforms.

For example, John Deere’s ongoing development of intelligent forestry solutions, including digital twin technology for real-time equipment and terrain monitoring, enhances precision and productivity in logging operations.

Additionally, state-level forestry departments across the U.S. are increasingly investing in drone-based surveillance and data analytics to monitor forest health and detect fire risks. These innovations, along with a mature forestry equipment market and progressive environmental regulations, position North America as the most mature and dominant region in the precision forestry space.

The Asia Pacific region emerged as the fastest-growing region in the Precision Forestry Market in 2023, with an estimated CAGR of 10.5% over the forecast period. Rapid urbanization, increasing awareness of deforestation, and strong reforestation policies in countries like China, India, and Australia are accelerating the demand for precision forestry solutions. Governments and private forestry companies are adopting drone-based surveillance, remote sensing, and AI-driven monitoring systems to optimize forest yield and reduce environmental damage.

Moreover, rising investments in smart agriculture and forestry technologies, along with initiatives focused on carbon offset programs and biodiversity conservation, are driving regional growth. The cost-effective availability of advanced equipment and increasing digital transformation efforts in the forestry sector are expected to fuel further expansion of precision forestry across the Asia Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

A.G. Leader Technology Inc (Ag Leader Insights, InCommand Displays)

-

AB Volvo (Volvo Construction Equipment, Volvo Penta)

-

AFRY AB (AFRY Experience Management, Digital Transformation Solutions)

-

AGCO Corporation (Fuse Technology, AGCO Parts)

-

AgEagle Aerial Systems, Inc. (eBee X Drone, AgEagle Software Solutions)

-

BouMatic LLC (BouMatic Milk Meter, BouMatic ProTouch)

-

Caterpillar Inc. (Cat Connect, Cat Digital Services)

-

CNH Industrial N.V. (Case IH AFS, New Holland Precision Land Management)

-

Deere & Company (John Deere Operations Center, JDLink)

-

Hitachi Construction Machinery Co., Ltd. (Hitachi Fleet Management, ConSite)

-

Hyundai Doosan Infracore Co., Ltd. (DX225LC-7, Doosan Connect)

-

Insight Robotics Limited (Insight Robotics Wildfire Detection, Insight Robotics Field Solutions)

-

J C Bamford Excavators Ltd. (JCB LiveLink, JCB Telemetry)

-

Komatsu Forest (Komatsu Forest Management Software, Komatsu Tracked Harvesters)

-

Komatsu Forest AB (Komatsu Forest Fleet Management, Komatsu Log Loaders)

-

Kubota Corporation (Kubota Connect, Kubota Machinery)

Recent Trends

-

September 2023: AGCO Corporation announced a joint venture with Trimble, acquiring an 85% interest in Trimble's agricultural assets and technologies for $2.0 billion. This collaboration aims to create a global mixed-fleet precision agriculture platform, enhancing AGCO's technology offerings in areas such as guidance, autonomy, and data management.

-

November 2023: AGCO signed an agreement to acquire digital assets from FarmFacts GmbH, a leader in Farm Management Information Software based in Germany. This acquisition is intended to strengthen AGCO's data management capabilities, providing farmers with advanced tools for field action planning and precision farming.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.40 Billion |

| Market Size by 2032 | US$ 11.72 Billion |

| CAGR | CAGR of 9.1 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Services, Software) • By Technology (Cut-to-Length, Fire Detection, Geospatial) • By Application (Harvesting, Inventory & Logistics, Silviculture & Fire Management) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | A.G. Leader Technology Inc, AB Volvo, AFRY AB, AGCO Corporation, AgEagle Aerial Systems, Inc., BouMatic LLC, Caterpillar Inc., CNH Industrial N.V., Deere & Company, Hitachi Construction Machinery Co., Ltd., Hyundai Doosan Infracore Co., Ltd., Insight Robotics Limited, J C Bamford Excavators Ltd., Komatsu Forest, Komatsu Forest AB, Kubota Corporation. |