Over-The-Counter Drugs Market Size & Trends Analysis:

To Get More Information on Over The Counter Drugs Market - Request Sample Report

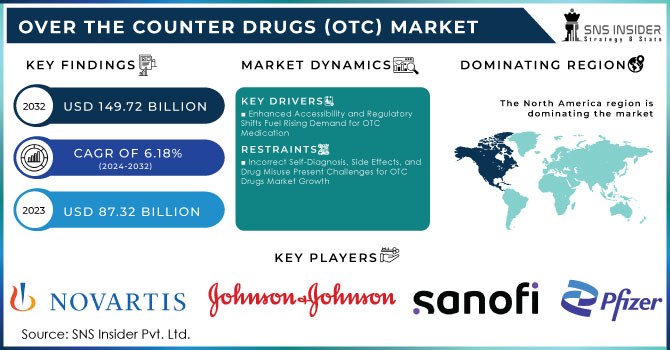

The Over-The-Counter Drugs (OTC) Market Size was valued at USD 87.32 billion in 2023 and is expected to reach USD 149.72 billion by 2032 and grow at a CAGR of 6.18% over the forecast period of 2024-2032.

Growth in the over-the-counter drugs market has been steady for several reasons. For one, consumers increasingly feel comfortable shelling out money on OTC medicines and are more aware of their benefits. Lifestyle-related disorders such as obesity and diabetes are increasingly causing problems, especially among the aged. Such trends have seen an increase in demand for easily accessible, non-prescription treatment options that can be acquired without medical consultation.

An increase in disposable income and a higher number of distribution channels have made OTC drugs more accessible to a wider range of consumers. A stronger availability of all these products in retail outlets and online platforms has simplified the purchasing process and led to more and more direct involvement in self-managed minor health issues. Accessibility to such quick relief in case of common ailments is more appealing to people, thereby fuelling the market further.

Moreover, chronic diseases like osteoarthritis contribute to the demand for OTC drugs, especially for pain relief medicines. According to the World Health Organization, approximately 528 million people worldwide are suffering from osteoarthritis condition based on estimates released in 2019. Patients who have joint pain and stiffness symptoms usually resort to available over-the-counter analgesics such as acetaminophen and NSAIDs for symptom management. The fact that these drugs can be had over the counter makes a person visit a doctor even though their symptoms are not too severe, thus increasing the OTC pain relief market.

Such factors will most likely continue to expand the market for OTC drugs because they align with the increasing acceptance of self-medication and the ease it brings. The prevalence of chronic diseases and a geriatric population will further mean that OTC medications will necessarily continue to fill the needs of consumers about easy access to healthcare solutions. Changing consumer preferences and a greater variety of products available over the counter are also expected to contribute to this trend.

| Country | Pain Relievers | Cold & Flu | Allergy Medication | Digestive Aids | Antacids | Sleep Aids |

|---|---|---|---|---|---|---|

| United States | Tylenol (Acetaminophen) | NyQuil | Benadryl | Pepto-Bismol | Tums | Unisom |

| United Kingdom | Nurofen (Ibuprofen) | Lemsip | Piriton (Chlorpheniramine) | Gaviscon | Rennie | Nytol |

| Germany | IbuHEXAL (Ibuprofen) | Wick MediNait | Cetirizine ADGC | Rennie | Maalox | Hoggar Night |

| Japan | Eve (Ibuprofen) | Contac | Allegra (Fexofenadine) | Gaster 10 | Gaviscon | Restamin |

| Canada | Advil (Ibuprofen) | Benylin | Reactine | Diovol | Pepcid | Sleep-eze |

| Australia | Panadol (Paracetamol) | Codral | Telfast (Fexofenadine) | Quick-Eze | Mylanta | Restavit |

| France | Doliprane (Paracetamol) | Actifed | Aerius (Desloratadine) | Mopral | Gaviscon | Donormyl |

| India | Crocin (Paracetamol) | D-Cold Total | Cetzine (Cetirizine) | Digene | Eno | Sleepwell |

| Brazil | Dipirona (Metamizole) | Benegrip | Polaramine (Dexchlorpheniramine) | Epocler | Estomazil | Dormont |

| South Korea | Tylenol (Acetaminophen) | Pan Cold | Zyrtec (Cetirizine) | Gaster N | Gaston | Tylenol PM |

Over-The-Counter Drugs Market Dynamics

Drivers

-

Enhanced Accessibility and Regulatory Shifts Fuel Rising Demand for OTC Medications

Major market players such as Johnson & Johnson Services Inc., Bayer AG, Novartis AG, Sanofi S.A., Dr. Reddy's Laboratories Ltd., and Pfizer, among others, have provided immense support to the market for over-the-counter drugs. These players have been making continuous investments in research and development activities and have recently launched a wide range of OTC products that deal with different health conditions. An example includes the firm of Dr. Reddy's Laboratories, which recently launched an OTC eye allergy solution, Olopatadine Hydrochloride in September 2020. The increase in the introduction of new products is expected to spur growth in the market due to the furthering of the portfolio of Over-the-Counter drugs.

Accessibility and affordability also fuel the market. Many retail stores cater to this category of products, thereby making it more accessible to consumers. Private sector investments in developing distribution channels in both developed and emerging countries open the avenues for further product presence. NCBI reported in 2020 that the sale of OTC products is majorly contributed by the U.S., Japan, Germany, and the UK, which implies the significant presence of retail networks in these regions.

Additional impetus to the market's growth is being provided by various regulatory approvals for the transition of prescription drugs into the OTC space. To this end, several prescription allergy medicines that were previously unaffordable are now converted into OTC products contributing to their general affordability for the consumer. According to the CHPA, in the year 2022, many allergy medications were transitioned from prescription-only drugs to being sold over-the-counter, indicating the general trend to affordable and accessible treatment options. As demand for affordable, easily accessible medications in the OTC space continues to increase, this is also certain to continue driving the market.

Restraints

-

Incorrect Self-Diagnosis, Side Effects, and Drug Misuse Present Challenges for OTC Drugs Market Growth

OTC Drugs Market Segmentation Overview

By Product Type

Cold & cough remedies comprised the largest market share 21.9% in 2023 because of an increased incidence of seasonal colds and coughs. These conditions were particularly common among children under 10 and individuals 65 years of age and older, reported the Centers for Disease Control and Prevention, creating a need for therapeutic solutions in this category. The ease of access and facilitation of self-administration by customers also helped this segment command market leadership.

Analgesics is the second largest helped by the surging geriatric population, as well as the high demand for pain relief products. This segment has been furthered by recent innovation in the form of new product launches; for instance, the US witnessed the launch of over-the-counter Diclofenac Sodium topical gel, a new product from Dr. Reddy's Laboratories Ltd. during the third quarter of 2020. On the other hand, such a strong market share of OTC analgesics is maintained by the fact that these drugs are available and quite accessible for simple, convenient use, allowing for self-medication; hence, not very surprisingly, they were in such heavy demand among pain sufferers seeking effective analgesia.

By Distribution Channel

The drug stores & retail pharmacies segment dominated the market in 2023 with a 38.6% share, as it accounts for the largest market share. This dominance is attributed to the rising patient preference for purchasing OTC products from retail pharmacies and the increasing number of retail locations offering these products. Consumers tend to favor drug stores and retail pharmacies for OTC drugs due to their accessibility and the ability to seek guidance from pharmacy staff, reinforcing this segment's leading position.

The hospital pharmacies segment holds the second-largest market share, supported by the growing availability of OTC drugs in hospital settings and the wide range of products available to patients.

Meanwhile, online pharmacies are anticipated to experience rapid growth at a lucrative compound annual growth rate (CAGR). This surge is driven by increased internet penetration, especially in emerging markets, and the competitive discounts offered by online platforms, making them a convenient choice for consumers seeking affordable and accessible OTC products.

OTC Drugs Market Regional Insights

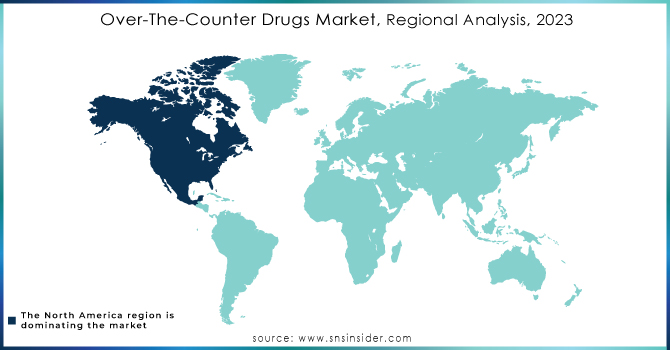

In 2023, North America remained the largest OTC drugs market. To a great extent, this was driven by the free availability of the over-the-counter emergency contraceptive pill known as Plan B One-Step. Since this drug is available without age restrictions, its free availability and the placement of this product without a prescription on pharmacy shelves greatly strengthened the OTC market in the region. Moreover, in 2023, the fact that many essential prescription drugs could be bought over the counter helped grow the sector further. Of note, those were Narcan and RiVive, which are naloxone nasal sprays used as emergency drugs in an overdose of opioids, and Opill, which is the first progestin-only oral birth control sold OTC in the U.S. Advances in this area are showing the trend of making essential medicines ready for full access, improvement of the OTC drugs market in North America in general.

Asia Pacific region is expected to grow at a strong pace during the forecast period. This is one factor making to growth of the OTC drugs market in the emerging markets: increasing disposable incomes, increasing healthcare awareness, and expanding the distribution networks. The compound annual growth rate (CAGR) for the Asia Pacific market, with a health-conscious consumer looking for convenient treatment options, will likely be robust.

Do You Need any Customization Research on Over The Counter Drugs Market - Enquire Now

Over-The-Counter Drugs Market Players

-

Johnson & Johnson Services Inc.

-

Sanofi S.A.

-

Pfizer

-

Mylan

-

GlaxoSmithKline Plc

-

Boehringer Ingelheim International GmbH

-

Reckitt Benckiser Group PLC

-

Perrigo Company plc

-

The Blackstone Group, Inc. (Alinamin Pharmaceutical Co., Ltd.)

-

Aytu Biopharma, Inc. (Aytu Consumer Health, Inc.)

-

Dr. Reddy's Laboratories

-

Viatris, Inc. and others.

Recent Developments

June 2023: McKesson Corporation, a diversified pharmaceutical company, announced the launch of Foster & Thrive, a curated private brand of over-the-counter health and wellness products aimed at addressing evolving patient needs and increasing demand.

July 2022: RLG Limited, an e-commerce and digital marketing firm, partnered with AFT Pharmaceuticals, a company based in New Zealand, to introduce a range of OTC drugs via the online marketplace Tmall Global.

| Report Attributes | Details |

| Market Size in 2023 | US$ 87.32 Bn |

| Market Size by 2032 | US$ 149.72 Bn |

| CAGR | CAGR of 6.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Analgesics, Cold & Cough remedies, Digestives & Intestinal remedies, Skin Treatment, Others) • By Distribution Channel (Drug Stores & Retail Pharmacies, Hospital Pharmacies, Online) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Johnson & Johnson, Bayer Ag, Novartis Ag, Sanofi, Pfizer, Takeda pharmaceutical, Reckitt Benckiser group and Others. |

| Key Drivers | • Enhanced Accessibility and Regulatory Shifts Fuel Rising Demand for OTC Medications |

| Market Restraints | • Incorrect Self-Diagnosis, Side Effects, and Drug Misuse Present Challenges for OTC Drugs Market Growth |