Analgesics Market Report Scope & Overview:

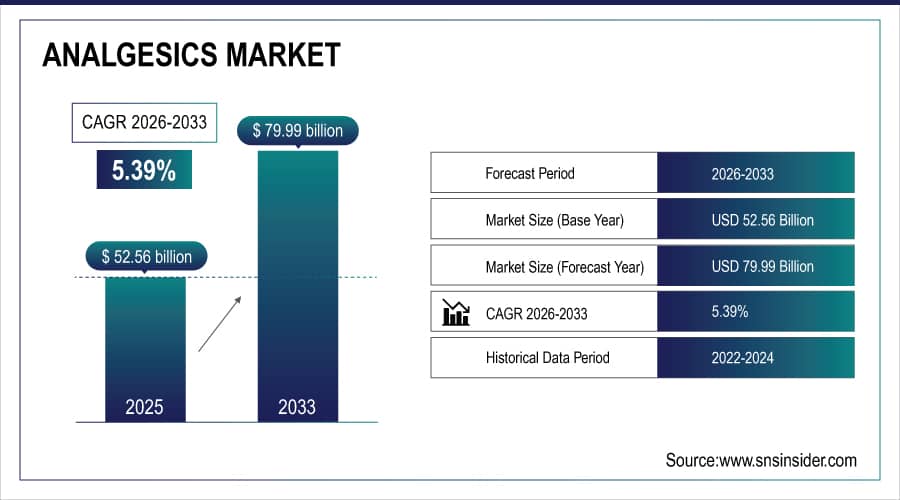

The Analgesics Market size is estimated at USD 52.56 billion in 2025 and is expected to reach USD 79.99 billion by 2033, growing at a CAGR of 5.39% over the forecast period 2026-2033.

Analgesics Market is growing due to increasing prevalence of chronic pain conditions, rising geriatric population, and growing surgical procedures globally. Market expansion is driven by innovation in pain management therapies, growing awareness of pain treatment, and rising healthcare expenditure. Digital transformation in healthcare delivery, telemedicine adoption for pain consultation, and development of non-addictive analgesic alternatives further accelerate market growth.

76% of pain management clinics integrated digital health platforms for analgesic prescription monitoring, achieving 30% better patient compliance and 25% reduction in opioid misuse through AI-powered tracking systems.

To Get More Information On Analgesics Market - Request Free Sample Report

Analgesics Market Size and Forecast

-

Market Size in 2025E: USD 52.56 Billion

-

Market Size by 2033: USD 79.99 Billion

-

CAGR: 5.39% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Analgesics Market Trends

-

Rising adoption of non-opioid and non-addictive analgesic formulations to combat opioid crisis and reduce dependency risks in chronic pain management.

-

Increasing development of targeted analgesics with novel delivery mechanisms for specific pain types including neuropathic, musculoskeletal, and migraine pain.

-

Growing integration of digital therapeutics and mobile health applications for personalized pain management and medication adherence monitoring.

-

Expansion of transdermal and extended-release analgesic formulations for improved patient compliance and sustained pain relief.

-

Rising focus on pediatric and geriatric-specific analgesic formulations addressing age-related pharmacokinetic differences and safety profiles.

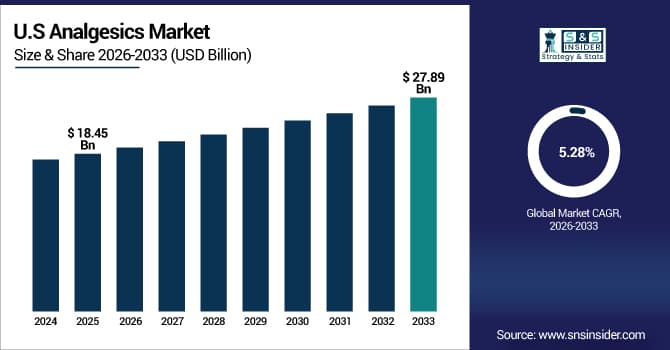

The U.S. Analgesics Market is estimated at USD 18.45 billion in 2025 and is expected to reach USD 27.89 billion by 2033, growing at a CAGR of 5.28% from 2026-2033.

U.S. Analgesics Market is driven by high prevalence of chronic pain conditions, advanced healthcare infrastructure, and significant R&D investments in pain management therapies. Growing geriatric population, increasing surgical procedures, and regulatory initiatives promoting safe analgesic use further accelerate market growth.

Analgesics Market Growth Drivers:

-

Rising Prevalence of Chronic Pain Conditions Sustains Global Demand for Analgesic Therapies

Chronic pain, estimated to affect around 20% of the adult global population according to the World Health Organization, generates significant demand for analgesic medications. The increasing number of patients with long-term pain, originating from musculoskeletal disorders, neuropathic conditions and age-related degenerative diseases, poses enormous challenges to current healthcare systems. Pain has become an indicator of quality of life, leading to the worldwide healthcare systems emphasis and higher rates of prescription, an increase in insurance coverage for pain management and patient access programs. This increased prevalence directly impacts the market growth in both prescription and over-the-counter (OTC) analgesic segments.

82% of healthcare providers reported increased analgesic prescriptions for chronic pain management, with musculoskeletal pain accounting for 45% of prescriptions and neuropathic pain representing 28% of specialized analgesic usage globally.

Analgesics Market Restraints:

-

Strict Regulations, Prescription Monitoring, and Opioid Controls Restrain Growth of Controlled Analgesics

Owing to the addiction risks and the possibility of overdose, regulatory agencies worldwide have placed tight controls on opioid analgesics. PDMPs, prescribing limits, and increased regulatory scrutiny make access to the market difficult. Market competition and related concerns surrounding the opioid crisis has had a chilling effect leading to less willingness of physicians to prescribe these potent analgesics, especially in North America and Europe. These regulatory challenges hinder new product approvals, heighten compliance costs, and limit legitimate patient access to needed pain medications, which negatively impacts market growth.

In 2025, 65% of physicians reported reduced opioid prescribing due to regulatory pressures, with 42% expressing concerns about regulatory audits affecting their analgesic prescribing patterns for chronic pain patients.

Analgesics Market Opportunities:

-

Innovation in Non-addictive, Targeted Analgesics Creates Opportunities for Product Differentiation

Allergan, Zogenix and other pharma companies are working to target next-generation analgesics for targeting potential pain pathways while taking the addiction out of the picture. There are several new methods, such as monoclonal antibodies for headache, sodium channel blockers for neuropathic pain, and non-opioid receptor agonists that represent new approaches. The changing healthcare paradigm shifting to personalized pain medicine guided by genetic markers, pain mechanisms, and phenotypes, opens therapeutic opportunities for precision analgesics. These solutions fill gaps in pain management and are able to avoid regulations on classic analgesics, creating large scale growth opportunities.

In 2025, 68% of pharmaceutical R&D investment in analgesics focused on non-opioid mechanisms, with 45 novel non-addictive analgesic candidates in clinical development stages globally.

Analgesics Market Segment Analysis

-

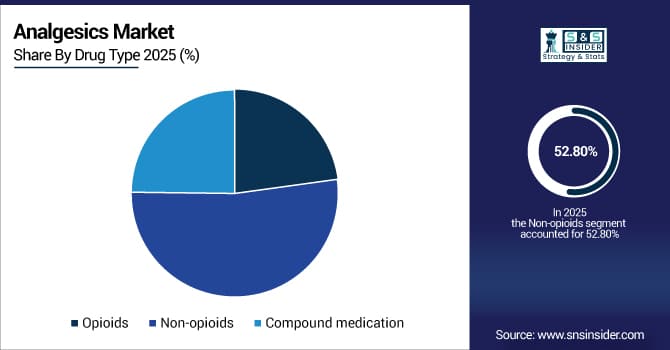

By Drug Type: Non-opioids led with 52.8% share, while Compound Medication is the fastest-growing segment with CAGR of 6.8%.

-

By Route of Administration: Oral led with 61.3% share, while Transdermal is the fastest-growing segment with CAGR of 7.2%.

-

By Distribution Channel: Retail Pharmacies led with 48.7% share, while Online Pharmacies is the fastest-growing segment with CAGR of 9.4%.

-

By Application: Musculoskeletal led with 34.2% share, while Neuropathic is the fastest-growing segment with CAGR of 7.1%.

By Drug Type: Non-opioids Led the Market, while Compound Medication is the Fastest-growing Segment in the Market

Non-opioids constitute the major share of the analgesics market due to their availability, safety, and large-scale use in mildly to moderately painful conditions. Non-Steroidal Anti-Inflammatory Drugs (NSAIDs), acetaminophen, and COX-2 inhibitors form the major revenue contributors backed by Over the Counter (OTC) availability and prescription formulations. With increasing fears over opioid-associated risk, there has been rapid adoption of non-opioids throughout primary care, orthopedics, and post-operative settings.

The Compound Medication is expected to be the fastest expanding category as healthcare providers are now manufacturing specific formulations of analgesics to suit the needs of individual patients and pain types. Precision dosing, alternative routes of administration, and combination therapies not commercially available can be provided with compounded analgesics. Expansion is fueled by the use of personalized medicine, specialized pain clinics, and patients with very specific needs including allergy or pediatric dosing.

By Route of Administration: Oral Segment Led the Market, while Transdermal is the Fastest-growing Segment in the Market

Oral route segment dominate the market with well-known advantages, such as patient‐friendliness, stability, universal prescribing guidelines, and a large product availability in all classes of analgesics. Tablet/capsule and liquid formulations are inexpensive, allow for flexible dose adjustments, and have high patient compliance. The oral route will remain the dominant route of administration for acute and chronic pain due to the versatility of advanced formulations such as controlled-release and combination products.

Transdermal delivery is the fastest-growing segment as it offers sustained pain relief, improved compliance, reduced systemic side effects, and bypasses gastrointestinal complications. Advancements in patch technology, including reservoir systems, matrix patches, and microneedle arrays, enhance drug delivery efficiency and patient comfort. Transdermal analgesics are particularly valuable for chronic pain conditions requiring continuous medication, patients with swallowing difficulties, and situations where steady plasma concentrations are essential.

The fastest-growing segment in the market is the transdermal delivery, drive by its advantages in achieving sustained pain relief, better compliance, minimal systemic side effect, and avoidance of gastrointestinal complications. Improvements of patch designs, such as reservoir systems, matrix patches, and microneedle arrays enhance drug delivery efficiency and reduce discomfort. They are especially useful in chronic pain requiring continuous treatment, swallowing difficulties, and when constant plasma levels are required.

By Distribution Channel: Retail Pharmacies Segment Led the Market, while Online Pharmacies is the Fastest-growing Segment Globally

Retail Pharmacies is the dominant segment in the market owing to extensive networks, immediate accessibility, pharmacist counseling services, and established relationships with healthcare providers. Chain pharmacies, independent drugstores, and supermarket pharmacy departments collectively handle the majority of analgesic prescriptions and OTC sales. Their physical presence enables face-to-face patient education, medication therapy management, and coordinated care with physicians.

Online Pharmacies represent the fastest-growing distribution channel in the market due to the increasing digital healthcare adoption, convenience benefits, and expanding telemedicine integration. E-pharmacies provide discreet access, price comparison capabilities, home delivery, and automated refill services, which are especially valuable for chronic pain patients. Regulatory frameworks supporting online prescription verification, enhanced cybersecurity for controlled substances, and insurance integration accelerate market penetration.

By Application: Musculoskeletal Dominates the Market, while Neuropathic is the Fastest-growing Segment in the Market

Musculoskeletal applications dominate the market as a result of high prevalence of osteoarthritis, rheumatoid arthritis, back pain, and sports injuries globally. Analgesics for musculoskeletal conditions is the largest revenue segment, as the indication includes both prescription and OTC products across all drug classes. Patients are increasingly being treated for musculoskeletal diseases because of the aging population, an increased proportion of sedentary lifestyles, the rising prevalence of obesity, and occupational factors.

Neuropathic pain is expected to be the fastest-growing application segment due to the advancement in understanding pain mechanisms and emerging targeted therapies globally. Conditions, such as diabetic neuropathy, post-herpetic neuralgia, fibromyalgia, and chemotherapy-induced peripheral neuropathy drive specialized analgesic demand. Unlike traditional nociceptive pain, neuropathic conditions require specific pharmacological approaches including anticonvulsants, antidepressants, and novel targeted agents.

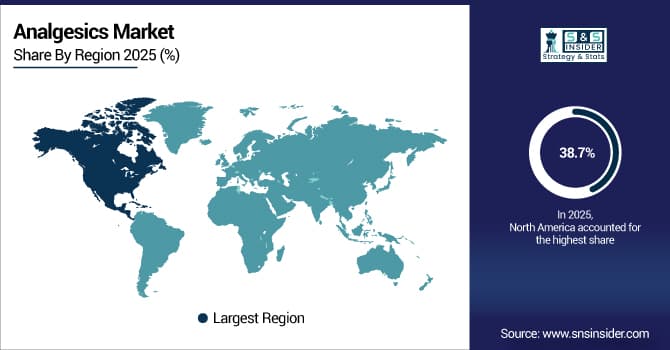

Analgesics Market Regional Analysis

North America Analgesics Market Insights:

North America dominated the Analgesics Market with a 38.7% share in 2025 due to high healthcare expenditure, advanced pain management infrastructure, significant geriatric population, and strong presence of pharmaceutical innovators. Strict opioid regulations driving non-opioid adoption, high chronic disease prevalence, and sophisticated distribution networks further reinforced the region’s market leadership.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Analgesics Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 6.8% from 2026–2033, driven by expanding healthcare access, rising chronic disease burden, increasing healthcare expenditure, and growing elderly population. Improving diagnosis rates, OTC market expansion, and local pharmaceutical manufacturing growth accelerate market expansion across emerging economies in the region.

Europe Analgesics Market Insights

Europe held a significant share in the Analgesics Market in 2025, supported by universal healthcare systems, strong regulatory frameworks, high pain management awareness, and established pharmaceutical distribution. Aging population demographics, government pain management initiatives, and balanced approach to opioid utilization further strengthened Europe’s position in the global analgesics landscape.

Middle East & Africa and Latin America Analgesics Market Insights

The Middle East & Africa and Latin America together showed steady growth in the Analgesics Market in 2025, driven by healthcare infrastructure development, increasing chronic disease awareness, improving access to medicines, and economic expansion. Government healthcare initiatives, local manufacturing investments, and growing pharmacist-led pain management further supported market development across these emerging regions.

Analgesics Market Competitive Landscape:

Johnson & Johnson

Johnson & Johnson is a global healthcare leader headquartered in the United States, with significant presence in analgesics through its Consumer Health and Pharmaceutical segments. The company markets leading OTC analgesic brands including Tylenol (acetaminophen) and Motrin (ibuprofen), along with prescription pain medications. J&J emphasizes innovation in pain management, safety profile enhancement, and accessibility across global markets through diversified distribution channels and strategic partnerships.

-

January 2025, Johnson & Johnson Consumer Health launched Tylenol Rapid Release Gels with 25% faster absorption technology, capturing significant market share in fast-acting OTC analgesics segment.

Pfizer Inc.

Pfizer Inc., headquartered in the United States, is a pharmaceutical leader with substantial analgesics portfolio including Celebrex (celecoxib) and Lyrica (pregabalin) for neuropathic pain. The company focuses on innovative pain management solutions, particularly in prescription analgesics for chronic conditions. Pfizer's strong R&D capabilities, global commercial infrastructure, and commitment to safe pain management practices position it as a key player across multiple analgesic therapeutic categories worldwide.

-

March 2024, Pfizer received FDA approval for novel neuropathic pain indication extension for Lyrica, expanding addressable patient population by approximately 15% in key markets.

GSK (GlaxoSmithKline)

GSK, headquartered in the United Kingdom, maintains strong presence in analgesics through its Consumer Healthcare division, featuring Panadol (paracetamol/acetaminophen) as a globally recognized brand. The company emphasizes accessible pain relief, product innovation in formulation and delivery, and evidence-based pain management recommendations. GSK's extensive distribution networks, brand recognition, and focus on self-care empowerment support its competitive position in both developed and emerging analgesic markets.

-

November 2023, GSK launched Panadol Digital Connected Cap in select markets, integrating medication tracking with mobile health applications to improve analgesic adherence and safety monitoring.

Analgesics Market Key Players

Some of the Analgesics Market Companies

-

Bayer AG

-

Novartis AG

-

Sanofi

-

Reckitt Benckiser

-

Sun Pharmaceutical

-

Teva Pharmaceutical

-

Endo International

-

Viatris

-

Dr. Reddy's Laboratories

-

AstraZeneca

-

Eli Lilly and Company

-

AbbVie Inc.

-

Merck & Co.

-

Bristol Myers Squibb

-

Takeda Pharmaceutical

-

Perrigo Company

-

Hikma Pharmaceuticals

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | US$ 52.56 Billion |

| Market Size by 2033 | US$ 79.99 Billion |

| CAGR | CAGR of 5.39 % From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Opioid, Non-opioid, Compound medication) • By Route of Administration (Oral, Parenteral, Transdermal, Others) • By Distribution Channel (Hospital pharmacies, Retail pharmacies, Online pharmacies) • By Application (Musculoskeletal, Surgical and Trauma, Cancer, Neuropathic, Migraine, Obstetrical, Fibromyalgia, Pain due to Burns, Dental/Facial, Pediatric, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Johnson & Johnson, Pfizer Inc., GSK (GlaxoSmithKline), Bayer AG, Novartis AG, Sanofi, Reckitt Benckiser, Sun Pharmaceutical, Teva Pharmaceutical, Endo International, Viatris, Dr. Reddy's Laboratories, AstraZeneca, Eli Lilly and Company, AbbVie Inc., Merck & Co., Bristol Myers Squibb, Takeda Pharmaceutical, Perrigo Company, Hikma Pharmaceuticals |