Paper Packaging Market Report Scope & Overview:

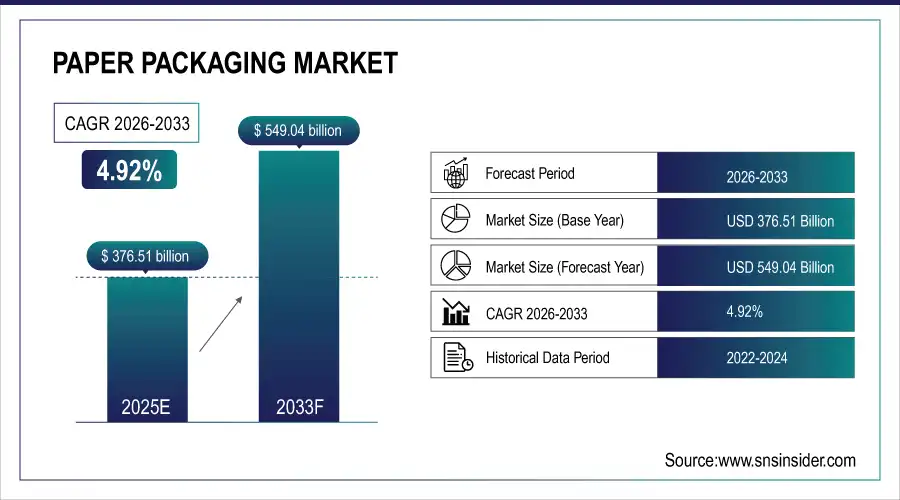

Paper Packaging Market was valued at USD 376.51 billion in 2025E and is expected to reach USD 549.04 billion by 2033, growing at a CAGR of 4.92% from 2026-2033.

The Paper Packaging Market is growing due to increasing demand for sustainable and eco-friendly packaging solutions across industries. Expansion of e-commerce, food & beverage, and retail sectors is driving the need for durable and recyclable packaging. Rising consumer awareness of environmental sustainability, coupled with government regulations limiting plastic use, is boosting adoption. Technological advancements in packaging design and materials further support market growth.

Paper Packaging Market Size and Forecast

-

Market Size in 2025: USD 376.51 Billion

-

Market Size by 2033: USD 549.04 Billion

-

CAGR: 4.92% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Paper Packaging Market - Request Free Sample Report

Paper Packaging Market Trends

-

Rising demand for sustainable and eco-friendly packaging solutions is driving the paper packaging market.

-

Growing restrictions on single-use plastics are accelerating the shift toward recyclable and biodegradable paper-based materials.

-

Expansion of e-commerce, food & beverage, and personal care industries is boosting the need for durable paper packaging formats.

-

Advancements in packaging design, lightweight materials, and printing technologies are enhancing product appeal and performance.

-

Increasing consumer preference for environmentally responsible brands is shaping packaging innovations.

-

Growing investments in recycled paper production and fiber recovery systems are supporting market growth.

-

Collaborations between packaging manufacturers, retailers, and FMCG companies are accelerating adoption and market expansion.

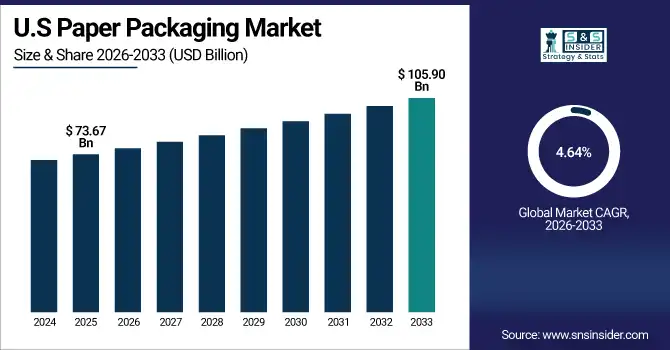

U.S. Paper Packaging Market was valued at USD 73.67 billion in 2025E and is expected to reach USD 105.90 billion by 2033, growing at a CAGR of 4.64% from 2026-2033.

The U.S. Paper Packaging Market is growing due to rising demand for sustainable packaging, expansion of e-commerce and retail sectors, increasing consumer awareness of eco-friendly solutions, and stringent regulations limiting plastic usage, driving adoption of paper-based packaging.

Paper Packaging Market Growth Drivers:

-

Rising e-commerce and retail sector growth is fueling increased demand for paper-based packaging solutions globally

The rapid expansion of e-commerce platforms has led to a substantial increase in packaged goods shipments, driving the demand for paper packaging. Paper cartons, corrugated boxes, and bags are preferred due to their strength, lightweight nature, and recyclability. Retailers also leverage custom-designed paper packaging for branding and marketing purposes. As consumers demand convenience and sustainability, paper packaging offers an effective solution to balance protection, aesthetics, and environmental responsibility. Consequently, the growth of e-commerce and retail industries serves as a key driver, directly influencing the rising adoption of paper-based packaging solutions worldwide.

Paper Packaging Market Restraints:

-

High production costs and raw material price volatility are limiting the growth of the paper packaging market globally

Fluctuating prices of pulp and recycled paper increase operational costs for manufacturers, affecting profitability. Additionally, energy-intensive production processes further contribute to high manufacturing expenses. Small and medium-sized enterprises often face difficulties in absorbing these costs, limiting market expansion. The dependency on imported raw materials in some regions also exposes manufacturers to supply chain disruptions. Combined with competition from cheaper plastic alternatives, these factors restrain the growth of paper packaging. Companies are challenged to maintain cost efficiency while delivering sustainable products, which slows widespread adoption and affects the overall market momentum globally.

Paper Packaging Market Opportunities:

-

Increasing investments in innovative, biodegradable, and recyclable paper packaging technologies create significant growth opportunities

Technological advancements in paper coatings, barrier materials, and structural design are enabling manufacturers to overcome traditional limitations. Biodegradable and recyclable packaging solutions appeal to environmentally conscious consumers and regulatory authorities, opening new markets. Investments in R&D allow companies to develop lightweight yet durable packaging, suitable for diverse applications including food, pharmaceuticals, and e-commerce. Additionally, integration of smart packaging technologies such as QR codes and anti-counterfeit features enhances functionality. These innovations present opportunities for companies to differentiate products, capture market share, and expand their footprint in both developed and emerging markets worldwide.

Paper Packaging Market Segment Analysis

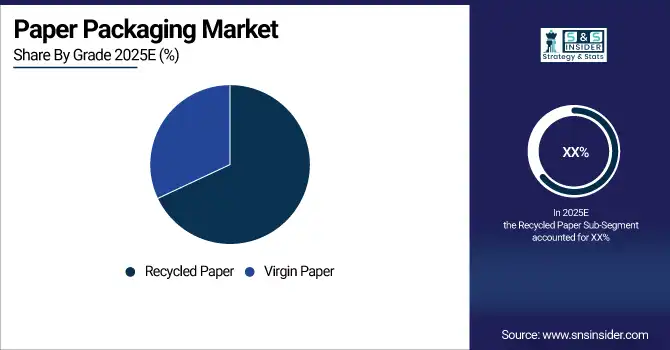

By Grade, Recycled Paper dominated the Market, while Virgin Paper is expected to grow at the fastest CAGR

Recycled Paper segment dominated the Paper packaging market in 2025 due to its cost-effectiveness and availability. Growing environmental awareness and regulatory support encouraged manufacturers to adopt recycled paper. Its sustainable nature, recyclability, and suitability for various packaging applications in food, beverages, and consumer goods contributed to its leading revenue share.

Virgin Paper segment is expected to grow at the fastest CAGR from 2026-2033 due to rising demand for premium, high-strength, and durable packaging. Industries such as luxury goods, pharmaceuticals, and specialty products require virgin paper for superior print quality and aesthetics, driving its adoption over recycled alternatives and boosting market growth during the forecast period.

By Product, Corrugated Boxes led the Market, with Folding Cartons projected to register the highest CAGR

Corrugated Boxes segment dominated the Paper packaging market in 2025 due to its strength, durability, and protective properties. Widely used for shipping and storage, especially in e-commerce and industrial sectors, corrugated boxes ensure safe handling of goods, reduce product damage during transit, and provide a cost-effective solution for bulk packaging needs.

Folding Cartons segment is expected to grow at the fastest CAGR from 2026-2033 due to increasing demand for attractive, lightweight, and customizable packaging. Their versatility in retail, pharmaceuticals, and consumer products, along with the ability to support branding and marketing initiatives, is driving adoption and fueling rapid market growth in this segment.

By Application, Food & Beverages held the largest share, while E-commerce & Retail is expected to grow at the fastest CAGR

Food & Beverages segment dominated the Paper packaging market in 2025 because of high consumption, hygiene requirements, and sustainability trends. Paper packaging ensures product safety, easy handling, and compliance with environmental regulations. Its suitability for various formats, including cartons, bags, and wraps, made it the preferred choice across the food and beverage industry.

E-commerce & Retail segment is expected to grow at the fastest CAGR from 2026-2033 due to the boom in online shopping and parcel shipments. Demand for lightweight, durable, and eco-friendly packaging solutions is rising. Retailers are increasingly using paper packaging for branding, sustainability, and safe product delivery, driving rapid adoption in this segment.

By Level of Packaging, Secondary Packaging dominated the market, with the fastest growth projected

Secondary Packaging segment dominated the Paper packaging market in 2025 due to its critical role in protecting, bundling, and transporting products efficiently. It provides enhanced safety during logistics, supports branding, and reduces product damage. The segment is expected to grow at the fastest CAGR from 2026-2033 as increasing e-commerce shipments and retail distribution require reliable, sustainable, and cost-effective packaging solutions, driving higher adoption across food, beverages, consumer goods, and industrial sectors worldwide.

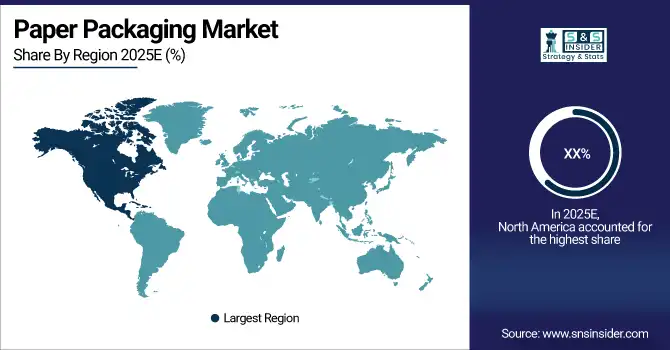

Paper Packaging Market Regional Analysis

North America Paper Packaging Market Insights

North America played a key role in the Paper packaging market in 2025 due to strong demand from food, beverage, and e-commerce industries. Increasing consumer awareness of environmental sustainability and stringent regulations against plastic usage drove the adoption of paper-based packaging. Advanced manufacturing technologies, well-developed logistics infrastructure, and rising preference for recyclable and eco-friendly packaging solutions contributed to the region’s significant market presence and steady growth during this period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Paper Packaging Market Insights

Asia Pacific dominated the Paper packaging market in 2025 with the highest revenue share of about 42% due to rapid industrialization, urbanization, and growing consumer demand for packaged goods. Expansion of e-commerce, retail, and food & beverage sectors increased the need for sustainable and cost-effective packaging solutions. Rising awareness of environmental sustainability and government initiatives promoting eco-friendly materials further boosted adoption, making Asia Pacific the leading region in the paper packaging market during this period.

Europe Paper Packaging Market Insights

Europe held a significant position in the Paper packaging market in 2025 due to strict environmental regulations and growing consumer preference for sustainable packaging. The region’s well-established manufacturing base, advanced recycling infrastructure, and high demand from food, beverage, and e-commerce sectors supported market growth. Increasing adoption of eco-friendly paper solutions and government initiatives to reduce plastic usage further strengthened Europe’s presence in the global paper packaging market during this period.

Middle East & Africa and Latin America Paper Packaging Market Insights

Middle East & Africa and Latin America witnessed growth in the Paper packaging market in 2025 due to rising industrialization, urbanization, and expanding retail and e-commerce sectors. Increasing consumer demand, government initiatives promoting sustainable packaging, and investments in local manufacturing and infrastructure supported adoption. Growing awareness of eco-friendly materials and steady expansion of food, beverage, and industrial industries further strengthened the presence and market share of both regions during this period.

Paper Packaging Market Competitive Landscape:

International Paper Company

International Paper is a global leader in renewable fiber-based packaging, pulp, and paper products. The company emphasizes sustainability, operational efficiency, and innovation in packaging solutions for consumer and industrial markets. It focuses on optimizing production, divesting non-core assets, and expanding its packaging footprint in high-growth regions while implementing cost-efficiency strategies to enhance competitiveness and long-term growth.

-

2025: Announced strategic operational changes in North America, including exiting molded fiber, closing certain packaging/recycling facilities, and selling containerboard/recycling plants in Mexico to bolster packaging focus.

-

2025: Exploring a sustainable packaging facility in Salt Lake City, Utah, to expand U.S. packaging capacity.

-

2025: Closed two Georgia paper mills and sold its pulp business, expanding cardboard production.

-

2025: EU antitrust regulators conditionally approved its $7.16 billion acquisition of DS Smith, contingent on divestitures.

-

2025: Laid off workers in South Texas as operations shift toward a modern sheet plant in Reynosa, Mexico.

Smurfit Westrock plc

Smurfit Westrock, formed from the combination of Smurfit Kappa and WestRock, is a leading global paper-based packaging company specializing in sustainable solutions for consumer and industrial markets. The company emphasizes operational excellence, capacity optimization, and strategic investments to drive profitability and market share. Its approach includes closing underperforming facilities, investing in high-growth regions, and leveraging synergies to improve efficiency while maintaining environmental and customer-focused initiatives.

-

2025: Reported strong Q1 financial results with $382 million net income, synergy gains, and investments in new converting plants in North America.

-

2025: Reduced capacity and closed U.S. and German facilities, cutting over 500,000 tons of annual paper capacity.

-

2024: Announced fiber price increases effective Jan 1 2025 for linerboard and corrugating medium to offset costs and inflation.

Mondi plc

Mondi is a multinational packaging and paper company with a strong focus on sustainability, innovation, and market expansion. It provides recyclable and renewable fiber-based solutions for industrial, consumer, and e-commerce applications. The company pursues strategic acquisitions and mergers to expand its footprint in Europe and beyond, emphasizing operational efficiency, sustainable growth, and leadership in eco-friendly packaging solutions.

-

2024: Offered to acquire DS Smith for £5.14 billion, aiming to create a leading European sustainable packaging company (deal later overtaken by International Paper).

-

2024: Completed acquisition of Schumacher Packaging assets across Germany, UK, and Netherlands, expanding sustainable packaging presence in Western Europe.

Key Players

Some of the Paper Packaging Market Companies

-

International Paper Company

-

Smurfit Westrock plc

-

Mondi plc

-

Packaging Corporation of America

-

Stora Enso Oyj

-

Graphic Packaging International, LLC

-

Nippon Paper Industries Co., Ltd.

-

Sonoco Products Company

-

Oji Holdings Corporation

-

Georgia-Pacific LLC

-

Nine Dragons Paper Holdings

-

Lee & Man Paper Manufacturing

-

Sappi Limited

-

Ilim Group

-

Klabin S.A.

-

Asia Pulp & Paper (APP)

-

Amcor plc

-

DS Smith Plc

-

Holmen Group

-

Huhtamäki Oyj

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 376.51 Billion |

| Market Size by 2033 | USD 549.04 Billion |

| CAGR | CAGR of 4.92% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Grade (Recycled Paper, Virgin Paper) • By Product (Corrugated Boxes, Folding Cartons, Paper Bags & Sacks, Liquid Packaging Cartons, Others) • By Application (Food & Beverages, E-commerce & Retail, Industrial Packaging, Healthcare, Personal Care & Cosmetics, Consumer Goods) • By Level of Packaging (Primary Packaging, Secondary Packaging, Tertiary Packaging) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | International Paper Company, Smurfit Westrock plc, Mondi plc, Packaging Corporation of America, Stora Enso Oyj, Graphic Packaging International, LLC, Nippon Paper Industries Co., Ltd., Sonoco Products Company, Oji Holdings Corporation, Georgia-Pacific LLC, Nine Dragons Paper Holdings, Lee & Man Paper Manufacturing, Sappi Limited, Ilim Group, Klabin S.A., Asia Pulp & Paper (APP), Amcor plc, DS Smith Plc, Holmen Group, Huhtamäki Oyj |