Pet Food Packaging Market Report Scope & Overview:

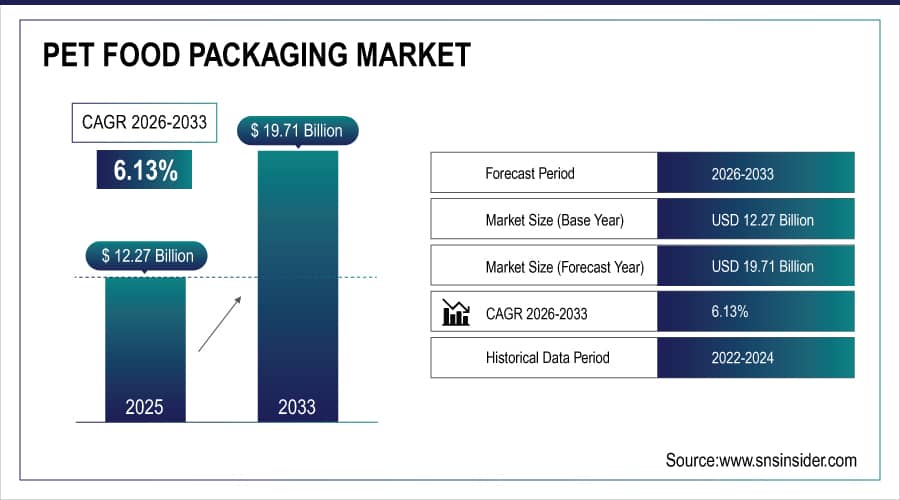

The Pet Food Packaging Market Size is valued at USD 12.27 Billion in 2025E and is projected to reach USD 19.71 Billion by 2033, growing at a CAGR of 6.13% during the forecast period 2026–2033.

The Pet Food Packaging Market analysis report provides comprehensive insights into industry developments, key influences, and potential prospects. Rising pet ownership, increasing demand for convenient and sustainable packaging solutions, and expanding e-commerce channels are driving market growth, which is expected to continue over the forecast period.

Pet food packaging sales reached 4.8 billion units in 2025, driven by rising pet ownership and growing demand for convenient packaging.

To Get More Information On Pet Food Packaging Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 12.27 Billion

-

Market Size by 2033: USD 19.71 Billion

-

CAGR: 6.13% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Pet Food Packaging Market Trends:

-

Growing consumer preference for eco-friendly and biodegradable packaging is pushing brands to adopt sustainable materials and production practices.

-

E-commerce and online pet food platforms are expanding rapidly, driving demand for innovative and convenient packaging formats.

-

Collaborations between pet food manufacturers and packaging solution providers are enabling creative, functional, and visually appealing designs.

-

Rising pet adoption and premiumization trends are increasing demand for customized, portion-controlled, and resealable packaging options.

-

Smart packaging solutions, including QR codes and freshness indicators, are enhancing consumer engagement and transparency.

-

Increasing focus on circular economy practices and recyclable materials is reshaping packaging strategies across the market.

U.S. Pet Food Packaging Market Insights:

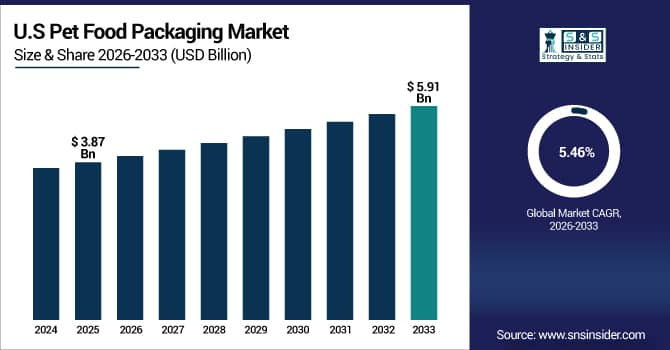

The U.S. Pet Food Packaging Market is projected to grow from USD 3.87 Billion in 2025E to USD 5.91 Billion by 2033, at a CAGR of 5.46%. Growth is driven by rising pet ownership, demand for convenient and sustainable packaging, and expansion of online and subscription-based pet food retail channels.

Pet Food Packaging Market Growth Drivers:

-

Rising pet ownership and demand for convenient, sustainable packaging solutions driving market expansion globally.

Rising pet ownership and increasing demand for convenient, sustainable packaging solutions are key drivers of Pet Food Packaging Market growth. Growing awareness about pet health and premium nutrition has led manufacturers to focus on functional, resealable, and eco-friendly packaging. Expansion of e-commerce and online pet food retail further fuels demand for innovative packaging formats. Brands are leveraging sustainability and convenience to enhance consumer engagement and capture market share.

Pet food packaging sales grew 6.1% in 2025, driven by rising pet ownership and demand for sustainable, convenient packaging.

Pet Food Packaging Market Restraints:

-

High packaging costs, regulatory compliance challenges, and limited consumer awareness are restricting consistent growth of the market.

High packaging costs, stringent regulatory compliance, and limited consumer awareness are key restraints for the Pet Food Packaging Market. Expensive sustainable or innovative packaging formats can limit adoption by smaller brands or cost-sensitive consumers. Compliance with safety and labeling regulations adds operational complexity and expense. Additionally, lack of consumer understanding about eco-friendly or functional packaging reduces demand. Together, these factors constrain market expansion and challenge manufacturers to balance innovation, cost, and accessibility.

Pet Food Packaging Market Opportunities:

-

Rising demand for eco-friendly and functional pet food packaging presents opportunities for innovation in materials and design.

Rising demand for eco-friendly and functional pet food packaging presents a significant opportunity for market growth. Consumers are increasingly conscious of sustainability, seeking recyclable, biodegradable, and resealable packaging. Simultaneously, e-commerce growth and online pet food retail are driving innovation in packaging design and convenience. Companies focusing on sustainable materials, innovative formats, and enhanced consumer experience are well-positioned to capture market share and strengthen brand loyalty in a competitive landscape.

Eco-friendly pet food packaging accounted for 22% of new packaging launches in 2025, driven by rising consumer demand for sustainable and convenient solutions.

Pet Food Packaging Market Segmentation Analysis:

-

By Packaging Type, Flexible Packaging held the largest market share of 38.45% in 2025, while Pouches are expected to grow at the fastest CAGR of 7.15% during 2026–2033.

-

By Material Type, Plastic dominated with a 46.87% share in 2025, while Biodegradable is projected to expand at the fastest CAGR of 7.42% during the forecast period.

-

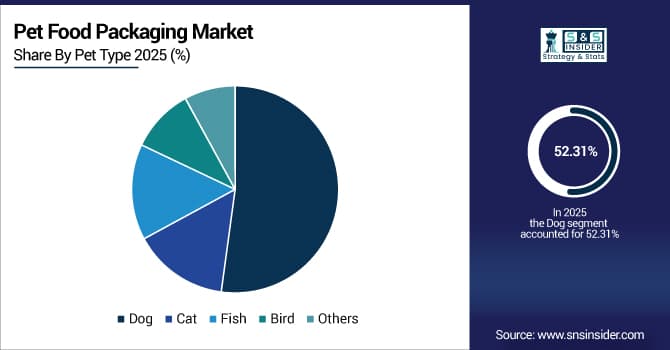

By Pet Type, Dog accounted for the highest market share of 52.31% in 2025, while Cat is anticipated to record the fastest CAGR of 6.78% through 2026–2033.

-

By Distribution Channel, Supermarkets & Hypermarkets held the largest share of 39.62% in 2025, while Online Retail is expected to grow at the fastest CAGR of 7.28% during 2026–2033.

By Packaging Type, Flexible Packaging Dominates While Pouches Expand Rapidly:

Flexible Packaging segment dominated the market due to its lightweight nature, convenience and ability to preserve freshness for various pet foods. Its versatility across dry, wet, and semi-moist formats makes it highly preferred by manufacturers and consumers alike. In 2025, flexible packaging units surpassed 1.85 billion units.

Pouches are the fastest growing segment, driven by rising demand for single-serve portions, resealable designs and portability. Innovations in stand-up and multi-layered pouches enhanced shelf appeal. In 2025, pouch demand reached 0.87 billion units.

By Material Type, Plastic Dominates While Biodegradable Surges Ahead:

Plastic segment dominated the market due to durability, cost-effectiveness and compatibility with flexible and rigid packaging formats. Its ability to protect food quality and extend shelf life has ensured mass adoption. In 2025, plastic packaging units exceeded 2.05 billion units.

Biodegradable are the fastest growing segment, fueled by increasing environmental awareness, government regulations and consumer preference for sustainable solutions. Eco-friendly innovation in compostable films and plant-based coatings is boosting adoption. In 2025, biodegradable packaging units reached 0.42 billion units.

By Pet Type, Dog Dominates While Cat Shows Fastest Growth:

Dog segment dominated the market due to the higher dog population and the increasing trend of premium, portion-controlled meals. Convenience-focused formats such as flexible pouches and resealable bags are highly favored by dog owners. In 2025, dog food packaging units surpassed 2.45 billion units.

Cat is the fastest growing segment, driven by rising cat adoption, specialized nutrition and growing premiumization in urban areas. Innovative pouches and small-portion packs cater to cat owners’ needs. In 2025, cat food packaging units reached 1.18 billion units.

By Distribution Channel, Supermarkets & Hypermarkets Dominate While Online Retail Accelerates:

Supermarkets & Hypermarkets segment dominated the market due to their extensive reach, one-stop shopping convenience and established pet food retail networks. Bulk purchases and promotional campaigns further drive sales through these channels. In 2025, units sold through supermarkets and hypermarkets reached 1.62 billion units.

Online Retail is the fastest growing segment, boosted by e-commerce penetration, subscription-based pet food delivery, and consumer preference for doorstep convenience. Digital platforms are also enhancing personalized packaging options. In 2025, online retail units exceeded 1.04 billion units.

Pet Food Packaging Market Regional Analysis:

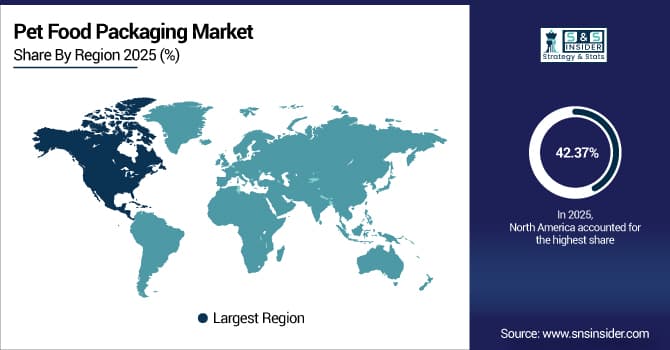

North America Pet Food Packaging Market Insights:

The North America Pet Food Packaging Market is dominated, holding a 42.37% share in 2025, driven by high pet ownership and preference for convenient, premium packaging formats. Rising consumer awareness of sustainable and resealable packaging is prompting innovation among manufacturers in the U.S. and Canada. Expansion of e-commerce platforms and subscription-based pet food delivery, coupled with functional and eco-friendly packaging designs, is further reinforcing North America’s market leadership.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Pet Food Packaging Market Insights:

The U.S. Pet Food Packaging Market is driven by the popularity of premium and eco-friendly packaging, rising pet adoption, and innovative convenience formats. E-commerce platforms, subscription deliveries, and personalized packaging experiences are shaping consumer preferences, while collaborations between brands and sustainable material suppliers are boosting innovation and reinforcing the U.S. market’s leadership.

Asia-Pacific Pet Food Packaging Market Insights:

The Asia-Pacific Pet Food Packaging Market is the fastest-growing region, projected to expand at a CAGR of 7.16% during 2026–2033. Growth is fueled by rising pet ownership, increasing disposable incomes, and growing awareness of sustainable and convenient packaging in China, India, Japan and Australia. Rapid expansion of e-commerce, online subscription services, and innovative packaging solutions are accelerating adoption. Increasing regional manufacturing capacities and premiumization trends further strengthen APAC’s market growth.

China Pet Food Packaging Market Insights:

The China Pet Food Packaging Market is driven by rising pet ownership, increasing disposable incomes, and expanding e-commerce platforms. Growing demand for premium and sustainable packaging, along with strong local and international brand presence, is fueling market growth. China plays a central role in APAC’s market with digital retail and innovative packaging trends.

Europe Pet Food Packaging Market Insights:

The Europe Pet Food Packaging Market is driven by rising pet ownership, increasing demand for sustainable and functional packaging, and the presence of established global and regional brands. Countries such as Germany, France, and the UK are leading in innovative packaging solutions, premium formats, and eco-friendly materials. Growing e-commerce adoption, awareness of pet nutrition, and evolving consumer preferences are shaping a competitive landscape and supporting steady market growth across Europe.

Germany Pet Food Packaging Market Insights:

Germany is a key market in Europe’s Pet Food Packaging sector, driven by high pet ownership, demand for sustainable and functional packaging, and presence of premium brands. Growth is supported by strong consumer preference for eco-friendly materials, innovative packaging formats, and expanding e-commerce and retail channels across the country.

Latin America Pet Food Packaging Market Insights:

The Latin America Pet Food Packaging Market is growing due to rising pet ownership and expanding middle-class incomes in Brazil, Mexico, and Argentina. Demand is supported by increasing domestic production, retail expansions, and e-commerce growth. Adoption of sustainable packaging solutions and collaborations with international brands are further driving regional market growth.

Middle East and Africa Pet Food Packaging Market Insights:

The Middle East & Africa Pet Food Packaging Market is expanding with rising pet ownership, increasing disposable incomes, and growing preference for premium and convenient packaging. Retail investments, e-commerce adoption, and innovative packaging solutions are driving demand, with key markets including Saudi Arabia, UAE, and South Africa leading regional growth.

Pet Food Packaging Market Competitive Landscape:

Amcor plc is a packaging leader specializing in both flexible and rigid packaging solutions for food, beverages, and pet food. Operating in over 36 countries with a vast network of production facilities, Amcor delivers packaging to leading brands. Its dominance comes from a wide product portfolio including pouches, cartons, and specialty containers, combined with a strong focus on sustainability, lightweight designs, and recyclable solutions, making it a preferred supplier for premium and mass-market pet food packaging.

-

In March 2025, Amcor announced that 96% of its flexible-packaging portfolio is now recycle-ready, advancing sustainable, circular solutions for pet food and other markets, reinforcing its leadership in eco-friendly, innovative packaging formats globally.

Berry Global, Inc. is a major manufacturer of plastic and flexible packaging solutions across consumer goods, food and pet care sectors. With extensive operations, the company serves a wide range of customers with high-volume, durable packaging solutions. Berry Global dominates the pet food packaging market due to its ability to scale production, offer innovative plastic packaging formats, and deliver reliable, cost-effective solutions that meet the growing demand for convenience, shelf-life preservation, and sustainability.

-

In January 2025, Berry Global launched 100% recycled plastic cat-treat canisters with Nestlé Purina PetCare, reducing virgin resin use and waste. In November 2024, it rolled out recyclable all-polyethylene films for durable, sustainable pet food packaging.

ProAmpac LLC is a leading flexible packaging specialist, providing pouches, bags, films, and sustainable packaging solutions for pet food and other consumer goods. Known for its material science expertise and innovation, ProAmpac delivers customizable, shelf-ready, and eco-friendly packaging designs. Its market dominance stems from its ability to offer versatile packaging formats, sustainable mono-material solutions and reach, making it a preferred partner for pet food brands seeking high-quality, convenient, and environmentally responsible packaging options.

-

In June 2025, ProAmpac introduced its “ProActive Sustainability” platform, ensuring 100% of its packaging portfolio features sustainable, circular solutions for pet food and other sectors, emphasizing eco-friendly innovation and commitment to sustainability goals.

Pet Food Packaging Market Key Players:

Some of the Pet Food Packaging Market Companies are:

-

Amcor plc

-

Berry Global, Inc.

-

ProAmpac LLC

-

Mondi Group

-

Huhtamäki Oyj

-

Smurfit Kappa Group Plc

-

Sealed Air Corporation

-

Sonoco Products Company

-

Constantia Flexibles

-

Crown Holdings, Inc.

-

Coveris Holdings S.A.

-

Packaging Corporation of America

-

Ardagh Group S.A.

-

Bemis Company, Inc.

-

Ball Corporation

-

Georgia‑Pacific LLC

-

ePac Holdings, LLC

-

Winpak Ltd.

-

Silgan Holdings, Inc.

-

American Packaging Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 12.27 Billion |

| Market Size by 2033 | USD 19.71 Billion |

| CAGR | CAGR of 6.13% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Packaging Type (Flexible Packaging, Rigid Packaging, Pouches, Cans, Bottles, Others) • By Material Type (Plastic, Paper & Cardboard, Metal, Biodegradable, Others) • By Pet Type (Dog, Cat, Fish, Bird, Others) • By Distribution Channel (Supermarkets & Hypermarkets, Specialty Pet Stores, Online Retail, Convenience Stores, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Amcor plc, Berry Global, Inc., ProAmpac LLC, Mondi Group, Huhtamäki Oyj, Smurfit Kappa Group Plc, Sealed Air Corporation, Sonoco Products Company, Constantia Flexibles, Crown Holdings, Inc., Coveris Holdings S.A., Packaging Corporation of America, Ardagh Group S.A., Bemis Company, Inc., Ball Corporation, Georgia Pacific LLC, ePac Holdings, LLC, Winpak Ltd., Silgan Holdings, Inc., American Packaging Corporation |