PARENTAL CONTROL SOFTWARE MARKET KEY INSIGHTS:

To Get More Information on Parental Control Software Market - Request Sample Report

The Parental Control Software Market Size was valued at USD 1.65 Billion in 2023 and is expected to reach USD 4.77 Billion by 2032 and grow at a CAGR of 12.56% over the forecast period 2024-2032.

Digital monitoring solutions are more popular around the world, 2023 and 2024, particularly for children's safety online as the demand has increased multifold with rising concerns about harmful content access via the internet in Japan, China, the United States, France, Germany, and India. Internet safety is actively promoted in Japan through regulations involving telecommunications providers, requiring them to offer built-in parental control tools. Digital literacy for parents has been strongly encouraged as an effort. The same can be said for China that has enforced various restrictions that check and curtail the time young children spend on the internet and by monitoring all content available on the internet. The state has also banned the following: it barred minors below 18 years from activating their electronic devices between 10 p.m. and 6 a.m. For children under 8, the time for screen use is limited to 40 minutes a day, while children from 8 to 16 are allowed to spend an hour, and persons aged from 16 to 18 years are allowed two hours.

For example, in the United States, Children's Online Privacy Protection Act (COPPA) controls the collection of information from children under 13 years with the necessity for companies to obtain parental consent before collecting any kind of data, and forces the software vendors to follow strict rules on data handling. France and Germany have a General Data Protection Regulation followed by the whole European Union, offering very robust data privacy protections, especially for minors. These regulations require the implementation of advanced features that provide data transparency and privacy. It is also the increasing Internet penetration, which India has recognized as a strong requirement for parental control solutions in strictly enforcing guidelines on safe online practices.

The technological advances have changed much of the landscape in parental control software. AI-driven content analysis, geo-fencing in real time, and comprehensive app monitoring are some of the new twists for 2023 and 2024. Smarter algorithms make it possible to track and filter more precisely the types of harmful content, and all this is complimented by a very comprehensive tool on social media monitoring that would help alert parents to potential cyber threats, such as cyberbullying.

Product releases have been very dynamic in the market, with product updates from companies like Norton, Qustodio, Bark, and Contentwatch Net Nanny. Such updates enhance the user interface while adding more layers to protection protocols, reflecting growing consumer demand for adaptive and intelligent monitoring solutions. Moreover, expansion of partnerships continues with educational institutions and telecommunication companies to improve content filtering and promote responsible digital habits among children. The demand for customized parental control solutions is expected to rise with increasing Internet penetration, especially in emerging markets, driving significant evolution in the global parental monitoring landscape.

MARKET DYNAMICS

KEY DRIVERS:

- The Massive Use of Digital Devices among Children and Teenagers

The increasing number of ownership of smartphones, tablets, and laptops amongst children has intensified the need for parental control software. According to industry data, about 68% of children between the ages of 8-12 in the U.S have some form of a digital device, and this is similarly happening throughout the world. In this high level of adoption, children are at a risk of encountering Harmful Internet Content and Cyberbullying. For instance, roughly half of U.S. teens believe online harassment and online bullying is a big problem for people their age. Another 40% said that it was a minor problem, while just 6% believed it was not a problem.

These parental control solutions give parents the tools of limited access, online activity monitoring, and screen time management. Governments around the world have put much emphasis on these solutions and why children are safeguarded not only physically but also psychologically and emotionally. Filtering content software monitors application usage and alerts parents to possible threats, thus increasing the security level of parents.

- The Role of Regulatory Frameworks in Enhancing Children's Online Safety and Data Protection.

Regulation frameworks are essential in ensuring market growth as they provide the rules of the game regarding the protection of minors' online presence. For instance, GDPR holds that explicitly through consent from the parent, collecting data of any nature from children under 16 years old is required. These policies make software companies more rigid in data handling practices and innovate with features that respect privacy while offering mighty parental controls. In the United States, COPPA forces strict adherence to the laws relating to children under 13 years of age related to data protection that influences product development to meet such requirements. Such policies combined with increasing parent awareness have raised the need for solutions that better monitor and protect children's digital experience.

RESTRAIN:

- One significant restraint is the challenge of balancing parental monitoring with children's privacy rights.

Though software for parental control provides protection from online threats against kids, it often leads to arguments over privacy and autonomy. Advocacy groups consider excessive monitoring as an infraction on the rights of children to personable space and self-expression, thus leading to ethical dilemmas. According to the child rights organizations, a 2023 survey for teenagers showed that 42% did not like the idea of continuous online surveillance from their parents.

The high demands are based on creating solutions that balance safety and privacy would be paramount; this is whereby developers of the software have to inculcate the ability to allow customizable features on age-appropriate autonomy. Government policies and parental control software also have to tread carefully not to clash with data protection laws in cases of collected information. That is, the information being collected should be used responsibly and stored safely. Failure to make the right decisions pertaining to ethics and the law would surely pose a significant restriction on adoption rates, especially in regions where data privacy is stringent and contains elements akin to areas under major European and parts of the U.S. regulations.

KEY SEGMENTATION ANALYSIS

BY DEPLOYMENT

In 2023, On-Cloud solutions held 73% of the total market share. The company has resulted in an increased demand because they are able to be accessed conveniently over the cloud from any device - either at the office or at home. In addition, ease of integration and auto update of cloud-based solutions make it easy to be on the latest safety features as far as parent protection is concerned, and educational institutions are also facilitated.

On the other hand, On-Premise solutions are expected to grow at the highest CAGR of 13.09% during the forecast period from 2024 to 2032. Organizations, including sensitive environments, are opting for more control over software configuration and heightened data security, which helps them choose On-Premise models despite having a high initial setting cost.

BY APPLICATION

In 2023, Residential applications dominated the market with 72% of market share. There is an increasing usage of homes because of increased concerned parents about the online activities of their children, especially with increased screen time and internet access. Another good reason for this segment to be so robust is that the convenience of these solutions and their comprehensive nature- including features such as web content filtering, screen time management, and real-time monitoring truly vast in scope.

On the contrary, Education Institutes will likely be the leading growth contributors of the market in 2024 to 2032 with a 13.27% CAGR. Digital learning and the adoption of e-learning tools in curricula have notched up the stakes for education institutions to impose stringent controls on accessible content so as to make them safe for students. The growth, however, is supplemented by government policies that encourage online safety protocols in schools.

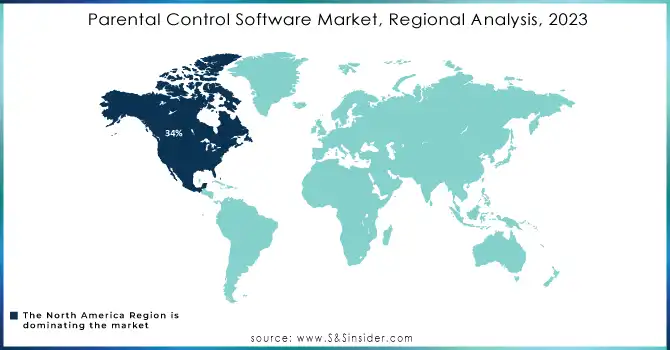

REGIONAL ANALYSIS

North America accounted for the largest share in the global parental control software market share in 2023 at 34%. High penetration of digital devices, proactive government regulations towards the safety of children online, and significant awareness on part of consumers have propelled its dominance in the region. The vast-scale adoptions of smart devices and robust internet infrastructure continue to contribute to a strong market presence in North America.

The Asia Pacific is expected to grow at the most rapid pace during the forecast period of 2024 to 2032 at a CAGR of 13.26%. It is due to rising awareness about child online threats, rapid urbanization, and boom in internet penetration across India, China, and Japan. Efforts by the government to protect children and encourage digital learning are also factors propelling further growth of the market in this region.

Do You Need any Customization Research on Parental Control Software Market - Inquire Now

KEY PLAYERS

Some of the major players in the Parental Control Software Market are

-

NortonLifeLock (Norton Family, Avira Prime)

-

Qustodio (Qustodio Family, Qustodio Schools)

-

Kaspersky (Safe Kids, Kaspersky Security Cloud)

-

Bark Technologies (Bark, Bark Phone)

-

Mobicip (Mobicip App, Mobicip School Plan)

-

Net Nanny (Net Nanny Parental Control, Family Protect Pass)

-

McAfee Corp. (Safe Family, Total Protection)

-

OpenDNS/Cisco Umbrella (FamilyShield, Umbrella Roaming)

-

Bitdefender (Parental Advisor, Bitdefender Total Security)

-

SafeDNS (SafeDNS Family, SafeDNS Business)

-

Clean Router (Basic Parental Control, Advanced Filtering)

-

Circle Media Labs (Circle Home Plus, Circle App)

-

ContentWatch (Net Nanny, ContentProtect Professional)

-

FamilyTime (FamilyTime App, FamilyTime Premium)

-

KidLogger (KidLogger PRO, KidLogger Free)

-

ESET (ESET Parental Control, ESET Internet Security)

-

Avast Software (Avast Family Space, Avast Premium Security)

-

Screen Time Labs (Screen Time App, Parental Control)

-

WebWatcher (WebWatcher Parental Monitoring, WebWatcher Mobile)

-

uKnowKids (uKnowKids Premier, uKnowFamily)

MAJOR SUPPLIERS (Components, Technologies)

-

Intel Corporation

-

Microsoft Corporation

-

AWS (Amazon Web Services)

-

IBM Corporation

-

Oracle Corporation

-

Broadcom Inc.

-

AMD (Advanced Micro Devices)

-

Cisco Systems

-

Google Cloud

-

Dell Technologies

MAJOR CLIENTS

-

Educational institutions

-

Schools and colleges

-

Private tutoring centers

-

Parents and guardians

-

Government agencies focused on child safety

-

Non-profit child welfare organizations

-

Corporations offering employee family support programs

-

Internet service providers

-

E-learning platforms

-

Technology distribution partners

RECENT TRENDS

-

January 2024: Snapchat will let parents understand what exactly is going on within its app. All of these new Family Center features come following the latest moves made for parents and are live starting today in countries worldwide.

-

November 2024: Preparations for the launch of its latest version of One UI have seen Samsung update all of its apps to become available for its next version, One UI 7, which will be based on the next generation of Android, Android 15. The firm has begun the rollout of a new update for the Samsung Parental Controls app, in order to not meet with any teething problems once the new software rolls out.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.65 Billion |

| Market Size by 2032 | US$ 4.77 Billion |

| CAGR | CAGR of 12.56% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Computer & Video Games, Mobiles & Digital Television), • By Platform (Windows, Android, iOS, and Cross Platform/Multiplatform), • By Deployment (On-Cloud and On-Premise), • By Application (Residential and Education Institutes), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NortonLifeLock, Qustodio, Kaspersky, Bark Technologies, Mobicip, Net Nanny, McAfee Corp., OpenDNS/Cisco Umbrella, Bitdefender, SafeDNS, Clean Router, Circle Media Labs, ContentWatch, FamilyTime, KidLogger, ESET, Avast Software, Screen Time Labs, WebWatcher, uKnowKids.NortonLifeLock, Qustodio, Kaspersky, Bark Technologies, Mobicip, Net Nanny, McAfee Corp., OpenDNS/Cisco Umbrella, Bitdefender, SafeDNS, Clean Router, Circle Media Labs, ContentWatch, FamilyTime, KidLogger, ESET, Avast Software, Screen Time Labs, WebWatcher, uKnowKids. |

| Key Drivers |

|

| Restraints |

|