Network Telemetry Market Key Insights:

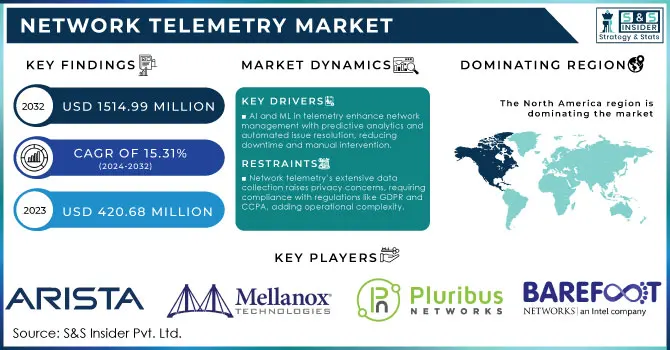

The Network Telemetry Market Size was valued at USD 420.68 Million in 2023 and is expected to reach USD 1514.99 Million by 2032 and grow at a CAGR of 15.31% over the forecast period 2024-2032. The Network Telemetry market is experiencing a surge in adoption, driven by the growing need for real-time monitoring and data analytics in complex network environments. According to research 75% of organizations across various industries have implemented or are in the process of adopting network telemetry systems to ensure optimal network performance and security. The increasing complexity of modern networks, which now incorporate cloud computing, 5G technologies, and IoT devices, has raised the stakes for organizations to maintain high levels of network efficiency and reliability. Approximately 60% of enterprises report using telemetry data to proactively identify network anomalies, improving their overall operational efficiency and reducing network downtimes.

To Get More Information on Network Telemetry Market - Request Sample Report

The role of telemetry in network performance management has expanded significantly, with data such as traffic patterns, bandwidth consumption, and device health providing crucial insights into network operations. The growing integration of AI and machine learning into these systems enables businesses to predict potential failures, with up to 50% of organizations leveraging these technologies to automate troubleshooting processes. Additionally, the global shift toward software-defined networking (SDN) and network function virtualization (NFV) is pushing businesses to adopt sophisticated telemetry solutions. Around 40% of large enterprises have adopted these technologies, allowing them to efficiently manage virtualized network environments and scale their operations. Cybersecurity is another major driving force for network telemetry. With cyberattacks increasing by over 30% year-on-year, organizations are increasingly relying on telemetry data to detect intrusions, analyze threats, and strengthen their defense mechanisms in real-time.

| Type of Network Telemetry | Description | Commercial Products |

|---|---|---|

| Packet-Based Telemetry | Captures and analyzes data packets to monitor network performance, ideal for detailed traffic analysis in real-time. | Cisco Nexus Data Broker, Arista DANZ |

| Flow-Based Telemetry | Uses network flow data (e.g., NetFlow, IPFIX) to track traffic patterns and anomalies across the network, suitable for high-level traffic monitoring. | SolarWinds NetFlow Traffic Analyzer, Plixer Scrutinizer |

| Event-Based Telemetry | Gathers network events and log data to monitor specific activities or triggers within the network, effective for security and compliance. | Splunk Enterprise, IBM QRadar |

| Model-Driven Telemetry | Utilizes data models (e.g., YANG) for structured and efficient data streaming, ideal for scalability in large networks. | Cisco Model-Driven Telemetry, Juniper HealthBot |

| Telemetry Using Streaming Protocols | Employs protocols like gRPC, MQTT, and Kafka for continuous data streaming, reducing data delays and enhancing real-time insights. | Kafka Streams, Amazon Kinesis |

| Agent-Based Telemetry | Relies on software agents installed on devices to gather data, suitable for detailed device-specific metrics and diagnostics. | AppDynamics, New Relic |

| Network Performance Monitoring (NPM) Telemetry | Focuses on metrics like latency, jitter, and packet loss, commonly used for service level agreement (SLA) monitoring. | ThousandEyes, Catchpoint NPM |

| Behavioral Analytics Telemetry | Analyzes network behavior patterns to detect anomalies and threats, essential for proactive threat detection. | Darktrace, Vectra AI |

| Synthetic Monitoring Telemetry | Uses simulated traffic to test network performance and reliability, helping to preemptively detect potential issues. | Dynatrace Synthetic Monitoring, Broadcom APM |

| Embedded Device Telemetry | Integrates telemetry directly into network devices for ongoing monitoring without additional hardware, ideal for low-latency monitoring. | Cisco Embedded Telemetry, Junos Telemetry |

MARKET DYNAMICS

DRIVERS

- AI and ML integration in telemetry enhances network management by enabling predictive analytics and automated issue resolution, reducing downtime and manual intervention.

Advancements in Artificial Intelligence (AI) and Machine Learning (ML) are significantly transforming network telemetry, enabling more efficient and proactive network management. By integrating AI and ML algorithms into telemetry solutions, enterprises can leverage predictive analytics to anticipate network issues before they impact operations. This proactive approach helps in reducing downtime and enhances network reliability. According to research predictive maintenance powered by AI can reduce unplanned downtime by up to 50%, providing substantial operational efficiency and cost savings. AI-driven network telemetry systems can also automate issue detection and resolution. The machine learning models can analyze data patterns in real-time to detect anomalies and initiate automated responses, such as rerouting traffic or alerting IT teams. This minimizes the need for manual intervention and speeds up response times, with some studies suggesting that AI can improve response speed by 30-50% over traditional methods. Additionally, AI’s role in analyzing vast datasets allows for deep insights into network behavior, helping companies optimize resource allocation and reduce the likelihood of human error.

- As cybersecurity threats rise, organizations are increasingly using network telemetry to detect anomalies and improve threat detection and response.

The increasing need for cybersecurity and threat detection is driving significant growth in network telemetry solutions. With cyberattacks becoming more frequent and sophisticated, organizations are prioritizing proactive defense measures to safeguard their networks. Network telemetry, which involves the continuous monitoring and analysis of network data, is essential for detecting unusual patterns that may signal potential cyber threats. For instance, telemetry tools can identify unexpected traffic spikes, unauthorized access attempts, and other anomalies that often precede security breaches. According to recent industry data, around 68% of organizations have experienced some form of cyberattack in the past year, underscoring the urgent need for robust threat detection systems.

As threats evolve, telemetry solutions are proving invaluable by enabling organizations to respond quickly and effectively to potential breaches. With the average cost of a data breach rising to approximately USD 4.45 million in 2023, the financial impact of cyber incidents is prompting more companies to invest in preventive solutions. Moreover, over 80% of IT leaders report that using telemetry-based analytics has improved their cybersecurity posture, allowing faster identification and resolution of vulnerabilities.

RESTRAIN

- Network telemetry’s extensive data collection raises privacy and security concerns, requiring organizations to comply with strict data protection regulations like GDPR and CCPA, which adds operational complexity.

Data privacy and security concerns are significant challenges in the Network Telemetry Market due to the extensive data collection involved in monitoring network traffic and performance. Network telemetry systems collect vast amounts of data, including sensitive user and organizational information such as IP addresses, communication patterns, and application performance metrics. This extensive data collection can raise serious privacy concerns, especially in light of strict data protection regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S. These regulations require businesses to ensure that personal data is processed transparently, with explicit consent, and only for specific purposes. Non-compliance can lead to substantial penalties and legal consequences.

The complexity increases as network telemetry tools often operate in dynamic and distributed environments, collecting data across different geographical regions, each subject to varying privacy laws. Organizations must implement strong data security measures to prevent unauthorized access, data breaches, and misuse of sensitive information. Encryption, anonymization, and access controls are some of the critical strategies to protect data, but these add to the operational burden.

KEY SEGMENTATION ANALYSIS

By Organization Size

The Large Enterprises segment dominated the market share over 61.94% in 2023, due to their extensive network infrastructure and need for advanced monitoring solutions. These organizations often deal with complex network environments, which require sophisticated tools for efficient performance and security management. Large enterprises benefit from higher IT budgets, enabling them to invest in scalable telemetry systems that can handle massive amounts of data, ensure operational continuity, and mitigate security risks.

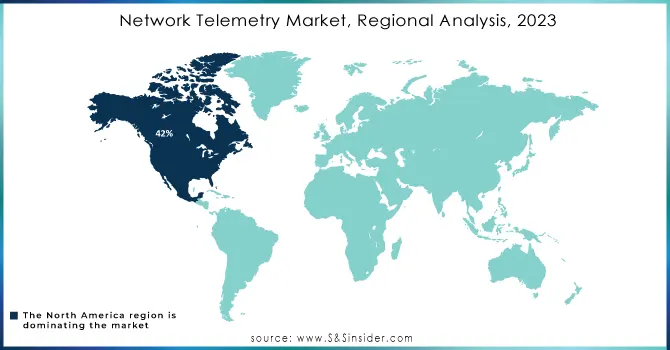

KEY REGIONAL ANALYSIS

North America region dominated the market share over 42% in 2023, driven by advanced technological infrastructure, a high adoption rate of digital transformation, and robust demand for network management tools. The region's strong presence of key players in network hardware, software, and telecommunications sectors contributes to this dominance. The U.S., in particular, is a major contributor, with the growing need for real-time network monitoring, optimization, and security in enterprise networks.

The Asia-Pacific region is the fastest-growing in the Network Telemetry Market, driven by rapid advancements in 5G and IoT technologies. Countries like China, India, Japan, and South Korea are experiencing a surge in the adoption of digital infrastructure, internet services, and cloud computing. Key factors fueling growth include significant investments in data centers, smart city initiatives, and the expansion of e-commerce.

Do You Need any Customization Research on Network Telemetry Market - Inquire Now

KEY PLAYERS

Some of the major key players of Network Telemetry Market

-

Arista Networks (CloudVision Telemetry)

-

Mellanox Technologies (NVIDIA Cumulus NetQ)

-

Pluribus Networks (Adaptive Cloud Fabric)

-

Barefoot Networks (P4 Programmable Switches)

-

Cisco Systems, Inc. (Cisco Tetration, Cisco Nexus Dashboard)

-

Juniper Networks (Juniper AppFormix, Junos Telemetry Interface)

-

Palo Alto Networks (Prisma Cloud, Cortex XDR)

-

Accenture (Intelligent Infrastructure Services)

-

Infosys (Network Telemetry Services as part of Infosys Cobalt)

-

Genpact (AI-driven Network Monitoring Solutions)

-

SolarWinds (Network Performance Monitor)

-

Nokia (Deepfield Cloud Intelligence)

-

NetScout Systems, Inc. (nGeniusONE)

-

IBM (IBM SevOne Network Performance Management)

-

Broadcom Inc. (Broadcom NetFlow Analyzer)

-

Huawei Technologies Co., Ltd. (Network Cloud Engine)

-

A10 Networks (Harmony Controller with Telemetry Insights)

-

Gigamon (Gigamon Visibility and Analytics Fabric)

-

Riverbed Technology (SteelCentral Network Performance Monitoring)

-

Keysight Technologies (Hawkeye Network Performance Monitoring Solution)

Suppliers for Provides CloudVision Telemetry, a solution enabling network-wide data collection and analytics of Network Telemetry Market:

-

Cisco Systems, Inc.

-

Juniper Networks

-

Arista Networks

-

SolarWinds

-

Gigamon

-

Nokia

-

NetScout Systems, Inc.

-

Palo Alto Networks

-

Broadcom Inc.

RECENT DEVELOPMENTS

-

In January 2023: Microsoft Corporation completed its acquisition of Fungible, a company known for its expertise in composable infrastructure. This strategic acquisition was designed to strengthen Microsoft's data center network and storage capabilities. By incorporating Fungible's specialized knowledge, Microsoft aims to improve a diverse array of its technologies and services.

-

June 2024: Cisco unveils AI-powered solutions at Cisco Live 2024 in Las Vegas, enhancing digital resilience through industry-leading security and observability tools. Cisco also introduces a USD 1 Million AI Investment Fund to support innovation and strategic customer readiness for an AI-driven future.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 420.68 Million |

| Market Size by 2032 | USD 1514.99 Million |

| CAGR | CAGR of 15.31% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component: Solutions, Services (Consulting, Integration and deployment, Training, Support, and Maintenance) • By Organization Size: Large Enterprises, Small and Medium-Sized Enterprises • By End-User: Service Providers (Telecom Service Providers (TSPs), Cloud Service Providers (CSPs), Managed Service Providers (MSPs), Others), Verticals |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Arista Networks, Mellanox Technologies, Pluribus Networks, Barefoot Networks, Cisco Systems, Inc., Juniper Networks, Palo Alto Networks, Accenture, Infosys, Genpact, SolarWinds, Nokia, NetScout Systems, Inc., IBM, Broadcom Inc., Huawei Technologies Co., Ltd., A10 Networks, Gigamon, Riverbed Technology, Keysight Technologies |

| Key Drivers | • AI and ML integration in telemetry enhances network management by enabling predictive analytics and automated issue resolution, reducing downtime and manual intervention. • As cybersecurity threats rise, organizations are increasingly using network telemetry to detect anomalies and improve threat detection and response. |

| RESTRAINTS | • Network telemetry’s extensive data collection raises privacy and security concerns, requiring organizations to comply with strict data protection regulations like GDPR and CCPA, which adds operational complexity. |