Passenger Service System Market Size:

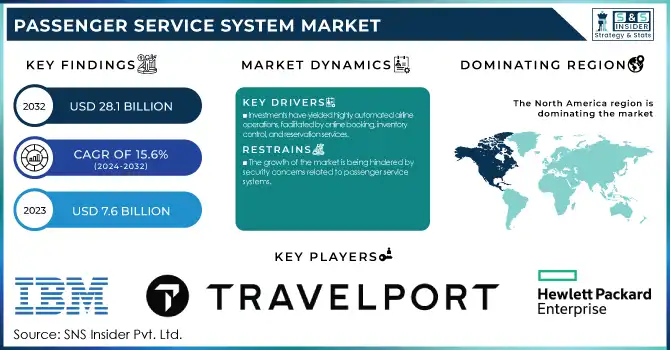

The Passenger Service System Market size was valued at USD 7.6 Billion in 2023. It is expected to grow to USD 28.1 Billion by 2032 and grow at a CAGR of 15.6% over the forecast period of 2024-2032.

Get more information on Passenger Service System Market - Request Sample Report

The increasing adoption of mobile applications in the Passenger Service System (PSS) market reflects airlines' focus on enhancing convenience and personalization for travelers. This is due to the rise of smartphones and a growing consumer expectation of seamless digital experiences, airlines are investing in mobile-friendly platforms that can perform important functions such as bookings, check-ins, and itinerary management. Moreover, Airlines' emphasis on improving passenger convenience and personalization is shown in the growing use of mobile applications in the Passenger Service System (PSS) sector. Airlines are investing in mobile-friendly platforms that can handle crucial tasks like bookings, check-ins, and itinerary management because of the proliferation of smartphones and the rising expectations of consumers for seamless digital experiences. Through their smartphone apps, passengers may track their bags, choose seats, get real-time flight information, and pay for additional auxiliary services. Through configurable features like trip-specific advice and personalized promos, this enhancement not only makes the user more comfortable but also improves client retention.

For example, the International Air Transport Association (IATA) noted that over 50% of passengers prefer using airline apps for real-time updates, boarding passes, and seat selection.

This change to subscription-based models within the PSS market highlights an increasing focus on affordable and adaptable solutions. A growing number of vendors provide Software-as-a-Service (SaaS) models that remove large up-front investments for airlines and substitute a manageable subscription fee. There are various advantages of this model which provides airlines with scalable platforms that can respond to changing volumes of passengers, and also the evolving operational needs. In addition, SaaS-based PSS promises regular updates, greater security, and seamless integration with other digital tools and technologies to become an appealing option for airlines looking to modernize their service offerings at the same time as fine-tuning budgets.

For instance, the U.S. Department of Commerce's 2024 projections suggest that SaaS solutions contribute significantly to reducing administrative inefficiencies across sectors.

Drivers

- Investments have yielded highly automated airline operations, facilitated by online booking, inventory control, and reservation services.

The growth of the passenger service system market is being driven by the expansion of the aviation industry, as it seeks to provide an enhanced user experience. With a steady increase in air travelers, there is a higher demand for efficient passenger service system solutions to handle the increased passenger volume and streamline operations. Furthermore, the growing competition among airlines is also increasing the demand for passenger service systems to provide an improved traveling experience. Passengers now expect a seamless journey experience, which further raises the demand for passenger service systems that offer enhanced user experience. These systems play a vital role in managing passenger data, enabling airlines to offer personalized services, loyalty programs, and efficient customer support. As a result, the expanding airline industry is driving the demand for advanced passenger service systems, ultimately leading to enhanced passenger satisfaction and loyalty, and driving business growth. in 2023, according to the Indian Aerospace and Defense Bulletin, Indian domestic airlines experienced a significant surge in passengers, accounting for 506 lakh passengers. This figure demonstrates a prominent annual expansion of 42% compared to 2022 when there were 354 lakh domestic passengers. The surge in the number of flyers is thus contributing to the growth of the passenger service system market, as it aims to offer an improved travel experience.

Restraint

The growth of the market is being hindered by security concerns related to passenger service systems.

The more prominent security threats hinder the growth of the passenger service system (PSS) market. With systems managing huge volumes of sensitive passenger data ranging from personal identification details to payment data and travel itineraries, they are an appealing target for cyberattacks. While data breaches lead to data privacy issues, they also affect everyday airline operations, which affects their customer trust and confidence. For example, ongoing incidents through ransomware attacks or system intrusions in the past few years have pointed to the weakness of both legacy and cloud-based systems.

Additionally, regulatory initiatives like the General Data Protection Regulation (GDPR) in Europe and other national data protection laws create heavy penalties for non-compliance which increases pressure on airlines & service providers to improve security. Even though advanced cybersecurity tools have been available for a while now, the difficulty of integration and low-priced offerings with limited security means that a robust security framework may not be available or attractive to the smaller airline adopting or upgrading a PSS solution a scenario that limits the growth potential of the market. Such characteristics highlight the importance of continuous innovation in PSS platform security against risk and market support.

Opportunities

- Integration of passenger service systems with artificial intelligence (AI) presents a wealth of future opportunities for market expansion.

By harnessing the power of AI, passenger service solutions can analyze vast amounts of passenger data and extract valuable insights. These algorithms are instrumental in understanding passenger preferences, behaviors, and travel patterns, allowing passenger service systems to offer personalized services based on this derived data. AI-powered web engines provide tailored travel options, ancillary services, and personalized promotions, resulting in enhanced customer satisfaction and increased revenue. Additionally, AI-powered chatbots and virtual assistants are capable of handling customer inquiries, providing real-time support, and assisting with various customer service tasks. This not only ensures that airlines can offer round-the-clock customer support but also enables quick responses to passenger queries and efficient problem resolution through the utilization of AI solutions.

Market segmentation

By Component

Services held the largest market share around 68% in 2023. Services is a vital aspect for the airlines since they often do not have the in-house knowledge to handle the complexity of modern cloud-based and subscription model PSS solutions. This inevitably creates a demand for ongoing monitoring, customizations, and augmented cybersecurity needs further allocating the resources to professional service providers. In addition, the increasing pace of technological change requires updates and technical support, which makes services an essential piece of the market's revenue model. Thus, the service segment is larger than software in terms of market share, as it fills the essential part needed to maintain and improve PSS functionalities.

By Service

Airline Reservation System held the largest market share around 32% in 2023. This dominance can be explained by the fact that a PSS is responsible for the largest part of an airline's operations, essentially managing flight bookings, ticket sales, and seat allocation. It allows airlines to manage their inventory for travels by individual travelers, travel agents, and third-party platforms effectively, facilitating ticketing and real-time information by flight availability.

With most of the airlines in the world changing their operations digitally, the airline reservation system has turned into a focal point for airlines, provisioning bookings and connecting with other aspects like internet booking systems, loyalty systems, etc. The way it has been embraced as of late both by legacy and low-cost carriers lends its significance to generating income and providing customer satisfaction. Moreover, the trend for mobile booking apps and personalized travel has led to an increased need for enhanced reservation systems, making these the dominant segment of the PSS market.

By Deployment

On-premises held the largest market share around 62% in 2023. It is because of its security, customization, and data control benefits. Many airlines opt for on-premises solutions, as they can keep sensitive passenger information in-house, which minimizes dependency on third-party cloud providers, which in turn can reduce the risk of data breaches. This model is especially popular among legacy carriers and operators in geographies with strict data sovereignty regulations as national laws could mandate the local storage and processing of data. Moreover, on-premise systems offer the highest level of tailored solutions for specific operational requirements, which is a critical aspect in the event of airlines that have complex networks or large-scale operations. Even with the increasing shift to cloud-based solutions, for many airlines, the reliability and control maintained by on-premises infrastructure is still top-of-mind, particularly for core functions such as reservation systems and departure control.

Regional Analysis

The North America region held the largest share 49% of the Passenger Service System Market. This is due to factors including advanced aviation infrastructure with technology adoption and the presence of major industry players. Home to some of the biggest and most technologically advanced airlines of the U.S. and Canada, which are early adopters of innovative solutions set to enhance customer experience and improve operational efficiency. To stay ahead of the competition in the dynamic global environment, these airlines intend to implement an advanced PSS platform that includes its reservations and inventory management, as well as loyalty and customer care systems. Additionally, the United States also has a significant market size in this industry. According to experts in the field, the growth in the U.S. can be attributed to the substantial investments made in government-supported infrastructure projects and the efficient provision of information on passenger transport services.

The Asia Pacific region is projected to register the fastest Compound Annual Growth Rate (CAGR) of 12%. This can be attributed to the ongoing digitalization trend across various industries, including aviation. The adoption of passenger service system solutions, which provide online booking capabilities, self-service options, mobile applications, and personalized digital experiences, is being driven by digital transformation. Furthermore, the expansion of the aviation industry is playing a significant role in accelerating market growth. This expansion aims to effectively manage the rising number of passengers, optimize operations, and enhance the overall customer experience. The high demand for Passenger Service Systems in this region can be attributed to the presence of several developing and potential countries, including India, Japan, and China. These nations offer attractive opportunities for vendors operating in this field.

Need any customization research on Passenger Service System Market - Enquire Now

Key Players

- IBM Corporation (IBM Cloud Pak for Integration, IBM Travel and Transportation Solutions)

- Travelport Worldwide Ltd. (Travelport Smartpoint, Travelport+)

- KIU System Solution (KIU Passenger Service System, KIU Booking Engine)

- Information Systems Associates FZE (ISA PSS, ISA Departure Control)

- IBS Software Services Pvt. Ltd. (iFly Res, iFly Loyalty)

- Bravo Passenger Solutions Pte Limited (BravoPSS, BravoCheck-in)

- Hewlett Packard Enterprise (HPE GreenLake, HPE Cloud Storage)

- Enoya-one LTD. (Enoya PSS, Enoya Check-in Solution)

- Travel Technology Interactive (e-PAX, TT Interactive Suite)

- Unisys Corporation (Unisys PSS, Unisys Cyber Security Solutions)

- Hexaware Technologies Ltd. (HexaPSS, Hexaware Travel Solutions)

- Mercator Limited (Mercator PSS, Mercator Loyalty Suite)

- Hitit Computer Services A.S. (Hitit PSS, Hitit Flight Operations)

- Intelisys Aviation Systems Inc. (Intelisys PSS, Intelisys Flight Control)

- Amadeus IT Group SA (Amadeus Altea Suite, Amadeus Selling Platform Connect)

- Radixx International, Inc. (Radixx Res, Radixx Go)

- Travelsky Technology Ltd. (Travelsky PSS, Travelsky Distribution Solutions)

- Sabre Corporation (SabreSonic, Sabre Red Workspace)

- Sirena-Travel JSCS (Sirena PSS, Sirena PNR Management)

- KIU System Solutions (KIU PSS, KIU Fare Management)

Recent Development:

- In February 2023, Sabre Corporation and JetBlue announced a multi-year renewal of their agreement for the SabreSonic passenger service system. This renewal guarantees that JetBlue's content will remain accessible on the Sabre Global Distribution System (GDS). Moreover, the collaboration between Sabre and JetBlue aims to elevate the customer experience and uncover revenue opportunities by leveraging the advanced capabilities of Sabre's passenger service system.

- In April 2022, IBS Software made an exciting announcement about the release of its cutting-edge software, iFly Res. This next-generation software boasts a customer-centric Passenger Service System (PSS) equipped with state-of-the-art offer and order management capabilities. The primary objective behind this innovative system is to elevate the passenger experience while simultaneously empowering airlines with enhanced operational efficiency.

- In November 2022, Sabre Corporation, a prominent technology provider in the global travel industry, made a significant announcement at the World Passenger Symposium (WPS). They revealed the extension of their long-standing partnership with Oman Air, the esteemed national carrier of the Sultanate of Oman. This collaboration aims to assist Oman Air in accomplishing its strategic goals. Sabre will continue to support them through a multi-year extension of the worldwide distribution system arrangement, as well as the renewal of Oman Air's SabreSonic Passenger Service System (PSS).

| Report Attributes | Details |

| Market Size in 2023 | US$ 7.6 Bn |

| Market Size by 2032 | US$ 28.1 Bn |

| CAGR | CAGR of 15.6 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Organizational Size (Large Enterprises, Small and Medium Enterprises) • By Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud) • By Industry Vertical (BFSI, IT and Telecom, Retail, Healthcare, Manufacturing, Government, Travel and Hospitality, Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | IBM Corporation, Travelport Worldwide Ltd., KIU System Solutions, Information Systems Associates FZE, IBS Software Services Pvt. Ltd., Bravo Passenger Solutions Pte Limited, Hewlett Packard Enterprise, Enoya-one LTD., Travel Technology Interactive, Unisys Corporation, Hexaware Technologies Ltd., Mercator Limited, Hitit Computer Services A.S., Intelisys Aviation Systems Inc., Amadeus IT Group SA, Radixx International, Inc., Travelsky Technology Ltd., Sabre Corp., Sirena-Travel JSCS |

| Key Drivers | • Investments have yielded highly automated airline operations, facilitated by online booking, inventory control, and reservation services. |

| Market Restraints | • The growth of the market is being hindered by security concerns related to passenger service systems. |