Competing Protocols Market Report Scope & Overview:

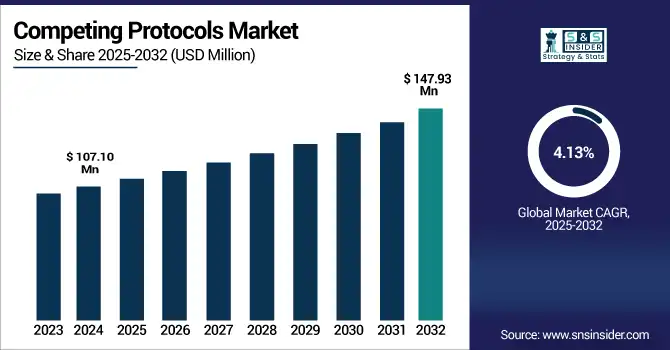

The Competing Protocols Market size was valued at USD 107.10 million in 2024 and is expected to reach USD 147.93 million by 2032, expanding at a CAGR of 4.13% over the forecast period of 2025-2032.

To Get more information on Competing Protocols Market - Request Free Sample Report

The Competing Protocols Market is growing steadily as demand for secure data transmission rises across corporate and personal applications. Protocols like IPsec, SSL, and 3DES are essential for safeguarding communication over networks. IPsec dominates due to its enterprise-grade security, while SSL is the fastest-growing, driven by remote work, cloud services, and secure web interactions. Corporate users hold the largest share, but personal users are growing rapidly with increased cybersecurity awareness. North America leads the market, followed by Europe and Asia Pacific. As cyber threats evolve, the market is expected to expand with innovations in encryption and secure communication technologies.

According to research, as of 2024, over 85% of global web traffic is encrypted using SSL/TLS protocols, up from 67%. Additionally, more than 40% of enterprises now deploy multi-protocol security frameworks, integrating SSL, IPsec, and TLS for enhanced protection.

The U.S Competing Protocols Market size reached USD 28.26 million in 2024 and is expected to reach USD 36.06 million in 2032 at a CAGR of 3.10% from 2025 to 2032.

The U.S. dominates the competing protocols market due to its advanced digital infrastructure, and the adoption of encryption technologies occurred early, with cybersecurity regulations like HIPAA and CCPA being strict. The competing protocols industry players like Cisco, IBM, and Microsoft foster continuous innovation upon secure communication protocols like IPsec and SSL. Also, the government invests deeply in national cybersecurity initiatives. Increasing cyber threats, the rapid shift to remote work, and growing reliance on cloud computing across sectors such as finance, defense, and healthcare further accelerate demand. In addition, enterprises are fully aware of data protection. These exact factors help the U.S. maintain its leadership within this market.

Market Dynamics

Drivers:

-

Rapid Increase in Cyber Threats and Remote Workforce Expansion Driving Protocol Adoption.

The exponential rise that is in cyberattacks and the shift toward remote and hybrid work models strengthen reliance that is on secure communication protocols. Organizations across industries are implementing SSL, IPsec, and advanced encryption standards in order to maintain network integrity and protect sensitive data. Newer advances cover multi-factor authentication upgrades and zero-trust implementations. With tighter integrations into cloud-native services, emerging vulnerabilities are addressed. Enterprises proactively adopt better protocol capabilities because digital transformation accelerated during and post-pandemic so they ensure secure access for a distributed workforce as they maintain compliance with regulatory mandates that evolve.

According to research, the average time to detect protocol-based breaches dropped from 207 days in 2020 to 138 days in 2023, as companies adopting secure protocol frameworks experienced a 36% reduction in phishing-related breaches within 12-months..

Restraints:

-

Regulatory Compliance Costs and Complexity Impeding Widespread Protocol Implementation.

Complying with strict cybersecurity regulations such as HIPAA, CCPA, and GDPR often mandates that you audit protocols extensively, manage complex configurations in addition to update frequently. In order to properly deploy and then maintain secure protocols, smaller organizations in particular do battle with the cost and with the expertise that is required. Dedicated resources and also skilled personnel must adapt themselves to continuously evolving standards. This adaptation can slow down implementation also increase operational expenses. The burden of certification, along with active vulnerability assessments and documentation, can divert attention and budgets away from innovation initiatives, which limits broader Competing Protocols market growth, especially among budget-constrained enterprises and public-sector entities.

Opportunities:

-

Expansion of Cloud-Native Applications Presents Opportunities for Advanced Protocol Integration.

The rapid migration to cloud-native architectures and microservices is creating significant opportunities for integrating advanced protocols like TLS 1.3, HTTP/3, and automated certificate management. Organizations are seeking seamless encryption built into containerized environments and API-driven services, paving the way for protocol-as-a-service offerings. Recent trends include automated key rotation, integration with service meshes like Istio, and protocol support within Kubernetes environments. These developments are enabling dynamic, scalable, and secure communication across distributed systems, opening up a substantial opportunity for vendors offering integrated, cloud-ready protocol solutions tailored to modern DevOps and CI/CD workflows.

Challenges:

-

Complexity of Legacy Infrastructure and Protocol Interoperability Challenges.

Legacy systems often rely on outdated encryption standards such as 3Des or older SSL versions, creating compatibility gaps when integrating with modern infrastructure. Ensuring interoperability across diverse environments—from on-premises to cloud—requires extensive testing, protocol translation layers, and sometimes costly upgrades. These challenges raise deployment barriers, increase project timelines, and heighten security risks during migration. Organizations must navigate a delicate balance between maintaining backward compatibility and advancing security capabilities. To address this, many are investing in middleware, protocol unification platforms, and expert services, though these measures often add complexity and cost to large-scale implementations.

Segment Analysis

By Types

The IPsec segment held the largest revenue share of 41.73% in 2024, driven by its robust encryption, authentication, and secure tunneling capabilities across enterprise networks. It is extensively used in Virtual Private Networks (VPNs), securing end-to-end communication across corporate and governmental IT infrastructures. Companies like Cisco and Juniper Networks have introduced advanced IPsec-enabled firewalls and routers, reinforcing their dominance in secure data transmission. Recent developments include Cisco’s IPsec support in SD-WAN and Juniper’s adaptive IPsec features tailored for hybrid networks. IPsec continues to serve as the backbone of enterprise-level secure communication in the Competing Protocols Market.

The SSL segment is witnessing the highest CAGR of 5.04% during the forecast period, propelled by increasing demand for secure web communications in cloud services, e-commerce, and remote work environments. SSL/TLS protocols ensure encrypted connections, protecting sensitive data exchanged between clients and servers. Companies like DigiCert and Microsoft have rolled out enhanced SSL certificate management tools and services to strengthen web and application security. Microsoft’s integration of SSL in its Azure services and DigiCert’s automated certificate lifecycle management highlight current trends. The segment’s growth aligns with the rising need for scalable, web-based encryption solutions in the Competing Protocols Market.

By End User

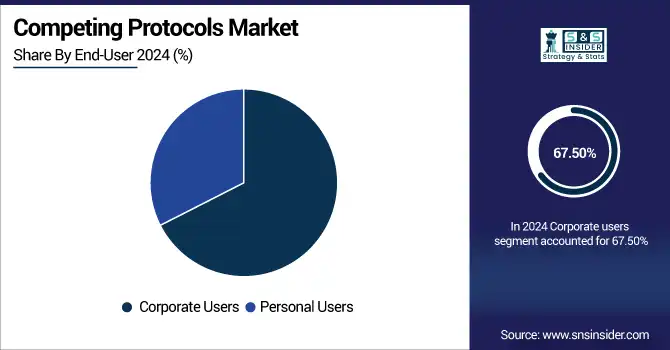

Corporate users dominated the market with a 67.50% revenue share in 2024 due to the widespread adoption of secure communication protocols to safeguard enterprise data and meet compliance standards. Enterprises across finance, healthcare, and IT deploy protocols like IPsec and SSL to support secure remote access, data sharing, and cloud integration. IBM and F5 Networks have launched enterprise-grade solutions incorporating multiple protocols to support hybrid workforces and zero-trust architectures. The growing threat landscape and regulatory pressure have compelled corporations to invest heavily in protocol-based security infrastructures, maintaining their leading role in the Competing Protocols Market.

The Personal Users segment is projected to grow at a CAGR of 4.95%, driven by rising individual awareness of data privacy and increased use of secure internet services like VPNs and encrypted browsers. Users are adopting SSL-based applications and IPsec-enabled VPNs for private browsing, streaming, and secure online communication. Companies like NordVPN and ExpressVPN have introduced advanced features such as multi-hop encryption and browser plug-in integration to enhance user privacy. These developments, coupled with frequent data breach news and global surveillance concerns, are prompting more individuals to adopt secure protocols, fueling growth in the personal user base of the Competing Protocols Market.

Regional Analysis

North America dominated the competing protocols market share of 37.56% in 2024. This leadership is attributed to the region’s advanced digital infrastructure, rapid adoption of cloud computing, and presence of competing protocols market companies such as Cisco, IBM, Microsoft, and Juniper Networks. The enforcement of strict data protection laws like HIPAA and CCPA, combined with rising cyber threats, has driven organizations to implement robust communication protocols across industries, including finance, healthcare, and government. The United States is the leading country in the region due to its mature cybersecurity framework, widespread cloud adoption, and heavy investments in secure protocol development and deployment.

According to research, between 2022 and 2024, over 78% of U.S. enterprises upgraded their communication protocols to meet compliance standards, with 81% of healthcare providers using SSL/TLS and 85% of government agencies adopting encrypted layers for zero-trust frameworks.

Europe accounted for a significant share of the market in 2024, driven by strict data privacy regulations under GDPR and increasing emphasis on cybersecurity in sectors like finance, manufacturing, and government. The region is witnessing consistent growth in the deployment of SSL/TLS and IPsec protocols. Investments in digital transformation, secure infrastructure modernization, and cross-border data security are contributing to Europe's strong market position. Germany leads the European market owing to its robust industrial base, strict regulatory adherence, and proactive investments in secure communication technologies.

Asia Pacific emerged as the fastest-growing region, capturing a market share of 21.39% in 2024. The region’s growth is driven by rapid digital transformation, expansion of cloud services, and increasing cybersecurity concerns across banking, telecom, and public sectors. The growing adoption of mobile and remote work solutions has accelerated the demand for secure protocols like IPsec and SSL, particularly in emerging economies undergoing technological advancement. China dominates the Asia Pacific market due to significant government-led cybersecurity initiatives, high enterprise cloud adoption, and large-scale digital infrastructure development.

The Middle East & Africa and Latin America regions are witnessing steady growth in the Competing Protocols Market, driven by national cybersecurity strategies, increased IT modernization, and rising digital services. Countries like the UAE and Brazil are leading their respective regions due to early adoption of encryption technologies, strong regulatory frameworks, and growing investments in secure, cloud-based digital infrastructure.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players of the competing protocols market are Ericsson, F5 Networks, Dialogic Corp, IBM, Cisco Systems, Inc., Synopsys, Inc., Juniper Networks, Inc., Microsoft Corporation, Huawei Technologies Co., Ltd., Nokia Corporation, and others.

Key Developments

-

In April 2024, Ericsson launched standardized security APIs in collaboration with U.S. telecom operators, aimed at strengthening authentication processes and enhancing fraud prevention for enterprise services, supporting the growing demand for secure communication protocols in digital networks.

-

In March 2024, IBM partnered with Telefónica Tech to integrate its quantum-safe encryption technologies into cybersecurity services, aiming to future-proof data protection against quantum computing threats and enhance secure communications across enterprise environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 107.10 Million |

| Market Size by 2032 | USD 147.93 Million |

| CAGR | CAGR of 4.13% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Types (IPsec, 3Des, SSL, Others) •By End-User (Personal Users, Corporate Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Ericsson, F5 Networks, Dialogic Corp, IBM, Cisco Systems, Inc., Synopsys, Inc., Juniper Networks, Inc., Microsoft Corporation, Huawei Technologies Co., Ltd., Nokia Corporation |