PCOS Diagnostic Market Report Scope & Overview:

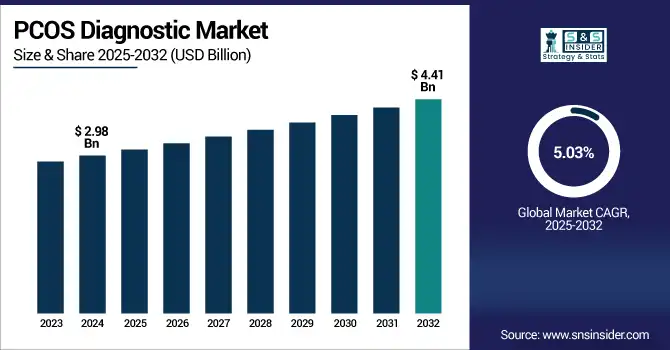

The PCOS diagnostic market size was valued at USD 2.98 billion in 2024 and is expected to reach USD 4.41 billion by 2032, growing at a CAGR of 5.03% over 2025-2032.

To Get more information on PCOS-Diagnostic-Market- Request Free Sample Report

The PCOS diagnostic market growth is gaining momentum owing to growing awareness towards women’s requirement for reproductive health, prevalence rate of hormonal disorder incidence, and strengthening network of diagnostic services in developed as well as in developing economies. PCOS affects an estimated 1 in 10 reproductive age females globally, and the demand for hormonal assays, imaging techniques, and metabolic panel testing is contributing to the PCOS diagnostic market growth.

In February 2024, Hologic Inc. launched a gynecologic-focused ultrasound platform based on artificial intelligence (AI) to improve diagnostic precision and assist in early detection of PCOS, confirming a major tech-facilitated care delivery in the PCOS diagnosis market.

The increasing incidence of infertility, delayed pregnancy, and metabolic disorders associated with obesity has also led to an increase in volumes of diagnostic tests. Furthermore, the global PCOS diagnostic market is experiencing an increase in R&D expenditure on novel biomarkers and multiplex hormone panels. For instance, Thermo Fisher Scientific and Roche are actively investing in women’s health diagnostics solutions. Regulatory guidelines such as the NIH criteria and Rotterdam Consensus are supportive, and this helps with provider adoption. Rising government investment, femtech growth, and AI integration in diagnostic interpretation are also enhancing the PCOS diagnostic market share globally.

In April 2024, Myriad Genetics joined in on the race, announcing a new addition to its women’s health diagnostics suite, offering genetic tests for PCOS risk and associated endocrine conditions driven by the innovation landscape of PCOS diagnostic companies.

Market Dynamics:

Drivers:

-

Rising Diagnostic Awareness and Technological Innovation Are Boosting Market Demand

The PCOS diagnostics market is developing with the growing prevalence of hormonal and metabolic disorders in women of reproductive age and increased public and clinical awareness. Between 60 and 70% of PCOS cases are believed to go undiagnosed worldwide, and governments and health associations have been organizing awareness initiatives and early detection for PCOS since. The need for precise diagnostics has never been greater, and there are new developments in multiplex hormone testing, transvaginal 3D imaging, and genetic risk profiling.

Entities such as Ansh Labs and Roberts Stago are introducing new assays targeting anti-Müllerian hormone (AMH) and insulin resistance, which leads to earlier detection. Further, more and more is being invested in femtech and women’s health diagnostics, like the USD 1.5 billion that has poured into women’s health startups globally in 2023 to drive R&D. To speed up product availability, regulatory bodies like the FDA and EMA have also simplified diagnostic approval pathways. These are the collective factors driving the PCOS diagnostic market growth, which in turn helps in a better PCOS diagnostic market analysis and hence is widening the PCOS diagnostic market size globally.

Restraints:

-

Limited Access and Lack of Standardized Testing Protocols Impede Market Expansion

Some of the main factors that are likely to restrict the PCOS diagnosis market growth include the disparities in access to diagnostic care and the lack of uniform diagnostic criteria, notwithstanding the technological advancements. In low- and middle-income countries, the lack of availability of specialized hormone tests and imaging hampers diagnosis. Rural healthcare facilities, for instance, usually do not have the technologies to perform transvaginal ultrasounds or endocrine assays, so that they represent a supply-side chokepoint. Additionally, inconsistent application of diagnostic criteria (including differences among NIH, Rotterdam, and AE-PCOS Society criteria) results in inconsistent diagnosis.

A study published in 2022 in The Journal of Clinical Endocrinology & Metabolism found that more than 40% of doctors rely on problematic PCOS criteria, resulting in the phenomenon of both under- and over-diagnosis. Lack of reimbursement and access to complete diagnostic panels is also a barrier in many systems of care. Although R&D investment is increasing, it remains disproportionately biased toward fertility-centric diagnostics, and there is little to no investment in metabolic or psychiatric symptom tracking, key to holistic PCOS care. These are a drag on the utilization of novel diagnostics in underserved market territories that have arrested the PCOS diagnostic market analysis despite increasing demand.

Segmentation Analysis:

By Type of Diagnostic Test

The hormone tests segment held a share of 35% in the PCOS diagnostics market in 2024, owing to the pivotal role of hormone tests in determining hormonal irregularities, including high levels of LH/FSH ratios, testosterone, and AMH in women. They are the first-line strategy for the diagnosis of PCOS and are broadly used in clinical laboratories and hospitals.

The category seeing the fastest growth in demand is the medical testing category, created by a surge in the interest in personalized medicine to genomic markers that indicate genetic predisposition for early identification. Increasing research in genomics, and integration of PCOS-specific gene panels further drive growth in this domain.

By Drug Class

The oral contraceptives segment accounted for the largest market share of around 38% in 2024, since they are prescribed as the first line of treatment for the relief of symptoms such as irregular menstruation and hyperandrogenism. Their broad availability and incorporation in standard protocols of care support their supremacy.

The highest expanding segment is insulin-sensitizing agents, which is propelled by the increasing disease burden of insulin resistance among the PCOS patients and the emerging trend of metformin being used as a therapeutic option for the treatment of metabolic symptoms.

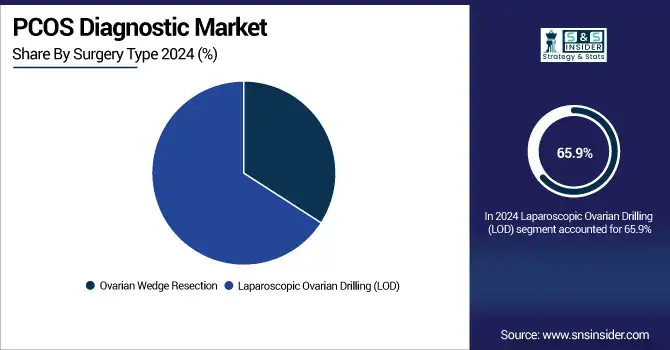

By Surgery Type

Laparoscopic Ovarian Drilling (LOD) was the most favoured treatment among surgical techniques, capturing 65.9% of the PCOS diagnostic market trends in 2024. Its less invasive nature and high efficiency to induce ovulation in drug-resistant patients, explain its clinical use versus classical approaches.

The fastest growth segment is LOD, due to the increasing incidence of infertility and its growing acceptance among developing countries where the availability of advanced fertility treatments is very limited.

By Distribution Channel

Hospital pharmacies held the leading position in the distribution channel segment in 2024, as there is a surge in the number of patients who are diagnosed and prescribed through hospital-based endocrinology and gynecology departments.

The fastest growing channel is online providers, due to the rise of telemedicine, home testing kits, and e-pharmacy players, making it easier to obtain detection and treatment solutions for PCOS. This trend is being reinforced by the digital health revolution and increased penetration in urban and semi-urban areas.

Regional Analysis:

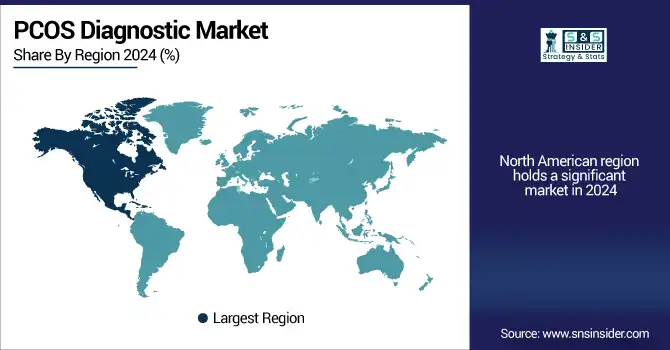

The PCOS diagnostic market in North America was the largest in 2024, owing to established healthcare infrastructure, high awareness about PCOS, and availability of advanced diagnostic technologies.

The U.S. PCOS diagnostic market size was valued at USD 1.11 billion in 2024 and is expected to reach USD 1.61 billion by 2032, growing at a CAGR of 4.73% over 2025-2032. The U.S. holds the dominant PCOS diagnostic market share due to the high prevalence of the disorder, the high number of diagnosed PCOS patients, awareness programs for PCOS, and reimbursement policies by insurance. An estimated 6 million to 10 million women in the U.S. have PCOS, and demand is being driven by increasing use of hormonal and imaging diagnostics. Canada is part of the solution, too, with publicly funded women’s health programs and broad access to genetic testing. The existence of well-established players, as Hologic, Thermo Fisher, and LabCorp, in the PCOS diagnostic market in the region also contributes to market growth. The US PCOS diagnostic market is boosted by widespread screening and use of algorithm-based diagnostic pathways.

Europe held a significant share of the global PCOS diagnostic market in 2024, owing to overall healthcare systems and a rise in clinical research on women's hormone disorders. Germany and the UK are among the top contributors, as these countries use transvaginal ultrasound and hormone panels extensively in gynecological practice.

Germany, in particular, has a strong diagnostics manufacturing foundation and has already begun adopting AI-based screening tools. The fastest-rising country in Europe is France, with growing government spending on reproductive health services and a population of females more focused on their fertility, pushing the rise in PCOS tests in the country. Europe, too, is experiencing a rising number of public-private partnerships in the field of endocrinology research, which in turn propels the market.

The Asia Pacific is the fastest-growing region in the global PCOS diagnostic market, owing to an increase in awareness, rising urbanization, and expanded healthcare accessibility in the developing economies.

India is a leading market in the region with almost one in five women of reproductive age affected by PCOS and a growing appeal for hormonal and metabolic testing. Adoption is being driven by government health programmes and private fertility clinics. China is another significant market, due to the proliferation of diagnostic laboratories and increasing fertility treatments. In Japan, sex, gender, and the genome are also the “Next Generation in Japan” with a focus on personalized medicine and genomic testing for reproductive disorders. The burgeoning development in the region is unthinkable phenomenal due to better health care facilities and the increasing burden of obesity and insulin resistance in women.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Leading PCOS diagnostics companies in the market include F. Hoffmann-La Roche Ltd, Quest Diagnostics, Thermo Fisher Scientific Inc., Siemens Healthineers, Bio-Rad Laboratories, Hologic Inc., Vitrolife, Myriad Genetics Inc., Ansh Labs, Diagnostica Stago Inc., Beckman Coulter Inc., Randox Laboratories Ltd., GE Healthcare, Laboratory Corporation of America Holdings, SRL Diagnostics, Perrigo Company plc, Lupin, Astellas Pharma Inc., Organon, and ADVANZ PHARMA.

Recent Developments:

-

In June 2024, Beckman Coulter announced the launch of a new high-sensitivity Anti-Müllerian Hormone (AMH) assay, aimed at improving ovarian reserve assessment and early PCOS diagnosis in women of reproductive age.

-

In May 2024, Vitrolife AB collaborated with a fertility clinic chain in Europe to integrate AI-based hormonal profiling into routine PCOS diagnostic workflows, enhancing diagnostic accuracy and cycle monitoring.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.98 billion |

| Market Size by 2032 | USD 4.41 billion |

| CAGR | CAGR of 5.03% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type of Diagnostic Test (Hormone Tests (Luteinizing Hormone (LH), Follicle-Stimulating Hormone (FSH), Testosterone, Anti-Müllerian Hormone (AMH), and Estrogen), Blood Tests (Fasting Insulin, Glucose Tolerance Test, Lipid Profile, and HbA1c), Imaging Tests (Transvaginal Ultrasound, Pelvic Ultrasound), Pelvic Examination, Genetic Testing, and Other Tests (Thyroid Function Tests (TSH, T3, T4), Prolactin Test, DHEAS (Dehydroepiandrosterone Sulfate))) • By Drug Class (Oral Contraceptives, Antiandrogens, Insulin-Sensitizing Agents, Antidepressants, and Anti-Obesity Medications) • By Surgery Type (Ovarian Wedge Resection, Laparoscopic Ovarian Drilling (LOD)) • By Distribution Channel (Hospital Pharmacies, Drug Stores & Retail Pharmacies, and Online Providers) |

| Regional Analysis/Coverage | North America (U.S., Canada), Europe (Germany, France, UK, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

| Company Profiles | F. Hoffmann-La Roche Ltd, Quest Diagnostics, Thermo Fisher Scientific Inc., Siemens Healthineers, Bio-Rad Laboratories, Hologic Inc., Vitrolife, Myriad Genetics Inc., Ansh Labs, Diagnostica Stago Inc., Beckman Coulter Inc., Randox Laboratories Ltd., GE Healthcare, Laboratory Corporation of America Holdings, SRL Diagnostics, Perrigo Company plc, Lupin, Astellas Pharma Inc., Organon, and ADVANZ PHARMA. |