Personal Computers Market Report Scope & Overview:

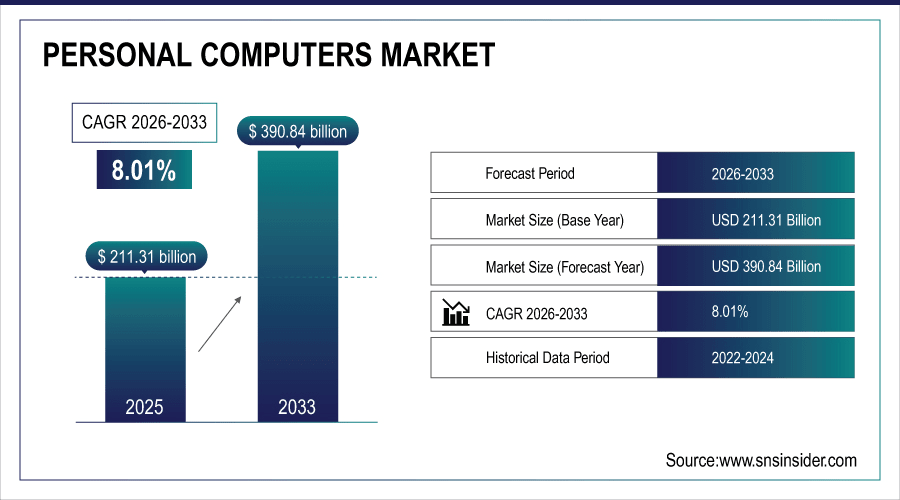

The Personal Computers Market size was valued at USD 211.31 Billion in 2025E and is projected to reach USD 390.84 Billion by 2033, growing at a CAGR of 8.01% during 2026-2033.

The Personal Computers Market analysis highlights the market status and development trend, including types, applications, growth, opportunities, rising technology, competitive landscape and product offerings of key players. Major vendors like HP, Dell, Lenovo and Apple are all seeing their numbers of worldwide shipment units stay consistently at the top with a high percentage of laptops compared to desktops and workstations. Buyers are also responding to consumer interest in ultra-thin form factors, high refresh rate displays and performance-oriented models that has helped sales too. On the whole, this market is moving away from cost-based competencies to innovation-led growth driven by both premium and mass-market uptake.

Global PC shipments hit 260M units; laptops dominate at 75%. Ultra-thin, high-refresh models surge 20% YoY. Premium segment grows 15%, led by Apple, Dell innovation and hybrid work demand.

To Get More Information On Personal Computers Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 211.31 Billion

-

Market Size by 2033: USD 390.84 Billion

-

CAGR: 8.01% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Personal Computers Market Trends

-

The market is witnessing a shift from desktops to laptops, fueled by portability, performance improvements, and consumer preference for compact devices supporting hybrid work and mobility.

-

Solid State Drives (SSDs) are rapidly replacing Hard Disk Drives (HDDs), driven by faster performance, reliability, and falling costs, making SSD-equipped PCs the mainstream standard globally.

-

The integration of AI chips and features in PCs is creating smarter, more efficient systems, enhancing productivity, security, and personalization across both consumer and enterprise markets.

-

High-performance gaming laptops and desktops are driving significant growth, supported by esports, high refresh rate displays, advanced GPUs, and strong demand from younger consumer demographics.

-

Businesses and consumers are upgrading PCs faster due to remote work, cloud adoption, and evolving software requirements, reducing the average replacement cycle to nearly four years.

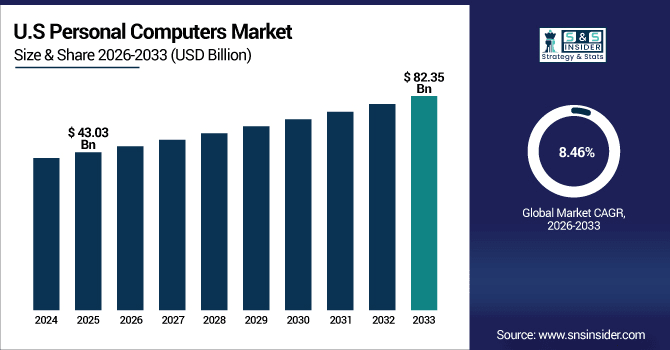

The U.S. Personal Computers Market size was valued at USD 43.03 Billion in 2025E and is projected to reach USD 82.35 Billion by 2033, growing at a CAGR of 8.46% during 2026-2033. Personal Computers Market growth is driven by increasing requirement of high performance laptops for remote working and online education. Higher penetration of gaming PCs and premium models is driving increased sales in younger age groups. Product offerings are being redefined as technological imperatives such as the rise of SSDs, and AI workloads drive largely new behaviors. Companies are also speeding up upgrades to work in the cloud and improve cybersecurity.

Personal Computers Market Growth Drivers:

-

Rising Demand for Portable, High-Performance Laptops in Remote Work, Gaming, and Digital Learning Environments.

Demand for thin and stylish laptops has been driven by widespread use of hybrid and remote work models, the expansion of digital learning, and growing popularity in gaming. Customer want light devices and high performance, SSD's storage and long battery durability. 'Enterprises are making investments in new breath of compute capabilities to support cloud-based applications, advanced security functions and enhanced communications features, which is resulting in steady growth in PC systems across all form factors,' says NPD chief analyst Stephen Baker.

68% of enterprise PC buys prioritize thin/light designs. Gaming laptops grow 22% YoY. 85% new models feature SSDs & 10hr+ battery. Cloud/security upgrades drive 7% corporate PC growth.

Personal Computers Market Restraints:

-

Declining Desktop Shipments and Supply Chain Disruptions Affecting Component Availability and Market Stability

The global PC market is being limited by waning interest in traditional desktops, while consumers look for more mobile replacements such as laptops and tablets. Supply chain bottlenecks, worst among them with the semiconductor chips that are critical to so many machines, mean production delays and mounting costs for manufacturers. These factors restrict the availability of products and influence pricing tactics, generating more uncertainty for both consumers as well as business users overall and decelerating growth momentum in personal computers (PC) market.

Personal Computers Market Opportunities:

-

Technological Advancements in AI-Enabled PCs, Cloud Integration, and Next-Generation High-Performance Computing Solutions

The Next Big Thing for the PC market is Innovation with AI-Enabled Devices and Applications for Personalization, Security, and Performance. Cloud-driven solution PCs give way to the ability for continuity across devices and high-performance computing solutions meet home office demand from gamers, developers, to creative professionals. Manufacturers who invest in slim designs, power-efficient components, and high-end graphics may be able to tap into growing demand and redefine PCs as indispensable companions for modern digital life and business transformation.

60% PCs AI-enabled; 75% support cross-device continuity. High-end GPU models grow 40%. Power-efficient designs dominate 65% shipments. AI-driven PCs redefine productivity, fueling 18% enterprise adoption and $32B market expansion.

Personal Computers Market Segment Analysis

-

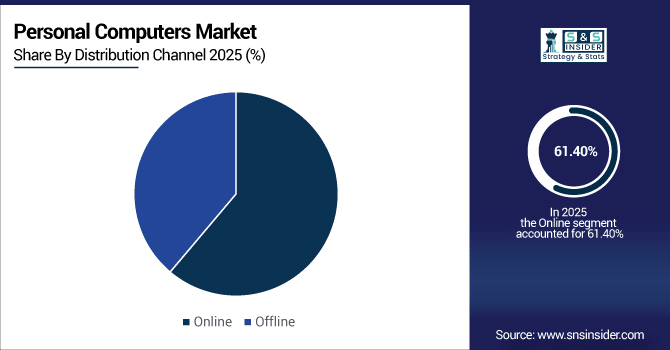

By Distribution Channel: In 2025E, the online channel led the Personal Computers Market with a 61.40% share, while the offline channel is expected to register the fastest growth with a CAGR of 10.50%.

-

By Operating System: Windows dominated the market in 2025E with a 72.80% share, whereas Chrome OS is projected to be the fastest-growing operating system at a CAGR of 12.10%.

-

By Type: Desktops led the market in 2025E with a 56.60% share, while hybrid devices are expected to witness the fastest growth with a CAGR of 11.80%.

-

By End-Use: The commercial segment held a 58.70% share in 2025E, whereas the household segment is anticipated to be the fastest-growing with a CAGR of 9.60%.

By Distribution Channel, Online Leads Market While Offline Registers Fastest Growth

In 2025, online is grabbing market share on the back of e-commerce players, attractive discounts and doorstep deliverability. Growth Drivers Rise in E-commerce Sales As purchase of Laptops and Accessories online have included brand.com stores and marketplaces the preference by consumer has been more. But growth is fasted online are far outweighed by offline, as we're seeing massive experiences bought, demos based sells and scalable retailer networks. Physical stores also ensure serving enterprise clients and customers who demand installation services, reliable post-purchase support and aftersales service.

By Operating System, Windows Dominate While Chrome OS Shows Rapid Growth

Windows remains the most popular Personal Computers Operating System in the world due to its adoption by enterprise, compatibility with a myriad of applications, and brand loyalty. Windows is the preferred choice of businesses, educational institutions and households when they face their daily productivity needs. And then there's Chrome OS, which is growing quickly (especially in education), since it provides a lightweight and relatively cheap cloud-first option. This combined with the simple, easy to use Chrome environment, low price hardware and adoption in schools and those on a budget makes Chromebooks take off across the world.

By Type, Desktops Lead While Hybrid Devices Registers Fastest Growth

The PC market is still dominated by desktops because of their prevalence in business, gaming and content creation environments that need extra performance and durability. Their affordability, upgradeability, and ability to handle heavy workloads continues their relevance. But hybrid devices — which offer laptop portability and tablet flexibility — make up the fastest-growing category. With their touchscreens, detachable keyboards and versatility they appeal to the modern professional or student. The move comes to accommodate consumers seeking a device that can be used as both a personal and professional computer.

By End-Use, Commercial Lead While Household Grow Fastest

The commercial sector dominates the market for personal computers, driven by industrial demand for productivity, cloud integration and IT security infrastructure. PCs are critical to work from home and enhance business. Explore the importance of PCs in daily life Businesses, government agencies, and educational institutions need PCs to provide essential services, such as operations, communication or digital transformation. The household segment is expanding fastest, as digital learning and entertainment, gaming and working remotely all rise. Trends of cheaper prices, online sales and consumer demand for high-performance but easily portable systems are driving penetration across the home scene, redefining demand in urban and semi-urban markets.

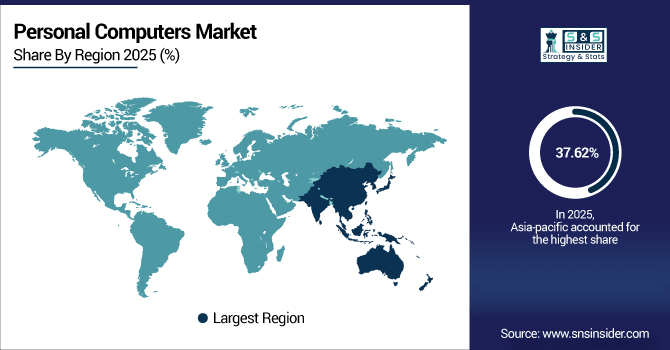

Personal Computers Market Regional Analysis:

Asia-pacific Personal Computers Market Insights

In 2025 Asia-Pacific dominated the Personal Computers Market and accounted for 37.62% of revenue share, this leadership is due to the adoption is spurred by quickening digitalization, online education and the rise of gaming communities. Mass-market penetration, especially within cost conscious segments driven by local production and low priced models. Multinational brands are dominating in the premium segments and regional brands are capturing in mid-range. E-government projects and proliferation of internet continue to significantly boost LT growth prospects in the region.

Get Customized Report as Per Your Business Requirement - Enquiry Now

China Personal Computers Market Insights

China is the biggest single-country market for personal computers, owing to its population size and large manufacturing base. Domestic powerhouses Lenovo, Huawei and Xiaomi are all integral to global supply chains. Consumer demand for cheap laptops and tablets has also helped to drive ongoing growth of household penetration.

North America Personal Computers Market Insights

North America is expected to witness the fastest growth in the Personal Computers Market over 2026-2033, with a projected CAGR of 8.64% due to widespread enterprise adoption and high consumer purchasing power. The surge in remote work and digital-first businesses are sparking frequent PC refreshes across sectors. The market is being led by brands like Dell, HP, and Apple with their top-class products. Strong demand for AI-related systems and personal computers with cybersecurity aspects is driving long-term expansion in business and home segments.

U.S. Personal Computers Market Insights

The U.S. leads in terms of the North America PC market due to strong enterprise infrastructure and high demand for premium laptops by consumers. Growth remains fueled by remote work, cloud adoption and digital education. Apple, Dell and HP still stand as market giants thanks to committed customer bases and innovative product portfolios.

Europe Personal Computers Market Insights

Europe has a substantial penetration of the personal computers market, which is quite enterprise driven though households are adopting in huge numbers. Germany, UK and France are also driving this market as growth in digitalization, e-learning and remote work open up new opportunities. The area is increasingly interested in energy-efficient, eco-friendly PCs, following its sustainability aims.

Germany Personal Computers Market Insights

Germany is one of Europe’s biggest Personal Computers markets and demand is driven by the industrial, enterprise and education markets. Powerful desktops are still essential for design, engineering and research. The trend also means mainstream notebook and hybrid systems are now not as popular with consumers seeking mobility and productivity.

Latin America (LATAM) and Middle East & Africa (MEA) Personal Computers Market Insights

The Personal Computers Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the growing internet penetration and a focus on digital education which will help pump more monitors into the market – for now. Demand is led by Brazil, Mexico and Gulf countries as businesses invest in IT infrastructure and digital transformation. Entry-level smartphone uptake in LATAM is driven by economic pressures and the resulting consumer demand for more affordable devices, while premium development of smartphones is a feature in corporate and government sectors of MEA.

Personal Computers Market Competitive Landscape:

Lenovo - Lenovo is a world leader in the design, development, manufacture and marketing of personal computers both for business and consumer use. It is popular for its ThinkPad and IdeaPad line of notebooks, which offer a tight packaging of innovation, price, performance and design. A significant stake presence in Asia-Pacific and Europe, with key acquisitions such as Motorola and IBM’s PC division added to its market armory. Lenovo is focusing on hybrid devices and gaming PCs for growth.

-

In March 2025, at MWC 2025, Lenovo unveiled AI-powered Yoga and IdeaPad laptops, enhancing creativity and productivity with integrated AI features and innovative accessories.

HP Inc. is a significant player in personal computing with desktops, laptops and hybrid devices for consumers and business users. Its offering focuses on performance, design and sustainability. And HP is No. 1 in enterprise solutions, where it continues to grow even as it gains share in gaming and thin-and-light laptops.

-

In March 2025, HP launched over 80 AI-integrated products at its Amplify Conference, including AI PCs and printers with quantum-resistant security, aiming to transform the future of work.

Dell Technologies is all about providing powerful, durable business PCs, workstations and gaming laptops that are made for premium performance. Its robust enterprise business, direct-to-consumer (DTC) sales model and innovation in hybrid and ultrathin devices help drive the market. By designing and servicing PC, Dell become one of the world's most trusted brands.

-

In May 2025, Dell introduced the Pro Max Plus laptop featuring an enterprise-grade Neural Processing Unit for on-device AI processing, enhancing performance and data privacy for developers and enterprises.

Apple Inc. is a prominent high-end PC brand and its products include MacBook laptops, iMac desktops and hybrid devices. Strong ecosystem integration, design innovation and high-performance hardware have fueled its brand loyalty. The company's other market is the pro, creative and well-heeled consumer who would like reassurance of proper synergy between hardware and software which Apple promises them.

-

In March 2025, Apple revealed the M3 Ultra chip, delivering up to 2.6x the performance of its predecessor, Thunderbolt 5 connectivity, and support for more than half a terabyte of unified memory.

Personal Computers Market Key Players:

Some of the Personal Computers Market Companies are:

-

Lenovo Group Limited

-

HP Inc.

-

Dell Technologies Inc.

-

Apple Inc.

-

ASUSTeK Computer Inc.

-

Acer Incorporated

-

Microsoft Corporation

-

Samsung Electronics Co., Ltd.

-

Micro-Star International Co., Ltd.

-

Huawei Technologies Co., Ltd.

-

Xiaomi Corporation

-

LG Electronics Inc.

-

Giga-Byte Technology Co., Ltd.

-

Fujitsu Limited

-

Panasonic Holdings Corporation

-

Toshiba Electronic Devices & Storage Corporation

-

CHUWI Innovation Technology Co., Ltd.

-

Framework Computer Inc.

-

NEC Corporation

-

Purism SPC

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 211.31 Billion |

| Market Size by 2033 | USD 390.84 Billion |

| CAGR | CAGR of 8.01% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Distribution Channel (Online and Offline) • By Operating System (Windows, macOS, Linux, Chrome OS and Others) • By Type (Desktops, Laptops, Tablets and Hybrid Devices) • By End-Use (Household, Commercial and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Lenovo Group Limited, HP Inc., Dell Technologies Inc., Apple Inc., ASUSTeK Computer Inc., Acer Incorporated, Microsoft Corporation, Samsung Electronics Co., Ltd., Micro-Star International Co., Ltd., Huawei Technologies Co., Ltd., Xiaomi Corporation, LG Electronics Inc., Giga-Byte Technology Co., Ltd., Fujitsu Limited, Panasonic Holdings Corporation, Toshiba Electronic Devices & Storage Corporation, CHUWI Innovation Technology Co., Ltd., Framework Computer Inc., NEC Corporation, Purism SPC |