Online Gambling & Betting Market Report Scope & Overview:

To Get More Information on Online Gambling & Betting Market - Request Sample Report

The Online Gambling & Betting Market was valued at USD 81.86 Billion in 2023 and is expected to reach USD 218.02 Billion by 2032, growing at a CAGR of 11.54% over the forecast period 2024-2032.

The online gambling and betting market has witnessed remarkable growth over the past decade, fueled by technological advancements, increased internet penetration, and evolving consumer preferences. As mobile technology continues to reshape the landscape, more individuals are embracing various forms of online betting, including sports betting, casino games, poker, and lotteries. One of the most significant trends driving this surge is the rising preference for mobile devices. Approximately 75% of online gamblers now engage in gaming activities via mobile platforms, reflecting the industry's shift towards accessible and convenient options. The typical online gambler is around 34 years old, with a notable male-to-female ratio of 3:1, indicating a predominantly male demographic.

While this vibrant industry offers substantial opportunities, it also presents considerable challenges. Approximately 10 million Americans struggle with gambling addiction, and around 1 in 20 college students are identified as compulsive gamblers. These statistics underscore the necessity for awareness and responsible gambling practices. Behaviors such as using gambling as an escape or experiencing guilt afterward may signal developing issues, highlighting the importance of monitoring gaming habits. As the iGaming community expands, it is projected that there will be around 593 million enthusiasts by 2024. Stakeholders must prioritize responsible gambling practices to ensure a sustainable and healthy gaming environment. This focus not only protects consumers but also strengthens the overall reputation of the industry.

The impact of online gambling extends beyond entertainment; it plays a crucial role in various industries, particularly in sports. The sports industry significantly benefits from online betting, which drives engagement and viewership for sporting events. In 2022, the sports betting industry employed over 200,000 individuals and saw participation from more than 25 million Americans. Sports betting platforms provide fans with the opportunity to place bets on various outcomes, creating an immersive experience that enhances their connection to the sport. Below is the table for active gamblers globally:

|

Country |

Active Gamblers (million) |

|

United States |

58 |

|

Germany |

29 |

|

The Netherlands |

1.1 |

|

United Kingdom |

29 |

|

Canada |

19.3 |

|

Australia |

6.8 |

|

France |

27 |

Market Dynamics

Drivers

- The impact of increased internet access on the growth of the online gambling and betting market

The increase in worldwide internet access has had a major effect on the Online Gambling and Betting Market. Due to increased high-speed internet availability, a wider range of individuals can now participate in online gambling. This ease of access has enabled the expansion of different platforms, such as mobile apps and websites, enabling individuals to place bets and gamble conveniently from their residences. The availability of online gambling sites has lured in new players, especially younger individuals who are familiar with digital transactions and online entertainment. With the rise of smartphones, mobile gambling has significantly increased as users prefer to gamble while being mobile. Moreover, enhancements in online technology, such as the introduction of 5G, have enhanced the overall user experience, enabling quicker transactions and better-quality streaming for live betting occasions.

- Live dealer games revolutionize the online gambling and betting market with enhanced social interaction and authentic experiences.

Live dealer games have played a major role in the growth of the Online Gambling and Betting Market. Live dealer games combine the ease of online gaming with the social aspect of brick-and-mortar casinos, appealing to players who want a genuine gambling experience without going to a physical venue. These games include actual dealers who engage with players via live video streams, enabling interactive gameplay and communication in real time. This new method closes the divide between online and offline betting, attracting a broader range of people. Gamers value the honesty and genuineness of live dealer games, being able to observe the gameplay as it happens and engage with the dealer and fellow players. In addition, a wide range of live dealer games such as blackjack, roulette, baccarat, and poker are offered to suit different player tastes. The increasing popularity of live dealer games is projected to grow further as operators invest in top-notch streaming technology and skilled dealers, contributing to overall market expansion.

Restraints

- Navigating security challenges in the online gambling and betting market to ensure trust and growth.

Security issues pose a major limitation for the Online Gambling and Betting Market. Online gambling platforms are appealing to cybercriminals because they deal with sensitive personal and financial data. Data breaches and hacking incidents have the potential to cause significant financial harm to operators and players, leading to a loss of confidence in the industry. Moreover, the utilization of cryptocurrencies in internet betting, despite offering benefits, can also bring about security threats. Players might worry about the safety of their online wallets and the risk of fraud or theft. Operators need to implement strong security measures like encryption, firewalls, and frequent security audits to safeguard their platforms and ensure player trust. The rise of fresh cybersecurity risks requires operators to stay watchful and take proactive steps in their security measures. Not meeting this requirement may lead to serious harm to reputation and a decrease in customer confidence, ultimately affecting market expansion.

Market Segmentation Analysis

By Type

The sports betting segment dominated the market with more than 50% market share in 2023, fueled by the rise in the legalization of sports wagering in different areas and the growing fascination with live sports. Due to technological advancements, bettors now can place bets live during events, increasing both excitement and engagement. Big companies such as DraftKings and FanDuel have taken advantage of this trend by providing creative platforms and a variety of betting choices like in-game betting and prop bets. These businesses have also put money into marketing strategies to appeal to a wider audience, specifically targeting younger age groups who prefer interacting with digital platforms.

The casino segment accounted for a rapid CAGR and is the fastest-growing during 2024-2032, due to the increasing popularity of online casinos and advancements in gaming technology. Online casinos provide a wide range of games like slot machines, table games, and live dealer options, giving players a similar immersive experience as traditional casinos. For instance, Bet365 and 888 Holdings are leading the way by utilizing advanced technology to improve user interaction, offering features like high-quality streaming and interactive gameplay.

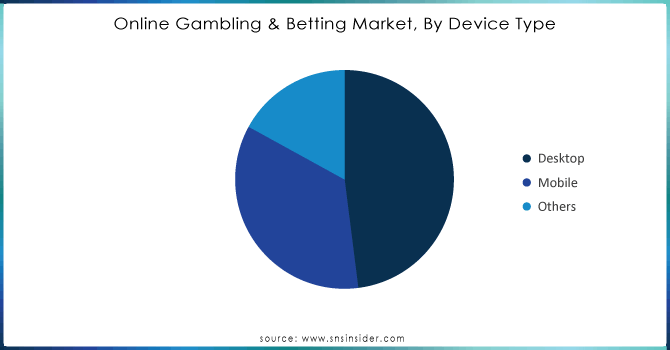

By Device

The desktop dominated with a 48% market share in 2023, making up a significant portion of overall earnings. The reason for this dominance lies in factors such as bigger screens, better processing power, and stronger internet connectivity. Desktop platforms provide a more engaging gaming experience with advanced graphics, interactive game options, and user-friendly interfaces, enhancing players' immersion. Well-known apps such as PokerStars and Bet365 have customized their sites for computer users, offering a wide range of casino games, sports betting, and live dealer choices.

The mobile segment is anticipated to have a progressive CAGR during 2024-2032, due to the rising popularity of smartphones and their convenience. Due to the increasing popularity of mobile apps, individuals can access gambling opportunities at any time and in any place, thus making mobile platforms very attractive. Apps like 888 Casino and DraftKings have taken advantage of this shift by creating advanced mobile applications that offer a wide variety of services such as sports betting, live casinos, and slot games.

Do You Need any Customization Research on Online Gambling & Betting Market - Inquire Now

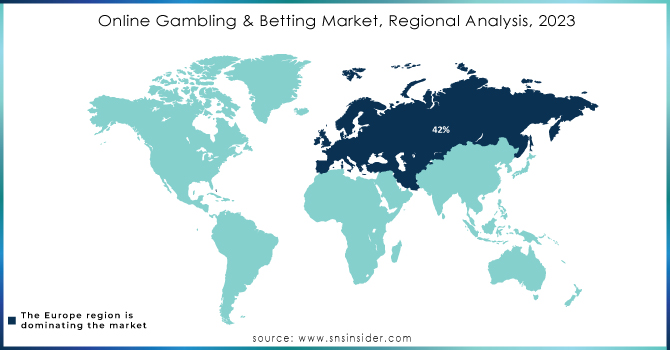

Regional Analysis

Europe held a market share of 42% in 2023 and led the market regionally, representing a large portion of the worldwide market. Reasons for this dominance stem from established regulations, widespread internet usage, and societal acceptance of gambling. Nations such as the UK, Germany, and Sweden are at the forefront, providing a wide range of betting choices like sports betting, online casinos, and poker. Key players such as Bet365, William Hill, and Kindred Group have a strong presence in Europe, utilizing advanced technology to improve user satisfaction and grow their services.

The APAC region is expected to have a significant growth rate during 2024-2032, due to fast urbanization, rising disposable incomes, and the widespread use of smartphones. Nations like China, Japan, and Australia are experiencing notable expansion, as more customers are adopting internet gambling websites. Regulatory changes in multiple countries are also creating a more conducive atmosphere for the gambling sector. Paddy Power Betfair and 888 Holdings are growing in the APAC area by providing tailored content and easy-to-use platforms to appeal to customers.

Key Players

The major key players in the Online Gambling & Betting Market are:

-

William Hill (Sportsbook, Casino)

-

Bet365 (Sports Betting, Poker)

-

Paddy Power Betfair PLC (Betting Exchange, Sportsbook)

-

Betsson AB (Online Casino, Sports Betting)

-

Ladbrokes Coral Group PLC (Sports Betting, Virtual Sports)

-

The Stars Group Inc. (PokerStars, Betfair Casino)

-

888 Holdings PLC (888poker, 888casino)

-

Sky Betting and Gaming (Sky Bet, Sky Casino)

-

Kindred Group PLC (Unibet, 32Red)

-

GVC Holdings PLC (Ladbrokes, bwin)

-

DraftKings Inc. (Daily Fantasy Sports, Sportsbook)

-

FanDuel (Daily Fantasy Sports, Sportsbook)

-

Caesars Entertainment Corporation (Caesars Sportsbook, WSOP)

-

Betfair International (Sports Betting, Exchange Betting)

-

BetMGM (Sports Betting, Casino)

-

Sportingbet (Sports Betting, Live Betting)

-

Parimatch (Online Sports Betting, Casino Games)

-

LeoVegas AB (LeoVegas Casino, Live Casino)

-

Mr Green Ltd. (Mr Green Casino, Sports Betting)

-

Evolution Gaming (Live Casino Solutions, Game Shows)

Recent Developments

-

August 2024: Dublin-based online sports betting and gaming company Flutter Entertainment on Tuesday announced the opening of a new Global Capability Centre (GCC) in Hyderabad with an investment outlay of USD 3.5 million.

-

August 2024: Hard Rock Casino Rockford and Hard Rock Digital unveiled the debut of Hard Rock Bet, now live in Illinois offering its top-rated online sports betting app statewide and with on-property wagering at the soon-to-be-opened sportsbook at Hard Rock Casino Rockford.

-

July 2024: The New Zealand government announces a curated approach to online casino regulation, targeting reductions in harm and improvements in consumer protection and tax revenue.

-

July 2024: Vanuatu, the small island nation with the boast of being shortly followed by Antigua to offer online gambling licenses during the late '90s has presented a new regulatory framework offering applications online.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 81.86 Billion |

| Market Size by 2032 | USD 218.02 Billion |

| CAGR | CAGR of 11.54% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Sports Betting, Casinos, Poker, Bingo, Others) • By Type (Desktop, Mobile, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | William Hill, Bet365, Paddy Power Betfair PLC, Betsson AB, Ladbrokes Coral Group PLC, The Stars Group Inc., 888 Holdings PLC, Sky Betting and Gaming, Kindred Group PLC, GVC Holdings PLC, DraftKings Inc., FanDuel, Caesars Entertainment Corporation, Betfair International, BetMGM, Sportingbet, Parimatch, LeoVegas AB, Mr Green Ltd., Evolution Gaming |

| Key Drivers | • The impact of increased internet access on the growth of the online gambling and betting market. • Live dealer games revolutionize the online gambling and betting market with enhanced social interaction and authentic experiences. |

| RESTRAINTS | • Navigating security challenges in the online gambling and betting market to ensure trust and growth. |