Photomask Market Size & Trends:

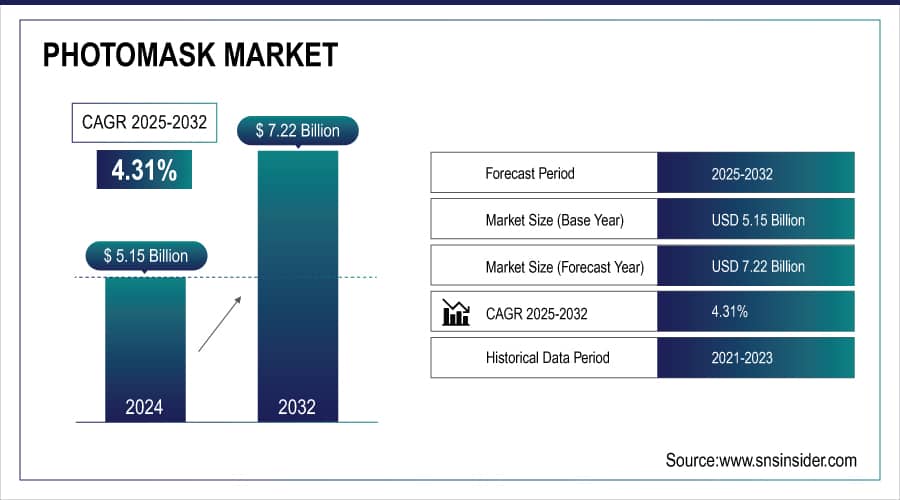

The Photomask Market size was valued at USD 5.37 Billion in 2025 and is projected to reach USD 8.19 Billion by 2035, at a CAGR of 4.31% from 2026-2035.

The photomask market is witnessing strong growth, due to growing demand for advanced semiconductor nodes and next-generation lithography technologies, including EUV and High-NA EUV. The demand for photomasks that are incredibly precise and complex is going up as chipmakers shift over to 2nm and beyond. Organizations are broadening their international manufacturing presence and targeting R&D collaborations to improve talent strength, especially in Asia-Pacific, Europe and the United States. These advanced photomask solutions are essential for developing chips for AI, 5G, automotive and consumer electronics that are smaller, faster and more power efficient. Not only this is driving yield and performance improvement but also creating competition and innovation in the semiconductor supply chain.

Oct. 1, 2024_Toppan Photomask transitions into Tekscend Photomask, rebranding to signal its growth into advanced semiconductor technology and expansion as a leader of semiconductor manufacturing around the world. This also follows its recent R&D collaboration with IBM on 2nm and High-NA EUV photomasks, which supports next-gen chip development at sites worldwide.

Market Size and Forecast:

-

Market Size in 2025 USD 5.37 Billion

-

Market Size by 2033 USD 8019 Billion

-

CAGR of 4.31% From 2026 to 2033

-

Base Year 2025

-

Forecast Period 2026-2035

-

Historical Data 2022-2024

To Get More Information On Photomask Market - Request Free Sample Report

Photomask Market Trends:

-

Advancements in EUV lithography at 13.5 nm are increasing demand for high-precision photomask etching technologies.

-

Reflective multi-layer EUV photomasks require extreme control over critical dimensions, defect suppression, and pattern uniformity.

-

Chipmakers moving toward 2 nm and smaller nodes are driving adoption of specialized etching systems to maintain yield and accuracy.

-

Growth in OLED, microLED, and high-resolution displays is boosting demand for ultra-precise photomasks with low defect rates.

-

Investment in advanced inspection tools, substrates, and grayscale mask fabrication enables strategic partnerships with leading display manufacturers and expands market opportunities.

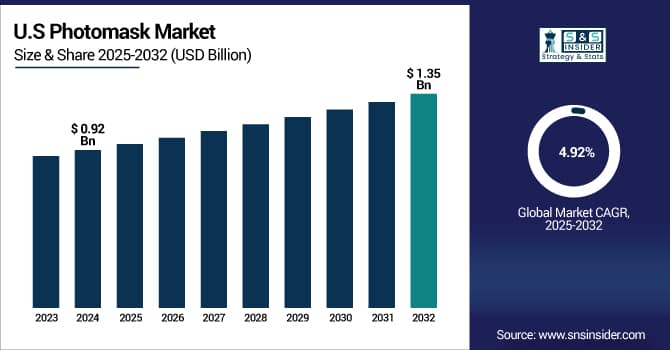

The U.S Photomask Market size was valued at USD 0.92 Billion in 2025 and is projected to reach USD 1.35 Billion by 2035, growing at a CAGR of 4.92% during 2026-2035, owing to increasing semiconductor manufacturing, growing demand for AI and 5G technologies, and adoption of EUV lithography. If you take a look at the trend towards smaller nodes, higher volume wafers, demand for high precision photomasks is increasing. And finally, there are a number of domestic initiatives to bolster chip manufacturing and the ability to support domestic supply chains that are also spurring interest in establishing photomask manufacturing locally.

Photomask Market Growth Drivers:

-

EUV Lithography Advancements Drive Demand for High-Precision Photomask Etching Technologies

The growing complexity of EUV lithography, especially at the 13.5nm wavelength, is accelerating the demand for advanced photomask etching technologies. Unlike conventional masks, EUV photomasks are reflective and consist of intricate multi-layer mirrors, requiring extreme precision in critical dimension control, defect suppression, and pattern uniformity. As chipmakers push toward 2nm and smaller nodes, maintaining high yield and accuracy in photomask fabrication becomes essential. This drives the market for highly specialized etching systems capable of handling complex materials and structures while minimizing damage. The increasing reliance on such technologies to support next-gen chip manufacturing is a key factor propelling growth in the photomask market.

January 2025_The Centura® Tetra™ EUV Advanced Reticle Etch system from Applied Materials will help address photomask challenges for next-gen EUV lithography. EUV masks with multiple layers can be accurately etched by the system while limiting defects, thus improving pattern fidelity and yield.

Photomask Market Restraints:

-

Stringent EUV Mask Requirements Drive Up Costs, Hindering Photomask Market Growth in the EU

The high cost and complexity involved in EUV photomask manufacturing limits the photomask market growth to a great extent, which is a major factor inhibiting the market all through the forecast period. Due to the need for multilayer reflective structures and simultaneously tight defect control (which makes them amongst the most expensive and hardest to produce), EUV masks are expensive and difficult to manufacture. This increases CAPEX and OPEX costs due to requirements for advanced etching and inspection systems. Scalability is also limited because of the immature supply chain of EUV grade materials, compounded with the small number of highly-skilled individuals able to run these complex processes. Such challenges slow down production schedules, lowers profit margins and makes market entry unattractive for smaller players, thereby confining total market growth.

Photomask Market Opportunities:

-

Display Innovation Spurs Demand for Ultra-Precise Photomasks, Expanding Market Opportunities

The accelerating advancement of OLED, microLED, and high-resolution display technologies presents a significant opportunity for the photomask market. As panel manufacturers strive for greater pixel density, flexibility, and energy efficiency, the demand for ultra-high precision photomasks with exceptional pattern fidelity and low defect rates is rising. This environment rewards suppliers with cutting-edge capabilities in defect detection, material uniformity, and grayscale mask fabrication. Companies that invest in next-gen inspection tools, advanced substrates, and tailored photomask design can form strategic partnerships with leading display fabs. Over the next decade, this trend is expected to expand the photomask addressable market, particularly in the display segment, offering sustained revenue growth and competitive differentiation for innovators in the sector.

June 19, 2025_Photronics, Inc. recognizes its Outstanding Contribution Award from Visionox in high-precision photomask solutions. This recognition underscores Photronics' contribution to the advancement of next-generation display technologies.

Photomask Market Segment Analysis:

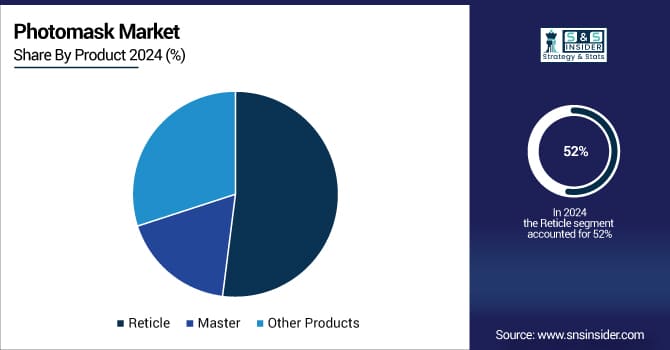

By Product

In 2025, the Reticle segment captured approximately 52% of the photomask market share, owing to its pivotal role in high-precision semiconductor lithography processes. The segment is projected to register the fastest growth from 2026 to 2035, with a CAGR of 4.45%. This expansion is primarily fueled by the rising adoption of advanced nodes and miniaturization trends in chip design, alongside growing investments in EUV and DUV lithography technologies across the semiconductor manufacturing ecosystem to meet next-gen device requirements.

By Application

In 2025, the Displays segment accounted for approximately 48% of the photomask market share, primarily boosted by increasing request for high-resolution OLED, microLED, and flexible display panels. Growing demand for advanced display technologies in consumer electronics, smartphones, and smart TVs are further driving precision photomask needs as manufacturers strive for higher visual performance, reduced power consumption, and smaller package sizes. The Discrete Components segment is expected to experience the fastest growth in photomask market over 2026-2035 with a CAGR of 7.88%, due to increasing demand for power device, RF component, and analog ICs for automotive, industrial, and 5G applications that require high-precision photomasks for reliability, efficiency, and miniaturization of discrete semiconductor components.

By Technology

In 2025, the Optical Lithography segment accounted for approximately 60% of the photomask market share, due to its commercialization in mature semiconductor fabrication processes. It is the most cost-effective and compatible option for 193nm immersion tools, also able to support high-volume production, making it the preferred solution for manufacturing nodes greater than 7nm. Still relevant due to the continued consumer electronics and automotive IC demand even with the introduction of EUV lithography. The EUV Lithography segment is expected to experience the fastest growth in photomask market over 2026-2035 with a CAGR of 8.22%, This surge is driven by the transition to advanced nodes at 5nm and below, requiring complex EUV masks with multilayer reflective structures. Growing investments in EUV fabs and demand for high-density chips in AI, HPC, and 5G are accelerating adoption of EUV-compatible photomasks.

By End Use

In 2025, the Consumer Electronics segment accounted for approximately 46% of the photomask market share, driven by high-volume demand for smartphones, tablets, wearables, and smart home devices. Increasing consumer preference for compact, high-performance, and energy-efficient electronics has boosted the need for advanced photomasks to support fine-pitch semiconductor designs. Rapid product cycles and innovation in display and logic chips continue to strengthen this segment's dominance. The Healthcare segment is expected to experience the fastest growth in photomask market over 2026-2035 with a CAGR of 10.93%, which is increasing adoption of miniaturized medical devices, lab-on-chip system, biosensors, and wearable health monitors manufactured using high precision semiconductor components, Demand for simply test and application outlines for photomasks in clinical hardware additionally expands by the push for advanced diagnostics and individualized treatment for medical devices.

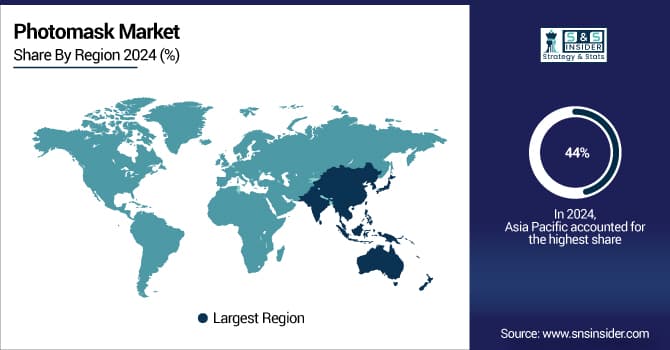

Photomask Market Regional Analysis:

Asia Pacific Photomask Market Insights

In 2025, Asia Pacific dominated the photomask market and accounted for 44% of revenue share, driven by its strong semiconductor manufacturing base in countries like Taiwan, South Korea, China, and Japan. Massive investments in chip fabrication, rising demand for consumer electronics, and the regional presence of major foundries and photomask suppliers have solidified Asia Pacific’s position as the key growth hub for photomask production and demand.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Photomask Market Insights

North America is expected to witness the fastest growth in the photomask market over 2026-2035, with a projected CAGR of 5.94%, supported by increase in domestic semiconductor production, government initiatives such as CHIPS Act, and demand for advanced photomasks for applications in AI, aerospace & defense, and HPC. The regional market is also expanding as more investments are made in local photomask fabrication facilities with the expanded adoption of EUV lithography.

Europe Photomask Market Insights

In 2025, Europe emerged as a promising region in the photomask market, driven by expanding semiconductor R&D investment, increasingly sophisticated lithography, and initiatives to regionalize chip production. Germany, France, and the Netherlands are also broadening photomask capabilities by teaming up with leading equipment and material suppliers. Steady demand for high-precision photomasks is derived from the focus of the region on strengthening its semiconductor supply chain and supporting industries such as automotive and industrial electronics.

Latin America (LATAM) and Middle East & Africa (MEA) Photomask Market Insights

LATAM and MEA are experiencing steady growth in the photomask market, owing to increasing penetration of consumer electronics manufacturing, industrial automation and digital infrastructure development. Gradual expansion in the market is supported by government initiatives to further strengthen local semiconductor capabilities and rising consumer and medical electronics demand. These regions are still in their infancy but offer room for growth as companies look to diversify their global supply chains and bring production closer to home, something that will become an increasingly strategic focus for industries downstream of chipmaking.

Photomask Market Key Players:

The Photomask Companies are Advance Reproductions Corp., Applied Materials Inc., HOYA Corporation, Infinite Graphics Incorporated, KLA Corporation, LG Innotek Co. Ltd., Nippon Filcon Co. Ltd., Photronics Inc., SK-Electronics Co. Ltd., Toppan Photomasks, Inc., Dai Nippon Printing Co., Ltd. (DNP), Taiwan Mask Corporation (TMC), Compugraphics International Ltd., SUSS MicroTec SE, Veeco Instruments Inc., Carl Zeiss SMT GmbH, Naura Technology Group Co., Ltd., Newway Photomask, Tianjin Zhonghuan Semiconductor Co., Ltd., Lasertec Corporation and Others.

Competitive Landscape for Photomask Market:

DNP (Dai Nippon Printing Co., Ltd.) is a leading provider of photomask solutions for semiconductor and advanced display manufacturing. The company specializes in high-precision mask fabrication, defect control, and pattern fidelity for EUV and high-resolution displays, supporting next-generation chip nodes, OLED, microLED, and microelectronics applications globally.

-

In May 2024, DNP inaugurated a new metal mask production line at its Kurosaki Plant in Fukuoka Prefecture. This expansion supports the rising demand for larger OLED displays used in various IT devices

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 5.37 Billion |

| Market Size by 2035 | USD 8.19 Billion |

| CAGR | CAGR of 4.31% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product(Reticle, Master and Other Products) • By Application(Displays, Discrete Components, Optical Devices, MEMS and Other Applications • By Technology(Optical Lithography, EUV Lithography and X-ray Lithography) • By End Use(Consumer Electronics, Automotive, Telecommunications and Healthcare) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The photomask market companies are Advance Reproductions Corp., Applied Materials Inc., HOYA Corporation, Infinite Graphics Incorporated, KLA Corporation, LG Innotek Co. Ltd., Nippon Filcon Co. Ltd., Photronics Inc., SK-Electronics Co. Ltd., Toppan Photomasks, Inc., Dai Nippon Printing Co., Ltd. (DNP), Taiwan Mask Corporation (TMC), Compugraphics International Ltd., SUSS MicroTec SE, Veeco Instruments Inc., Carl Zeiss SMT GmbH, Naura Technology Group Co., Ltd., Newway Photomask, Tianjin Zhonghuan Semiconductor Co., Ltd., Lasertec Corporation. and Others. |