Low Voltage Motor Control Centers Market Size & Growth:

The Low Voltage Motor Control Centers Market Size was valued at USD 3.75 Billion in 2023 and is expected to reach USD 5.78 Billion by 2032 and grow at a CAGR of 5.0% over the forecast period 2024-2032. The market is growing due to industrial automation, energy efficiency demands, and the adoption of smart motor control. LV MCCs manage multiple motors efficiently across industries like oil & gas, manufacturing, and utilities. The rise of IoT-enabled smart MCCs, modular designs, and digital twin technology is reshaping the market. Asia-Pacific leads growth, followed by North America and Europe, driven by industrial expansion and regulatory compliance. Key players focus on R&D, M&As, and technological innovations. With the increasing adoption of Industry 4.0, the market presents significant opportunities for advanced motor control solutions and intelligent automation systems.

To Get more information on Low Voltage Motor Control Centers Market - Request Free Sample Report

Low Voltage Motor Control Centers Market Dynamics

Key Drivers:

-

Growing Adoption of Industrial Automation and Smart Manufacturing Drives the Low Voltage Motor Control Centers Market Growth

The increasing shift towards industrial automation and smart manufacturing is a key driver of the Low Voltage Motor Control Centers (LV MCC) market. Industries such as oil & gas, utilities, and manufacturing are adopting digitally integrated MCCs to enhance operational efficiency, reduce downtime, and optimize energy consumption. The integration of IoT, cloud computing, and AI-based predictive maintenance in MCCs enables real-time monitoring and diagnostics, improving motor performance and safety.

Additionally, stringent energy efficiency regulations and growing demand for cost-effective motor control solutions are accelerating market growth. The rapid expansion of Industry 4.0, digital twin technology, and connected devices further enhance market adoption. Governments and industries worldwide are investing in smart factories and automation technologies, fueling the demand for intelligent MCC solutions. As industries continue to modernize their production facilities, the demand for advanced motor control solutions is expected to surge in the coming years.

Restrain:

-

High Initial Investment and Installation Costs Restrain the Low Voltage Motor Control Centers Market Growth

Despite its benefits, the high initial investment and installation costs associated with Low Voltage Motor Control Centers (LV MCCs) act as a major restraint. Implementing intelligent MCCs with advanced monitoring and automation features requires significant upfront capital expenditure, making it challenging for small and medium-sized enterprises (SMEs) to adopt these solutions.

Additionally, integrating IoT, AI, and cloud-based monitoring systems demands costly hardware and software upgrades, further increasing the financial burden. The complexity of customizing MCCs for specific industry requirements and the need for trained personnel to manage and maintain these systems also add to the overall costs. Furthermore, economic uncertainties and budget constraints in various industries may limit the adoption of smart MCC solutions, particularly in developing regions where cost-sensitive buyers prefer traditional motor control systems. Overcoming this restraint requires cost-effective innovations, flexible financing options, and government incentives to encourage broader adoption of LV MCCs.

Opportunities:

-

Growing Demand for Energy-Efficient Solutions Creates Lucrative Opportunities in the Low Voltage Motor Control Centers Market

The increasing emphasis on energy efficiency and sustainability presents a significant opportunity in the Low Voltage Motor Control Centers (LV MCC) market. Industries worldwide are shifting towards energy-efficient motor control systems to comply with strict environmental regulations and reduce operational costs. Governments and regulatory bodies, such as the International Electrotechnical Commission (IEC) and the National Electrical Manufacturers Association (NEMA), are enforcing energy efficiency standards, pushing industries to adopt smart MCCs with optimized power consumption.

Additionally, the rising trend of renewable energy integration and the need for efficient motor control in wind farms, solar power plants, and smart grids are expanding the market potential. Manufacturers are focusing on developing eco-friendly and energy-efficient MCC solutions, incorporating variable frequency drives (VFDs), advanced sensors, and AI-powered monitoring to minimize energy waste and enhance overall performance. These advancements create lucrative opportunities for sustainable, high-performance MCC solutions across various industries.

Challenges:

-

Cybersecurity Risks and Data Vulnerabilities Pose Challenges to the Low Voltage Motor Control Centers Market

The increasing digitalization and connectivity of MCCs introduce cybersecurity risks and data vulnerabilities, posing a major challenge to the market. As industries adopt IoT-enabled smart MCCs with remote monitoring and cloud-based analytics, they become susceptible to cyber threats, hacking, and data breaches. Unauthorized access to motor control systems can lead to system failures, production halts, and financial losses, impacting overall operations.

Additionally, industries handling critical infrastructure such as power plants, oil & gas facilities, and manufacturing units face heightened risks of cyberattacks targeting control systems. Ensuring robust cybersecurity measures, secure communication protocols, and regular software updates is essential to protect sensitive data and maintain system integrity. However, many companies lack adequate cybersecurity frameworks and expertise, making them vulnerable to potential cyber threats. Overcoming this challenge requires stronger encryption, advanced threat detection systems, and industry-wide collaboration to establish secure digital motor control solutions.

Low Voltage Motor Control Centers Market Segmentation Overview

By Type

The Conventional Motor Control Center (MCC) segment held the largest revenue share of 65% in 2023, driven by its widespread adoption across industries requiring cost-effective, centralized motor control solutions. Industries such as oil & gas, chemicals, power generation, and manufacturing prefer conventional MCCs due to their proven reliability, ease of maintenance, and lower initial investment compared to intelligent MCCs. Major players like Schneider Electric, Siemens, ABB, and Rockwell Automation continue to enhance their conventional MCC offerings.

In 2023, Siemens introduced its SIRIUS 3RA6 MCC system, which provides a compact and energy-efficient motor control solution designed for industrial applications. Similarly, Schneider Electric launched the TeSys Giga MCC, featuring enhanced motor protection and safety mechanisms for harsh environments. However, the market is witnessing a gradual transition towards hybrid solutions, where conventional MCCs are integrated with advanced communication modules and digital monitoring capabilities to enhance operational efficiency.

The Intelligent Motor Control Center (MCC) segment is experiencing the highest Compound Annual Growth Rate (CAGR) of 5.61% during the forecast period, driven by the increasing adoption of automation, digitalization, and Industry 4.0 in manufacturing and industrial operations. Intelligent MCCs integrate IoT, real-time monitoring, predictive maintenance, and advanced motor diagnostics, enabling industries to enhance operational efficiency and minimize downtime. Leading manufacturers such as Rockwell Automation, Eaton, and ABB are at the forefront of intelligent MCC development.

Rockwell Automation introduced its CENTERLINE 2500 MCC, designed with Ethernet-enabled smart modules for seamless industrial connectivity. Similarly, ABB launched the ABB Ability Smart MCC, which leverages AI-based analytics for predictive maintenance and energy optimization.

By Component

The Busbars segment accounted for the largest revenue share of 25% in 2023 in the Low Voltage Motor Control Centers (LV MCC) market, owing to their high efficiency, compact design, and ability to distribute power with minimal energy loss. Busbars are widely used in industrial motor control systems to provide safe, reliable, and flexible power distribution, reducing wiring complexity and enhancing system durability. Leading manufacturers like Schneider Electric, Siemens, and Eaton are continuously innovating in this segment. The growing demand for energy-efficient and space-saving power distribution solutions is driving the adoption of busbars in industries such as oil & gas, manufacturing, and utilities. With the increasing emphasis on smart MCCs and digital power monitoring, modern busbar systems are integrating IoT-based sensors for real-time performance tracking.

The Circuit Breakers & Fuses segment is experiencing the highest CAGR of 6.30% in the Low Voltage Motor Control Centers market, driven by the increasing focus on safety, equipment protection, and regulatory compliance. Circuit breakers and fuses play a vital role in safeguarding electrical systems from overloads, short circuits, and voltage fluctuations, ensuring uninterrupted industrial operations. As industries shift towards digitally connected MCCs, demand for smart circuit protection solutions is rising. Companies like ABB, Schneider Electric, and Mitsubishi Electric are leading innovations in this segment. The rising adoption of intelligent MCCs with cloud-based diagnostics and AI-powered fault detection is further fueling the demand for advanced circuit breakers and fuses. With strict safety regulations and the increasing need for high-reliability electrical protection, this segment is set to grow rapidly.

By End-Use

The Industrial segment held the largest revenue share of 73% in 2023 in the Low Voltage Motor Control Centers (LV MCC) market, driven by the high demand for motor control solutions in manufacturing, oil & gas, mining, power generation, and water treatment industries. These industries rely heavily on efficient motor control systems to manage operations, improve energy efficiency, and enhance safety. The growing focus on industrial automation, predictive maintenance, and digital transformation has further boosted demand for intelligent MCCs in industrial facilities. Major companies such as ABB, Schneider Electric, and Rockwell Automation continue to expand their offerings to cater to industrial needs.

In 2023, ABB introduced the ABB Ability™ Smart MCCs, which integrate IoT, AI-driven analytics, and remote monitoring to optimize motor performance and reduce downtime. Similarly, Rockwell Automation launched the CENTERLINE 2500 MCC, featuring EtherNet/IP-enabled smart components for real-time diagnostics and seamless industrial connectivity.

The Commercial segment is growing at the highest CAGR of 5.91% in the Low Voltage Motor Control Centers (LV MCC) market, fueled by increasing investments in infrastructure development, smart buildings, data centers, and commercial facilities. With the rising adoption of energy-efficient HVAC systems, elevators, lighting controls, and security systems, the demand for advanced MCC solutions is growing in commercial applications. The surge in urbanization, smart city initiatives, and expansion of metro rail projects, airports, and shopping malls is also contributing to the segment's rapid growth. The rapid growth of data centers and cloud infrastructure has also driven the adoption of LV MCCs for critical power management. With increasing emphasis on sustainability, energy savings, and smart building technologies, the commercial sector is emerging as a key growth area in the LV MCC market.

Low Voltage Motor Control Centers Market Regional Analysis

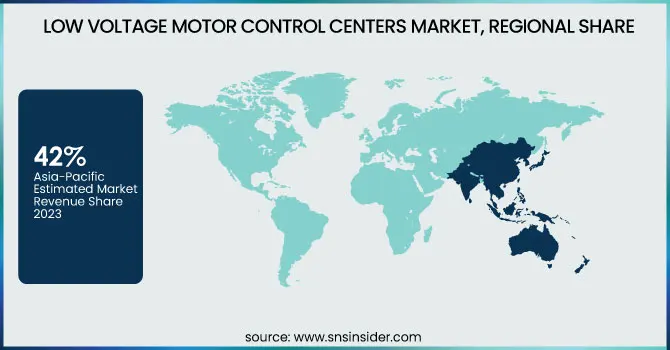

The Asia-Pacific region led the Low Voltage Motor Control Centers market in 2023, accounting for an estimated market share of 42%, driven by rapid industrialization, infrastructure development, and increasing investments in automation. Countries like China, India, Japan, and South Korea are witnessing a surge in demand for industrial motor control solutions due to expanding manufacturing, power generation, and oil & gas sectors. The "Made in China 2025" initiative and India's "Make in India" campaign are pushing for increased automation and energy-efficient industrial solutions, further boosting MCC adoption. Additionally, major players such as Siemens, Schneider Electric, and ABB have expanded their operations in Asia-Pacific, introducing advanced MCC solutions with smart monitoring capabilities. The growing focus on sustainability, smart cities, and renewable energy integration is also driving demand for intelligent MCCs in the region, ensuring continued market dominance.

North America is the fastest-growing region in the Low Voltage Motor Control Centers market, expected to grow at an estimated CAGR of 6.02% during the forecast period. The growth is fueled by the rising adoption of Industry 4.0, smart grid expansion, and increased demand for energy-efficient solutions. The U.S. and Canada are leading the adoption of intelligent MCCs across industries such as oil & gas, automotive, data centers, and commercial buildings.

In 2023, Rockwell Automation introduced its FactoryTalk Smart MCCs, which leverage real-time data analytics to optimize motor performance and predictive maintenance.

Additionally, government initiatives promoting green energy and electrification of industries are accelerating demand for LV MCCs in renewable energy projects. With increasing digitalization and automation trends, North America is set to experience strong market expansion in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Low Voltage Motor Control Centers Market are:

-

ABB (MNS Low Voltage Motor Control Center, ACS580 Variable Frequency Drive)

-

Allis Electric Co., Ltd. (Low Voltage Switchgear, Motor Control Panels)

-

Boerstn Electric Co., Ltd. (MCC Panels, Low Voltage Distribution Boards)

-

Cape Electrical Supply Integration (Low Voltage Motor Control Solutions, Industrial Electrical Panels)

-

EAMFCO (Motor Control Centers, Power Distribution Systems)

-

Eaton (Freedom Series MCC, Power Xpert CX Motor Control Center)

-

GT Engineering (Low Voltage MCC Panels, Intelligent Motor Control Centers)

-

Ingeteam SA (Ingecon Motor Control Solutions, Low Voltage Switchgear)

-

Mitsubishi Electric Corporation (MELFAC Motor Control Center, FR-A800 Series VFD)

-

Powell Industries (Powell IntelliSafe MCC, Low Voltage Motor Control Assemblies)

-

Rockwell Automation (CENTERLINE 2100 MCC, PowerFlex 750-Series Drives)

-

Schneider Electric (TeSys Motor Control Solutions, Okken Low Voltage MCC)

-

Siemens (SIRIUS Motor Control Center, SIMOCODE Pro Motor Management System)

-

WEG (Weg CFW Series VFD, Low Voltage MCC Solutions)

-

Zhejiang Zhegui Electric Co., Ltd. (Intelligent MCC Panels, Low Voltage Control Cabinets)

Recent Trends

-

In June 2024, ABB India's IEC low voltage motors saved over 500 GWh annually across various industries, equivalent to Sikkim's yearly energy consumption. In 2023, orders for high-efficiency IE3 and IE4 motors constituted approximately 50% of total orders, with IE4 motor sales doubling yearly.

-

In May 2024, Eaton completed the acquisition of Exertherm, a UK-based provider of continuous thermal monitoring solutions for electrical equipment. This strategic move aimed to integrate Exertherm's technology into Eaton's Brightlayer software suite, enhancing safety and reliability in critical electrical infrastructure across key markets, including data centers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.75 Billion |

| Market Size by 2032 | USD 5.78 Billion |

| CAGR | CAGR of 5.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Conventional MCC, Intelligent MCC) • By Component (Busbars, Circuit Breakers & Fuses, Overload Relays, Variable Speed Drives, Soft Starters, Others) • By End Use (Industrial [Oil & Gas, Metals & Mining, Power Utilities, Chemicals, Food & Beverages, Others] Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB, Allis Electric Co., Ltd., Boerstn Electric Co., Ltd., Cape Electrical Supply Integration, Eaton, GT Engineering, Ingeteam SA, Mitsubishi Electric Corporation, Powell Industries, Rockwell Automation, Schneider Electric, Siemens, WEG, Zhejiang Zhegui Electric Co., Ltd. |