Physical AI Market Report Scope & Overview:

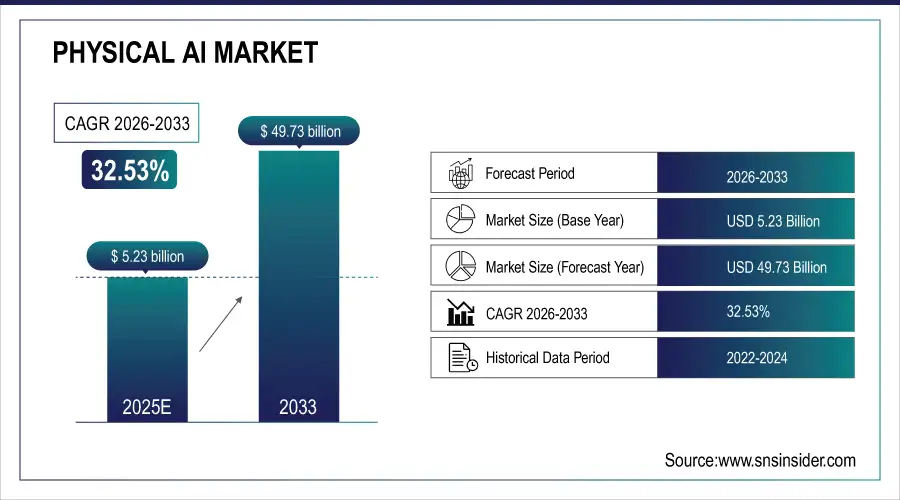

The Physical AI Market Size is valued at USD 5.23 Billion in 2025E and is expected to reach USD 49.73 Billion by 2033 and grow at a CAGR of 32.53%% over the forecast period 2026-2033.

The Physical AI Market analysis, driven by rapid advances in robotics, perception technologies and AI capabilities that enable machines to sense, interpret, and act in the real world effectively blending intelligence with physical action. Improvements in computer vision, reinforcement learning, multimodal AI, and efficient edge-AI hardware mean robots and autonomous systems are becoming smarter, more reliable, and capable of functioning in dynamic, unstructured environments.

According to study, Robots that integrate AI reportedly deliver up to 40% higher operational efficiency compared to traditional (non-AI) automation systems.

Market Size and Forecast:

-

Market Size in 2025: USD 5.23 Billion

-

Market Size by 2033: USD 49.73 Billion

-

CAGR: 32.53%% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Physical AI Market - Request Free Sample Report

Physical AI Market Trends:

-

Rising adoption of intelligent robots across manufacturing, healthcare, logistics, and services.

-

Growing deployment of multimodal AI for real-time perception and autonomous decision-making.

-

Edge AI chips enabling faster, safer, and more adaptive robotic operations.

-

Human-robot collaboration expanding as systems gain improved tactile and movement intelligence.

-

Biomimetic and humanoid robots gaining traction for complex, dexterous real-world tasks.

-

Cloud-robotics platforms increasing scalability and reducing operational barriers for enterprises.

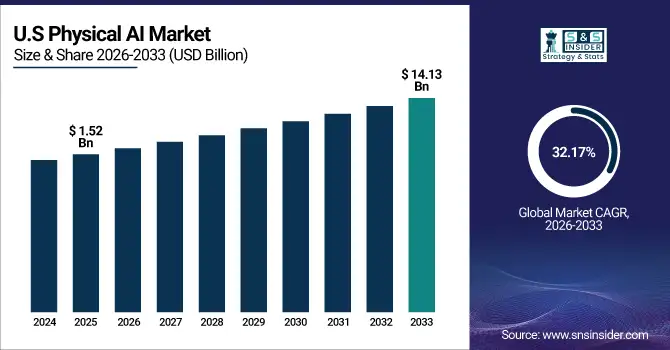

The U.S. Physical AI Market size is USD 1.52 Billion in 2025E and is expected to reach USD 14.13 Billion by 2033, growing at a CAGR of 32.17% over the forecast period of 2026-2033, due to strong robotics innovation, advanced AI research, and high adoption of automation across manufacturing, logistics, healthcare, and defense. Significant investments, supportive government initiatives, and widespread commercialization accelerate deployment of intelligent, autonomous physical systems.

Physical AI Market Growth Drivers:

-

Intelligent Robotics Adoption Accelerates Physical AI Growth Across Global Industries Rapidly

A major driver for the Physical AI market growth is the rapidly increasing adoption of intelligent robots and autonomous systems across manufacturing, healthcare, logistics, defense, and service sectors. Organizations are shifting toward robotic systems that can not only perform mechanical tasks but also perceive, analyze, and respond to real-world environments through advanced AI capabilities. Improvements in computer vision, multimodal AI, edge processing, and reinforcement learning are enabling robots to perform complex, unstructured, real-time operations that traditional automation cannot handle.

Adaptive and biomimetic robots may see a 50% surge in demand, especially in healthcare, agriculture, and domestic applications.

Physical AI Market Restraints:

-

High Costs and Complexity Limit Broader Integration of Advanced Physical AI Systems

A major restraint for the Physical AI market is the high cost and infrastructure requirements associated with deploying advanced robotic and AI systems. These systems require expensive hardware modules such as sensors, actuators, and locomotion systems for high-performance compute units, safety frameworks, and seamless integration with enterprise workflows. Additionally, organizations face challenges related to workforce upskilling, system interoperability, cybersecurity, and ongoing maintenance. Small and medium enterprises often struggle with limited budgets and lack of technical expertise, which slows adoption.

Physical AI Market Opportunities:

-

Autonomous Human-Centric AI Systems Create Massive Market Expansion Opportunities Worldwide

A major opportunity lies in the rapid evolution of next-generation autonomous, human-centric and adaptive Physical AI systems that operate safely alongside humans. Innovations such as tactile AI, adaptive movement control, real-time environment mapping, biomimetic robotics, and multimodal intelligence are opening new possibilities across healthcare, eldercare, hospitality, agriculture, construction, and domestic robotics. Emerging economies are also increasing investments in smart factories, AI-enabled logistics, and automated service infrastructures, creating massive new demand pools.

Next-generation edge AI chips may reduce latency in physical systems by up to 60%, enabling safer autonomous operation.

Physical AI Market Segmentation Analysis:

-

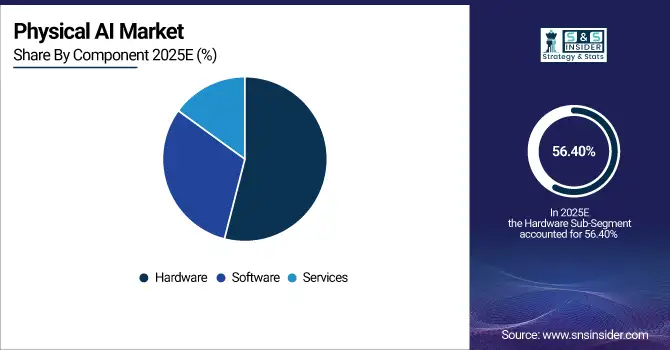

By Component: In 2025, Hardware led the market with a share of 56.40%, while Software is the fastest-growing segment with a CAGR of 34.10%.

-

By Technology: In 2025, Computer Vision led the market with a share of 45.02%, while Reinforcement Learning & Control Systems is the fastest-growing segment with a CAGR of 31.14%.

-

By Form Factor: In 2025, Industrial Robots led the market with a share of 36.12%, while Cobots is the fastest-growing segment with a CAGR of 35.12%.

-

By Deployment: In 2025, On-device led the market with a share of 51.24%, while Cloud-based AI is the fastest-growing segment with a CAGR of 38.61%.

-

By Applications: In 2025, Manufacturing & Automotive led the market with a share of 45.20% while Healthcare is the fastest-growing segment with a CAGR of 34.90%.

By Component, Hardware Lead Market and Software Fastest Growth

In 2025, Hardware is the dominant segment in the physical AI market due to it forms the foundational layer of robotic and autonomous systems, including sensors, actuators, mobility units, AI chips, and integrated mechatronic assemblies. These physical elements account for the highest share of system cost and are essential for precision, safety, and real-world interaction. As industries scale automation, the demand for advanced hardware ranging from surgical robotic arms to industrial manipulators continues to rise. Continuous hardware upgrades, new robotic form factors, and large-scale deployments sustain hardware’s leadership position.

Meanwhile, Software is the fastest-growing segment, driven by accelerated integration of AI algorithms, real-time perception, control systems, and cloud robotics platforms. As Physical AI shifts toward intelligence-heavy operations, software enables adaptive automation, reinforcement learning, digital twins, and predictive analytics. The growing reliance on AI-driven decision-making, autonomous navigation, and cross-device orchestration is boosting demand for advanced software frameworks, making it the fastest-expanding segment in the ecosystem.

By Technology, Computer Vision Leads Market and Reinforcement Learning & Control Systems Fastest Growth

In 2025, Computer Vision remains the dominant segment due to it is fundamental for object detection, inspection, navigation, medical imaging, and environment mapping capabilities that nearly all physical AI systems depend on. The high adoption of CV-enabled robots in healthcare, logistics, defense, and manufacturing ensures it holds the largest market share. Its critical role in enabling safe and autonomous interactions cements its continued dominance.

Meanwhile, Reinforcement Learning & Control Systems is the fastest-growing segment, driven by the need for robots and autonomous machines that can learn, adapt, and self-optimize. RL enables dynamic decision-making and supports next-generation applications such as self-learning factory robots, autonomous mobility systems, and adaptive exoskeletons. As industries transition toward hyper-automation and autonomous operations, demand for advanced control intelligence is rising rapidly.

By Form Factor, Industrial Robots Lead Market and Cobots Fastest Growth

In 2025, Industrial robots dominate the physical AI market due to their long-established role in manufacturing, automotive, electronics, and heavy engineering industries. Their ability to deliver high precision, speed, and consistent performance makes them indispensable for welding, assembly, material handling, and quality inspection.

Meanwhile, Cobots are the fastest-growing segment form factor as companies increasingly adopts human-robot collaboration to improve safety, flexibility, and efficiency on production floors. Unlike traditional robots, cobots are cost-effective, easy to deploy, and suitable for SMEs, enabling automation without heavy infrastructure needs. Their ability to work safely alongside humans in tasks such as packaging, inspection, assembly, and testing fuels rapid adoption.

By Deployment, On-device Leads Market and Cloud-based AI Fastest Growth

In 2025, On-Device AI dominates the segment due to it enables real-time processing, low-latency decision-making, and high reliability, which are essential for surgical robots, autonomous navigation, industrial manipulators, and safety-critical operations. On-device intelligence reduces dependence on connectivity and ensures seamless performance in unpredictable environments.

Meanwhile, Cloud-Based AI is the fastest-growing deployment segment, driven by increasing reliance on cloud robotics platforms, federated learning, remote fleet management, and continuous AI model updates. Cloud-based systems enable large-scale coordination, centralized training, and real-time optimization across distributed robotic fleets. Digital twin simulations and cross-location automation are expanding rapidly, making cloud AI essential for scalable deployments.

By Applications, Manufacturing & Automotive led market and Healthcare fastest Growth

In 2025, Manufacturing & Automotive dominate the physical AI market due to extensive use of robots for assembly, welding, inspection, material handling, and production automation. This sector has the highest integration of industrial robots, cobots, and AI-enabled machinery, driven by Industry 4.0 and smart factory modernization. The need for precision, efficiency, and cost optimization strengthens its leadership.

Meanwhile, Healthcare is the fastest-growing segment as hospitals rapidly adopt surgical robots, rehabilitation systems, patient-assistive robots, and AI-driven diagnostic platforms. Rising demand for precision surgery, aging populations, and labor shortages accelerate robotic integration in clinical workflows. Advancements in robotic surgery, exoskeletons, and automated hospital operations are driving exponential growth

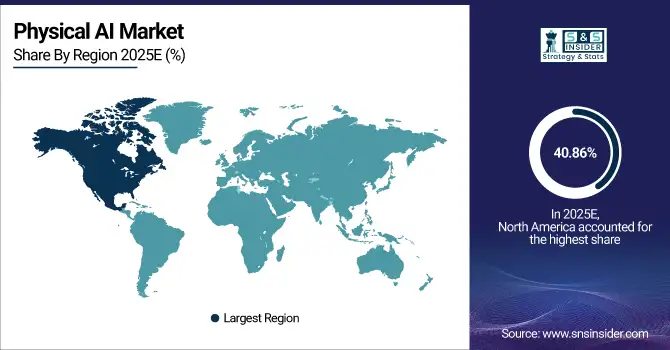

Physical AI Market Regional Analysis:

North America Physical AI Market Insights:

The North America dominated the physical AI market in 2025E, with over 40.86% revenue share, due to early adoption of advanced robotics, strong AI capabilities, and high investment in automation across manufacturing, defense, healthcare, and logistics. The region benefits from a mature R&D ecosystem, active involvement of leading AI and robotics companies, and strong government funding for next-generation autonomous systems. High demand for warehouse robotics, humanoid assistance systems, and autonomous mobility platforms further strengthens market leadership. Integration of multimodal AI, computer vision, and reinforcement learning technologies continues to accelerate Physical AI deployment across various industries, sustaining North America’s dominance.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Physical AI Market Insights

The U.S. and Canada lead with high investments in robotics, strong AI innovation, and advanced industrial automation. Adoption spans healthcare, logistics, defense, and autonomous mobility. A mature tech ecosystem and robust commercialization speeds accelerate Physical AI integration across enterprise and public-sector applications.

Asia Pacific Physical AI Market Insights:

The Asia-Pacific region is expected to have the fastest-growing CAGR 33.51%, driven by rapid industrial automation, increasing labor costs, and rising demand for advanced robotics across manufacturing, logistics, automotive, and smart infrastructure. Strong government initiatives supporting AI adoption, combined with large-scale investments in robotics production, fuel rapid expansion. The region is witnessing accelerated deployment of autonomous machines, industrial cobots, and AI-driven service robots. Growing interest in intelligent mobility, smart factories, and healthcare automation strengthens long-term growth. High technology adoption rates and expanding AI research ecosystems make Asia Pacific a powerful global growth engine.

China and India Physical AI Market Insights

China and India show rapid growth in Physical AI adoption driven by large manufacturing bases, rising automation needs, and expanding AI research ecosystems. Increased demand for industrial robots, autonomous vehicles, and smart service systems accelerates deployment, making both countries key contributors to global Physical AI expansion.

Europe Physical AI Market Insights

Europe holds a strong position in the physical AI market due to high adoption of industrial automation, strong regulatory support for robotics, and significant investments in AI-enabled manufacturing and mobility systems. The region benefits from advanced engineering capabilities, widespread use of cobots in factories, and strong emphasis on safety-certified automation technologies. Demand for autonomous logistics systems, smart healthcare robots, and AI-powered inspection equipment is rising steadily. Europe’s focus on sustainable, human-centric physical AI development and continuous innovation in edge-AI hardware, precision robotics, and multimodal perception systems ensures stable and long-term market growth.

Germany and U.K. Physical AI Market Insights

The U.K. and Germany maintain strong momentum in Physical AI due to advanced engineering capabilities, widespread manufacturing automation, and consistent investment in robotics and AI research. High deployment of cobots, autonomous warehouse systems, and precision robotics supports steady market expansion across critical industries.

Latin America (LATAM) and Middle East & Africa (MEA) Physical AI Market Insights

Latin America is experiencing increasing adoption of physical AI technologies, driven by the need for operational efficiency, warehouse automation, and robotics in manufacturing and retail sectors. Growth is supported by expanding e-commerce activity, rising interest in autonomous material-handling systems, and gradual modernization of industrial facilities. Although challenges such as limited high-end infrastructure and slower technology penetration exist, demand for intelligent robots, AI-powered surveillance systems, and automated service platforms is steadily growing

Additionally, The Middle East & Africa region shows growing interest in the physical AI market, supported by smart city initiatives, infrastructure modernization, and increasing adoption of robotics in logistics, security, and service industries. High-value economies in the region are investing in autonomous vehicles, AI-driven surveillance robots, and industrial automation systems. While adoption remains slower in some areas due to cost and skill barriers, increasing digital transformation initiatives, rising labor optimization needs, and expanding innovation hubs contribute to steady growth.

Physical AI Market Competitive Landscape:

NVIDIA plays a central role in the physical AI market by providing high-performance GPUs, edge computing platforms, and AI frameworks that power autonomous robots, humanoids, drones, and smart machines. Its NVIDIA Isaac platform accelerates robot perception, motion planning, and simulation training. By enabling real-time AI decision-making and 3D spatial understanding, NVIDIA supports industries like logistics, manufacturing, healthcare, and mobility. The company drives the creation of autonomous physical systems capable of navigating, interacting, and adapting to real-world environments.

-

In January 2025, NVIDIA launched a robotics-focused compute stack including its new “Jetson Thor” AI-chip platform for humanoid robots positioning itself as a foundational infrastructure provider for physical AI.

Google DeepMind advances physical AI through breakthroughs in reinforcement learning, robotics control algorithms, and autonomous decision-making systems. Its research focuses on enabling robots and embodied AI agents to learn from interactions, adapt to uncertain environments, and perform complex physical tasks. DeepMind leverages deep neural networks, large-scale simulation, and imitation learning to push the boundaries of robot dexterity and physical reasoning. By integrating AI with real-world robotics, DeepMind significantly contributes to next-generation autonomous machines and embodied intelligence.

-

In March 2025, DeepMind unveiled two new robotics-oriented AI models Gemini Robotics and Gemini Robotics-ER enabling robots to perform vision-language-action tasks and adapt to new physical tasks without explicit training.

FANUC is a global leader in industrial robotics and factory automation, increasingly integrating AI capabilities into robotic arms, CNC systems, and automation platforms. In the Physical AI market, FANUC focuses on intelligent motion control, self-optimizing robots, predictive maintenance, and human–robot collaboration technologies. Its AI-enhanced robots support automotive, electronics, and manufacturing industries with high precision and reliability. Through advanced data analytics, machine learning, and scalable automation ecosystems, FANUC strengthens the evolution of autonomous, physically capable AI systems.

-

In August 2024, FANUC America unveiled its R-50iA robot controller the first in the world with built-in cybersecurity features, targeting safer and smarter industrial automation.

Physical AI Market Key Players:

Some of the Physical AI Market Companies

-

SoftBank Robotics Group

-

ABB

-

Toyota Motor Corporation

-

FANUC

-

KUKA AG

-

Siemens

-

Boston Dynamics

-

Tesla

-

NVIDIA

-

Google DeepMind

-

Agility Robotics

-

Mech-Mind Robotics

-

Hanson Robotics

-

Universal Robots

-

iRobot

-

Intuitive Surgical

-

Doosan Robotics

-

Covariant

-

Apptronik

-

UBTech

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 5.23 Billion |

| Market Size by 2033 | USD 43.73 Billion |

| CAGR | CAGR of 32.53% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Deployment (Cloud-Based AI, On-Device) • By Technology (Computer Vision, Speech/NLP, Gesture/Movement Recognition, Reinforcement Learning & Control Systems, Others – Multi-modal AI, Biomimetic Robotics) • By Form Factor (Industrial Robots, Service Robots, Humanoids/Social Robots, Cobots, Exoskeletons/Prosthetics, Mobile Robots/Drones) • By Application (Healthcare, Manufacturing & Automotive, Logistics & Warehousing, Retail & Hospitality, Defense & Security, Agriculture, Education & Research) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | SoftBank Robotics Group, ABB, Toyota Motor Corporation, FANUC, KUKA AG, Siemens, Boston Dynamics, Tesla, NVIDIA, Google DeepMind, Agility Robotics, Mech-Mind Robotics, Hanson Robotics, Universal Robots, iRobot, Intuitive Surgical, Doosan Robotics, Covariant, and Apptronik, UBTech., |