PID Controller Market Size & Trends:

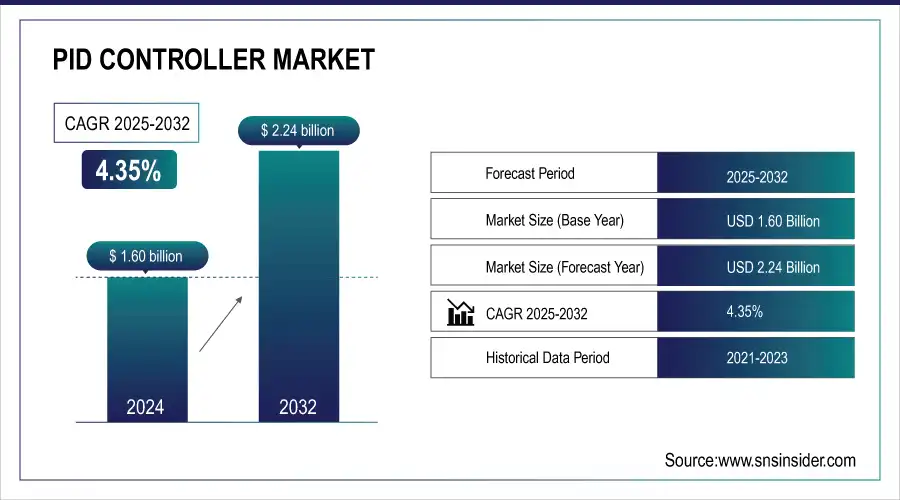

The PID Controller Market size was valued at USD 1.60 billion in 2024 and is expected to reach USD 2.24 billion by 2032, growing at a CAGR of 4.35% over the forecast period of 2025-2032. Growing industrial automation and the need for an accurate controlling mechanism in various processes are expected to drive the growth of the PID controller market. PID systems are being increasingly used in core sectors such as oil & gas, power, and manufacturing due to their value in terms of efficiency, safety, and energy optimization, resulting in consistent global market expansion concerning both applications and regions.

To Get more information On PID Controller Market - Request Free Sample Report

The PID controller market growth is attributed to rising adoption in smart manufacturing and predictive maintenance tools. The growing trend of the digital transformation in industries and the increasing use of embedded systems and PLCs increases the integration of the PID controllers. Furthermore, the emergence of low-cost, compact PID controllers with improved tuning capabilities facilitates wider use. The development of electric vehicles and renewable energy systems has also broadened the market scope beyond the traditional industrial applications, thus driving steady growth.

-

Honeywell introduced an IoT-enabled PID controller series in 2024, allowing remote monitoring and adaptive process control, resulting in a 38% reduction in operational downtime

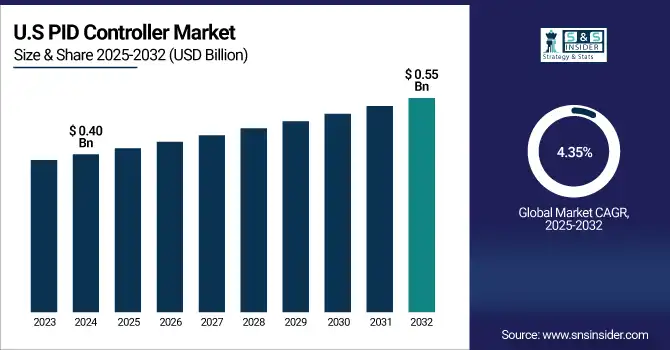

The U.S. PID controller market size is estimated to be valued at USD 0.40 billion in 2024 and is projected to grow at a CAGR of 4.35%, reaching approximately USD 0.55 billion by 2032. The U.S. PID controller market growth is propelled by digital control technology enhancements, increasing penetration into HVAC and renewable energy technology systems, energy conservation focus, and the emergence of compact size and cost-effective controllers suitable for a range of industrial and commercial automation markets.

PID Controller Market Dynamics:

Key Drivers:

-

Accelerating Demand for PID Controllers is Driven by Automation IoT and Energy Efficiency Trends

Key drivers of the market for the PID controller industry are the swift growth of industrial automation and smart manufacturing, which demand accurate and effective control systems. The emergence of digital transformation across various applications, combined with the pervasive usage of IoT, embedded systems, and PLCs, has led to a remarkable uptake of PID controllers. Rising need for energy efficiency and sustainability in industries such as oil & gas, chemicals, and renewable energy entails market growth.

-

A significant 87% of manufacturers recognize digital transformation as crucial for future success, with 81% viewing the Internet of Things (IoT) as a strategic priority in their digital transformation efforts.

Restraints:

-

High Complexity and Cost Limit Wider Adoption of Advanced PID Controller Systems

The market for PID controllers is restrained mainly due to the complexity of tuning PID controllers in dynamic systems or systems that are nonlinear. It may be difficult to guarantee the proper tuning of PID controllers in some industrial applications, such as those in chemical processing or automotive, where operations change. Furthermore, advanced PID systems incorporating wireless technology with AI features will require to make a huge CAPEX and installation cost at the beginning, and small customers might be di. Using these technical solutions, the introduction will be slowed down.

Opportunities:

-

Emerging Tech and AI Integration Unlock New Growth Opportunities in the PID Controller Market

The PID controller market trend is shifting toward AI integration, wireless technology, and condition monitoring, unlocking new opportunities in electric vehicles, smart grids, and renewable energy systems. This evolution supports the transition from preventive to predictive maintenance, driving efficiency, adaptability, and widespread adoption across emerging and technologically advanced industrial applications.

-

In 2024, global EV sales reached approximately 10.8 million units, reflecting a 5% increase from the previous year. This growth is attributed to increased consumer demand, supportive government policies, and advancements in battery technology.

Challenges:

-

Navigating Compatibility and Security are Challenges in the Evolving PID Controller Market

The rapid technological development, such as the transition into AI-enabled systems, leads to serious difficulties in adapting legacy PID controllers to new technological developments. It is quite challenging to apply PID controllers in modern applications, such as smart grids, electric vehicles, and renewable energy systems. Furthermore, as wireless-ready PID controllers become more susceptible to remote attacks, protecting them also increases in importance. Solving these problems is significant for the development of the PID controller market.

PID Controller Market Segmentation Analysis:

By Type

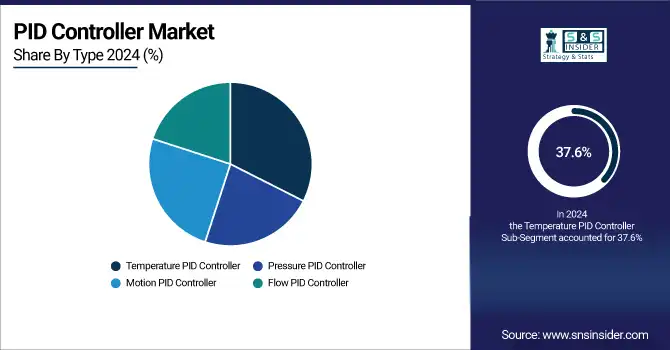

The temperature PID controller market will dominate the market, with an estimated 37.6% share in 2024, as it is popular and used in a variety of industries, including chemical, food and beverage, automotive, and HVAC. In both sectors, temperature control is a key parameter, and accurate, reliable systems are needed to keep conditions under control. The demand for temperature PID controllers remains high as industries are increasingly relying on automation and energy saving, prompting them to maintain a stronghold in the market.

The motion PID controller market is projected to record the fastest CAGR, in terms of value, during 2025-2032. This expansion is fueled by the increasing use of motion control in robotics, CNC machines, and industrial automation. With the ongoing trend of various industries automating their manufacturing operations to ensure accuracy and precision, the demand for motion control systems overlaying motion PID controllers is projected to skyrocket shortly, and these products will find more applications shortly.

By Application

The oil & gas industry led the PID controller market share in 2024, accounting for a share of 31.4% as the industry continually requires accurate control of pressure, temperature, and flow in vital processes such as drilling, refining, and pipeline transportation. PID controllers are indispensable in achieving reliable and efficient control within these risky domains. The industry’s historical reliance on cutting-edge control frameworks and sustained investments in automation and process improvement have cemented its frontrunner position in the marketplace.

The food & beverage sector will register the largest CAGR during 2025-2032. The growth is based on the expanding demand for achieving process consistency, quality control, and compliance with hygiene and safety regulations. PID controllers are very frequently used in food processing industrial sector and packaging for gases, temperature, and moisture. The industry movement for the utilization of smart manufacturing and automation technologies is also likely to boost the requirement for PID controllers, thereby driving the market.

PID Controller Market Regional Outlook:

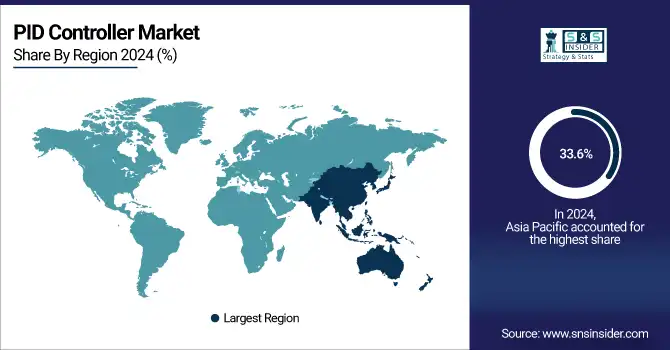

The PID controller market was dominated by Asia Pacific, accounting for 33.6% of the market share in 2024, and is projected to witness the highest CAGR during the forecast period. This dominance and expansion are owing to increasing industrial automation in emerging countries, such as automotive, manufacturing, electronics, and power. Furthermore, the strong presence of OEMs in the region, coupled with increasing adoption of Industry 4.0 technologies, would be one of the factors fuelling the demand for PID controllers. The smart infrastructure and renewable energy, and digital transformation segments are also contributing robustly to the deployment of precision control systems, as the governments of countries including China, Japan, and South Korea are heavily investing in these segments. Moreover, growing uptake of IoT, PLCs, and embedded control systems in process industries is also expected to support market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

China accounted for the largest share in the PID controller market, owing to significant industrial production, government-supported automation programs, and high demand from process industries. Rapid modernization and industrialization, coupled with the domination of manufacturing and electronics, drive the market growth.

North America is a key region in the PID controller market as the region has a developed economy, which has allowed for early acceptance of the advanced automation technologies in the region and is home to various prominent industries, including oil & gas, pharmaceuticals, chemicals, and power generation. The area enjoys high R&D investments, smart technology integration, and energy efficiency emphasis. Growing applications of IoT and AI in industrial processes are driving demand for PID controllers, which are particularly high in precision in the manufacturing and process control industries.

The U.S. holds the largest share in the North American PID controller industry on account of a well-developed industrial sector, advanced infrastructure, and an increasing focus of industry participants on optimizing processes. The country's leadership in automation adoption, extensive utilization of PLCs, and constant endeavor of technological advancement are the major factors increasing the demand for accurate control solutions in diverse industries.

Europe is another significant market for PID controllers based on high industrial automation, strict regulatory norms, and the implementation of energy-efficient technologies. The demand in the region comes from industries, such as chemicals, automotive, and power generation, with a well-established infrastructure in place and an emphasis on sustainable, precision process control systems.

The European PID controller market is led by Germany due to the presence of its manufacturing industry, position as a pioneer in Industry 4.0, and widespread presence of automation technology vendors.

Latin America and the Middle East & Africa are expected to witness moderate growth in the PID controller market on account of advancing industrialization, increasing energy requirement, and expanding investment in automation in industries including oil & gas, power, and water treatment. With increasing infrastructure development and growth in industrialization, the use of affordable, energy-efficient control systems, such as PID controllers, is forecasted to increase consistently in these regions.

PID Controller Companies are:

Some of the major PID Controller companies are Honeywell International Inc., ABB Ltd., OMRON Corporation, Eurotherm by Schneider Electric, Gefran SpA, Calex Electronics Limited, Durex Industries, Inc., Enfield Technologies, LLC, Red Lion Controls, Inc., and RKC Instrument Inc.

Recent Development:

-

In 2023, Honeywell's UDC2800 Universal Digital Controller offers enhanced precision with 40% improved accuracy and faster scanning speeds, ideal for industries such as pharmaceuticals and aerospace.

-

In 2023, ABB launched AI-integrated PID controllers that boost efficiency by 40% through real-time process optimization and predictive maintenance. These controllers are designed to enhance automation in the power and manufacturing industries.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.60 Billion |

| Market Size by 2032 | USD 2.24 Billion |

| CAGR | CAGR of 4.35% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Temperature PID Controller, Pressure PID Controller, Motion PID Controller, Flow PID Controller) • By Application (Oil & Gas, Power, Chemical, Food & Beverage, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honeywell International Inc., ABB Ltd., OMRON Corporation, Eurotherm by Schneider Electric, Gefran SpA, Calex Electronics Limited, Durex Industries, Inc., Enfield Technologies, LLC, Red Lion Controls, Inc., RKC Instrument Inc. |