Embedded Systems Market Report Scope & Overview:

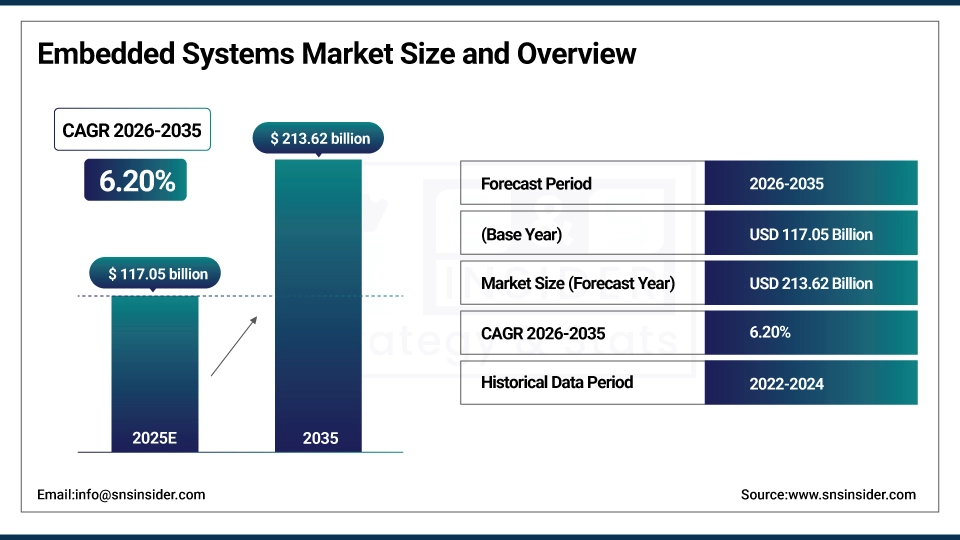

The Embedded Systems Market Size was valued at USD 117.05 billion in 2025 and is expected to reach USD 213.62 billion by 2035 and grow at a CAGR of 6.20% over the forecast period 2026-2035.

Increasing developments in autonomous vehicles, electric vehicles (EVs), and safety technology such as Advanced Driver Assistance Systems (ADAS) are driving the growth of embedded systems market. These features are essential in improving aspects of vehicle such as fuel economy, connectivity, and safety - controlling important functions such as ECU [engine control units], and also infotainment unit. The combination of AI and machine learning, allowing real-time monitoring and decision-making, is pushing the complexity of these systems even further and a modern vehicle may contain as many as 70 microcontrollers.

Market Size and Forecast: 2025

-

Market Size in 2025 USD 117.05 Billion

-

Market Size by 2035 USD 213.6 Billion

-

CAGR of 6.20 % From 2026 to 2035

-

Base Year 2025

-

Forecast Period 2026-2035

-

Historical Data 2022-2024

Get more information on Embedded Systems Market - Request Sample Report

Embedded Systems Market Trends:

-

Growing adoption of IoT-connected devices is driving demand for embedded systems, with over 30 billion IoT devices expected to be active globally by 2035.

-

Rising use of embedded systems in automotive electronics and ADAS, as electronics content now accounts for 35–40% of total vehicle cost.

-

Increasing deployment in industrial automation and smart manufacturing, contributing to productivity gains of 20–25% through real-time control and monitoring.

-

Expansion of edge computing is accelerating embedded processor demand, with over 50% of enterprise data expected to be processed at the edge.

-

Focus on low-power, high-performance microcontrollers is growing, reducing energy consumption by 30% in battery-operated and portable devices.

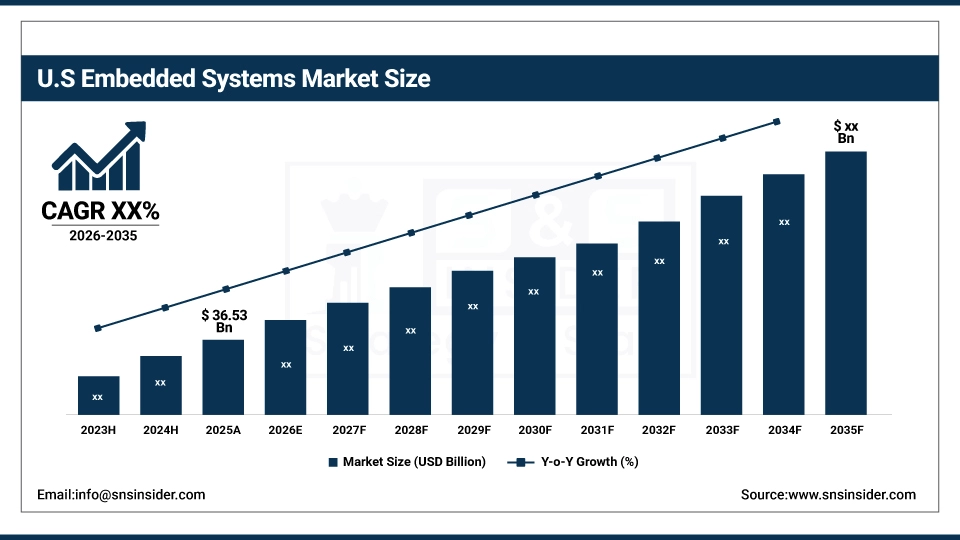

The US Embedded Systems Market is valued at USD 36.53 Billion in 2025, driven by extensive adoption in automotive, industrial automation, IoT, and consumer electronics. Strong innovation, semiconductor advancements, and government initiatives support sustained growth through 2035.

Embedded Systems Market Growth Drivers:

-

Exploring the Role of AI and Decentralization in Shaping the Future of Embedded Security Systems

The increasing need for embedded security solutions is fueling the growth of the market, as the use of connected devices and IoT is on the rise. With the sophistication of cyber threats, the need for integrated security solutions in embedded systems has become imperative for safeguarding critical data in industries such as automotive, healthcare, and finance. The increasing use of AI and machine learning improves these systems, making them optimized for threat detection and performance. However, with the widespread use of AI models, securing these systems has become a concern, with the use of generative AI systems expanding the attack surface. By 2027, it is estimated that 75% of the workforce will buy or develop technology outside the control of the IT department, further decentralizing decision-making for cybersecurity. This trend demands adaptable approaches for overall risk management. Despite advancements in technology, human factors remain a fundamental challenge, with 74% of security incidents involving a human factor.

Embedded Systems Market Restraints:

-

High development costs, regulatory hurdles, cybersecurity risks, and a shortage of skilled professionals hinder the embedded systems market's growth.

High development costs are the major restraint for such market but yellowing cost in different regions, development and maintenance of embedded systems cost a very high faction prove to be one of the major challenge. Complex systems, especially those that combine advanced technologies such as AI and machine learning, require a significant amount of investment to develop. They also face an added difficulty of having to comply with industry standards and regulations, making development more complicated. In addition, evolving cyber security threats require the continual evolution of maintenance and upgrades to systems. There's also a lack of suitably skilled professionals in the market, which means progress is stalled and budgets are breached. These cause great challenges for the effective growth of the market.

Embedded Systems Market Segment Analysis:

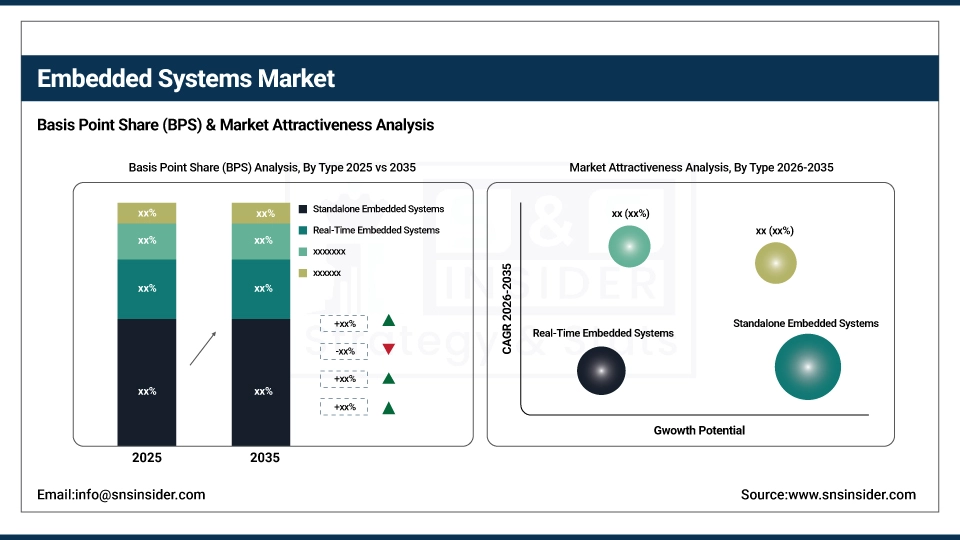

By Type

Globally, the segment for standalone embedded systems, being self-contained, makes up 39% of the embedded systems market by 2025. They are purpose-built and stand-alone systems with high reliability, and are widely used in consumer electronics, automotive, medical, and industrial applications. They are used for different purposes, effortless integration and higher scalability, so they are very attractive in business areas that need focused, dedicated solutions. This is cementing its dominance of the segment in the light of increasing demand for efficient, reliable systems in various industries like automation and healthcare.

By Component

In 2025, hardware segment is expected to account for more than 63% of the market share in embedded systems market. The vast majority of this predominance is from the rising request of microcontrollers, sensors, processors, and other significant segments that control implanted frameworks for a wide range of enterprises including car, customer hardware, and modern automation. Another factor contributing to the growth of the market is the increasing demand for high speed hardware backed by the faster growth of IoT devices and connected technologies. Moreover, the very functionality, characteristics, and functionality of embedded hardware have improved with the innovation of energy efficiency, miniaturization, and integration making embedded hardware an important contribution to the industry.

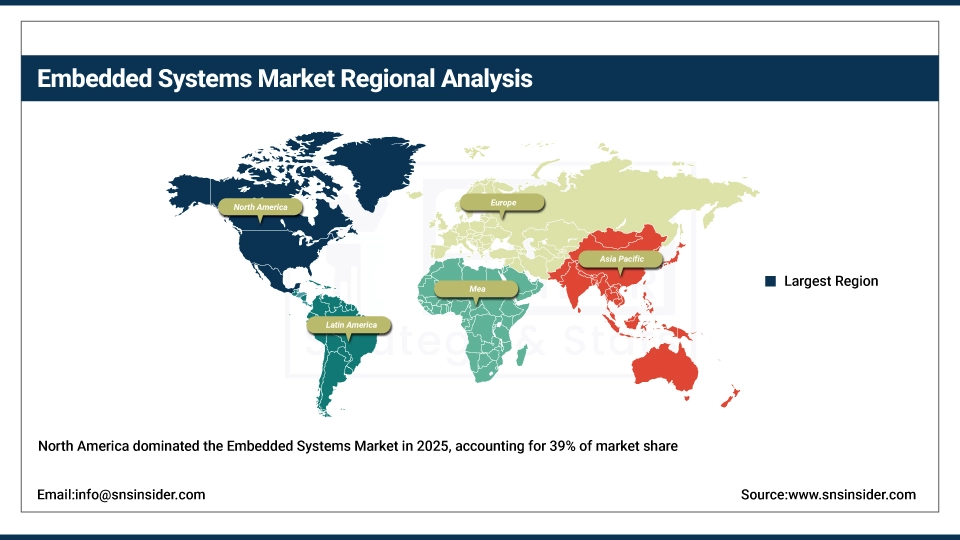

Embedded Systems Market Regional Analysis:

North America Embedded Systems Market Insights

North America has the highest market share in the embedded systems market, accounting for around 39% of the total revenue in 2025. This is due to the fast-paced technological evolution and high demand for embedded systems in sectors such as automotive, healthcare, consumer electronics, and aerospace. Heavy investments in IoT, AI, and automation are also fueling the demand for embedded systems. Moreover, the presence of major tech giants and a favorable R&D infrastructure is also adding to the dominance of North America in the embedded systems market. The trend of smart devices, smart solutions, and advanced systems is likely to keep North America at the top of the market in the coming years.

Asia Pacific Embedded Systems Market Insights

The Asia-Pacific region is anticipated to witness the highest growth rate in the embedded systems market during the period from 2026 to 2035. The major countries in this region, such as China, India, Japan, and South Korea, are propelling this market. The smart city developments in China, the growing IT sector in India, and the automotive and robotics sectors in Japan and South Korea are critical. Moreover, the investments by the governments and robust manufacturing infrastructure, along with the rising demand for IoT, AI, and automation, are driving the embedded systems market in the Asia-Pacific region. The Asia-Pacific market is also aided by the rising focus on innovation in technology and R&D in the region.

Need any customization research on Embedded Systems Market - Enquire Now

Europe Embedded Systems Market Insights

The European market for embedded systems is expanding steadily, driven by the increasing adoption of IoT, Industry 4.0, and connected automotive solutions. Germany, France, and the UK are leading the way in the adoption of smart manufacturing, industrial automation, and secure consumer electronics solutions. The strict data privacy laws and government support for innovation in technology are also contributing factors. The European market is also seeing growing investments in advanced microcontrollers, real-time operating systems, and edge computing solutions, making it an important player in the global embedded systems market.

Latin America (LATAM) and Middle East & Africa (MEA) Embedded Systems Market Insights

The Latin America and MEA embedded systems market is growing due to the increasing adoption of industrial automation, IoT, and the need for connected automotive and consumer electronics solutions. Countries such as Brazil, Mexico, UAE, and Saudi Arabia are focusing on smart infrastructure, secure industrial devices, and advanced embedded solutions. Although the regions face challenges such as fragmentation of regulations and infrastructure in some countries, the growing awareness of cybersecurity, government policies, and the adoption of technology are contributing to steady growth in these regions, making them more prominent in the global embedded systems market.

Embedded Systems Market Key Players:

-

Renesas Electronics – Microcontrollers, Automotive ICs

-

STMicroelectronics – Automotive ICs, Sensors, Power Management ICs

-

Infineon Technologies – Automotive ICs, Power Semiconductors

-

Texas Instruments – Analog ICs, Embedded Processors

-

Qualcomm – Mobile SoCs, Wireless Communication Chips

-

NXP Semiconductors – Automotive ICs, Security Solutions, Microcontrollers

-

Microchip Technology – Microcontrollers, Analog ICs, Memory

-

Analog Devices – Analog, Mixed-Signal, and Digital Signal Processing ICs

-

Intel Corporation – Processors, Memory, Data Center Solutions

-

Advanced Micro Devices – CPUs, GPUs, APUs

-

Broadcom – Semiconductors, Networking Chips

-

Cisco Systems – Networking Hardware, Telecommunications Equipment

-

Samsung Electronics – Semiconductors, Displays, Consumer Electronics

-

IBM – Mainframes, Cloud Solutions, AI Chips

-

Micron Technology – Memory and Storage Solutions

-

Qualcomm Technologies International – Wireless Chipsets, Bluetooth Solutions

-

ON Semiconductor – Power Management ICs, Automotive Semiconductors

-

Broadcom Inc. – Networking, Wireless Communication Chips

-

MediaTek – Mobile SoCs, Wireless Communication Solutions

-

Nvidia Corporation – Graphics Processing Units (GPUs), AI Chips

Competitive Landscape for Embedded Systems Market:

Renesas Electronics is a leading semiconductor company providing advanced microcontrollers, embedded processors, and security solutions for automotive, industrial, and IoT applications. Its innovation-driven portfolio and strong market presence support growth in the global embedded systems and security markets.

-

On January 2025, Honda and Renesas partnered to develop a high-performance SoC for software-defined vehicles, targeting 2,000 TOPS AI performance and power efficiency. The SoC integrates multi-die chiplet technology and AI accelerators to support autonomous driving and centralized ECUs.

STMicroelectronics is a global leader in semiconductor solutions, offering microcontrollers, sensors, and secure embedded technologies for automotive, industrial, and IoT applications. Its robust product portfolio and innovation capabilities drive growth in the worldwide embedded systems and security markets.

-

On September 2024, STMicroelectronics announced the FIPS 140-3 certification for its STSAFE-TPM trusted platform modules (TPMs), the first cryptographic modules to achieve this certification. These TPMs provide secure protection for critical systems in PCs, servers, IoT devices, and automotive applications.

| Report Attributes | Details |

| Market Size in 2025 | USD 117.05 Billion |

| Market Size by 2035 | USD 213.62 Billion |

| CAGR | CAGR of 6.20% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Hardware, Software) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

|

Company Profiles |

Renesas Electronics, STMicroelectronics, Infineon Technologies, Texas Instruments, Qualcomm, NXP Semiconductors, Microchip Technology, Analog Devices, Intel Corporation, Advanced Micro Devices, Broadcom, Cisco Systems, Samsung Electronics, IBM, Micron Technology, Qualcomm Technologies International, ON Semiconductor, Broadcom Inc., MediaTek, Nvidia Corporation. |