Motion Control Market Size & Trends:

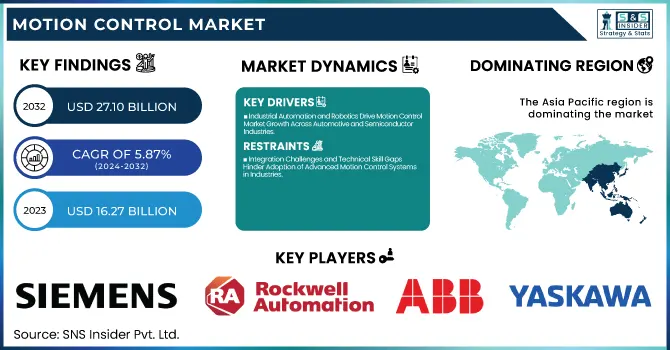

The Motion Control Market Size was valued at USD 16.27 billion in 2023 and is expected to reach USD 27.10 billion by 2032, growing at a CAGR of 5.87% over the forecast period 2024-2032. The Motion Control Market is made up of different segments including motors, motion controllers, and actuators each critical to automation. Technological sophistication is rising AI, IoT, and cloud integration are being adopted at an increasing pace and expanding system functionality.

To Get more information on Motion Control Market - Request Free Sample Report

As an example, automotive, robotics, and healthcare some of the prominent industries that motion control is changing are using a precise motion-control system due to its efficiency benefits. In addition to this, both open-loop and closed-loop systems are also gaining momentum in the market supporting diverse operational requirements across industry sectors.

Motion Control Market Dynamics

Key Drivers:

-

Industrial Automation and Robotics Drive Motion Control Market Growth Across Automotive and Semiconductor Industries

The motion control market is propelled by the swift integration of industrial automation and robotics in various sectors. The automotive industry still holds its reign in almost all applications of motion control systems, since they have a heavy usage of motion control systems with most losses being on production lines. Moreover, the electronics & semiconductor industry is witnessing high growth due to escalating demand for high-precision motion control systems in semiconductor fabrication and chip fabrication as well. Integrating technologies like AI-enabled motion control, on-the-spot monitoring, and predictive maintenance adds to their efficacy by minimizing downtime. Growing trends of Industry 4.0 and the need for smart factories are also lifting the high customer demand for advanced motion control solutions that are connected from the field level to the cloud.

Restrain:

-

Integration Challenges and Technical Skill Gaps Hinder Adoption of Advanced Motion Control Systems in Industries

Advanced motion control systems often come with issues related to their complexity and integration challenges which is one of the prominent factors plaguing the motion control market. While industries are advancing towards more complex automation solutions, the process of integrating such systems into the preexisting infrastructure can be high on tech scares. Also, there are compatibility constraints between existing machinery and upcoming motion control technologies which may hinder and slow down the adoption process, particularly, in manufacturing and packaging, which are traditional industries. In addition, the high requirement of specific technical skills for configuring, deploying, and maintaining such systems limits their adoption in the market.

Opportunity:

-

Growing Demand for Automation in Logistics Healthcare and Food Drives Motion Control Market Expansion

The motion control market continues to expand as the demand for automation increases in logistics, healthcare, and food & beverage. Autonomous warehouses, and robotic process automation in logistics to boost new opportunities for motion control applications are also having an impact on growth in healthcare through robotic-assisted surgeries and medical automation. Moreover, the rising demand for energy-efficient motion control systems is driving the demand for green and intelligent actuators, motors, and controllers. The Asia-Pacific region will have rapid industrialization, which galvanizes the region's potential for fast economic growth, especially for countries such as China and India, where governments are actively promoting automation and smart manufacturing.

Challenges:

-

Slow Adoption and Cybersecurity Concerns Challenge Motion Control System Integration Across Emerging Markets

Adoption is slow in many parts of the economy, especially in emerging market nations. With fields such as automotive and robotics receptive to motion control technologies, different industries, paper & printing, and healthcare in particular, are gradually integrating them into their operation due to regulatory challenges, technological restrictions, and inertia in adopting new technologies. Moreover, the integration of motion control systems with IoT-enabled devices and cloud-based solutions may raise cybersecurity concerns, which can limit the adoption of motion control systems in the market. However, as systems become more interconnected, the gap between capabilities of national security and cyberattacks narrows, raising serious concern for industrial sectors highly dependent on near real-time operations centered on smart-control loops.

Motion Control Market Segmentation Outlook

By System

In 2023, the market share of closed-loop systems was 51.1% and dominated the motion control market. Constantly observing their environment and changing their operations based on live feedback, these systems offer unparalleled precision, accuracy, and reliability, ideal for high-performance automated processes, and the likes of robotics, automotive provision, and semiconductor manufacturing. Industries that want to make production more efficient, have less downtime, and control operations more tightly drive the demand for closed-loop systems. This versatility, along with consistent performance across different operational environments, makes them a giant in a variety of sectors, including aerospace, automotive, and electronics.

Open-loop systems are predicted to be the fastest-growing segment by CAGR from 2024 to 2032. These are easy and inexpensive systems because there is no feedback we need for their functioning; these are good for applications where accuracy is not very important like material handling, packaging, and routine manufacturing processes. Open-loop systems are improved continuously due to continuous developments in sensor technologies and automation and thus are introduced in more and more industries. The faster adoption would be driven by their capability to reduce the system complexity and costs including the rising automation requirements.

By Offering

In 2023, motors accounted for 34.7% of the motion control market. This is mainly due to the widespread use of electric motors in different applications including automotive, robotics, and manufacturing that need power and control for precision motion. Motors are critical elements in efficiency-sensitive applications including automation systems, conveyor belts, and robotic arms. In 2023, high penetration was attained due to the steady demand for electric vehicles as well as the increased trend of industrial automation.

The segment of motion controllers is expected to get the highest CAGR from 2024-2032. Motion controllers which provide real-time coordination of motors and other actuators, and even pack advanced features such as multi-axis synchronization can be found at the heart of most industrial automation systems. With the continuous adoption of advanced automation technologies, the need for motion controllers will be enhanced to perform complicated tasks in robotics, manufacturing, and precision sectors. This segment is expected to witness the fastest growth due to their increasing importance in increasing efficiency and minimizing downtime.

By Application

The market share for metal cutting was 28.8%, making it the largest stake in the motion control market in 2023. This dominance stems from the extensive usage of motion control systems across CNC (Computer Numerical Control) machines that are essential for precision cutting in the automotive, aerospace, and manufacturing sectors. Since high precision, speed, and efficiency are essential for metal-cutting applications, motion control technologies have become an integral part of all metal-cutting operations. Rising need for position-dependent components and parts in industrial applications alongside adapting metalworking towards automation.

Robotics is poised to record the highest CAGR from 2024 to 2032. This rapid growth in the global robotic system market is primarily attributed to the increasing adoption of robotic systems across industries such as manufacturing, logistics, and healthcare. The use of robotics incorporates highly sophisticated motion control systems designed to perform precise and repetitive tasks and is becoming increasingly common with recent advances in automation, artificial intelligence, and machine learning. Robotics will remain a major growth sector for the motion control market as industries try to optimize efficiency, cut costs, and increase productivity.

By Industry Vertical

In 2023, the motion control market was mainly driven by the automotive industry accounted for 27.9% of the total market share. The widespread installation of motion control systems for various automotive manufacturing processes assembly lines, robotics, and automated testing largely drives this dominance. Furthermore, the rising adoption of automation to improve production efficiency, coupled with the increasing trend of electric vehicle (EV) production, has further fueled the demand for motion control in the manufacturing application market in this segment. A robust motion control solutions industry is also supported by the automotive industry's drive towards smart factories whereas growth in precision in vehicle assembly processes will maintain motion segment leadership.

The electronics and semiconductor sector is projected to witness the fastest CAGR during the forecast period of 2024 to 2032. Since semiconductor manufacturing processes such as wafer processing and chip testing are becoming more automated and are ever-advancing in terms of miniaturization and tighter performance criteria, there is an increasing demand for high-precision motion control systems to deliver consistently low-cost products. This makes the motion control motion sector one of the key sectors for expansion to cater to the growing market demand for electronics, due to the growing trend of IoT, 5G & AI.

Motion Control Market Regional Analysis

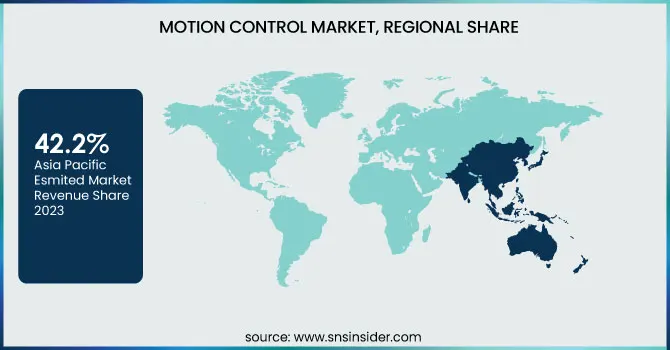

The motion control market in 2023 was led by Asia-Pacific, which accounted for a substantial market share of 42.2%. The primary reason behind this is the swift industrialization and premier manufacturing functional of China, Japan, and South Korea. China in particular is the largest production hub in automotive, electronics, and robotics, where motion control is a critical technology. Take the automotive industry for example, where the likes of BYD or Geely rely on motion control-based automated assembly lines to improve production efficiency. Furthermore, Japan is home to major robotics players, such as FANUC and Yaskawa Electric, which contribute to the use of motion control technologies within the manufacturing process.

North America is projected to experience the highest CAGR from 2024 to 2032. Automation is increasingly gaining traction in the automotive, aerospace, and healthcare industries in the U.S. and Canada. In areas such as Tesla’s Gigafactories and Boeing’s automated production lines, motion control systems are being integrated to enhance precision and minimize operational costs in the aerospace sector. In addition, the North American motion control market will witness substantive growth owing to the growing trend of smart manufacturing and Industry 4.0 initiatives across the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Motion Control Market are:

-

Siemens (SINAMICS V20, Simatic ET 200SP)

-

Rockwell Automation (Kinetix 5700, PowerFlex 755)

-

ABB (AC500, ACS880)

-

Yaskawa Electric (Sigma-7 Servos, A1000 Inverter)

-

Schneider Electric (Lexium 32, Altivar Process)

-

Mitsubishi Electric (MR-J5 Servo, FR-A800)

-

Emerson Electric (PacDrive 3, Automation Control Solutions)

-

B&R Industrial Automation (ACOPOS, Power Panel)

-

Parker Hannifin (Compax3, XD Series Servo)

-

Bosch Rexroth (IndraDrive, VarioDrive)

-

Fuji Electric (FRENIC, V5 Servo)

-

Nidec (Sanyo Denki Servos, Smart Servo Drives)

-

Lenze (i500 Drive, Smart Motor Solutions)

-

Delta Electronics (ASDA-AB, ECMA Motor)

-

Kollmorgen (AKD Servo, AKM Motor)

Recent Trends

-

In April 2024, Siemens unveiled the Simatic S7-1200 G2, a new generation controller within its Xcelerator portfolio, enhancing connectivity, processing power, and data analytics for improved production efficiency.

-

In April 2024, Rockwell Automation launched the FLEXLINE 3500 low-voltage motor control center at Hannover Messe 2024, integrating smart motor control for enhanced efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 16.27 Billion |

| Market Size by 2032 | USD 27.10 Billion |

| CAGR | CAGR of 5.87% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By System (Open-loop System, Closed-loop System) • By Offerings (Actuators & Mechanical Systems, Drives, Motors, Motion Controllers, Sensors & Feedback Devices, Software & Services) • By Application (Metal Cutting, Metal Forming, Material Handling, Packaging, Robotics, Others) • By Industry Vertical (Electronics & Semiconductor, Logistics, Automotive, Healthcare, Food & Beverage, Paper & Printing, Aerospace & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens, Rockwell Automation, ABB, Yaskawa Electric, Schneider Electric, Mitsubishi Electric, Emerson Electric, B&R Industrial Automation, Parker Hannifin, Bosch Rexroth, Fuji Electric, Nidec, Lenze, Delta Electronics, Kollmorgen. |