PET & PBT Resins Market Report Scope & Overview:

Get More Information on PET & PBT Resins Market - Request Sample Report

The Polyethylene Terephthalate (PET) & Polybutylene Terephthalate (PBT) Resins Market Resins Market Size was valued at USD 33.8 billion in 2023 and is expected to reach USD 58.5 billion by 2032 and grow at a CAGR of 6.3% over the forecast period 2024-2032.

Polybutylene Terephthalate resins have gained prominence in the automotive, particularly the electric vehicle sector. The developing technology is one of the reasons why the PBT resins have continued to capture the largest market share. Additionally, many utility features and attributes are pegged to these materials, including being lightweight and sturdy. PBT resins are designed to have excellent mechanical strength, remain thermally stable, and be highly resistant to chemicals. Thus, it is good for automotive materials, whether it be connectors, housings, or sensors.

As several governments across the globe continue to push for carbon reduction and fuel efficiency, the demand for PBT and other such advanced materials has been on the rise. For example, in the USA, there is the DoE’s Road plan to double the vehicle’s fuel efficiency, putting pressure on the automakers to ensure they are using light materials to achieve the said standards.

For instance, In March 2024, Eastman Chemical Company expanded its PBT production line in the United States, a move aimed at catering to the growing demand from the automotive and electronics sectors. This expansion was in line with the U.S. government's initiatives to promote advanced manufacturing and reduce the carbon footprint of the automotive industry.

The growing environmental awareness and the creating several solid recycling policy programs or campaigns stimulate the profound growth of Polyethylene Terephthalate PET Polybutylene Terephthalate PBT resins. The demand for such items as PET increases, and this tendency may be considered global as all the countries require plastics used in packaging to be recycled.

Market Dynamics:

Drivers

-

Rising demand for the packaging industry drives the market growth.

The world Polyethylene Terephthalate and Polybutylene Terephthalate Resins market has been experiencing considerable growth on account of the expanding packaging industry and the advent of stringent government rules and regulations for the promotion of certain materials. As per the Environmental Protection Agency, the packaging sector has an immense preference for PET resins, due to their recyclable nature, and the consequent recycling rate of PET bottles and containers was observed to be 29% in 2023. In addition, the world is anticipating the explicit use of PET bottles with a minimum of 25% recycled content, according to the EU’s Directive on Packaging and Packaging Waste by 2025. Further, the drive for PET resins can also be felt in the automobile industry given its lightweight properties and durable characteristics. The U.S. Department of Energy reports that PBT resins are more favorable in electric cars due to the government’s low carbon emissions and fuel tray efficiency drive. Hence, it can be concluded that the augmenting governmental interest has been acting as a lucrative factor for the PET and PBT resins market.

Moreover, PET's extensive use in packaging, especially for bottles and containers, is a significant driver due to its lightweight, strength, and recyclability. The push for sustainable packaging solutions further enhances its demand.

Restrain

Price fluctuations in raw commodities hamper the market growth.

Price fluctuations in raw commodities represent a significant restraint on the Polyethylene Terephthalate (PET) and Polybutylene Terephthalate (PBT) resins market. The production of PET and PBT resins heavily relies on petrochemical derivatives such as crude oil, ethylene glycol, and terephthalic acid. These raw materials are subject to considerable price volatility, driven by factors such as geopolitical tensions, changes in global oil supply and demand, and market speculation. For instance, sudden spikes in crude oil prices can lead to increased production costs for PET and PBT resins, making them less competitive compared to alternative materials.

Market segmentation

By Type

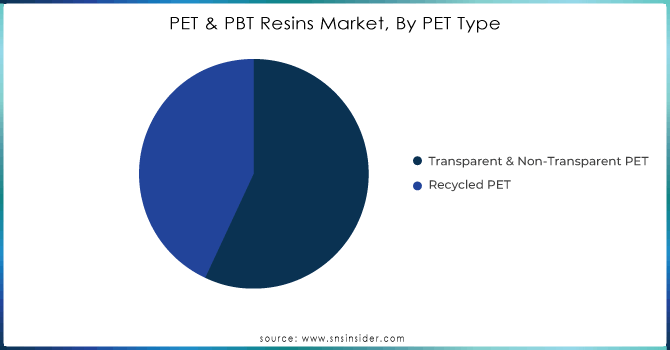

Transparent & Non-Transparent PET segment held the largest market share around 58.23% in 2023. Among the various types of PET, Transparent PET emerged as the leading segment in 2023, driven by its widespread use in packaging applications, particularly in the beverage industry. Transparent PET is favored for its clarity, strength, and barrier properties, making it the material of choice for products like water and soda bottles, where visual appeal and product integrity are crucial. According to the U.S. Food and Drug Administration (FDA), Transparent PET is also highly valued for its safety in food contact applications, further boosting its demand.

By PET Application

The highest emerging among the PET applications was the bottles segment in 2023, which held more than 60% of the PET market share. It is because processing of bottled water and carbonated soft drinks triggered the demand for bottled beverages, including bottled juice and even bottled ready-to-drink teas and coffees. Moreover, the U.S. FDA, PET bottles are very popular and they are favored because they are not poisonous, long-lasting, difficult to break, and moreover they can be recycled. It was also emphasized by IBAMA that the consumption of the bottled water was pushed up due to the low-quality water and that had significantly influenced the demand for PET bottles. The PET bottle has also been brought in use because of the drive towards sustainable packing and the government rules which have been regulating the management of the waste plastic has hastened its production.

Get Customized Report as per your Business Requirement - Request For Customized Report

Regional Analysis:

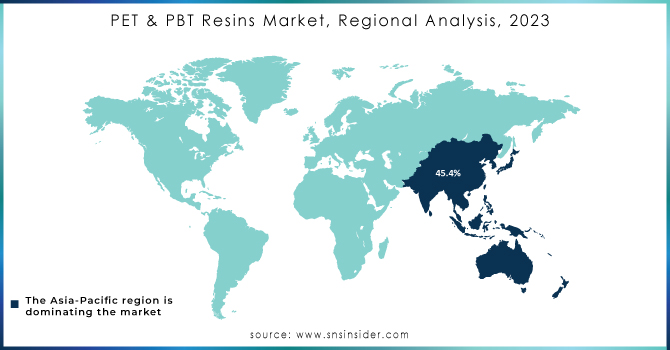

In 2023, the Asia-Pacific region held the highest market share of around 45.4%. This dominance is primarily attributed to the region's rapid industrialization, urbanization, and growing population, which have led to an increased demand for packaging materials. According to the National Development and Reform Commission of China, the country has been the highest consumer of PET resins, driven by the booming food and beverage industry, as well as the rising demand for sustainable packaging. Moreover, the Indian Ministry of Commerce and Industry reported that the government's initiatives to promote the use of recyclable materials and reduce plastic waste have further propelled the market growth in the region. The presence of major manufacturing hubs and the availability of raw materials at competitive prices have also contributed to the Asia-Pacific region's leadership in the PET & PBT resins market.

During the forecast period, the Asia Pacific PET & PBT resins market is expected to grow at the fastest rate. The Asia Pacific area has a large number of end customers of PET and PBT resins in industries such as automobiles and electrical and electronics. The Asia Pacific area has the most people and the most emerging countries, which account for the majority of market growth as these countries focus on industrialization. To assure sustainable demand and grow their market share, leading global corporations are relocating production facilities, opening sales offices, and expanding their distribution channels to regions such as China, India, and Southeast Asia. The growing relocation of manufacturing facilities to nations with high demand and low production costs is boosting market expansion.

Key Players:

The major key players listed in the PET & PBT Resins Market are Nan Ya Plastics Corp., SABIC, Indorama Ventures Limited (Bangkok), BASF (Germany), Mitsubishi Chemical Corporation, Reliance Industries Limited (India), Far Eastern New Century Corporation, DuPont (US), Alpek (Mexico).

Recent Development:

July 2024: Indorama Ventures announced the expansion of its PET recycling facility in Poland, aiming to increase its recycling capacity by 20%. This move aligns with the European Union's Circular Economy Action Plan, which mandates higher recycling targets for PET by 2025.

March 2024: Eastman Chemical Company unveiled a new PBT production line in the United States, enhancing its capacity to meet the growing demand from the automotive and electronics sectors. The expansion was supported by the U.S. Department of Energy's initiatives to promote advanced manufacturing in the country

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 33.8 Billion |

| Market Size by 2032 | US$ 58.5 Billion |

| CAGR | CAGR of 6.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By PET type (Transparent & Non-Transparent PET, Recycled PET) • By PET application (Bottles, Films, Food Packaging, Others) • By PBT application (Electrical & Electronics, Automotive, Consumer Appliances, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nan Ya Plastics Corp., SABIC, Indorama Ventures Limited (Bangkok), BASF (Germany), Mitsubishi Chemical Corporation, Reliance Industries Limited (India), Far Eastern New Century Corporation, and Mitsui Chemicals, DuPont (US), Alpek (Mexico) |

| DRIVERS | • Rising demand for the packaging industry drives the market growth. • Investments in the region's collection/recycling capacities. |

| Restraints | • Increase the operating cost. • Price fluctuations in raw commodities hamper the market growth. |