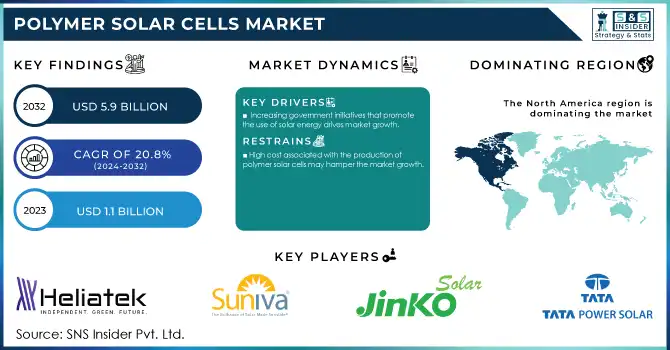

Polymer Solar Cells Market Size:

The Polymer Solar Cells Market size was USD 1.1 Billion in 2023 and is expected to reach USD 5.9 Billion by 2032 and grow at a CAGR of 20.8% over the forecast period of 2024-2032. One of the major drivers for expanding the product segment for the polymer solar cells market is the increasing demand for renewable energy. Global tendency towards using renewable energy is becoming evident governments, industries, and consumers are moving to it as a way to decrease carbon emissions and dependency on fossil fuels. Solar energy especially has been gaining traction as it is abundant, scalable, and cheaper. Polymer solar cells are an outstanding type of solar technology that has been gaining growing interest as a viable, low-cost, flexible, and large-scale applicable alternative to rally around residential and commercial buildings and portable solar systems instead of silicon-based solar cells. The increasing focus on renewable energy sources along with the decarbonization initiatives are increasing polymer solar cell acceptance which in turn is driving the growth of the market. Moreover, other government policies like subsidies, tax credits, clean energy targets, etc. promote the shift to solar sources of energy and all these factors together will act as a driver for the polymer-based solar technologies market.

Get More Information on Polymer Solar Cells Market - Request Sample Report

The U.S. Energy Information Administration (EIA) reported that in 2021, solar power contributed approximately 3.3% to the U.S. electricity generation mix. The Biden Administration's 2021 American Jobs Plan proposed a target to cut carbon emissions by 50% to 52% by 2030, with a focus on expanding renewable energy sources, including solar.

Rapidly growing commercial and residential solar installation is a major factor driving the growth of the polymer solar cells market. With energy prices climbing and people getting more conscious about keeping the environment healthy, both businesses and households are looking for long-term, sustainable, and economical energy solutions. With the economic cost-effectiveness, lower carbon footprint, and energy independence that solar power offers, it has emerged as a preferred option. The design of polymer solar cells is lightweight, flexible, and suitable for appearance integration, so they are suitable for building integrations, roof power generation, and even window power generation. In the commercial sector, businesses are turning to rooftop solar installations to achieve corporate sustainability targets, lower operating costs and meet regulatory requirements for renewable energy consumption. On the other hand, several government incentives, including tax credit programs, grants, and rebates, are contributing to more accessible solar systems for households in residential installations. On the other hand, polymer solar cells are gaining traction with its growing demand for customizable and flexible solar solutions suitable for non-planar surfaces. The increasingly widespread adoption in both the commercial and residential sectors highlights the significant contribution of polymer solar cells to the sustainable energy transformation.

According to the European Commission, the EU added over 41 GW of solar capacity in 2022, the highest annual addition ever, driven by increasing adoption in both residential and commercial sectors.

Polymer Solar Cells Market Dynamics

Drivers

-

Increasing government initiatives that promote the use of solar energy drives market growth.

One of the most important factors creating demand for polymer solar cells over the forecast period are increasing government initiatives to adopt solar energy. Various nations and countries around the world --particularly those in the developed world-- are laying out lofty plans filled with policy, subsidies, and programs to accelerate the rollout of renewable energy and carbon neutrality goals. Such measures include tax credits, grants, feed-in tariffs, and loans at below-market interest rates, which have reduced the costs of solar energy systems for residential, commercial, and industrial users. Furthermore, regulation, especially renewable portfolio standards (RPS) and net metering policies, will force many governments to use renewable energy, thereby making solar energy more popular. As an example, the European Green Deal requires the European Union, as a whole, to reach at least 40% renewable energy by 2030, which will translate into increasing demand for innovative solar technologies such as polymer solar cells. In much the same way, the U.S. Inflation Reduction Act of 2022 contains hundreds of billions in grants and tax credits for the expansion of solar energy. These are because these measures further minimize the financial barriers for consumers while also stimulating the development of advanced solar technologies in the form of polymer solar cells, making them efficient and accessible and eventually pervasive.

Restraint

-

High cost associated with the production of polymer solar cells may hamper the market growth.

The major hurdles for market growth are the cost involved in the manufacturing of polymer solar cells. Polymer solar cells promise the combination of being lightweight, flexible, and environmentally friendly, but their production processes are largely based on costly raw materials, sophisticated fabrication, and special tools. The advancement of these organic electronics, for example, the synthesis of high-performance conductive polymers and organic semiconductors, is sometimes, however, costly and restricts scaling up capability. Moreover, it is still expensive, as continuous development is needed to reach the same stability and efficiency as regular silicon-based solar cells. This translates to an inability to pass these auxiliary expenses to consumers, which in turn makes polymer solar cells less competitive in more price sensitive markets. In addition, low economies of scale and a smaller manufacturing base as compared to silicon-based solar technologies also lead to the high cost of production. This, paired with their potential, means specialists are reluctant to switch to polymer solar cells until these come down in price through improved technology and production volumes.

Polymer Solar Cells Market Segments

By Junction Type

The bulk heterojunction segment held the largest market share around 48% in 2023. BHJ solar cells are distinct in their architecture, where donor and acceptor materials are mixed in a single layer to create a nanoscale interpenetrating network. Such an architecture maximizes the interface for charge separation and also provides efficient charge transport, leading to improved power conversion efficacies compared to single-layer or bilayer systems. Moreover, BHJ cells are relatively simple to fabricate through solution-based methods such as spin coating or roll-to-roll printing, which are scalable and affordable methods for mass production. Their compatibility with different substrates, such as bendable and thin substrates, also makes them very useful for different applications, such as portable electronics, building-integrated photovoltaics (BIPV), and wearable devices. Meanwhile, ongoing R&D naturally further enhanced the stability and performance of BHJ polymer solar cells, assuring their market dominance compared to other competing architectures such as single-layer, bilayer, or multi-junction structures.

By Technique

The printing technique segment held the largest market share around 68% in 2023. It is owing to its mass constructability, cost-efficient and cost-efficient for mass scale production. Roll-to-roll printing, inkjet printing, and screen printing facilitate a cost-efficient and scalable manner of fabricating large-scale solar cells. Such methods are especially beneficial for the fabrication of lightweight and flexible polymer solar cells that are progressively being employed in portable electronics, building-integrated photovoltaic (BIPV), and other novel applications. Especially, product scale-up on flexible substrates through roll-to-roll process can greatly decrease production cost and lead to an affordable commercial application of polymer solar cells. In addition, in terms of print methods, printing as well allows for flexibility and makes it suitable for different consumer and industrial applications as it can be customized to fit different designs and sizes.

By Forms

Panels held the largest market share around 49% in 2023. This is due to their widespread adoption in commercial, residential, and industrial applications. Panels offer the most robust and practical solution for energy generation, providing high power output and durability compared to other formats like foils and stickers. Polymer solar panels are often integrated into traditional photovoltaic systems, making them an appealing choice for rooftop installations, solar farms, and building-integrated photovoltaics (BIPV). Their larger surface area compared to stickers and foils allows for greater energy absorption, improving overall efficiency and energy yield. Additionally, advancements in polymer solar technology have enabled the development of lightweight and flexible panels that are easier to install and transport, further boosting their popularity.

By Application

BIPV (Building Integrated Photovoltaic) held the largest market share around 35% in 2023. It is due to its advantage of integrating solar power generation into a facility, which also has an aesthetic value–such as in the case of a building. Building integrated photovoltaic, or BIPV, systems incorporate solar cells within building elements such as windows, façades and roofs, offering both an energy generation function and building material functionalities. Its seamless integration not only saves space but it also elevates the aesthetics of buildings, making it an ideal solution for architects, developers, and home builders looking to add sustainability to their designs. With rapid urbanization and high demand for energy efficient buildings, BIPV has gained attention a critical solution to provide energy independence and sustainability objectives. However, polymer solar cells are both flexible and thus lightweight, which makes them ideal for BIPV applications as they can be shaped to conform to building contours with little to no lost efficiency or performance.

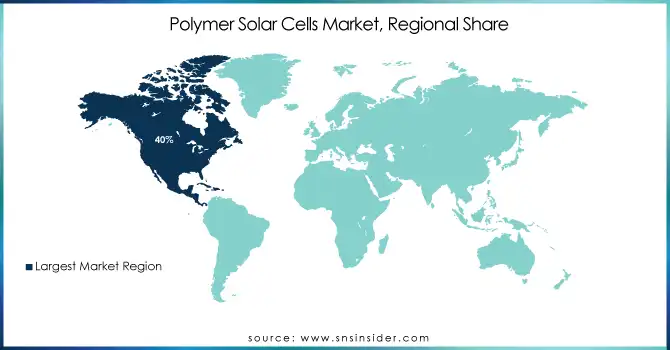

Polymer Solar Cells Market Regional Analysis

North America region held the major share of the polymer solar cells market of more than 40% in 2022. The US is the dominating country in this region. This surge is primarily attributed to the increasing number of renewable energy initiatives taking place throughout the region. Renewable energy projects, such as solar farms and installations, have experienced a substantial increase in North America. This surge can be attributed to various factors, including the growing awareness of the environmental impact of traditional energy sources, the need for sustainable energy solutions, and government incentives promoting the adoption of renewable energy. Furthermore, the North American region boasts a favorable regulatory environment that encourages the development and implementation of renewable energy projects. Government policies and initiatives, such as tax incentives, grants, and subsidies, have played a pivotal role in attracting investments and fostering the growth of the polymer solar cells market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

Tata Power Solar Systems Limited (Solar Panels, Solar Rooftop Solutions)

-

Jinko Solar Holding Co. Ltd (Jinko Solar Panels, Solar Module Solutions)

-

Suniva Inc (High-Efficiency Solar Cells, PERC Solar Modules)

-

Borg Inc. (BIPV Modules, Flexible Solar Cells)

-

Heliatek GmbH (HeliaFilm, Organic Solar Cells)

-

Trina Solar Limited (Trina Solar Panels, Vertex Modules)

-

Solar World AG (Solar Panels, Solar Modules)

-

Alps Technology Inc (Flexible Solar Panels, Thin-Film Solar Modules)

-

Pionis Energy Technologies LLC (Flexible Solar Cells, BIPV Solutions)

-

Infinity PV ApS (Organic Photovoltaic Modules, Flexible Solar Film)

-

First Solar, Inc. (Series 6 Modules, Thin-Film Solar Modules)

-

Hanergy Thin Film Power Group (HanTile, Flexible Solar Panels)

-

Sharp Corporation (Mono Solar Panels, Residential Solar Systems)

-

LG Electronics (LG NeON Solar Panels, Residential Solar Modules)

-

REC Group (REC Alpha Series, REC TwinPeak Panels)

-

Sungrow Power Supply Co., Ltd. (Solar Inverters, Energy Storage Systems)

-

LONGi Solar (Hi-MO Series Modules, Monocrystalline Solar Panels)

-

Canadian Solar (KuMax Modules, Solar PV Modules)

-

Kyocera Corporation (Solar Modules, BIPV Systems)

-

Panasonic Corporation (HIT Solar Panels, HIT Double Solar Modules)

Recent Development:

-

In 2023: Tata Power Solar announced the successful commissioning of a 100 MW solar power project in the state of Rajasthan, marking a significant step in their renewable energy expansion.

-

In 2023: Jinko Solar introduced the Jinko Tiger Pro 78-cell module, designed to deliver increased efficiency and lower LCOE (Levelized Cost of Electricity), enhancing the performance of solar power generation.

-

In 2022, Suniva launched the OPTIM High Efficiency Solar Modules with advanced PERC (Passivated Emitter and Rear Cell) technology, offering increased energy generation efficiency for residential and commercial markets.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.1 Billion |

| Market Size by 2032 | USD 5.9 Billion |

| CAGR | CAGR of 20.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Junction Type (Single Layer, Bilayer, Bulk Heterojunction, Multi-Junction, Others) • By Application (Bipv (Building Integrated Photovoltaic), Consumer Electronics, Automotive, Defense, Others) • By Technique (Printing Technique, Coating Technique) • By Forms (Foils, Panels, Stickers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Tata Power Solar Systems Limited, Jinko Solar Holding Co. Ltd, Suniva Inc, Borg Inc., Heliatek GmbH, Trina Solar Limited, Solar World AG, Alps Technology Inc, Pionis Energy Technologies LLC, Infinity PV ApS, and other players. |

| Drivers | • Increasing government initiatives that promote the use of solar energy drives market growth.. |

| Restraints |

• High cost associated with the production of polymer solar cells may hamper the market growth. |