Solar Power Market Report Scope & Overview:

To Get More Information on Solar Power Market - Request Sample Report

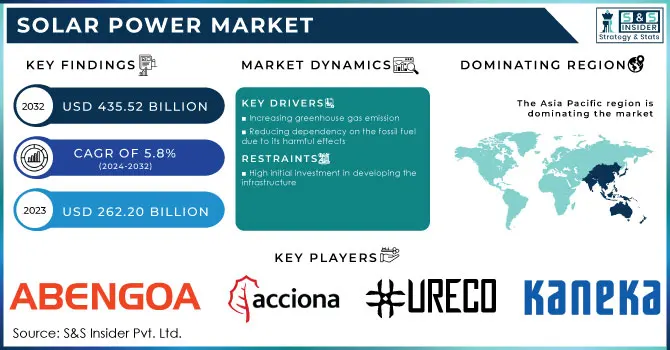

The Solar Power Market size was valued at USD 262.20 Billion in 2023 and is projected to reach USD 435.52 Billion by 2032, growing at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2032.

Solar power is derived by using the sun’s energy and used directly as thermal energy i.e heat or through the use of photovoltaic cells in solar panels and transparent photovoltaic glass to generate the electricity. There are two types of technologies used to generate the energy from sun one is the photovoltaic system and another is a concentrated solar power system.

The most efficient application of photovoltaic is the standard photovoltaic solar panels. Photovoltaic glass generates energy from the surfaces like windows, buildings, etc. Multiple lenses or reflectors are used by concentrated solar power to collect more n more sun’s thermal energy. This collected energy throughout the day is then applied to molten salts or oil that retain heat to boil the water for steam turbine generators throughout the night.

Solar power is the renewable and cleanest form of energy that converts the sun’s energy into thermal or electrical energy. The potential for solar power is huge since the Earth receives solar energy every day in the amount of nearly 200,000 times the world's daily electric generating capacity. The exploitation of solar power is limited in many places because a high cost is required for the collection, conversion, and storage of energy. Unlike fossil fuel, solar power does not produce any harmful greenhouse gas emissions which helps to reduce the carbon footprint and protect the environment from pollution.

Impact of COVID-19

The COVID-19 pandemic had considerably affected the solar power sector due to serious issues like working capital requirement, cash flow crunch, lack of workforce, difficulty in payment recovery from distribution companies, and most important supply chain disruption. The International Solar Alliance (ISA) produced a report on the operational and financial impact of Covid-19 on the solar power sector across the globe. According to this report, the pandemic caused a reduction of about 20% in the global capacity of solar power generation. During the pandemic consumption of bioenergy and other renewable energies decreased due to the restriction on travel, business activities, and border crossing.

Market Dynamics

Drivers

-

Increasing greenhouse gas emission

-

Reducing dependency on the fossil fuel due to its harmful effects

-

Rising demand for green energy from the population

-

The rise in the usage of electricity in houses, public institutions, and businesses

Silver is the major raw material used in the solar module. Due to the fluctuating price of silver demand for solar panel installation is increased which further drives solar power market growth. The emission of harmful greenhouse gas is hazardous to the environment as well as to living beings. Solar power is a form of renewable energy which reduce the carbon footprint and protect the environment from depletion of the ozone layer therefore there is increasing demand for green energy and decreasing dependency on fossil fuel for energy and electricity. These factors drive the solar power market globally.

Restrain

-

High initial investment in developing the infrastructure

The initial cost required to develop the infrastructure to collect, convert, and store the energy is high which may hamper the solar power market. Another reason which can restrain the growth of the market is the lack of infrastructure to collect more energy.

Opportunities

-

Increasing investment in the solar power sector

-

Rising government initiative to adopt renewable energy resources to curb the carbon footprint

Challenges

-

Continuously changing climatic conditions and geographical latitudes

Impact of Russia-Ukraine War:

The ongoing conflict between Russia and Ukraine has had a significant impact on the solar power market. The instability in the region has caused a decrease in investment and a slowdown in the growth of the solar industry. One of the main reasons for this is the uncertainty surrounding the future of the energy market in the region. The conflict has led to a decrease in demand for energy, which has resulted in a decrease in the price of oil and gas. This has made it more difficult for solar power to compete in the market.

Additionally, the conflict has caused a decrease in foreign investment in the region. Many investors are hesitant to invest in a region that is experiencing political instability and conflict. This has made it more difficult for solar power companies to secure funding for new projects.

Impact of Recession:

The solar power market has been significantly affected by the recent economic recession. The recession has caused a decrease in demand for solar power products, as consumers and businesses have become more cautious with their spending. This has resulted in a decrease in sales and revenue for solar power companies. Furthermore, the recession has also affected the financing of solar power projects. Banks and other financial institutions have become more hesitant to provide loans for solar power projects, as they are seen as risky investments during uncertain economic times. This has made it more difficult for solar power companies to secure the necessary funding to develop and expand their projects.

Segmentation Analysis

On the basis of Technology, the Solar Power Market is further segmented into Photovoltaic Systems and Concentrated Solar Power Systems

On the basis of Solar Module, the Solar Power Market is further segmented into Monocrystalline, Polycrystalline, Cadmium Telluride, Amorphous Silicon Cells, and Others

On the basis of End-use, the Solar Power Market is further classified into Electricity Generation, Heating, Charging, and Lighting

On the basis of Application, the Solar Power Market is further bifurcated into Residential, Commercial, and Industrial

Key Market Segmentation

By Technology

-

Photovoltaic Systems

-

Concentrated Solar Power Systems

By Solar Module

-

Monocrystalline

-

Polycrystalline

-

Cadmium Telluride

-

Amorphous Silicon Cells

-

Others

By End-use

-

Electricity Generation

-

Heating

-

Charging

-

Lighting

By Application

-

Residential

-

Commercial

-

Industrial

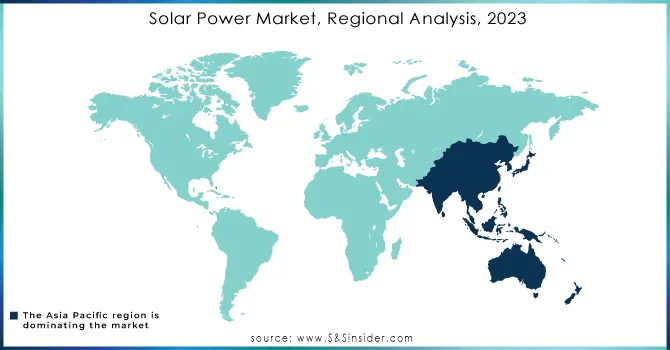

Regional Analysis

Asia Pacific region dominated the solar power market in 2021 and is expected to show dominance during the forecast period. Presence of a large population base, top countries such as China, India, and Japan utilize solar power in abundance. The rapidly growing urbanization, increase in per-capita income and increasing adoption of renewable energy sources are some of the macroeconomic factors that drive the solar power market in the Asia-Pacific region. Moreover, increasing demand for energy from various sectors, and rising awareness regarding greenhouse gas emission drives the solar power market in this region.

North America region is also estimated to grow significantly during the forecast period owing to the high consumption of solar power, increasing purchasing capacity, rising adoption of smart devices and digital technologies, and increasing adoption of renewable energy resources from the countries of the North American region.

Do You Need any Customization Research on Solar Power Market - Enquire Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are Abengoa Se, Acciona S.A., Canadian Solar, Inc., Esolar, Inc., United Renewable Energy Co. Ltd., Sunpower Corporation, Kaneka Corporation, Tata Power Solar Systems Ltd., Wuxi Suntech Power Co., Ltd., Brightsource Energy, Inc., Urja Global Limited, and other key players mentioned in the final report.

| Report Attributes | Details |

| Market Size in 2023 | US$ 262.20 Bn |

| Market Size by 2032 | US$ 435.52 Bn |

| CAGR | CAGR of 5.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Photovoltaic Systems and Concentrated Solar Power Systems) • By Solar Module (Monocrystalline, Polycrystalline, Cadmium Telluride, Amorphous Silicon Cells, and Others) • By End-use (Electricity Generation, Heating, Charging, and Lighting) • By Application (Residential, Commercial and Industrial) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Abengoa Se, Acciona S.A., Canadian Solar, Inc., Esolar, Inc., United Renewable Energy Co. Ltd., Sunpower Corporation, Kaneka Corporation, Tata power solar systems ltd., Wuxi Suntech Power Co., Ltd., Brightsource Energy, Inc., Urja Global Limited |

| Key Drivers | • Increasing greenhouse gas emission • Reducing dependency on the fossil fuel due to its harmful effects |

| Market Opportunities | • Increasing investment in the solar power sector • Rising government initiative to adopt renewable energy resources to curb the carbon footprint |