Power T&D Equipment Market Report Scope & Overview:

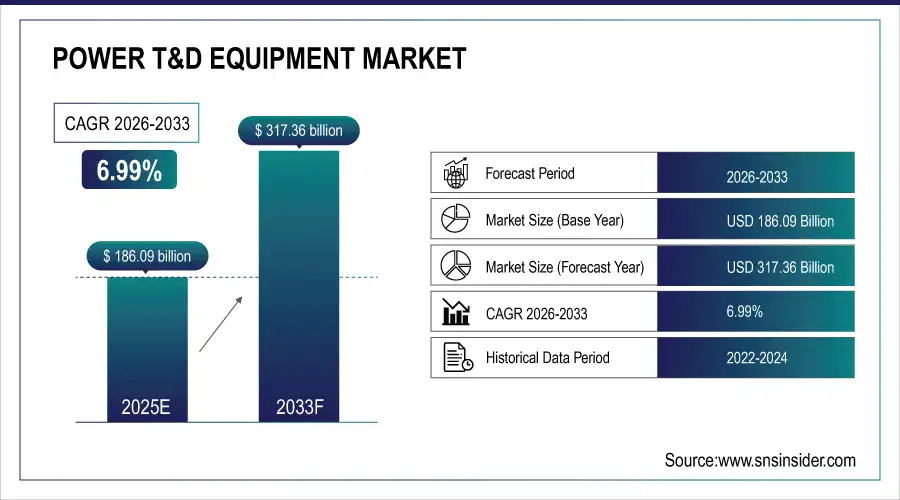

Power T&D Equipment Market was valued at USD 186.09 billion in 2025E and is expected to reach USD 317.36 billion by 2032, growing at a CAGR of 6.99% from 2026-2033.

The Power T&D Equipment Market is growing due to increasing electricity demand from industrial, commercial, and residential sectors, rapid urbanization, and expanding power infrastructure. Investments in smart grids, renewable energy integration, and modernization of aging transmission and distribution networks drive adoption. Technological advancements in transformers, switchgear, meters, and automation systems, along with supportive government policies and rising industrialization, further boost market growth and strengthen regional and global deployment of T&D equipment.

Market Size and Forecast

-

Market Size in 2025: USD 186.09 Billion

-

Market Size by 2033: USD 317.36 Billion

-

CAGR: 6.99% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Power T&D Equipment Market - Request Free Sample Report

Power T&D Equipment Market Trends

-

Rising electricity demand and grid expansion are driving the power transmission & distribution (T&D) equipment market.

-

Increasing adoption of smart grids, automation, and digital monitoring is boosting market growth.

-

Expansion of renewable energy integration is fueling demand for advanced transformers, switchgear, and substations.

-

Focus on reducing transmission losses, improving reliability, and enhancing grid efficiency is shaping market trends.

-

Advancements in high-voltage, compact, and eco-friendly equipment are improving performance and sustainability.

-

Government initiatives, infrastructure investments, and regulatory support are accelerating market adoption.

-

Collaborations between equipment manufacturers, utilities, and technology providers are driving innovation and deployment globally.

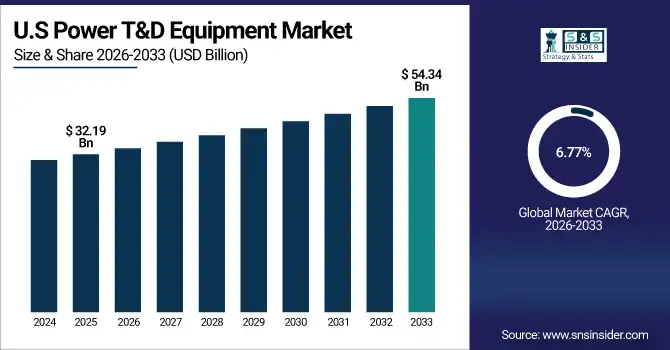

U.S. Power T&D Equipment Market was valued at USD 32.19 billion in 2025E and is expected to reach USD 54.34 billion by 2032, growing at a CAGR of 6.77% from 2026-2033.

The U.S. Power T&D Equipment Market is growing due to rising electricity demand, grid modernization initiatives, renewable energy integration, and increasing investments in advanced transformers, switchgear, meters, and automation systems across industrial, commercial, and residential sectors.

Power T&D Equipment Market Growth Drivers:

-

Rapid growth in electricity demand and modernization of power infrastructure is driving the global Power T&D Equipment Market significantly

Increasing electricity demand from industrial, commercial, and residential sectors is accelerating investments in power transmission and distribution infrastructure. Governments and utilities are upgrading aging grids with advanced transformers, switchgear, and smart meters. Expansion of renewable energy sources, such as solar and wind, requires enhanced transmission networks. Technological advancements in high-efficiency equipment and automation improve grid reliability and reduce losses. Rising electrification in developing regions and government incentives for smart grid deployment further propel market growth, ensuring widespread adoption of Power T&D equipment globally and supporting long-term revenue generation.

Power T&D Equipment Market Restraints:

-

Complex regulatory compliance and stringent safety standards limit Power T&D Equipment Market expansion

Power transmission and distribution equipment must comply with national and international standards, including voltage ratings, insulation, and safety protocols. Adherence to environmental regulations and grid reliability requirements increases project complexity. Delays in approvals and certifications can extend implementation timelines, discouraging potential investors. Utilities must maintain rigorous inspection and testing protocols, increasing operational costs. In emerging markets, lack of harmonized standards may hinder cross-border equipment deployment. These regulatory and safety challenges pose significant constraints, slowing the adoption of advanced T&D solutions and impacting overall market growth despite rising electricity demand and modernization initiatives.

Power T&D Equipment Market Opportunities:

-

Rising demand for smart grids and digital substations presents new growth opportunities in Power T&D Equipment Market

Governments and utilities are increasingly investing in smart grid technologies to improve reliability, reduce losses, and integrate renewable energy. Digital substations, automated switchgear, and IoT-enabled monitoring equipment enhance operational efficiency and predictive maintenance. Energy management systems and real-time data analytics provide new revenue streams for equipment manufacturers. Expanding electrification in developing regions and modernization of legacy infrastructure further boost adoption. Technological collaborations between vendors, software providers, and utilities create innovation opportunities. These factors present significant prospects for market players to expand their footprint and introduce advanced T&D solutions globally.

Power T&D Equipment Market Segment Highlights

-

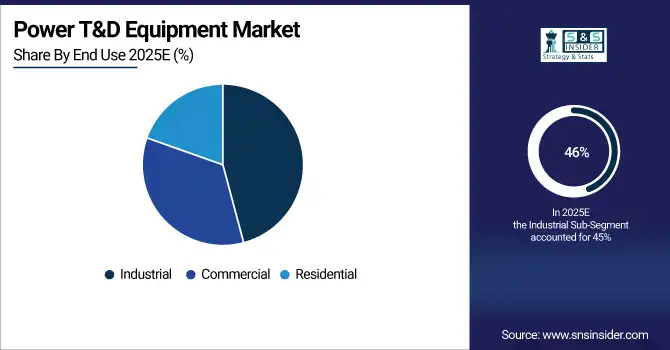

By End Use, Industrial dominated wilth ~46% share in 2025; Commercial fastest growing (CAGR)

-

By Voltage Level, High Voltage dominated with ~43% share in 2025; Medium Voltage fastest growing (CAGR)

-

By Equipment, Transformers dominated with ~29% share in 2025; Meters fastest growing (CAGR)

-

By Application, Transmission dominated with ~42% share in 2025; Substation Automation fastest growing (CAGR)

Power T&D Equipment Market Segment Analysis

By End Use, Industrial segment dominated in 2025; Commercial segment projected fastest growth 2026–2033

Industrial segment dominated the Power T&D Equipment Market in 2025 due to high electricity demand from manufacturing facilities, heavy industries, and large-scale operations. Industrial facilities require reliable and robust transformers, switchgear, and cables to ensure uninterrupted power supply, efficiency, and safety, driving widespread adoption of T&D equipment.

Commercial segment is expected to grow at the fastest CAGR from 2026-2033 because expanding urbanization, office complexes, and commercial establishments increase electricity demand. Rising adoption of energy-efficient equipment, smart meters, and automation in commercial buildings supports rapid deployment of medium and low voltage T&D solutions. Growing infrastructure development accelerates market growth.

By Voltage Level, High Voltage segment led in 2025; Medium Voltage segment expected fastest growth 2026–2033

High Voltage segment dominated the Power T&D Equipment Market in 2025 as transmission of large electricity loads over long distances requires reliable high-voltage transformers, switchgear, and lines. Utilities rely on high voltage systems to reduce losses and maintain grid stability, ensuring strong market adoption globally.

Medium Voltage segment is expected to grow at the fastest CAGR from 2026-2033 due to rising demand for efficient electricity distribution in urban and industrial areas. Smart grid projects, suburban electrification, and expanding commercial and residential networks drive adoption of medium-voltage equipment, accelerating market growth.

By Equipment, Transformers segment dominated in 2025; Meters segment projected fastest growth 2026–2033

Transformers segment dominated the Power T&D Equipment Market in 2025 because of their essential role in stepping up and stepping down voltage for efficient transmission and distribution. High industrial and urban electricity demand ensures consistent usage of transformers in substations and grid networks globally.

Meters segment is expected to grow at the fastest CAGR from 2026-2033 as smart metering adoption increases for residential and commercial sectors. Utilities deploy meters for real-time monitoring, energy management, and billing efficiency, supporting rapid growth in modern grid infrastructure and smart cities worldwide.

By Application, Transmission segment led in 2025; Substation Automation segment expected fastest growth 2026–2033

Transmission segment dominated the Power T&D Equipment Market in 2025 due to critical need for transporting electricity over long distances with minimal losses. High-voltage lines, substations, and related equipment are essential for connecting generation plants to distribution networks, driving widespread industrial and utility adoption.

Substation Automation segment is expected to grow at the fastest CAGR from 2026-2033 because modernization of electricity grids requires automated monitoring, control, and protection systems. Adoption of digital substations enhances reliability, reduces operational costs, and supports integration of renewable energy, accelerating demand for automation equipment globally.

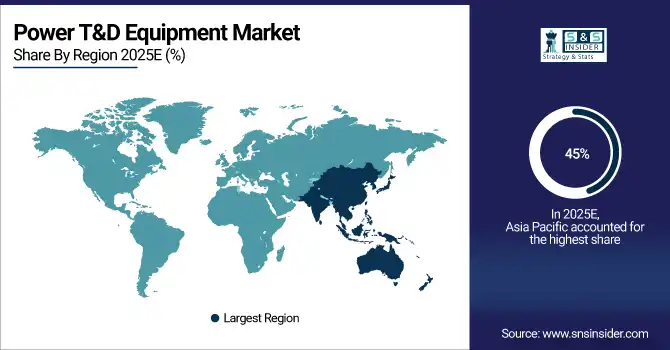

Power T&D Equipment Market Regional Analysis

Asia Pacific Power T&D Equipment Market Insights

Asia Pacific dominated the Power T&D Equipment Market in 2025 with the highest revenue share of about 45% due to rapid industrialization, urbanization, and infrastructure expansion. Growing electricity demand from industrial, commercial, and residential sectors drives large-scale deployment of transformers, switchgear, and cables. Supportive government policies, investment in smart grids, and modernization of transmission and distribution networks further strengthen market adoption, making the region a key contributor to global T&D equipment revenue.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Power T&D Equipment Market Insights

North America holds a significant share in the Power T&D Equipment Market due to well-established electricity infrastructure, high industrial and commercial power demand, and ongoing grid modernization projects. Investments in smart grids, renewable energy integration, and advanced transmission and distribution technologies drive adoption. Utilities and industrial sectors focus on upgrading transformers, switchgear, and meters to improve efficiency, reliability, and sustainability, supporting steady market growth and reinforcing the region’s strong position in the global T&D equipment market.

Europe Power T&D Equipment Market Insights

Europe holds a prominent position in the Power T&D Equipment Market due to extensive electricity networks, strong industrial base, and growing adoption of smart grid technologies. Government initiatives for grid modernization, renewable energy integration, and energy efficiency drive demand for advanced transformers, switchgear, and meters. Increasing investments in upgrading aging infrastructure and expanding transmission and distribution systems support consistent market growth, making Europe a key region for T&D equipment deployment and technological innovation.

Middle East & Africa and Latin America Power T&D Equipment Market Insights

Middle East & Africa and Latin America are witnessing growth in the Power T&D Equipment Market due to expanding electricity infrastructure, industrialization, and urban development. Investments in grid modernization, renewable energy integration, and rural electrification drive demand for transformers, switchgear, and distribution equipment. Increasing government initiatives, international funding, and focus on reliable power supply support adoption, enabling these regions to enhance transmission and distribution networks and steadily contribute to global market growth.

Power T&D Equipment Market Competitive Landscape:

ABB Ltd.

ABB Ltd. is a global leader in electrification, automation, robotics, and digital solutions. The company focuses on sustainable power transmission, advanced electrification systems, and industrial automation to support energy transition and grid modernization worldwide. ABB combines R&D and operational expertise to deliver innovative solutions for data centers, utilities, and industrial applications.

-

2025: ABB announced a $110 million investment in U.S. manufacturing to expand R&D and production of advanced electrification solutions, targeting increased demand from data centers and grid modernization.

Schneider Electric

Schneider Electric is a multinational specializing in energy management and automation solutions. Its offerings include medium- and low-voltage equipment, software-driven energy optimization, and sustainable electrification solutions. The company emphasizes SF₆-free technologies and scalable infrastructure to enhance grid reliability and reduce environmental impact.

-

2025: Schneider Electric launched the Ringmaster AirSeT, a next-generation SF₆-free medium-voltage switchgear, produced at its Leeds facility following a £7.2 million investment.

-

2024: Schneider Electric announced a €44 million investment to expand its Dunavecse factory in Hungary, responding to significant global demand for low-voltage distribution equipment.

Mitsubishi Electric

Mitsubishi Electric provides comprehensive electrical and electronic solutions, including power transmission and distribution equipment. The company focuses on advancing smart grid infrastructure, increasing production capacity, and addressing growing electricity demand through sustainable and reliable technology solutions.

-

2025: Mitsubishi Electric invested in a new U.S. switchgear factory and expanded its Pennsylvania facility to meet growing electricity demand.

-

2024: Toshiba (collaboration context: Japan-based solutions) won an equipment order for a major geothermal power plant expansion in Indonesia, supplying power transmission and distribution systems.

Eaton Corporation

Eaton Corporation delivers power management solutions for electrical, industrial, and utility sectors. Its offerings include switchgear, transformers, UPS systems, and grid modernization technologies. Eaton emphasizes operational efficiency, safety, and sustainability across its global electrification portfolio.

-

2025: Eaton completed the acquisition of Resilient Power Systems Inc., enhancing its power distribution offerings.

GE Vernova

GE Vernova provides advanced energy infrastructure and grid solutions, including power transmission systems, renewable integration, and SF₆-free technologies. The company focuses on decarbonizing energy networks and enhancing electricity access in industrial and urban markets.

-

2025: GE Vernova advanced Norway’s grid decarbonization with SF₆-free technology and boosted India’s renewable energy transmission network.

Toshiba Energy Systems & Solutions

Toshiba Energy Systems & Solutions develops electrical systems for transmission, distribution, and industrial power applications. The company invests in expanding production capacity and deploying advanced equipment to meet growing energy demand, particularly in Asia and emerging markets.

-

2025: Toshiba announced a JPY 10 billion investment to increase production capacity of power transmission and distribution equipment in India.

-

2024: Toshiba won an equipment order for a major geothermal power plant expansion in Indonesia, supplying power transmission and distribution systems.

Siemens Energy

Siemens Energy provides comprehensive solutions for electricity generation, transmission, and industrial applications. The company emphasizes sustainable power infrastructure, smart grids, and decarbonization technologies to meet rising electricity demand from industrial and digital sectors.

-

2023: Siemens Energy reported a record-high order backlog of nearly €136 billion, driven largely by soaring demand for electricity from new data centers, particularly in the U.S.

Key Players

Some of the Power T&D Equipment Market Companies

-

ABB Ltd.

-

Siemens Energy AG

-

Schneider Electric SE

-

Mitsubishi Electric Corporation

-

Eaton Corporation plc

-

Hitachi Energy Ltd.

-

General Electric (GE) Vernova

-

Toshiba Energy Systems & Solutions

-

Hyundai Electric & Energy Systems

-

LS Electric Co., Ltd.

-

Hyosung Heavy Industries

-

CG Power & Industrial Solutions Ltd.

-

Fuji Electric Co., Ltd.

-

Powell Industries, Inc.

-

Meidensha Corporation

-

Socomec Group

-

Hubbell Incorporated

-

DMC Power

-

Schneider Electric India

-

Larsen & Toubro (L&T)

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 186.09 Billion |

| Market Size by 2033 | USD 317.36 Billion |

| CAGR | CAGR of 6.99% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Equipment (Transformers, Switchgear, Cables and Wires, Meters, Insulators, Capacitors, Inductors, Others) • By Voltage Level (High Voltage, Medium Voltage, Low Voltage) • By Application (Transmission, Distribution, Substation Automation) • By End Use (Industrial, Commercial, Residential) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | ABB Ltd., Siemens Energy AG, Schneider Electric SE, Mitsubishi Electric Corporation, Eaton Corporation plc, Hitachi Energy Ltd., General Electric (GE) Vernova, Toshiba Energy Systems & Solutions, Hyundai Electric & Energy Systems, LS Electric Co., Ltd., Hyosung Heavy Industries, CG Power & Industrial Solutions Ltd., Fuji Electric Co., Ltd., Powell Industries, Inc., Meidensha Corporation, Socomec Group, Hubbell Incorporated, DMC Power, Schneider Electric India, Larsen & Toubro (L&T) |