Concentrated Solar Power Market Report Scope & Overview:

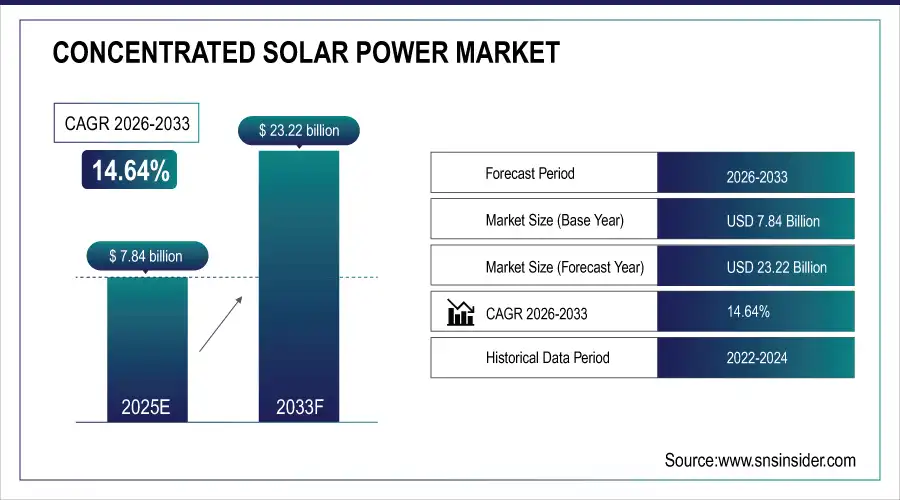

Concentrated Solar Power Market was valued at USD 7.84 billion in 2025E and is expected to reach USD 23.22 billion by 2032, growing at a CAGR of 14.64% from 2026-2033.

To Get more information On Concentrated Solar Power Market - Request Free Sample Report

The Concentrated Solar Power Market is growing due to rising global energy demand, supportive renewable energy policies, and the integration of advanced thermal storage systems that enhance reliability and grid stability. Increasing investments in large-scale utility projects, coupled with the push for decarbonization and clean energy transitions, are driving adoption. Technological advancements in receivers, collectors, and heat transfer fluids further improve efficiency, making CSP increasingly competitive with other renewable energy technologies.

The U.S. National Renewable Energy Laboratory (NREL) projects a significant decline in CSP CAPEX. From USD 7,912/kWe in 2022, it is expected to drop to USD 5,180/kWe by 2030, and further to USD 3,150/kWe by 2050 under an advanced technology innovation scenario.

The U.S. Department of Energy's Solar Energy Technologies Office (SETO) reports that the cost of electricity produced by CSP has decreased by more than 50% over the past decade, thanks to more efficient systems and the wider use of thermal energy storage. SETO aims to achieve USD 0.05 per kilowatt-hour for baseload plants with at least 12 hours of thermal energy storage.

In the United States, utility-scale solar electricity generation, including CSP, accounted for about 1% of total solar electricity generation in 2023. CSP plants, such as the Noor III in Morocco, demonstrate the scalability and effectiveness of CSP technology.

Concentrated Solar Power Market Size and Forecast

-

Market Size in 2025: USD 7.84 Billion

-

Market Size by 2033: USD 23.22 Billion

-

CAGR: 14.64% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Concentrated Solar Power Market Trends

-

Rising demand for renewable and sustainable energy sources is driving the concentrated solar power (CSP) market.

-

Increasing investments in large-scale solar thermal plants are boosting adoption.

-

Integration of thermal energy storage systems is enabling round-the-clock power supply.

-

Supportive government policies, incentives, and clean energy targets are accelerating CSP deployment.

-

Advancements in parabolic trough, power tower, and Fresnel technologies are improving efficiency.

-

Growing need to reduce carbon emissions and dependence on fossil fuels is shaping market growth.

-

Collaborations between energy companies and technology providers are fostering innovation and global expansion.

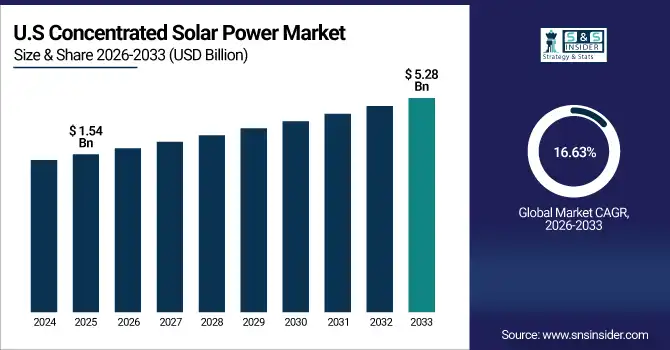

U.S. Concentrated Solar Power Market was valued at USD 1.54 billion in 2025E and is expected to reach USD 5.28 billion by 2032, growing at a CAGR of 16.63% from 2026-2033.

The U.S. Concentrated Solar Power Market is growing due to strong government incentives, rising renewable energy targets, and increasing adoption of thermal storage systems. Advancements in CSP technologies and investments in large-scale utility projects further accelerate market expansion and competitiveness.

Concentrated Solar Power Market Growth Drivers:

-

Increasing integration of thermal storage enhances reliability and long-term competitiveness of concentrated solar power compared to conventional energy sources

Thermal storage technology enables CSP plants to provide electricity beyond sunlight hours, addressing one of the biggest challenges in renewable energy—intermittency. This makes CSP a reliable baseload power source capable of replacing fossil-fuel-based plants in several regions. With storage, CSP can stabilize grids, meet peak demand, and reduce dependence on conventional generation. Additionally, storage integration improves project economics and boosts competitiveness against other renewable technologies. Nations prioritizing 24/7 renewable energy supply view CSP as a strategic investment, which drives investor interest, technology development, and project pipeline expansion globally.

-

In 2024, SETO announced an investment of up to $35 million in 15 CSP projects, with total project costs reaching $67.6 million, to advance thermal energy storage technologies.

-

Additionally, U.S. deployment of 52 new photovoltaic and battery hybrid plants set a record with 5.3 GW installed in 2023, highlighting the growing trend of integrating CSP with other renewable sources to enhance grid stability and overall energy reliability.

Concentrated Solar Power Market Restraints:

-

Land and water requirements create environmental and geographical constraints for deployment of concentrated solar power in several global regions

CSP plants require large tracts of flat, sun-rich land for mirrors and heliostats, making them unsuitable for densely populated regions. Furthermore, many CSP systems use water for cooling, posing challenges in arid areas where water scarcity is already severe. Environmental concerns, including impacts on biodiversity and ecosystem disruption, also hinder approvals. These geographic and environmental constraints make CSP less flexible compared to solar PV, which can be installed on rooftops or smaller spaces. As a result, site selection challenges restrict CSP’s global scalability and limit widespread adoption.

Concentrated Solar Power Market Opportunities:

-

Technological advancements in solar receiver materials and heat transfer fluids open opportunities for efficiency gains and cost reduction in concentrated solar power

Continuous R&D in receiver coatings, molten salt storage, and innovative heat transfer fluids is enhancing CSP efficiency and reducing operational costs. Improved thermal stability allows plants to reach higher operating temperatures, resulting in greater electricity output and extended storage durations. Such advancements also reduce maintenance needs and improve system durability, directly lowering levelized cost of energy. Global partnerships and pilot projects are accelerating commercialization of these next-generation materials and fluids. Over time, technological innovations will make CSP more competitive with other renewables and expand its viability across diverse geographies.

Research is underway to develop heat transfer fluids capable of operating at temperatures exceeding 700°C, crucial for improving CSP thermal efficiency and enabling higher-temperature operations.

China has initiated two 350 MW pilot CSP projects in Qinghai Province, each featuring 14 hours of thermal energy storage, marking its entry into third-generation CSP technology.

Additionally, the Extresol Solar Power Station in Spain, operational since 2009, utilizes parabolic trough technology with molten salt thermal storage, boasting a total capacity of 150 MW and annual generation of approximately 495 GWh, demonstrating large-scale operational effectiveness.

Concentrated Solar Power Market Segment Highlights

-

By Operation Type, With Storage dominated with ~67% share in 2025; Stand-alone Systems fastest growing (CAGR).

-

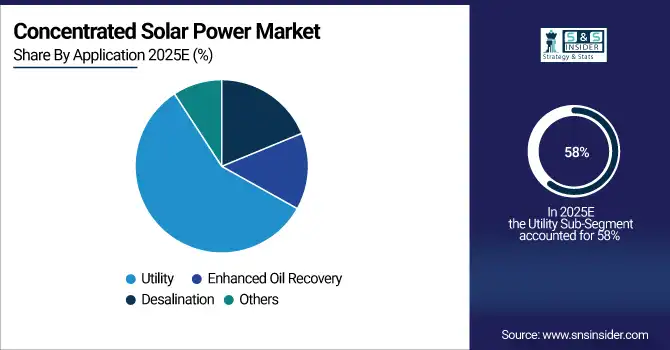

By Application, Utility dominated with ~58% share in 2025; Desalination fastest growing (CAGR).

-

By Technology, Parabolic Trough dominated with ~54% share in 2025; Power Tower fastest growing (CAGR).

-

By Component, Solar Collector dominated with ~38% share in 2025; Thermal Storage System fastest growing (CAGR).

-

By Capacity, 100 MW and above dominated with ~63% share in 2025; 100 MW and above fastest growing (CAGR).

Concentrated Solar Power Market Segment Analysis

By Operation Type, With Storage dominated in 2025; Stand-alone Systems expected fastest growth 2026–2033 due to low-cost, off-grid deployment.

With Storage segment dominated the market in 2025 due to its ability to provide reliable power supply beyond daylight hours. Integration of thermal storage enhances grid stability, ensures energy availability during peak demand, and supports large-scale renewable adoption, making it more attractive to utilities and investors compared to standalone alternatives.

Stand-alone Systems segment is expected to grow fastest from 2026 to 2033 as they require lower initial investment and simpler infrastructure. Their suitability for small-scale projects, off-grid applications, and remote installations makes them increasingly favorable in developing regions where cost-sensitive deployment and energy access are critical factors driving adoption.

By Application, Utility led in 2025; Desalination projected fastest growth 2026–2033 driven by renewable-driven water solutions.

Utility segment dominated the market in 2025 as large-scale power generation projects are increasingly prioritized by governments to meet rising electricity demand. Strong financial backing, supportive policies, and grid integration advantages make utility-scale projects the preferred choice for achieving renewable energy targets and reducing dependence on conventional energy sources.

Desalination segment is expected to grow fastest from 2026 to 2033 as global water scarcity drives demand for sustainable desalination solutions. CSP-based desalination offers a renewable-driven alternative to energy-intensive conventional processes, reducing costs and environmental impact. Rising urbanization and industrialization are boosting investments in solar-powered desalination projects worldwide.

By Technology, Parabolic Trough dominated in 2025; Power Tower expected fastest growth 2026–2033 for higher efficiency and thermal storage.

Parabolic Trough segment dominated the market in 2025 due to its proven commercial maturity, operational reliability, and cost-effectiveness. Widely deployed across several regions, it benefits from established technology, scalability, and strong industry confidence. Its lower risk profile and extensive project pipeline made it the leading CSP technology compared to other alternatives.

Power Tower segment is expected to grow fastest from 2026 to 2033 as it offers higher efficiency, higher operating temperatures, and superior thermal storage capacity. Its capability to achieve greater electricity output and reduce levelized cost of energy is driving interest, particularly for large-scale projects seeking enhanced performance and flexibility.

By Component, Solar Collector led in 2025; Thermal Storage System expected fastest growth 2026–2033 enhancing CSP reliability and dispatchability.

Solar Collector segment dominated the market in 2025 as it is the core component responsible for capturing solar radiation and enabling energy conversion. Its wide deployment across various CSP technologies and continuous improvements in design and efficiency solidified its leadership role, making it indispensable for project performance and energy output.

Thermal Storage System segment is expected to grow fastest from 2026 to 2033 as storage integration enhances CSP reliability and competitiveness against intermittent renewables. Extended electricity supply beyond sunlight hours and peak demand support make it highly attractive. Growing demand for stable, dispatchable renewable energy positions storage as a vital growth driver.

By Capacity, 100 MW and above dominated in 2025 and expected fastest growth 2026–2033 due to utility-scale adoption and decarbonization focus.

100 MW and above segment dominated the market in 2025 and is projected to grow fastest from 2026 to 2033 due to its suitability for large-scale power generation and ability to integrate advanced thermal storage. These plants deliver reliable, utility-scale renewable energy, meeting rising electricity demand while supporting decarbonization targets. Strong government backing, favorable financing models, and economies of scale further strengthen adoption, making high-capacity CSP projects a preferred choice for long-term energy security and sustainable infrastructure development.

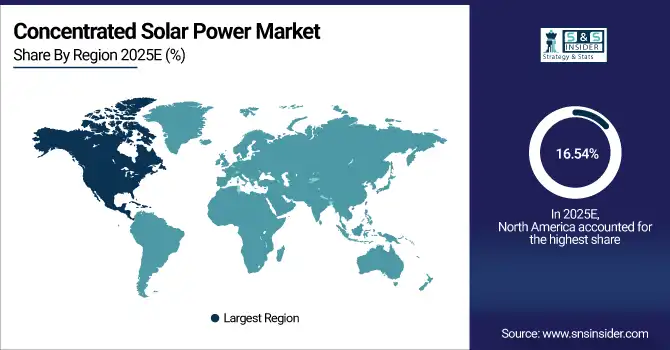

Concentrated Solar Power Market Regional Analysis

North America Concentrated Solar Power Market Insights

North America is expected to grow at the fastest CAGR of about 16.54% from 2026-2033 driven by supportive government incentives, advancements in solar thermal technologies, and rising investments in clean energy infrastructure. Growing focus on decarbonization, corporate renewable energy commitments, and integration of CSP with storage technologies enhance adoption. The U.S. and Canada are witnessing increasing utility-scale CSP projects, boosting the region’s strong future growth trajectory in the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Concentrated Solar Power Market Insights

Asia Pacific dominated the Concentrated Solar Power Market with the highest revenue share of about 40% in 2025 due to strong government initiatives, rising investments in renewable energy, and rapid industrialization. Increasing electricity demand, coupled with favorable policies promoting large-scale solar projects in countries like China and India, has accelerated adoption. The region’s abundant solar resources and focus on reducing dependency on fossil fuels further strengthen its leadership in the global concentrated solar power sector.

Europe Concentrated Solar Power Market Insights

Europe holds a significant position in the Concentrated Solar Power Market, supported by early adoption of renewable technologies, favorable policies, and strong R&D investments. Countries like Spain pioneered CSP deployment with large-scale plants, setting global benchmarks. The region’s commitment to achieving carbon neutrality, coupled with technological advancements in thermal storage and hybrid solar projects, continues to drive growth. Increasing cross-border renewable energy collaborations further strengthen Europe’s role in the CSP industry globally.

Middle East & Africa and Latin America Concentrated Solar Power Market Insights

Middle East & Africa are emerging as vital regions in the Concentrated Solar Power Market due to abundant solar resources, government-backed renewable initiatives, and large-scale utility projects in countries like the UAE, Morocco, and South Africa. Latin America is also gaining traction, with Chile and Brazil leading investments in CSP to diversify energy portfolios and reduce carbon emissions. Strong solar irradiance and rising demand for sustainable power generation foster market growth across both regions.

Concentrated Solar Power Market Competitive Landscape:

BrightSource Energy, Inc. / Kelvin Energy

BrightSource Energy, now rebranded as Kelvin Energy, is a pioneer in Concentrated Solar Power (CSP) and renewable energy technologies. The company focuses on innovative solar thermal systems, integrating storage and energy management to deliver reliable clean power. With decades of expertise in large-scale CSP projects, Kelvin Energy continues to develop advanced solutions for utility-scale solar plants while maintaining minority interests in global CSP ventures through its strategic restructuring.

-

2023: BrightSource Energy, Inc. spun off its Israeli, UK, and South African CSP business into New BrightSource Energy LTD, separating CSP & renewable energy management from other operations.

-

2023: New BrightSource LTD formed under management in Israel & UK, with BrightSource (renamed Kelvin Energy) retaining a minority stake, focusing CSP & battery storage solutions.

Abengoa

Abengoa is a Spanish multinational specializing in sustainable infrastructure solutions, renewable energy, and engineering services. With extensive experience in solar thermal technologies, the company has been a key player in the advancement of Concentrated Solar Power (CSP) plants worldwide. Abengoa leverages innovative molten salt tower and parabolic trough designs to deliver renewable electricity with integrated storage, ensuring stability and dispatchability. Its projects emphasize long-duration storage and scalable solutions for decarbonized power generation.

-

2024: Abengoa took full control of the Palen Solar Energy Generating Station (PSEGS) CSP project in California, planning to use molten salt tower design with large thermal storage capacity.

Key Players

Some of the Concentrated Solar Power Market Companies

-

Abengoa Solar

-

BrightSource Energy, Inc.

-

ACWA Power

-

TSK Flagsol Engineering GmbH

-

Aalborg CSP A/S

-

SolarReserve, LLC

-

Acciona Energia, S.A.

-

eSolar, Inc.

-

Atlantica Sustainable Infrastructure plc

-

Enel Green Power

-

ENGIE SA

-

Sener Grupo de Ingeniería, S.A.

-

Siemens Energy AG

-

Torresol Energy

-

Solarlite CSP Technology GmbH

-

Chiyoda Corporation

-

Shouhang High-Tech Energy Co., Ltd.

-

Northwest Electric Power Design Institute (NWEPDI)

-

GE Renewable Energy

-

Cobra Energia

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 7.84 Billion |

| Market Size by 2033 | USD 23.22 Billion |

| CAGR | CAGR of 14.64% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Enhanced Oil Recovery, Desalination, Utility, Other) • By Technology (Linear Fresnel, Dish, Parabolic Trough, Power Tower) • By Capacity (Less than 50 MW, 50 MW to 99 MW, 100 MW and above) • By Operation Type (Stand-alone Systems, With Storage) • By Component (Solar Collector, Receiver, Heat Transfer Fluid, Thermal Storage System, Power Block) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Abengoa Solar, BrightSource Energy, Inc., ACWA Power, TSK Flagsol Engineering GmbH, Aalborg CSP A/S, SolarReserve, LLC, Acciona Energia, S.A., eSolar, Inc., Atlantica Sustainable Infrastructure plc, Enel Green Power, ENGIE SA, Sener Grupo de Ingeniería, S.A., Siemens Energy AG, Torresol Energy, Solarlite CSP Technology GmbH, Chiyoda Corporation, Shouhang High-Tech Energy Co., Ltd., Northwest Electric Power Design Institute (NWEPDI), GE Renewable Energy, Cobra Energia |