Precast Concrete Market Report Scope & Overview:

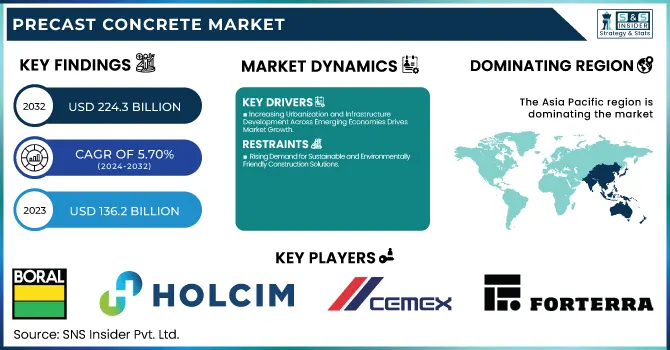

The Precast Concrete Market size was valued at USD 136.2 billion in 2023 and is expected to reach USD 224.3 billion by 2032, growing at a CAGR of 5.70% over the forecast period 2024-2032.

To Get more information on Precast Concrete Market - Request Free Sample Report

The precast concrete industry is driven by several dynamic forces including advancements in the field through technological changes and cost efficiency through sustainability initiatives towards an increase in urbanization. Innovative methods of manufacturing within the industry including automated lines and 3D printing-reduce waste through precision, among other factors toward overall cost-efficiency. In February 2025, Al-Futtaim Engineering opened a new precast concrete factory in Dubai with an annual capacity of over 700,000 cubic meters. This is a bid to respond to the increasing demand for high-quality construction solutions. In the same month, Abu Dhabi's Integrated Transport Centre inaugurated the largest precast concrete factory in the UAE, a step underlining the region's commitment to sustainable infrastructure development.

Another important milestone has been realized through the housing project completed in India by Magicrete in March 2024 utilizing 3D modular precast concrete that resonates with India's "Housing for All" vision. This has established significant savings on construction time and costs with providing 1,008 families affordable, disaster resilient homes. Apart from that, design flexibility along with options to customize the product has allowed increasing architectural creativity along with the possible adaptability towards different projects. These developments explain the influence of precast concrete on the landscape of construction by providing environmental and economic benefits towards the growing demands for durable, sustainable, and efficient building solutions.

Precast Concrete Market Dynamics

Drivers

-

Increasing Urbanization and Infrastructure Development Across Emerging Economies Drives Market Growth

Rapid urbanization in emerging economies is significantly contributing towards the expansion of the precast concrete market. As cities continue growing, there will be greater needs for swift, cost-effective, and enduring construction techniques in meeting housing demands as well as roads and bridges infrastructures among others. The rising preference for large-scale infrastructure projects is seen to be precast concrete, especially because it is fastening up the construction timeline and delivering a strong and reliable result. Also, investments made by governments in infrastructure development across Asia-Pacific, Africa, and Latin America create a huge demand for precast concrete solutions. The scalability of precast concrete manufacturing supports the growing infrastructure needs of these rapidly urbanizing regions.

-

Rising Demand for Sustainable and Environmentally Friendly Construction Solutions

Restraints

-

Rising Demand for Sustainable and Environmentally Friendly Construction Solutions

High capital investment to set up a precast concrete manufacturing plant is a significant restraint for the market. Advanced machinery and technology to set up a production facility are highly expensive and demand considerable investment upfront, which may pose as a deterrent to small and medium-sized construction companies. In addition, the specific equipment and highly skilled labor involved in the precast manufacturing process add more initial investment and higher operational costs. Precast concrete would face financial challenges that might hinder or restrict the large-scale adoption in smaller projects or areas wherein the construction industry is generally not strengthened financially. This might retard market expansion overall.

Opportunities

-

Growing Demand for Modular Construction Solutions Offers New Market Avenues for Precast Concrete

The increasing popularity of modular construction due to cost savings and reduced timelines for construction represents a great opportunity for the precast concrete market. Precast concrete is the best option for modular construction as it can have its components prefabricated under controlled factory settings, which then are transported to the site for assembly. Construction delays are minimal, and this method also results in waste minimization and ensures safety. As more people continue to opt for modular homes and buildings, particularly in urban cities with limited space, the need for precast concrete products will also increase. Housing projects- affordable housing, for instance accommodations-there is increased interest in them.

Challenge

-

Supply Chain and Logistics Complexities Pose Challenges to Precast Concrete Distribution

The main challenge in the precast concrete market is the complexity involved in transporting and delivering large, heavy precast components to construction sites. Because the components are typically produced in centralized factories and must be transported over long distances, issues such as transportation costs, logistical delays, and potential damage during transit can impede market growth. Precast elements are prone to handling difficulties due to their size and weight, adding costs and possible delays in the project timeline. Overcoming supply chain and logistics challenges is necessary to ensure that precast concrete products are delivered on time and competitively.

Precast Concrete Market Segments

By Type

In 2023, Wet Concrete dominated the Precast Concrete Market with a significant market share of 65.4%. Wet concrete's dominance is mainly due to its ability to form complex shapes and achieve high strength and durability, which is suitable for large-scale construction projects. The wet mix is often used in manufacturing precast elements such as beams, walls, and columns that require consistent structural integrity. Wet concrete is preferred because it can be processed in controlled factory settings, thereby ensuring precise mixtures, uniform quality, and better finish with fewer defects. Companies like Holcim Ltd. and Boral Ltd. rely heavily on wet concrete for its superior workability, especially for demanding infrastructure applications. Controlled production also saves time on-site, speeding up construction while maintaining quality standards. This is essential, given that the usage of such high-performance building materials, like commercial buildings and infrastructure projects, is on the rise in the regions. Speed, durability, and quality combined are what wet concrete becomes a favorite among urban developers as well as large-scale construction projects.

By Element

Columns & Beams dominated the Precast Concrete Market in 2023 with a 25.3%. Columns and beams are mainly used for vertical and horizontal support in buildings and infrastructure projects. The fundamental need for columns and beams is to provide stability to the structure while offering flexibility in design and implementation. Precast columns and beams are produced in factories with controlled conditions and therefore provide much better strength and durability. Thus, there are fewer chances of delays or mistakes on the site. Companies such as Tindall Corporation and Balfour Beatty also depend on using these structural components in residential and commercial projects, mainly because they are manufactured relatively quickly and less expensively. These are also useful for the construction of high-rise buildings and bridges, which require much higher structural integrity. Furthermore, columns and beams help to complete projects in a much shorter time, since they are prefabricated elsewhere and assembled at the site. This minimizes the effect of bad weather. Thus, columns and beams form an important aspect of accelerating massive construction works and improving construction time.

By Construction Type

In 2023, Elemental Construction dominated the Precast Concrete market with a share of 50.4%. Elemental construction refers to the technique where primary components, such as walls, floors, and beams, are prefabricated in a controlled factory environment and then transported to the construction site and assembled. The technique serves to increase the speed of construction activities, has good quality control, and saves on costs. In many ways, it reduces the usage of on-site labor and offers more accuracy with construction. Hence, Larsen & Toubro Limited utilized this method on a large-scale basis and combined advanced manufacturing technologies to deliver higher quality precast elements in harmony with modern building standards. Further, elemental construction also aids the cause of sustainability by minimizing wastage of material and consumption of energy. It also enables construction teams to stick to tight project timelines, an important aspect of meeting the ever-growing demand for residential, commercial, and infrastructure developments. Modular homes, which are largely based on precast components, are also driving the growth of this segment. The elemental construction method has thus become a favorite for developers seeking to meet market demands efficiently and sustainably while streamlining the construction process.

By Application

Building components dominated the Precast Concrete in 2023, accounting for around 40.5%. Precast building components, including walls, floors, columns, and beams, provide several benefits, including increased longevity, quick construction time, and uniformity in quality. The components can be produced in controlled conditions to achieve the desired levels of structural integrity and finishing. This growing demand for fast construction especially in urbanized regions has hugely relied on the precast components for building structures. Companies, such as Spancrete, deal with the specialized production of tailored precast solutions to enable rapid completion of a project. Even more, through mass production, factory-produced parts will allow controlling the cost incurred by reducing its total cost compared to construction work. The modularity of prefabricated components allows the design flexibility of precast components, which makes them a perfect fit for a wide range of buildings, including residential buildings, commercial buildings, and other industrial properties. This easily merges with the global construction industry's pursuit of a more sustainable, cost-effective, and efficient building scenario. With the ongoing demand for speed and quality in the construction industry, the popularity of precast building components is bound to keep rising.

By End-Use

The Commercial segment dominated the Precast Concrete market at 40.5% in 2023. This is because commercial constructions, such as office buildings, retail centers, and hotels require fast, durable, and economical construction materials. Precast concrete comes with a unique advantage over traditional construction methods in their applications on commercial work as they have faster installation times, reduced labor costs, and higher precision as compared to most conventional methods. Commercial works are widely carried out in Balfour Beatty and Laing O'Rourke due to the fast production of the material, giving way to on-site construction at very high levels without compromising the quality. Its modularity promotes an efficient usage of space and material, as space is more scarce in an urban commercial development. Precast elements also display high structural performance that makes them contribute to making a building more secure and enduring. Additionally, the rising tendency of sustainable construction practices is promoting the increasing demand for precast concrete due to the avoidance of waste generation and minimizing impacts in the environment. Commercial construction would continue to surge, which could further see growth in precast concrete utilization across the industry driven by the factors of efficiency and performance advantages.

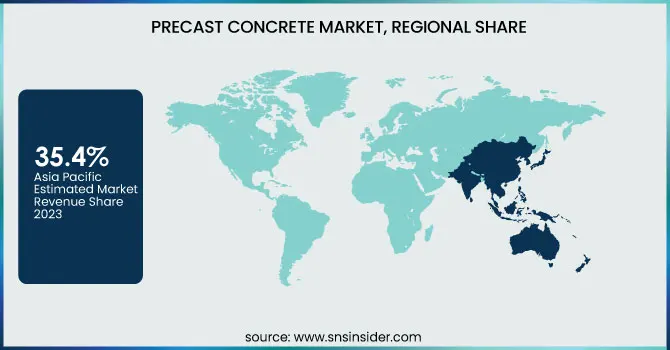

Precast Concrete Regional Analysis

Asia Pacific region dominated the Precast Concrete Market in 2023, accounting for a market share of around 35.4%. This has been due to rapid urbanization, infrastructural advancement, and investment in major construction projects within the developed economies, including China, India, and Japan. The government's plan to develop large-scale infrastructure is raising the demand for precast concrete products in China. India, with its expanding urban areas and affordable housing projects, also contributes to the region’s market growth. Japan, known for its advanced construction methods, has seen increased adoption of precast concrete due to its ability to withstand natural disasters. The region’s dominance is also fueled by the growing trend toward energy-efficient and sustainable construction materials. It means that construction continues to occur unabatedly across these regions; hence, continuous market growth makes Asia Pacific dominant in the worldwide precast concrete market.

The Europe region emerged as the fastest-growing in the Precast Concrete Market in 2023, with an estimated CAGR of 7.2%. It is driven by increasing demand for sustainable, energy-efficient building materials in countries like Germany, France, and the UK. Precast concrete is widely used for commercial and residential building projects in Germany, thereby expanding the market. France's increasing investment in renewable energy and infrastructure is further driving the demand for prefabricated concrete products. In the UK, growth in precast concrete applications is being experienced because of its increasing construction sector, including residential housing and transportation infrastructure. In addition, innovations in precast technology are benefitting the European market by making construction more efficient and eco-friendlier. These factors, coupled with government regulations promoting sustainable construction, contribute to Europe's rapid market growth. The region's commitment to reducing carbon footprints and improving energy efficiency is expected to continue driving the precast concrete market forward in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Boral Ltd. (Precast Concrete Panels, Precast Wall Systems, Precast Columns)

-

Holcim Ltd. (Precast Concrete Solutions, Precast Floor Elements, Precast Concrete Beams)

-

CEMEX S.A.B. de C.V. (Precast Concrete Structures, Precast Concrete Walls, Precast Concrete Pipes)

-

Larsen & Toubro Limited (Precast Concrete Walls, Precast Concrete Beams, Precast Concrete Slabs)

-

Forterra (Precast Concrete Pipe, Precast Concrete Wall Panels, Precast Concrete Lintels)

-

Tindall Corporation (Precast Concrete Wall Panels, Precast Concrete Parking Structures, Precast Concrete Beams)

-

Gulf Precast Concrete Co. LLC (Precast Concrete Elements, Precast Concrete Blocks, Precast Concrete Slabs)

-

Spancrete (Precast Concrete Slabs, Precast Concrete Beams, Precast Concrete Parking Structures)

-

Bouygues Construction (Precast Concrete Walls, Precast Concrete Slabs, Precast Concrete Columns)

-

Balfour Beatty plc (Precast Concrete Slabs, Precast Concrete Beams, Precast Concrete Foundations)

-

Oldcastle Infrastructure Inc. (Precast Concrete Manholes, Precast Concrete Pipes, Precast Concrete Vaults)

-

LafargeHolcim (Precast Concrete Panels, Precast Concrete Columns, Precast Concrete Beams)

-

Elementbau Osthessen GmbH & Co., ELO KG (Precast Concrete Slabs, Precast Concrete Walls, Precast Concrete Columns)

-

GÜlermak A.S. (Precast Concrete Panels, Precast Concrete Beams, Precast Concrete Slabs)

-

STECS (Precast Concrete Walls, Precast Concrete Beams, Precast Concrete Columns)

-

LAING O’Rourke (Precast Concrete Panels, Precast Concrete Slabs, Precast Concrete Bridges)

-

ACS Group (Precast Concrete Slabs, Precast Concrete Panels, Precast Concrete Foundations)

-

Kiewit Corporation (Precast Concrete Structures, Precast Concrete Columns, Precast Concrete Panels)

-

Skanska AB (Precast Concrete Walls, Precast Concrete Columns, Precast Concrete Slabs)

-

Red Sea Housing Services (Precast Concrete Buildings, Precast Concrete Walls, Precast Concrete Floors)

Recent Development:

-

October 2024: CEMEX has been chosen as the preferred concrete supplier for the Bogotá Metro Line 1. The collaboration will provide substantial demand for concrete in the construction of infrastructure in the city to achieve sustainable transport targets.

-

January 2024: Holcim has approved three strategic acquisitions in Europe focused on cementing its leadership position in the construction material space. They are focused on customer experience and operational strength across a multitude of geographies.

-

March 2023: Holcim bought the HM Factory in Poland, thereby increasing its production strength and its share in the Central and Eastern European markets. The purchase of this factory further boosts Holcim's expansion plan in the region.

-

February 2023: Forterra announced the efforts to produce low-carbon precast products in a move towards sustainability. The company unveiled innovative solutions to reduce carbon emissions related to the manufacture of precast concrete.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 136.2 Billion |

| Market Size by 2032 | US$ 224.3 Billion |

| CAGR | CAGR of 5.70% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Wet Concrete, Dry/Semi-dry Concrete) •By Element (Columns & Beams, Girders, Floors & Roofs, Walls & Barriers, Pipes, Paving Slabs, Others) •By Construction Type (Elemental Construction, Permanent Modular Buildings, Relocatable Construction) •By Application (Building Components, Transportation, Water & Waste Handling, Others) •By End-Use (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Boral Ltd., Holcim Ltd., CEMEX S.A.B. de C.V., Larsen & Toubro Limited, Forterra, Tindall Corporation, Gulf Precast Concrete Co. LLC, Spancrete, Bouygues Construction, Balfour Beatty plc and other key players |