Precision Oncology Market Report Scope & Overview:

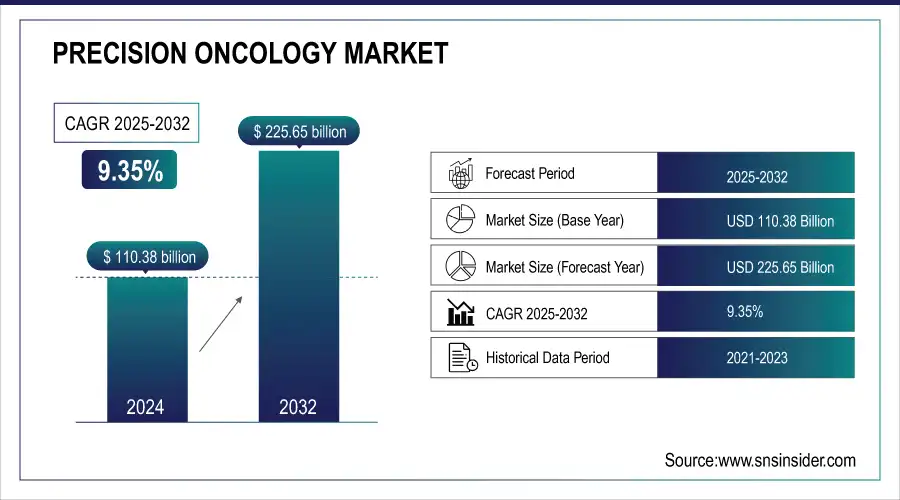

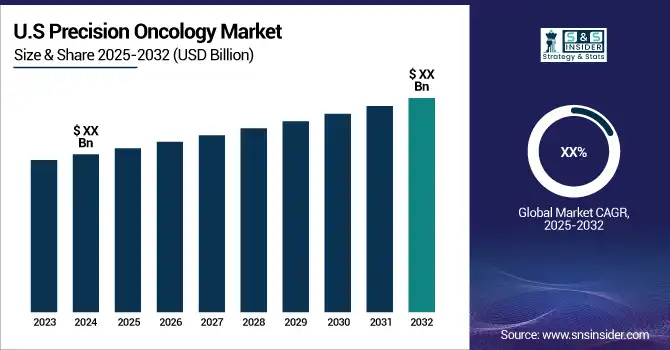

The Precision Oncology Market was valued at USD 110.38 billion in 2024 and is expected to reach USD 225.65 billion by 2032, growing at a CAGR of 9.35% from 2025-2032.

The precision oncology market is expected to experience significant growth in the coming years due to the high demand for personalized treatments in the fight against cancer. Personalized medicine not only provides patients with more information to make informed health decisions but also leads to increased patient engagement and a sense of control over their treatment plans. This ultimately contributes to better health outcomes, increased revenue for healthcare providers, and stronger patient-therapist relationships. The Department of Health and Human Services reports that actively engaged patients are more likely to adhere to their treatment plans. The integration of precision oncology with AI, big data analytics, and digital health options is expected to enhance patient outcomes and accelerate drug development.

Get More Information on Precision Oncology Market - Request Sample Report

Nanotechnology and AI have significantly improved the performance of cancer treatment by enabling the development of more precise diagnostic and treatment platforms. For instance, AI-based imaging has enhanced disease characterization on MRIs, leading to more accurate results. Additionally, nanomedicine has demonstrated the potential for revolutionizing cancer treatment through the AI-based design of biological devices known as nanomaterials. The National Institutes of Health (NIH) is focusing on the development of AI-enhanced nanosensors and other biological and nanomaterial devices, including nanoelectronics biosensors.

Precision Oncology Market Trends

-

Rising prevalence of cancer and demand for targeted therapies are fueling precision oncology adoption.

-

Integration of genomics, biomarkers, and molecular diagnostics is enabling more personalized treatment strategies.

-

AI and big data analytics are accelerating drug discovery, clinical decision-making, and patient stratification.

-

Growing use of companion diagnostics with targeted drugs is enhancing treatment accuracy and outcomes.

-

Liquid biopsies and next-gen sequencing (NGS) are transforming non-invasive cancer detection and monitoring.

-

Pharmaceutical companies are increasing collaborations with diagnostic firms to co-develop precision therapies.

-

Shift toward value-based healthcare is driving adoption of precision oncology for improved cost-effectiveness.

-

Expanding clinical trials in immuno-oncology and gene-based therapies is widening the treatment pipeline.

Precision Oncology Market Growth Drivers:

-

Rapid Advancements in Genomic Research and Growing Demand for Personalized Medicine Propel the Precision Oncology Market

The Precision Oncology Market is primarily driven by rapid advancements in genomic research, enabling detailed understanding of cancer at the molecular and genetic levels. These developments facilitate the identification of specific biomarkers, mutations, and pathways, allowing for highly targeted therapies. Simultaneously, there is a growing demand for personalized medicine as patients and healthcare providers increasingly prefer treatments tailored to individual genetic profiles, which improve efficacy and minimize side effects. Together, these factors accelerate the adoption of precision oncology solutions across hospitals, research centers, and biotechnology firms globally, fueling significant market growth.

Precision Oncology Market Restraints:

-

High Costs of Precision Oncology Treatments Pose a Significant Restraint on Market Growth

One of the key challenges restraining the Precision Oncology Market is the high cost of targeted therapies, genomic testing, and personalized treatment plans. These expenses limit accessibility, particularly in low- and middle-income regions, and place a financial burden on patients and healthcare systems. Additionally, the need for advanced laboratory infrastructure, specialized personnel, and ongoing monitoring further increases treatment costs. As a result, adoption rates of precision oncology solutions may be slower than expected, and market expansion is constrained despite strong technological advancements and growing awareness of personalized cancer therapies worldwide.

Precision Oncology Market Opportunities:

-

Integration of Artificial Intelligence and Big Data Analytics in Precision Oncology Presents Significant Growth Opportunities

The Precision Oncology Market stands to benefit greatly from the integration of artificial intelligence (AI) and big data analytics. These technologies enable the analysis of vast genomic, clinical, and patient data to identify patterns, predict treatment responses, and design personalized therapies with higher precision. AI-driven tools can accelerate drug discovery, optimize clinical trial design, and enhance decision-making for oncologists. The growing adoption of digital health platforms and advanced analytics in oncology provides opportunities for improved patient outcomes, cost efficiency, and faster market expansion, positioning AI and big data as key growth enablers.

Precision Oncology Market Segment Analysis

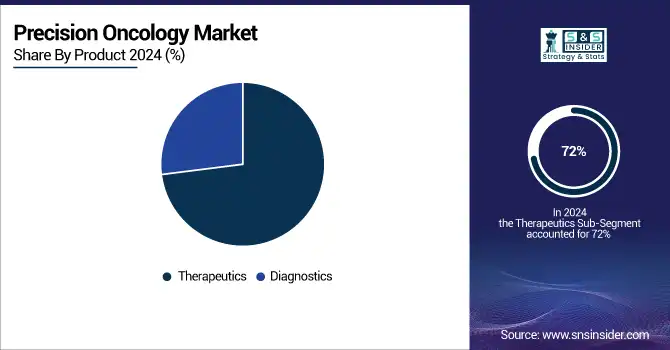

By Product, Therapeutics segment dominated in 2023 with a 72% revenue share

The therapeutics segment dominated the market with a 72% revenue share in 2024. This was mainly due to the increasing approval of tumor-agnostic therapies and the unique features of therapeutics targeting specific proteins or mutations driving cancer growth.

Additionally, the diagnostic tools segment is projected to experience rapid growth, with a 10.6% compound annual growth rate (CAGR) from 2025 to 2032. The diagnostic products available in the precision oncology market will be involved in verification and validation activities, relying on the outcomes from current tests. Moreover, the emergence of technological products for diagnostics has improved decision-making, leading to better clinical outcomes, reduced unnecessary therapies, minimized side effects, and prevention of drug resistance.

By Cancer Type, Breast cancer segment held the largest market share of 42% in 2024

By 2024, the breast cancer held the largest market share of 42%. This is subject to the increased focus on breast cancer screening, diagnosis, and surgical and radiation techniques. Furthermore, with expanded research activities, and technology revelations for DNA sequencing, relating to the early detection of breast cancer by patients the overall prognosis presents a growth factor for novel methods of development, especially precision oncology. Moreover, the cervical cancer segment is expected to offer the fastest CAGR of 10.7% over the forecast period. This is because of the growing research projects development in the sector including product launches like the CDC announcing a funding award of USD215 million.

Precision Oncology Market Regional Analysis

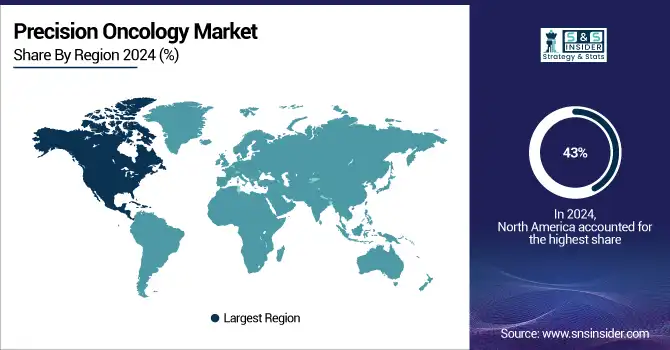

North America Precision Oncology Market Insights

In 2024, North America led the industry accounted for 43% of the market share. The industry in this region is competitive with the presence of most of the major market players including Thermo Fisher Scientific Inc., Invitae Corporation, Illumina, Inc., and Laboratory Corporation of America Holding. Further, a high cancer population, several types of research, the development of a diagnostic software platform, and increased healthcare spending offer new service growth opportunities.

Need any customization research on Precision Oncology Market - Enquiry Now

Asia Pacific Precision Oncology Market Insights

The Asia Pacific Precision Oncology Market is experiencing rapid growth, driven by rising cancer prevalence, increasing healthcare expenditure, and expanding genomic research initiatives. Countries like China, Japan, and India are witnessing higher adoption of targeted therapies and advanced diagnostic tools. Government support, growing awareness of personalized medicine, and investments in healthcare infrastructure are further accelerating market expansion across the region.

Europe Precision Oncology Market Insights

Europe’s Precision Oncology Market is witnessing steady growth due to advanced healthcare infrastructure, strong research initiatives, and high adoption of personalized cancer therapies. Countries such as Germany, France, and the UK are investing in genomic testing, targeted treatments, and clinical trials. Increasing awareness among patients, supportive government policies, and collaborations between biotech firms and healthcare providers are driving the region’s expanding precision oncology landscape.

Middle East & Africa and Latin America Precision Oncology Market Insights

The Precision Oncology Market in the Middle East & Africa and Latin America is growing steadily, driven by rising cancer incidence, increasing healthcare investments, and expanding access to advanced diagnostics and targeted therapies. Emerging economies are adopting personalized medicine initiatives, while government support and international collaborations enhance research and treatment capabilities, creating significant opportunities for market expansion across these regions.

Precision Oncology Market Competitive Landscape:

Illumina

Illumina is a leading contributor to the Precision Oncology Market, offering advanced genomic sequencing solutions that enable detailed cancer profiling and personalized treatment strategies. Its platforms facilitate high-throughput DNA and RNA analysis, supporting early diagnosis, therapy selection, and clinical research. By integrating innovative sequencing technologies, Illumina empowers clinicians and researchers to deliver precise, targeted oncology care, improving patient outcomes and advancing the adoption of personalized medicine worldwide.

-

Illumina (2025) Expanded its clinical oncology portfolio with FDA-approved TSO Comprehensive and new Pillar oncoReveal CDx panels—enabling in-house tumor profiling and accelerating targeted therapy decisions in community and academic clinical labs.

Foundation Medicine

Foundation Medicine is a prominent player in the Precision Oncology Market, specializing in comprehensive genomic profiling to guide personalized cancer therapies. Its solutions enable clinicians to identify actionable mutations, select targeted treatments, and improve patient outcomes. By integrating advanced diagnostics with real-world clinical data, Foundation Medicine supports precision oncology adoption across hospitals, research centers, and clinical trials, driving innovation in cancer care and expanding access to tailored therapeutic strategies.

-

Foundation Medicine (2025) Announced more than 15 abstracts to be presented at the ASCO 2025 meeting, showcasing clinical advances and real-world applications of its high-quality biomarker tests for informing cancer care.

-

Foundation Medicine (2024) Introduced FoundationOne®Liquid CDx as the first liquid biopsy FDA-approved companion diagnostic for tepotinib in MET exon 14 skipping non–small cell lung cancer, broadening precision treatment access.

-

Foundation Medicine & Roche (2023) Reported improved outcomes in a global trial (CUPISCO) using comprehensive genomic profiling (CGP) to guide treatment for patients with cancer of unknown primary, validating CGP’s therapeutic value.

Key Players

Some of the Precision Oncology Market Companies

-

Thermo Fisher Scientific Inc.

-

Invitae Corporation

-

Qiagen N.V.

-

Illumina, Inc.

-

Laboratory Corporation of America Holding

-

Exact Sciences Corporation

-

Rain Oncology Inc.

-

Strata Oncology, Inc.

-

Xilis, Inc.

-

Variantyx, Inc.

-

Bioserve

-

Relay Therapeutics

-

Acrivon Therapeutics

-

Foundation Medicine, Inc.

-

Guardant Health, Inc.

-

Nanostring Technologies, Inc.

-

Caris Life Sciences

-

Bio-Rad Laboratories, Inc.

-

Freenome Holdings, Inc.

-

Tempus Labs, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 110.38 Billion |

| Market Size by 2032 | US$ 225.65 Billion |

| CAGR | CAGR of 9.35% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Diagnostics, Therapeutics) •By Cancer Type (Breast Cancer, Colorectal Cancer, Cervical Cancer, Prostate Cancer, Lung Cancer, Others) •By End Use (Hospitals & Diagnostic Laboratories, Pharmaceutical & Biotechnology Companies, Healthcare Data Companies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific Inc., Invitae Corporation, Qiagen N.V., Illumina, Inc., Laboratory Corporation of America Holding, Exact Sciences Corporation, Rain Oncology Inc., Strata Oncology, Inc., Xilis, Inc., Variantyx, Inc., Bioserve, Relay Therapeutics, Acrivon Therapeutics, Foundation Medicine, Inc., Guardant Health, Inc., Nanostring Technologies, Inc., Caris Life Sciences, Bio-Rad Laboratories, Inc., Freenome Holdings, Inc., Tempus Labs, Inc. |