Sleep Tech Market Report Scope & Overview:

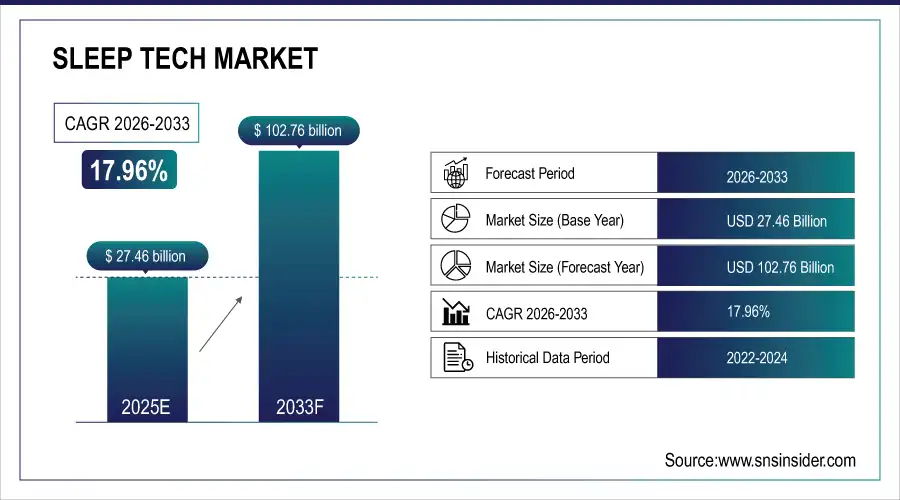

The Sleep Tech Market Size was valued at USD 27.46 Billion in 2025E and is projected to reach USD 102.76 Billion by 2033, growing at a CAGR of 17.96% during the forecast period 2026–2033.

Sleep Tech analysis details performance trends and developments in the category, as well as market value and growth. The market is segmented by product type, end user (residential, healthcare, wellness centers and hospitality), technology and distribution channel such as online retail, specialty stores and medical equipment stores. Growth can be attributed to factors such as prevalence of sleep disorder, growing awareness about the health consequences of snoring and adoption percentage of innovative gadgets.

Sleep trackers and wearables accounted for 35% of the Sleep Tech Market in 2025, driven by rising awareness of sleep disorders and growing adoption of smart health devices.

Market Size and Forecast:

-

Market Size in 2025: USD 27.46 Billion

-

Market Size by 2033: USD 102.76 Billion

-

CAGR: 17.96% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Sleep Tech Market - Request Free Sample Report

Sleep Tech Market Trends:

-

Growth in awareness of sleep disorders and wellness has had a high demand for custom sleep tracking devices and smart sleep solutions.

-

AI, IoT and mobile application integration is making for smarter, connected sleep tracking and more effective sleeping habits.

-

Sleep Tech Phenomenon Luxury and tech-enabled sleep products like smart mattresses and wearables are appealing to a new generation of health-conscientious consumers.

-

E-commerce and your favorite specialty retailers are making it easier to access sleep tech products that were previously niche, if not downright unusual.

-

Increasing disposable incomes, urbanisation, and focus on wellness is supporting the uptake of advanced sleep technology in developing countries.

U.S. Sleep Tech Market Insights:

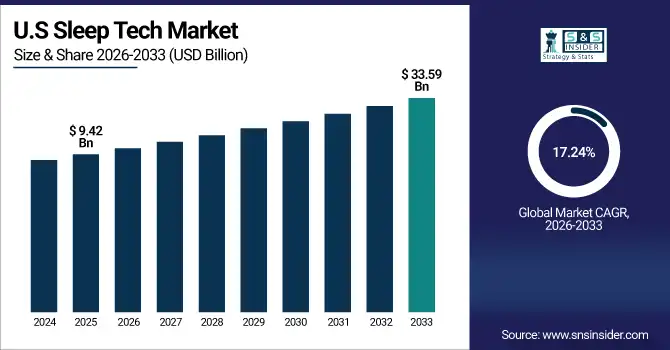

The U.S. Sleep Tech Market will expand from USD 9.42 Billion in 2025E to USD 33.59 Billion by 2033, growing at a CAGR of 17.24%. Growth is driven by the uptake of CPAP devices, smart mattresses, wearables and further expansion in e-commerce and specialty medical equipment distribution.

Sleep Tech Market Growth Drivers:

-

Rising prevalence of sleep disorders and growing health consciousness are accelerating global adoption of advanced sleep technologies.

The Sleep Tech Market growth is due to rising prevalence of sleep disorders and increasing health awareness across emerging and developed regions. The volumes of sleep tracking devices and smart sleep solutions will see the number of units shipped rise above 500 million by 2033, versus around 150 million in 2025, driven by urbanisation, rising wellness trends and connected health uptake. Increase in online sales and specialty channels: are also boosting market growth across the globe.

Rising awareness of sleep disorders and wellness drove nearly 40% of global Sleep Tech adoption in 2025, led by sleep trackers and wearables.

Sleep Tech Market Restraints:

-

Data privacy concerns and regulatory restrictions on medical devices hinder adoption and slow growth of sleep technology solutions.

Data privacy issues and strict medical device regulations are hindering the growth of the Sleep Tech Market. Almost a third of manufacturers report difficulties in meeting device safeguarding or certification requirements, especially in North America and Europe. They suppress innovation, delay putting product onto the market and are a barrier to entry for smaller players. However, increasing consumer wariness around personal heath data and sluggish regulatory approvals continue to hinder adoption of connected sleep technologies worldwide.

Sleep Tech Market Opportunities:

-

Growing interest in personalized wellness and smart home integration presents significant global expansion opportunities for sleep technologies.

New opportunities in the Sleep Tech Market are on account of growing demand for customized well-being and smart home connectivity. 35% of next-generation sleep tech products will have AI-based monitoring, mobile app integration or smart home compatibility by 2025 For health-focused consumers. Increased online retail, specialty store, and wearable technology channels will make these solutions more widely available, and drive strong market growth through 2033.

Introduction of personalized sleep solutions and connected wellness devices represented nearly 38% of global Sleep Tech product launches in 2025.

Sleep Tech Market Segmentation Analysis:

-

By Product Type, Sleep Trackers held the largest market share of 35.42% in 2025, while Smart Mattresses are expected to grow at the fastest CAGR of 19.23%.

-

By End User, Residential / Household accounted for the highest market share of 48.19% in 2025, and Wellness & Fitness Centers are projected to record the fastest CAGR of 20.01%.

-

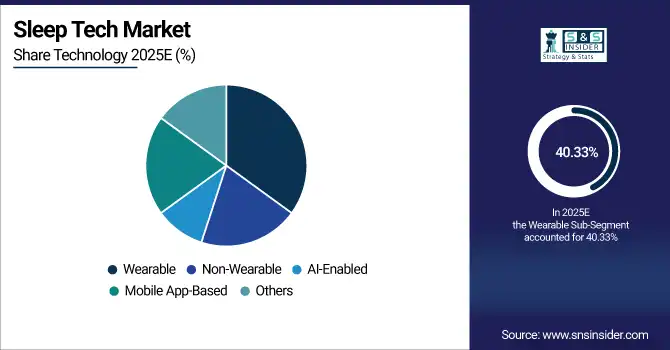

By Technology, Wearable Devices held the largest share of 40.33% in 2025, while AI-Enabled Solutions are expected to grow at the fastest CAGR of 21.07%.

-

By Distribution Channel, Online Retail held the largest share of 38.92% in 2025, while Specialty Stores are projected to record the fastest CAGR of 20.55%.

By Product Type, Sleep Trackers Lead While Smart Mattresses Expand Rapidly:

Sleep Trackers dominated by totaling over 150 million devices in 2025 due to low cost, user-friendly product design and high levels of consumer acceptance of wrist-worn health monitoring products. Their strong brand recognition, integration with mobile apps and constantly improving software continue to set them apart from the competition. Smarter Mattresses, (95 million units in 2025), are fast-growing sector as AI-driven sleep optimization, premium comfort features and intelligence to connect with the home become standard. Quick adoption has been fueled by growing consumer demand for personalized well-being.

By End User, Residential / Household Lead While Wellness & Fitness Centers Expand Rapidly:

Residential/ Homecare adoption dominated with more than 220 million units by 2025, on account of individual focus towards well-being along with ease and familiarity of home health monitoring. Rising consciousness among the populace about sleep problems and lifestyle wellness trends also boost demand. Wellness & Fitness Centers (85 million units) are the fast-growing sector, as gyms and wellness retreats incorporate sleep tracking into their broader wellness offerings. Increasing corporate health programs and professional healthcare practices are further fueling adoption in this space.

By Technology, Wearable Devices Lead While AI-Enabled Solutions Expand Rapidly:

Wearable sensors dominated with over 160 million units in 2025 due to portability, real-time tracking and the acceptance of health wearables. There’s also a strong measure of lock-in with fitness apps and brand loyalty. Despite being smaller (60 million units in 2025), AI-Enabled Solutions are fast-growing, driven by predictive analytics, personalized sleep insights, and smart home integration. Growing interest in data-oriented health and connected ecosystems fueling rapid AI adoption.

By Distribution Channel, Online Retail Lead While Specialty Stores Expand Rapidly:

Online Retail dominated with more than 180 million units sold in 2025, on account of convenience, availability of vast range of products, competitive pricing and direct-to-consumer access. Quick shipping and hassle-free returns continue to keep it in the lead. Specialty Stores, (70 million units in 2025) are fast growing due to custom in-store demos, higher shelf products and expert advice. Increasing interest with boutique and wellness-based retail experiences, the high-touch segment is driving uptake.

Sleep Tech Market Regional Analysis:

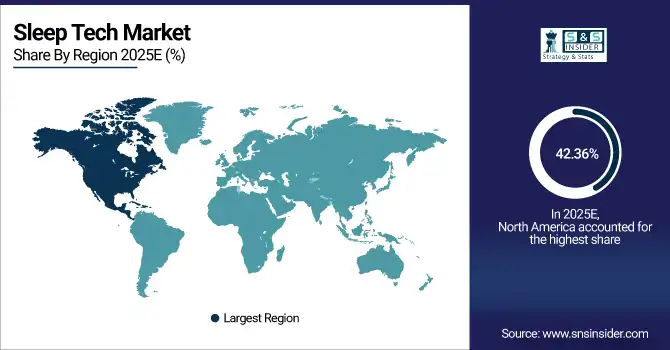

North America Sleep Tech Market Insights:

The North America Sleep Tech Market dominated with 42.36% of share in 2025, driven by strong adoption of smart mattresses, sleep trackers, and CPAP devices. The U.S and Canada saw over 18 million units’ worth of demand driven by rising sleep disorder diagnoses and growing healthcare infrastructure. Increasing consumer preference for connected health ecosystems and high-quality sleep solutions further supplements regional centrality, as online avenues and specialty suppliers extend product availability among urban inhabitants.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Sleep Tech Market Insights:

The U.S. used more than 18 million sleep tech devices from some 250 top brands in 2025. 11 million units were sold online and through specialty retailers, whereas 7 million were distributed to medical equipment store. The Growth is projected to be helped by increasing demand for smart mattresses, sleep trackers and CPAP machines.

Asia-Pacific Sleep Tech Market Insights:

Asia-Pacific Sleep Tech Market is a fast-growing market with CAGR of 19.41%, over 9.5 million units sold in 2025 driven by China (4.2 million units) and Japan (2.1 million units). Smart mattresses and sleep trackers took a healthy chunk of the market, while CPAP machines’ popularity has been expanding. Growing disposable income, urbanisation and health consciousness are the factors that are encouraging adoption of this product with growing e-commerce as well as speciality wellness retailers fuelling its growth.

China Sleep Tech Market Insights:

In 2025, China consumed about 4.2 million sleep tech devices largely smart mattresses and sleep trackers. Roughly 2.5 million were sold through online retail and specialty stores, with the rest distributed to medical equipment stores. Its growing themes are disposable income on the rise, urbanization and a growing interest in sleep wellness around the country.

Europe Sleep Tech Market Insights:

The Europe Sleep Tech Market in 2025 for 6.5 million units, Germany about 1.8 million units, the UK about 1.5 million and France around 1.2 million unit counted market volume of forecasted time frame was. Some 3.8 million units were from online retail and specialty stores, while 2.7 million came via medical equipment stores. Growth will be bolstered by a growing health consciousness, rising disposable income levels, urbanization and the adoption of premium and connected sleep solutions in the region.

Germany Sleep Tech Market Insights:

The German population used 1.8 million sleep tech products in 2025, with around 2 million units sold (1 million from online retail and specialty stores, the rest through medical equipment stores). Smart mattresses and sleep trackers saw the lion’s share of success, propelled by an increasing health consciousness, disposable income and uptake of premium connected sleep solutions.

Latin America Sleep Tech Market Insights:

In 2025, Latin America consumed 0.8 million devices with Brazil (0.35 million units), Argentina (0.2 million units) and Chile (0.15 million units) being the main markets. Nearly half of the 0.5 million units wholesale drawn through retail and a third to online channels. Growth is attributed to increasing awareness of health, urbanization and growing penetration of smart mattresses and sleep trackers.

Middle East and Africa Sleep Tech Market Insights:

In 2025, the Middle East and Africa market consumed about 0.55 million sleep tech devices, of which 0.35 million were realised through retail and 0.2 million through web based sales channels. It was still the domain of smart mattresses, sleep trackers and CPAP machines. This is driven by the increasing health consciousness, urbanisation and preference of connected wellness & premium sleep solutions across the region.

Sleep Tech Market Competitive Landscape:

Apple Inc. Apple is one of the leaders in the sleep tech market, with its Apple Watch Series 11 featuring more advanced tracking and health features. The Sleep Score and sleep apnea notifications yield actionable results for users. Apple leads the way in making it seamless and well-integrated into their ecosystem, continuous focus on health innovation, and that they have a strong brand following. Apple is a leader in smart wearable sleep technology, both in retail and online market presence, setting industry standards.

-

In September 2025, Apple also added a new daily Sleep Score in Apple first watchOS 26 to give you a number representing last night’s restfulness. The said feature can be found on the Apple Watch Series 6 and later models, making the sleep tracking experience better for its users.

Fitbit, top player in the category of wearable sleep tracking devices, they known for its detailed sleep analysis as well as monitoring heart rate and activity. By 2023, over 6.6 million units had been sold, indicating its market strength. Fitbit wins on intuitive design, holistic health insights and support for Google services. Its broad retail presence in stores across the country and online, along with groundbreaking innovation in wearable wellness tech makes it a global leader in sleep tech end-market.

-

In August 2025, Fitbit released an update to their sleep tracking algorithm, increasing accuracy of sleep stages by more effectively identifying short awakenings. This further enables accurate monitoring of sleep patterns which is in favour for user with specific demands on sleep analysis.

Oura Health sells smart rings for sleep and wellness tracking and had sold more than 5.5 million units by 2025. Its rings track sleep stages, heart rate and body temperature with impressive precision. It’s Oura, thanks to its accurate data analysis, the comfort of the ring and emphasis on full-body wellness information. Supported by successful e-commerce distribution and increasing reception among health-minded consumers, Oura Health is widely recognized as a leader in the global sleep tech industry.

-

In June 2025, Oura Health was included in the TIME’s 100 Most Influential Companies for 2025 due to its work on health-monitoring smart rings. The company is still making inroads toward ensuring the products that it delivers provide users with a holistic view of their health.

Sleep Tech Market Key Players:

Some of the Sleep Tech Market Companies are:

-

Apple Inc.

-

Fitbit (Google)

-

Oura Health

-

Philips

-

ResMed

-

Sleep Number

-

Garmin

-

Xiaomi

-

Casper

-

Sleepace

-

Withings

-

Dreem

-

Onera Health

-

Nokia Health

-

Apnimed

-

ProSomnus

-

Muse

-

Jawbone

-

NeuroSky

-

Biotricity

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 27.46 Billion |

| Market Size by 2033 | USD 102.76 Billion |

| CAGR | CAGR of 17.96% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Sleep Apnea Devices, Smart Mattresses, Sleep Trackers, Wearables, White Noise & Sound Devices, Light Therapy Devices, Others) • By End User (Residential/Household, Healthcare Facilities, Wellness & Fitness Centers, Hospitality, Others) • By Technology (Wearable, Non-Wearable, Mobile App-Based, AI-Enabled, Others) • By Distribution Channel (Online Retail, Specialty Stores, Medical Equipment Stores, Supermarkets & Hypermarkets, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Apple Inc., Fitbit (Google), Oura Health, Philips, ResMed, Sleep Number, Garmin, Xiaomi, Casper, Sleepace, Withings, Dreem, Onera Health, Nokia Health, Apnimed, ProSomnus, Muse, Jawbone, NeuroSky, Biotricity |