Procure-to-Pay Solution Market Report Scope & Overview:

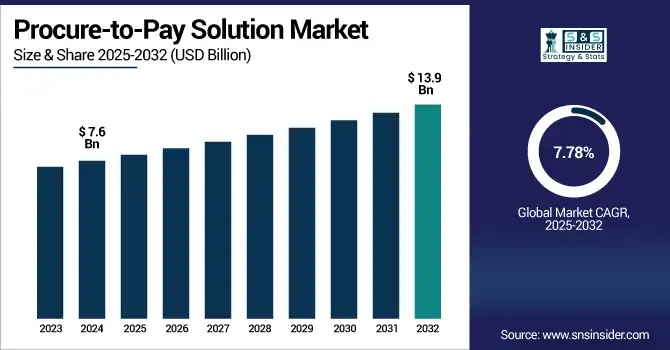

The procure-to-pay solution market size was valued at USD 7.6 billion in 2024 and is expected to reach USD 13.9 billion by 2032, growing at a CAGR of 7.78% during 2025-2032.

To Get more information on Procure-to-Pay Solution Market - Request Free Sample Report

Procure-to-Pay Solution Market growth is driven by the rising demand for E2E procurement automation, real-time financial visibility, and improved collaboration with suppliers. The slow old days of procure-to-pay (P2P) with inefficient processes are gone, and organizations are increasingly adopting P2P solutions to streamline procurement, invoice processing, compliance management, and payment automation. The combination of AI, analytics, and cloud-based platforms is heralding widespread adoption across industries such as manufacturing, retail, BFSI, and healthcare. Growth has also been driven by remote work and digital workflows after the pandemic. From SMEs to large enterprises, everyone is investing in scalable P2P platforms to reduce costs and optimize procurement cycle time. According to the report, the increasing demand for digital transformation initiatives, vendor management needs, and the globalization of SaaS based procurement platforms globally sets up the market for strong growth through 2032.

The Procure-to-Pay Solution Market in the US is experiencing robust growth driven by the rising adoption of digital procurement tools, automation of compliance workflows, and cloud-based financial operations. In 2024, the market was valued at USD 2.1 billion and is projected to reach USD 3.8 billion by 2032, growing at a CAGR of 7.55%. The procure-to-pay solution market trend includes the rapid rise of AI-driven platforms that enable real-time spend analytics, dynamic supplier management, and predictive procurement capabilities.

Market Dynamics:

Drivers:

-

Surging Adoption of End-to-End Procure-to-Pay Solutions for Operational Efficiency Propel Market Growth

One of the primary drivers of market growth is the growing need for easy procurement processes across various industries. To minimize manual work, cut down the procurement cycle times, and ensure seamless connectivity between the procurement and finance departments, organizations are adopting procure-to-pay solutions. These platforms provide improved oversight for purchases, invoice matching, and payment approvals to enhance compliance and reduce costs. It gives real-time spend visibility, helps in monitoring supplier performance, and fosters strategic sourcing with the help of automation. As a complex of supply chains emerges in a globally interconnected region Automation and optimization of procurement workflow from simplicity and fragmentation into a unified strategy of practice becomes advantageous hence making every medium scale of enterprise and SME moving ahead towards and enjoying the competitive edge with robust P2P solution in place.

For instance, Organizations implementing full P2P automation achieved a 45% reduction in invoice processing time, as highlighted in the 2024 Ardent Partners ePayables Study.

Restraints:

-

Limited Adoption Among Small and Mid-Sized Enterprises Impede Market Growth

However, high initial costs related to the implementation and integration of procure-to-pay solutions are a major restraint on the market. Many of these platforms require businesses to replace their current legacy systems or ERP frameworks, which come with a price tag, both in infrastructure and licensing costs, and in costly training for employees. Moreover, for large enterprises with diverse global operations, integration with various procurement, finance, and vendor systems can be unwieldy. Such barriers may dissuade smaller and mid-tier organizations with constrained spending power from using P2P systems. Very tedious deployment and change management processes delay market penetration further, especially in traditional or highly regulated industries.

For instance, 52% of procurement organizations have deployed AI chatbots for handling supplier inquiries, streamlining communication and improving response times

Opportunities:

-

Enabling Intelligent, Real-Time Procurement, and Spend Management Creates Market Growth Opportunities

This is a significant market opportunity in procure-to-pay solutions, which can be addressed due to the convergence of artificial intelligence and advanced analytics. AI-enabled P2P platforms can automate repetitive tasks, such as invoice matching and fraud detection and provide relevant recommendations for developing your procurement strategy. Predictive analytics improves demand forecasting, supplier risk evaluation, and tracking of the budget altogether in real time. But with the increased emphasis on visibility and control over spend management, these powerful technologies are taking center stage in next-generation P2P systems. In addition, all of these capabilities are scalable and affordable using cloud-based platforms, even for smaller firms. As AI and machine learning continue to mature, further efficiency leaps are anticipated, which likely will lead to broader adoption in the foreseeable future.

Challenges:

-

Increasing Complexity in Deployment and Vendor Selection Create Challenges for Market Expansion

Digitized data provides room for several unknown challenges, the most important being data security and compliance, which could hamper the growth of the procure-to-pay solution market. Since P2P systems deal with a lot of sensitive financial, supplier, or transactional data, they have become a prime target for cyberattacks and fraud. Beyond that, organizations have to stay compliant with a convoluted array of regulations including tax laws, procurement policies, and cross-border trade compliance, among others. Non-compliance can lead to fines or reputational harm. It is the responsibility of cloud-based P2P platforms to comply with stringent data protection protocols such as GDPR or HIPAA (if relevant). That requirement for strong cybersecurity and ongoing monitoring makes implementation more complex and costly, especially for more risk-averse firms, which may find themselves taking a breath before fully embracing the technology.

Segmentation Analysis:

By Deployment:

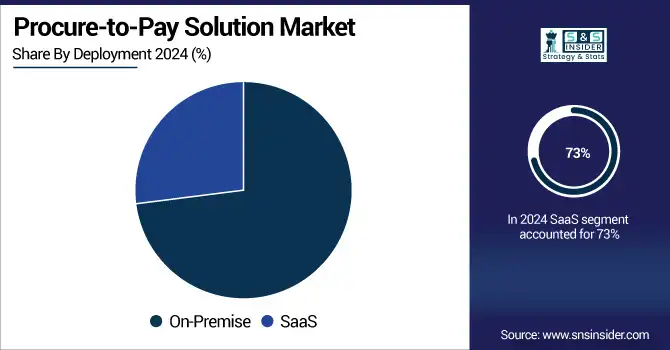

The SaaS segment dominated the market and represented a revenue share of more than 73% of revenue share and is projected to register the fastest CAGR through 2032. This growth is backed by the demand for scalable, cost-effective, and quickly deploying procurement solutions. The advantages of SaaS that make it preferable for enterprises are remote access, easy availability on all the ERP systems, and continuous updates. The SaaS model is expected to gain traction as adoption rises across both SMEs and large organizations. AI-enabled cloud-native platforms and real-time analytics are providing a further tailwind to this demand. SaaS is expected to retain dominance through 2032, with increased digital transformation projects, enhanced cybersecurity capabilities, and the transition towards subscription-based procurement ecosystems.

In July 2024, SAP introduced an enhanced cloud-native procure-to-pay offering focused on real-time analytics and improved supplier collaboration, reinforcing SaaS's scalability and efficiency advantages

By Enterprise Size:

The large enterprise segment dominated the market in 2024 and accounted for 65% of the procure-to-pay solution market share, due to leading technology providers, as a result of large corporations having complex procurement processes, broader vendor ecosystems, and more digital transformation capabilities. Such organizations require enterprise-grade solutions with built-in compliance, analytics, and automation capabilities. With global supply chains evolving fast and risk management becoming paramount, the vast deployment of AI-infused and ERP-integrated P2P platforms by large enterprises is an inevitable trend.

A G2 survey in April 2025 found that more than two-thirds of enterprise buyers are paying premiums for AI in procurement software. Nearly 50% switched vendors seeking better AI features.

The SMB segment is projected to grow at the fastest CAGR through 2032, owing to low-cost, scalable SaaS-based P2P platforms that are increasingly accessible. Rising awareness of procurement efficiency, control of cost, and vendor automation in conjunction with the current shift toward lightweight, cloud-native solutions, to reduce the burden of infrastructure costs, are trends supporting the growth of the SME domain. They provide AI, analytics, and real-time spend visibility, but for smaller operations. With a more pronounced embrace of digitalization than ever before, SMBs will turn to automation at a sharper clip to maintain competitive positions, serving as a primary growth driver in the P2P space in the years ahead.

By End-User Industry:

The BFSI segment dominated the procure-to-pay solution market in 2024 and accounted for a significant revenue share, due to the complex nature of financial operations, the high volume of transactions, and strict compliance with regulations in the environment. Banks and insurance companies are focusing on automation to improve the procurement process, mitigate the risk of fraud, and enable auditability. Adoption trends are further fueled by a heightened focus surrounding real-time analytics, centralized procurement, and secure financial workflows. In 2032, the BFSI sector will continue to be the dominant adopter as institutions will keep investing more in P2P platforms integrated with AI to facilitate changing compliance standards, enhance supplier governance, and improve spend management due to rising digitization and the need for risk mitigation.

The healthcare segment is projected to register the fastest CAGR through 2032, owing to rising demand for transparency in procurement, controlling costs, and expediently using a digitized inventory. The procure-to-pay platforms offer supply chain management for critical items, automate vendor transactions, and ensure operational resilience, and hence are being adopted by hospitals, clinics, and research institutions. This shift has been further hurried by post post-pandemic need to digitize healthcare infrastructure. Healthcare type will capture growth across the P2P market till 2032 as conformity regulations can be mitigated more efficiently in a wrinkly environment owing to a plethora of sustainability pressures, and growth propelled by AI-enabled tools for human resource optimization, mobile-enabled procurement, and cloud-based solutions for budget optimization and supply chain risks across the sector.

Regional Analysis:

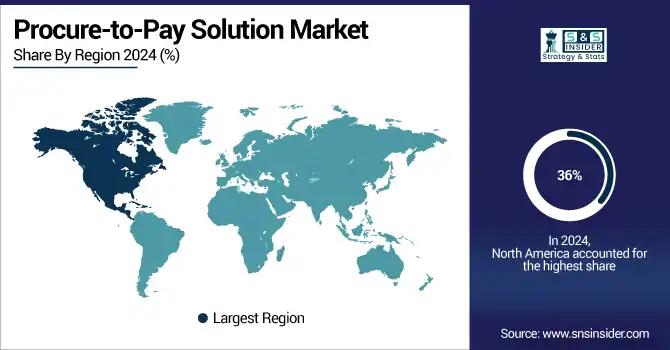

North America dominated the procure-to-pay solution market and accounted for 36% of revenue share, owing to the adoption of SaaS at a comparatively early age, strong digital infrastructure, and huge IT spending across industries, such as BFSI, healthcare, and telecom. Automation, compliance, and real-time analytics are top priorities for enterprises, driving rapid adoption. The region will remain dominant until 2032, owing to the sustained investment in AI-based procurement solutions, supplier risk management, and cloud-native platforms.

According to the procure-to-pay solution market analysis, Asia Pacific is projected to grow at the fastest rate during the forecast period. fueled by fast-paced digital transformation, higher SaaS adoption, and greater procurement automation in developing countries such as India and China. Scalable, cost-effective, and mobile-first procurement tools are in demand by businesses. APAC will grow to be the largest, fastest-growing region by 2032 due to increasing regional compliance, the rise of AI, and the adoption of cloud-based procurement.

Europe’s Procure-to-Pay market is driven by stringent regulations (GDPR, eInvoicing mandates), fueling growth in the region. The rapid adoption of AI in procurement (particularly in the DACH region) and emphasis on sustainability are also significant drivers of the Procure-to-Pay market in Europe. Demand for integrated, cloud-based, ESG-aligned procurement platforms capable of supporting multilingual, multi-currency buy-side procurement across manufacturing, BFSI, and public sectors will grow through 2032.

Germany leads Europe's Procure-to-Pay market due to its advanced manufacturing base, early ERP digitization, and strong demand for supplier risk and compliance tools. By 2032, AI-powered and SAP-integrated platforms will experience expanded use as German enterprises prioritize automation, cost control, and procurement resilience in global supply chains.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major Procure-to-Pay solution market companies are SAP SE, Oracle Corporation, Coupa Software, Basware, Zycus, GEP, JAGGAER, Tradeshift, Ivalua, IBM Corporation, and others.

Recent Developments:

-

In March 2025, Oracle Corporation was named a Leader in Gartner’s Magic Quadrant for Source-to-Pay Suites for its Fusion Cloud Procurement, featuring embedded generative AI for sourcing, contract authoring, and supplier engagement.

-

In April 2024, Coupa Software launched Coupa Navi, a generative AI assistant for procurement users, and announced a roadmap for AI agents to autonomously manage transactions.

-

In September 2024, Coupa Software appointed Salvatore Lombardo as Chief Product & Technology Officer to lead AI-first product transformation.

|

Report Attributes |

Details |

|

Market Size in 2024 |

US$ 7.6 Billion |

|

Market Size by 2032 |

US$ 13.9 Billion |

|

CAGR |

CAGR of 7.78% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Deployment (On-Premise, SaaS) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

|

Company Profiles |

SAP SE, Oracle Corporation, Coupa Software, Basware, Zycus, GEP, JAGGAER, Tradeshift, Ivalua, IBM Corporation and others in the report |