Digital Accessibility Software Market Report Scope & Overview:

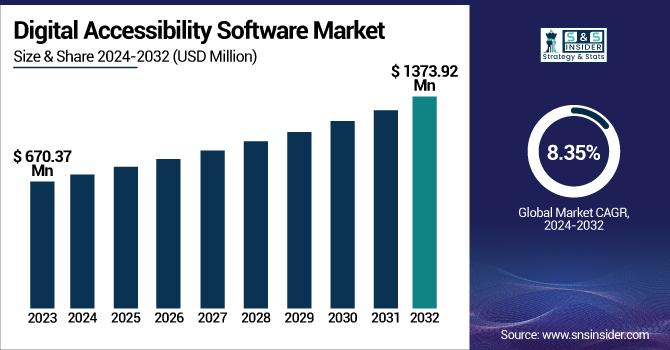

The Digital Accessibility Software Market was valued at USD 670.37 million in 2023 and is expected to reach USD 1373.92 million by 2032, growing at a CAGR of 8.35% from 2024-2032.

To Get more information on Digital Accessibility Software Market - Request Free Sample Report

This report includes key insights on user demographics and accessibility needs, highlighting the demand for solutions that cater to diverse user groups, including those with disabilities. It also examines the regulatory impact, with increasing regulations driving the adoption of digital accessibility standards. Funding and investment trends indicate strong financial support for the sector, spurring innovation. Additionally, AI integration in accessibility tools is enhancing user experiences, providing smarter solutions for diverse accessibility challenges. The market is poised for growth as technology advances and accessibility becomes a priority for businesses and governments worldwide.

U.S. Digital Accessibility Software Market was valued at USD 211.09 million in 2023 and is expected to reach USD 431.50 million by 2032, growing at a CAGR of 8.27% from 2024-2032. The growth of the U.S. Digital Accessibility Software Market is driven by increasing regulatory requirements for accessible digital experiences, boosting demand for compliance solutions. The rise in awareness of inclusivity, along with a growing number of individuals with disabilities, is pushing businesses to prioritize digital accessibility. Additionally, advancements in AI and machine learning are enhancing the efficiency and effectiveness of accessibility tools. Increased investment in technology innovation and support for accessibility initiatives further accelerates market growth.

Digital Accessibility Software Market Dynamics

Drivers

-

Businesses Drive Digital Accessibility Adoption by Aligning with ESG, DEI, and CSR Initiatives to Enhance Inclusivity, Compliance, and Market Reach.

Companies globally are focusing on inclusivity and sustainability, aligning their strategies with Environmental, Social, and Governance (ESG) guidelines and Diversity, Equity, and Inclusion (DEI) initiatives. As firms focus on corporate social responsibility (CSR), the need for digital accessibility solutions has been growing. Making digital platforms accessible to people with disabilities is now a significant part of brand reputation, customer interaction, and regulatory requirements. Businesses acknowledge that accessible digital experiences increase user reach, customer satisfaction, and legal compliance. Moreover, accessibility efforts enable employee productivity through inclusive digital work environments. By embedding accessibility solutions within their digital ecosystems, businesses are not only complying with ethical and legal requirements but also achieving a competitive edge in a more responsible and consumer-aware marketplace.

Restraints

-

High Costs of Developing and Maintaining Digital Accessibility Solutions Hinder Adoption, Especially for Small and Medium Enterprises (SMEs) with Limited Budgets.

Creating and sustaining accessible digital platforms requires huge financial outlays, which prove to be challenging for organizations, especially small and medium enterprises (SMEs). The expense of incorporating accessibility tools, redesigning websites, and maintaining compliance with changing regulations can be staggering. Many businesses struggle to allocate budgets for specialized software, expert consultations, and continuous updates to meet accessibility standards. Additionally, implementing accessibility solutions often requires employee training and IT system upgrades, further increasing expenses. For SMEs operating with limited financial flexibility, these costs can delay or prevent adoption, despite the long-term benefits of inclusivity and legal compliance. Absent from cost-saving remedies or monetary inducements, most companies could put accessibility work on the backburner, curtailing comprehensive application of accessible digital experiences industry-wide.

Opportunities

-

AI and Machine Learning Drive Automated Digital Accessibility Solutions, Reducing Costs and Enhancing Inclusivity Across Industries.

A combination of artificial intelligence (AI) and machine learning is changing digital accessibility into automated solutions for improved user experience at lower costs and reduced manpower. Artificial intelligence -powered technology, including real-time captioning, voice-to-text, and automated alternative text, is providing digital content in a form accessible to those with disabilities. Technologies automate compliance with accessibility requirements at a much reduced level of human intervention. More and more businesses are adopting AI-based solutions for enhancing site navigation, text-to-speech conversions, and adaptive user interfaces in order to become inclusive at moderate development expense. As technology develops further, digital accessibility solutions will be more intelligent, scalable, and efficient, promoting mass adoption across industries. The capabilities to offer seamless, automated accessibility features are transforming the way organizations embrace inclusivity in the digital environment.

Challenges

-

Evolving and Region-Specific Accessibility Regulations Make Consistent Compliance Difficult for Businesses Operating Across Global Markets.

Organizations are increasingly struggling with compliance with digital accessibility legislation because of changing standards and region-specific legislative requirements. Legislation on accessibility, including the Americans with Disabilities Act (ADA), Web Content Accessibility Guidelines (WCAG), and the European Accessibility Act, differs across regions, making it difficult for organizations to find common solutions. Multi-nationals have to deal with a complicated regulatory environment, where in many cases several compliance approaches are needed to cover diverse legal environments. Relatively frequent updates to accessibility guidelines complicate compliance, calling for ongoing surveillance and updating. Furthermore, the absence of a unified enforcement framework causes uncertainty, causing some companies to defer accessibility until court proceedings are initiated. Without global standardized policies, obtaining uniform digital accessibility compliance is still an insurmountable barrier, affecting the adoption and deployment processes.

Digital Accessibility Software Market Segment Analysis

By Offering

Website Accessibility Software held the highest revenue share of approximately 78% in the Digital Accessibility Software Market in 2023. Its dominance stems from the increasing regulatory compliance requirements and the growing demand for inclusive web experiences. Businesses and organizations prioritize website accessibility to meet legal mandates such as WCAG guidelines and ADA regulations. Additionally, rising digital transformation efforts across industries have fueled investments in accessibility solutions. The widespread adoption of e-commerce, online education, and digital services further reinforces its market leadership.

Color Contrast Checker Software is expected to expand at the fastest CAGR of approximately 10.34% during the period 2024-2032. Expansion is fueled by growing awareness about visual disabilities and the demand for accessible digital media. Tighter compliance regulations compel organizations to adopt contrast-checking tools in their design processes. In addition, the increasing use of AI-based accessibility testing and automation has improved contrast-checking solutions in terms of efficiency. The expanding use of web and mobile design best practices continues to fuel demand for this software.

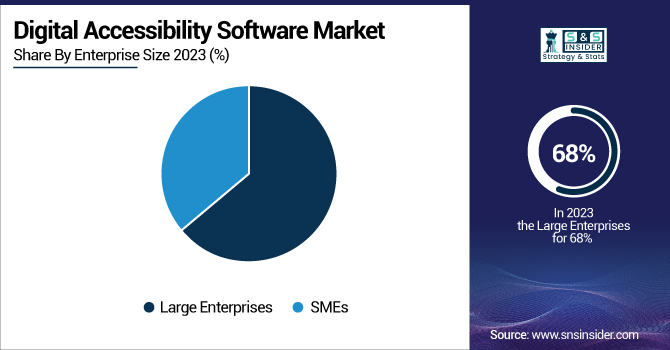

By Enterprise Size

Large Businesses commanded the largest revenue percentage of about 68% in the Digital Accessibility Software Market in 2023. This is driven by significant budgets for observance of accessibility law and a desire to advance digital inclusivity over large numbers of customers. Large Businesses include accessibility among their priorities to avoid legal consequences, build a positive brand image, and target multiple audiences. Furthermore, their mass-scale online activities, such as sites, apps, and internal websites, require sophisticated accessibility solutions, driving adoption and market share leadership even further.

SMEs are expected to expand with the fastest CAGR of around 9.89% during 2024-2032. The growth is boosted by growing awareness of accessibility compliance as well as the affordability of cloud solutions. Inclusivity drives from government drives the adoption of accessibility software by SMEs. Competitive pressures also drive smaller companies to make users a priority for wider customer access. Growth of AI-based, affordable accessibility tools also allows SMEs to accommodate compliance measures without heavy financial burdens.

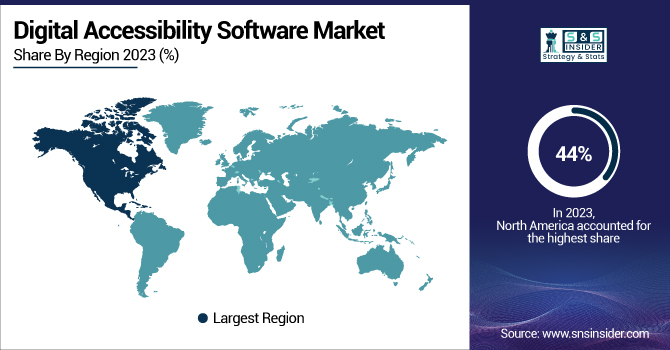

Regional Analysis

North America held the highest revenue share of approximately 44% in the Digital Accessibility Software Market in 2023. This dominance is driven by stringent accessibility regulations, such as the Americans with Disabilities Act (ADA) and Web Content Accessibility Guidelines (WCAG). The presence of major technology companies and early adoption of digital transformation initiatives further boost market growth. Additionally, rising corporate commitments to inclusivity and a strong focus on customer experience enhancement contribute to the region’s leadership in digital accessibility solutions.

Asia Pacific is expected to expand at the fastest CAGR of approximately 10.06% during the period from 2024 to 2032. This growth is driven by rising internet penetration, fast-paced digitalization, and growing awareness of accessibility compliance. Regional governments are enforcing tougher regulations to facilitate digital inclusivity. Moreover, growth in e-commerce, online learning, and mobile application penetration fuels demand for accessibility software. Increasing visibility of startups and corporates investing in accessible digital experiences also fuels market growth in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

accessiBe Inc. (accessWidget, accessFlow)

-

AccessibilityChecker.org INC (AccessibilityChecker, ADA Compliance Checker)

-

AudioEye, Inc. (AudioEye Platform, Auto-Remediation)

-

Axess Lab (Axess Lab's WCAG, Axess Lab's ADA Compliance)

-

Deque Systems, Inc. (WorldSpace, axe-core)

-

Evinced Inc. (Evinced Accessibility Scanner, Evinced Automated Testing)

-

Level Access (WorldSpace, A11yTools)

-

Silktide Ltd (Silktide Platform, Silktide Analyze)

-

Siteimprove (Siteimprove Accessibility, Siteimprove Analytics)

-

UsableNet Inc. (UsableNet Accessibility, UsableNet Compliance)

-

SmartBear (TestComplete, accessibility insights)

-

Glimpse (Glimpse Scanner, Glimpse Validator)

-

Alcove (Alcove A11y, Alcove Insights)

-

TetraLogical (TetraLogical Accessibility Scanner, TetraLogical WCAG Auditor)

-

EqualWeb (EqualWeb Accessibility Suite, EqualWeb Compliance Widget)

-

Fable Tech Labs (Fable Design Platform, Fable Accessibility Auditing)

-

UserWay (UserWay Accessibility Widget, UserWay AI-powered Solutions)

-

WebAIM (WAVE, WAVE API)

Recent Developments:

-

2024: AudioEye introduced an Accessibility Testing Software Development Kit (SDK), enabling developers to integrate accessibility testing directly into their workflows. This tool helps identify and fix issues early in the development process, ensuring more inclusive web experiences.

-

2024: Level Access acquired UserWay, combining its expertise with UserWay’s AI-driven accessibility technology. This unification aims to enhance digital accessibility solutions, enabling organizations to achieve compliance more efficiently.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 670.37 Million |

| Market Size by 2032 | US$ 1373.92 Million |

| CAGR | CAGR of 8.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Website Accessibility Software, Color Contrast Checker Software) • By Enterprise Size (SMEs, Large Enterprises) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | accessiBe Inc., AccessibilityChecker.org INC, AudioEye, Inc., Axess Lab, Deque Systems, Inc., Evinced Inc., Level Access, Silktide Ltd, Siteimprove, UsableNet Inc., SmartBear, Glimpse, Alcove, TetraLogical, EqualWeb, Fable Tech Labs, UserWay, WebAIM. |