Protein A Resin Market Scope & Overview:

The Protein A Resin Market Size was valued at USD 1.34 billion in 2023, and is expected to reach USD 3.08 billion by 2032, and grow at a CAGR of 9.7% over the forecast period 2024-2032.

To Get More Information on Protein A Resin Market - Request Sample Report

The latest research study includes market buying patterns, price analysis, patent analysis, conference and webinar materials, and industry trends. The market is expected to rise as a result of rising demand for protein-engineered products used in the creation of vaccines and treatments, as well as increased pharmaceutical industry R&D spending.

A low-cost thermophoretic aptasensor (TAS) is used to profile cancer-associated protein profiles of plasma EVs without the influence of soluble proteins, according to an NCBI article published in May 2021. This showed that protein analysis can distinguish between metastatic breast cancer, non-metastatic breast cancer, and healthy donors (HD) with a high accuracy of 91.2%. Therefore, research demonstrating the effectiveness of protein A resin in cancer diagnostics is anticipated to support market expansion.

Furthermore, the market is anticipated to expand as a result of the increased burden of chronic illnesses. In the United States, an estimated 2.1 million new instances of cancer were discovered. The research also noted that 400,000 kids worldwide are diagnosed with cancer each year. The most common form of prevalent in 23 nations, including South Africa, India, Eswatini, and others. Breast, lung, colon, rectum, and prostate cancers are the most prevalent types of cancer.

MARKET DYNAMICS

DRIVERS

-

The need for therapeutic antibodies is rising.

The monoclonal antibody (mAb) purification process must include chromatography. The need for monoclonal antibodies in cancer and various other therapeutic fields, such as neurological, autoimmune, and inflammatory illnesses, has significantly increased during the past ten years. The R&D of therapeutic antibodies is now a primary priority for practically all major pharmaceutical firms.

Chromatography is used to remove anionic contaminants, including nucleic acids and endotoxins, during the purification of monoclonal antibodies. This procedure uses a lot of resins in drug discovery applications since it is used not just for purification but also to examine how compounds interact with ions. Size-exclusion chromatography (SEC) is used to exclude impurities like albumin and transferrin. High amounts Protein-A affinity resins can be used to achieve various levels of purification. This occurs because antibodies and resins specifically bind protein A ligands. This should increase demand for protein.

RESTRAIN

-

Expensive resins.

About 5–10 times more expensive than other forms of resin are protein A resins. Despite the fact that protein A resins are the only approach that can reach the same level of purification, their expensive cost prompts end users to explore alternatives. Both chromatography and non-chromatography procedures are a few of the purification methods that offer respectable degrees of purity. As alternatives to protein A chromatography, mAb crystallisation and polyethylene glycol (PEG) precipitation are being investigated. In rising areas like Latin America and the Asia Pacific, this restraint is increasingly noticeable. However, the price of protein A resins is anticipated to drop dramatically with the introduction of new market participants. The pressure on key market participants is rising because.

OPPORTUNITY

-

The number of CMOs and CROs is rising.

CHALLENGES

-

Problems in increasing the synthesis of protein A resins.

IMPACT OF RUSSIA-UKRAINE WAR

Trade restrictions, sanctions, and geopolitical conflicts may all affect trade patterns and cause them to shift. Companies who purchased protein A resin from producers in the impacted area could need to locate other sources, which might lead to changes in the market and volatility. Cost variations geopolitical conflicts can produce unpredictability and interruptions, which might result in price changes in the market for protein A resin globally. Prices may rise as a result of increased demand from businesses looking for different suppliers, particularly if there are few choices. Impact of Investment and Research Geopolitical conflicts may result in an unstable economic climate, which may deter investment and research in the area. This could have an impact on the creation of novel protein A resin-related goods and technology.

IMPACT OF ONGOING RECESSION

Reduced or Delayed Studying and Developing During a recession, biotechnology businesses may experience financial difficulties that cause them to cut back on their R&D investments. This might cause delays or reductions in the development of new biopharmaceutical drugs whose manufacturing methods rely on protein A resin. Price Disturbance The biopharmaceutical business may experience greater price sensitivity as a result of decreased demand and budgetary constraints. Customers may bargain for cheaper protein A resin costs, placing pressure on producers to change their pricing policies. Inventory Control In order to efficiently control expenses during a recession, businesses frequently concentrate on optimising their inventory levels. In order to prevent having too much stock and probable financial losses, this can cause protein A resin inventory purchases to decline.

consolidation of suppliers, a few smaller protein producers During a recession, a business can experience financial difficulties, which might cause market consolidation. Larger, more financially secure businesses could buy out failing rivals or suppliers, possibly changing the dynamics of the market.

KEY MARKET SEGMENTATION

By Product

-

Agarose based protein A resin

-

Glass/Silica based protein A resin

-

Organic Polymer based protein A resin

By Type

-

Recombinant protein A resin

-

Natural protein A resin

By Application

-

Antibody Purification

-

Immunoprecipitation

By End User

-

Pharmaceutical and biopharmaceutical companies

-

Academic Research institutes

-

Other end users

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

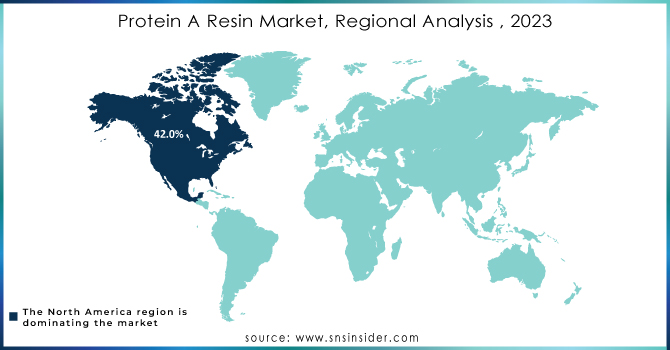

REGIONAL ANALYSES

In 2023, North America led the sector and generated 42.0% of the total industry revenue. This is because there is an increasing need for protein-based medicines to treat infectious illnesses and because there are more pharmaceutical and biotechnology firms in this area that have received FDA approval. A rise in partnerships, mergers, and acquisitions among the major competitors is another factor driving the industry's expansion. In addition, both public and commercial organisations are working to advance healthcare research and development.

Asia-Pacific Protein The resin market is anticipated to see the highest rate of growth globally during the anticipated timeframe. Factors such as the biopharmaceutical industry's fast expansion, the rise in the number of businesses producing and developing biologics such as monoclonal antibodies, the size of the population, and rising Healthcare costs help the APAC market expand even more. Developing nations like China and India are becoming prominent biopharmaceutical industry key players who are luring investments, pushing up demand for Protein A resins, and stoking market expansion in APAC. The expanding number of legislative changes, improvements to healthcare infrastructure, and the expansion of the protein the resin market in the Asia-Pacific region is supported by rising research and development efforts.

Do You Need any Customization Research on Protein A Resin Market - Enquire Now

Key Players

The major players are Danaher Corporation, Merck KGAa, Repligen Corporation, Thermo Fisher Scientific, Agilent Technologies, GenScript, PerkinEimer Inc., Bio-Rad Laboratories, Inc., Orochem Technologies Inc., Kaneka Corporation, Abcam Plc., Agarose Bead Technologies, Avantor, Inc., and others.

RECENT DEVELOPMENTS

Purolite: In November 2022, With Repligen, a business that provided the bulk of Protein A ligands, Purolite stated that it has increased and extended its ligand supply relationship with them. Praesto Jetted A50 HipH, a new protein A resin that combines Purolite's base beads with Repligen's ligand technology, was created and commercialised as a result of the pre-existing cooperation.

Navigo Proteins GmbH: In June 2022, Affinity resin for the capture of the glycoprotein gp64, an unwanted contaminant from the baculovirus insect cell expression system, has been successfully developed, according to Navigo Proteins GmbH, a leading provider of affinity ligands for custom chromatography solutions.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.34 Bn |

| Market Size by 2032 | US$ 3.08 Bn |

| CAGR | CAGR of 9.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By product (Agarose based protein A resin, Glass/Silica based protein A resin, Organic Polymer based protein A resin) • By Type (Recombinant protein A resin, Natural protein A resin) • By Application (Antibody Purification, Immunoprecipitation) • By end user (Pharmaceutical and biopharmaceutical companies, Academic Research institutes, Other end users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Danaher Corporation, Merck KGAa, Repligen Corporation, Thermo Fisher Scientific, Agilent Technologies, GenScript, PerkinEimer Inc., Bio-Rad Laboratories, Inc., Orochem Technologies Inc., Kaneka Corporation, Abcam Plc., Agarose Bead Technologies, Avantor, Inc. |

| Key Drivers | • The need for therapeutic antibodies is rising. |

| Market Restraints | • Expensive resins. |