Protein Therapeutics Market Size & Trends

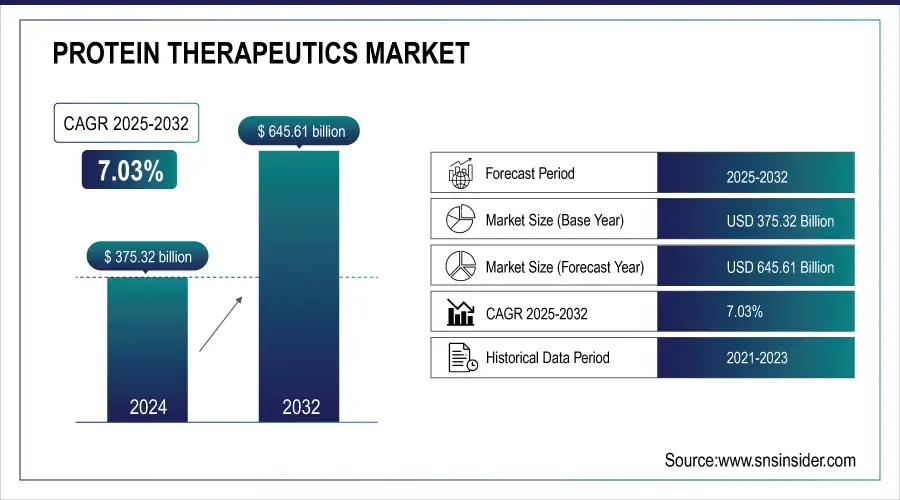

The Protein Therapeutics Market size was valued at USD 375.32 billion in 2024 and is expected to reach USD 645.61 billion by 2032, growing at a CAGR of 7.03% over 2025-2032.

The global protein therapeutics market is growing significantly due to the increasing prevalence of chronic diseases, a large patient pool, and rising healthcare expenditure. Additionally, advancements in biotechnology and increasing focus on personalized medicine is a key growth driver for the protein therapeutics market. The market is growing primarily on account of the increasing prevalence of cancer, diabetes, metabolic disorders, and autoimmune and infectious diseases, leading to a rise in demand for monoclonal antibodies, insulin analogs, and recombinant proteins as medications.

In June 2024, Amgen and Generate Biomedicines announced a multi-target collaboration to develop and use generative AI for identifying and designing therapeutic proteins, demonstrating the ongoing trajectory of innovation in the protein therapeutics market trends.

To Get more information on Protein Therapeutics Market - Request Free Sample Report

The growing prevalence of biosimilars and a promising reimbursement landscape in key markets, including the U.S., Germany, and Japan, are accelerating the supply-side dynamics. Investment in protein therapeutics companies has tracked that growth, with well-established players such as Roche, Amgen, and Pfizer growing their R&D expenditure. For example, in 2023, Roche spent more than USD 14 billion in R&D alone. Furthermore, regulatory agencies in both the U.S. and Europe have fast-tracked approval of biologics, opening up the market. Innovations in drug delivery systems and the collaboration between large biotech companies and academic institutions are fostering the growth of the protein therapeutics market. With an ageing population, an increase in healthcare expenditure, and greater government investment in biopharmaceuticals, demand is forecasted to grow further.

For instance, Eli Lilly received the FDA approval of a next-generation protein therapeutic in early 2025, a long-acting GLP-1 therapy for T2D, highlighting the first major achievement of regulatory acceleration and market penetration.

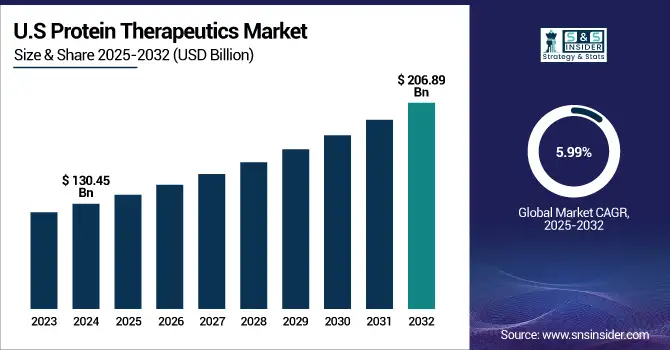

The U.S. protein therapeutics market size was valued at USD 130.45 billion in 2024 and is expected to reach USD 206.89 billion by 2032, growing at a CAGR of 5.99% over 2025-2032. The U.S. continues to stand as a powerhouse, propelled by the acceleration of the FDA approval process, the explosion of biologics-related clinical trials, public-private R&D partnerships, and more than 60% of global monoclonal antibody clinical trial projects are U.S.-sited. Modest growth in Canada is being driven by increasing biosimilar penetration and favorable health policies, whereas Mexico is gaining interest for biosimilar manufacturing partnerships to cater to domestic and LATAM markets.

Table: Pipeline Protein Therapeutics by Phase and Type, Global (2025)

|

Phase |

Monoclonal Antibodies |

Fusion Proteins |

Hormones |

|

Phase I |

120 |

25 |

10 |

|

Phase II |

180 |

40 |

12 |

|

Phase III |

85 |

15 |

7 |

Protein Therapeutics Market Dynamics

Drivers:

-

Increasing Demand for Biologics, Strategic Collaborations, and Regulatory Support Fuels Market Growth

The protein therapeutics market growth is primarily due to the increase in demand for next-generation biologics to treat chronic and rare diseases and a surge in the drug design process. Biologics comprise almost 40% of the drugs in current developmental pipelines, while monoclonal antibodies and fusion proteins are the major ones based on their potent therapeutic activity.

For instance, AstraZeneca's purchase of Alexion Pharmaceuticals for USD 39 billion was intended to bolster its biologics pipeline in immunology and rare disease. Sanofi’s deal-making in 2024 against smaller biotech companies is also in clear service of stretching its protein drug-making out into the years ahead.

In 2023, the U.S. FDA approved more than 20 protein-based therapeutics, indicating accelerated regulatory routes for biologics. On the R&D side, Biogen invested around USD 2.3 billion in 2023 on Protein-based neurologic research, an indicator of growing investments. Further, there is increasing demand-side support from patient advocacy and healthcare systems for improved, long-acting treatments, and this is catalysing protein innovation and the protein therapeutics market analysis.

Restraints:

-

High Production Costs, Cold Chain Dependency, and Complex Manufacturing Regulations Hamper Market Expansion

The protein therapeutics market is not fully accessible, being constrained by complex and expensive manufacturing processes. Biologics production needs large investments to develop cell tissue culture systems and scale up bioreactors. The profit margin for a biologic drug is 5–10 times more expensive to produce than a small molecule drug, as per BioPlan Associates. Similarly, cold chain logistics is crucial for most protein drugs, and any disruption of the temperature can result in the loss and or reduction of product efficacy, making the supply chain more vulnerable.

In addition, stringent global regulatory requirements, including the FDA’s new cGMP regulations for biologics in 2023 and the EMA’s updated biosimilar guidance, add another layer of complexity to manufacturing and delay product launch timelines. A shortage of manpower experienced in protein engineering and bioprocessing is another driving factor. These obstacles have been impediments, especially in small protein therapeutics companies, which inhibit their capacity and market share in the global protein therapeutics market.

Protein Therapeutics Market Segmentation Insights

By Applications

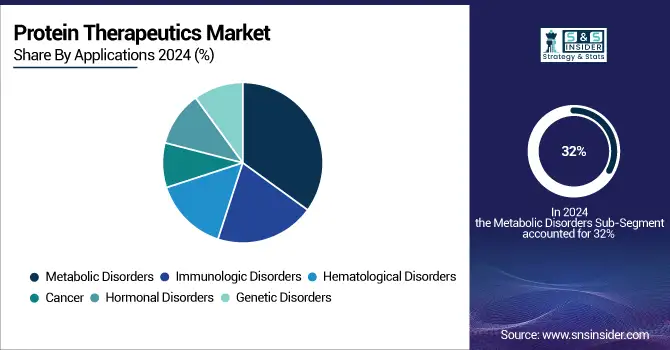

Metabolic disorders were the largest application segment of the protein therapeutics market globally in 2024, accounting for more than 32% share. This domination is mainly propelled by the increasing global prevalence of diabetes and obesity, for which protein therapeutics such as insulin and GLP-1 receptor agonists are pivotal to disease control. Their market leadership is even more entrenched by their heavy penetration into chronic care pathways.

Immunologic disorders, on the other hand, are the fastest growing application segment due to an increase in the incidence of autoimmune diseases such as rheumatoid arthritis, psoriasis, multiple sclerosis, and others. The growing demand for protein therapeutics, such as interferons and monoclonal antibodies, and advancements in the immune-modulating biologics space are the primary drivers for growth in this segment.

By Product

Monoclonal antibodies were the largest protein therapeutics market share holder in 2024, contributing 43% of the total market share. Their dominance is due to their strong specificity, minimal off-target effects, and wide usage in oncology, autoimmune, and infectious diseases. Major drug manufacturers introduce new monoclonal antibodies into the market, and some best-selling drugs (for instance, pembrolizumab and trastuzumab) secure their market standing. Furthermore, continuous discovery in bispecific antibodies and ADCs boosts their hegemony.

Meanwhile, the insulin segment is forecasted to be growing the fastest, driven by the global increase in diabetes incidence rates, increased market access of recombinant and long-acting insulin analogs, and the greenlighting of biosimilars in emerging nations. New delivery platforms, like once-a-week or inhaled insulin, are widening their attractiveness with Type 1 and Type 2 diabetes alike.

Protein Therapeutics Market Regional Outlook

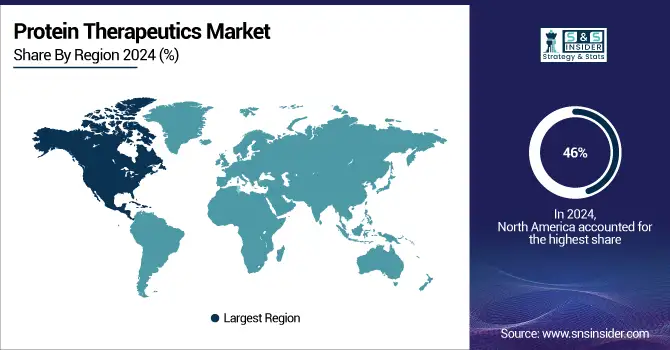

North America dominated the global protein therapeutics market share, accounting for 46% of total revenue in 2024. This aggression is driven by the region's sophisticated healthcare system, early introduction of biologic-origin drugs for the treatment of BCC, and powerhouses including Amgen, Pfizer, and Johnson & Johnson that have been in the game for some time. Strong R&D spending, reimbursement schemes, and consumption of biologics also help add to its lead.

Get Customized Report as per Your Business Requirement - Enquiry Now

The second position is held by Europe, which is taking the market share from the North American region due to spending on high healthcare services, better academic-research relations, and increasing penetration rate of biosimilar products. Germany and France are at the forefront, thanks to structured biologic approval systems and the incorporation of new treatments within the framework of national health care. Germany is a particular beneficiary of centralized pricing and high volumes of biologic prescribing. The UK is also growing strongly, with post-Brexit regulatory changes and investment in protein-based drug R&D providing a boost. Encouraging efforts that have supported market access and promoted regional uptake have been exemplified by the European Medicines Agency’s promotion of biosimilars. Eastern European nations, such as Poland and Turkey, are experiencing significant local manufacturing activity aimed at decreasing reliance on imports.

The protein therapeutics market in Asia Pacific is projected to grow at the highest CAGR from 2020 to 2025 due to the expanding patient population, increasing healthcare spending, and increasing local production capabilities in this region. China and India are the drivers of this growth, with government policy supporting the R&D in biotech and the biosimilar expansion. In 2023 approved more than 15 protein-based drugs by the NMPA and has committed more than USD 4.5 billion to biopharmaceutical research. India is establishing a footprint with a cost-efficient biosimilar production and export plan. Japan contributes heavily with its ageing population and use of high-end biologics, while South Korea has firmly established itself as a biologics production powerhouse with companies such as Samsung Biologics scaling global supply.

Table: Regional R&D Investments in Protein Therapeutics (USD Billion), 2024

|

Region |

R&D Spending |

Leading Contributors |

|

North America |

18.6 |

Amgen, AbbVie, NIH |

|

Europe |

12.3 |

Sanofi, AstraZeneca, Roche |

|

Asia Pacific |

9.8 |

Samsung Biologics, WuXi Biologics |

Key Players in the Protein Therapeutics Market

Leading protein therapeutics companies in the market include Bayer AG, Bristol-Myers Squibb, Daiichi Sankyo Company, Abbott, Sanofi, Thermo Fisher Scientific Inc., Genzyme Corporation, AbbVie Inc., Leadiant Biosciences, and Takeda Pharmaceutical Company Limited.

Recent Developments in the Protein Therapeutics Market

-

In June 2025, AbbVie announced the acquisition of Capstan Therapeutics for up to USD 2.1 billion in cash. Capstan is a developer of CAR‑T cell therapies, including CPTX2309 targeted at autoimmune conditions. This move expands AbbVie’s pipeline beyond antibody drugs into cutting-edge cell-based immunotherapies.

-

In May 2025, the FDA granted accelerated approval to telisotuzumab vedotin (Emrelis), an antibody‑drug conjugate for c-Met overexpressing non-small cell lung cancer. This approval highlights the growing significance of ADCs in targeted cancer treatment.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 375.32 billion |

| Market Size by 2032 | USD 645.61 billion |

| CAGR | CAGR of 7.03% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Monoclonal Antibodies, Insulin, Fusion Protein, Erythropoietin, Interferon, Human Growth Hormone, and Follicle Stimulating Hormone) • By Applications (Metabolic Disorders, Immunologic Disorders, Hematological Disorders, Cancer, Hormonal Disorders, and Genetic Disorders) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Bayer AG, Bristol-Myers Squibb, Daiichi Sankyo Company, Abbott, Sanofi, Thermo Fisher Scientific Inc., Genzyme Corporation, AbbVie Inc., Leadiant Biosciences, and Takeda Pharmaceutical Company Limited. |