Protein Labeling Market Report Scope & Overview:

Get More Information on Protein Labeling Market - Request Sample Report

The Protein Labeling Market size was estimated at USD 2.39 billion in 2023 and is expected to reach USD 4.83 billion by 2032 at a CAGR of 8.14% during the forecast period of 2024-2032.

The Protein Labeling Market is expanding significantly because of the continuous development of biotechnology and the tendency of the market towards personalized medicine when the number of injuries and information regarding chronic diseases and critical conditions accompanied by protein dysfunction is increasing is also a significant rationale. In addition, the recurring phenomenon can be explained by the decrease in protein functionality for basic vital processes. Protein labeling is becoming more popular because it is important to comprehend protein locations, interaction modes, functions, and dynamics for efficient drug targeting. Besides, one more reason is the emergence of novel protein-labeling reagents and methods, which will help to more correctly and effectively detect, synthesize, and purify proteins. The growing number of proteomics studies general and the significant number of applications for protein labeling aiming to find appropriate biomarkers and work on targeted treatments are among the explanations for the tendency of the market to grow. The issues regarding the development of the market even further will be related to the growing popularity of precision healthcare as technology is being developed for genetic, biomarker, and alternative testing before making critical decisions.

The existence of breakthroughs in analytical technologies, especially mass spectrometry and chromatography, allowed for addressing the issue of the essential complexity of protein structures. By understanding how they influence health, disease, and pharmaceutical product development, it is possible to analyze the influence of different proteins on the organism and the potential impact of their malfunctioning. The increased R&D investments of the pharmaceutical companies created the growing focus on proteomics because it assists in target definition and understanding of the way they can function. In September 2023, NIH presented approximately USD 50.3 million for disease and human health multi -omics research. As a result, the new research consortium, whose activity will be concentrated on the advanced generation and analysis of multi-omics data points to human health, will be developed. The growing demand for advanced proteomics methods and the corresponding protein-labeling tools will also emerge with the increase of personalized medicine as it will be crucial to understand the differences in protein expression.

MARKET DYNAMICS

DRIVERS

- Technological advancements in protein labeling, such as new fluorophores, tags, and detection methods, are enhancing accuracy and sensitivity, thus driving market growth.

Advanced technologies in protein labeling have been a significant driver of market growth. The technologies that utilize fluorophores molecules that “light up” upon their excitation bring more vibrant and stable dyes, enhancing clarity via reducing background noise. In addition, the newly developed tags, including genetically encoded ones and affinity tags, exhibit greater specificity and are more versatile, allowing for better identification and tracking of complex samples. Moreover, the introduction of modern detection methods, such as advanced forms of microscopy and high-throughput screens, increases the degree of detailing in observing and counting protein interactions. The clarity in detection brought by these methods has resulted in higher dependability and reproducibility in a wide range of applications, from basic research to clinical diagnostic and drug discovery. These technologies drive market expansion due to several reasons. First, the improvements in protein analysis allow scientists to understand biological processes better, advancing various forms of research. Additionally, as the present tagging and analyzing forms of technologies develop, the market demand for more advanced solutions is increasing. Researchers and clinicians attempt to incorporate the more powerful tools in a large number of methods of protein labeling they utilize for practical purposes. Hence, it is evident that the past development of novel technologies has provided a significant opportunity for market growth.

- The rising prevalence of chronic diseases is increasing the demand for advanced diagnostic tools and personalized medicine, including protein labeling technologies.

The escalating incidence of chronic diseases such as cancer, cardiovascular conditions, and diabetes is propelling the demand for advanced diagnostic aids and personalized medication. Many chronic diseases necessitate precise and early diagnosis for proper cure and management. As a result, the requirement for modern diagnostic instruments has been on the rise. Protein labeling technologies are one of the diagnostic tools that come with the requirements mentioned above. It is now feasible for researchers to identify and analyze the functions and actions of proteins that are indispensable in the diagnosis and treatment of diseases. When proteins are labeled with specific markers, it is now easy for the specialists to gauge how far the the disease has evolved, diagnose the disease in the early stages, and prescribe curative measures. This diagnostic process contributes to the escalation of the demand for individualized and effective medication solutions as it enhances the accuracy in the diagnosis of diseases.

RESTRAIN

- The high cost of advanced protein labeling technologies and reagents can restrict their accessibility and hinder widespread adoption, especially for smaller labs and institutions.

One of the major reasons that prevent the high number of laboratories from using the latest methods of proteomic research is the price of these technologies. Modern protein labeling technologies and reagents are rather expensive and not affordable to many small laboratories having a limited budget. Importantly, these technologies are necessary for accurate protein analysis in multiple fields, including drug discovery, molecular biology, and other areas, and their use presupposes the acquisition of expensive equipment and corresponding reagents. The high costs of this research may be a source of obstacles on the way of numerous small research institutions since many of them are not able to get the most recent equipment and new reagents. Therefore, prospects for more significant advances in some sectors and the development of scientific innovations may be limited by costs associated with the latest technologies. Moreover, people may be denied an opportunity to carry out certain types of experiments and to explore the most recent approaches because of these prohibitive costs. That is why costs are the central factor in the promotion of democratization and the extensive adoption of highly beneficial technologies that are indispensable for further advances in specific fields.

KEY MARKET SEGMENTATION

By Product

The reagents segment dominated the market and accounted for 64.02% of the market revenue in 2023. The share was estimated attributable to the increasing discovery of number labeling agents and genetically engineered protein labels. The wide range of applications facilitated by protein labeling reagents to researchers and practitioners cannot be underpinned. The array provided is a versatile toolbox, which plays a key role in advancing understanding in cellular processes, mechanisms of disease, and development of new therapeutics.

By Method

The In-vitro segment dominated the market and accounted for 69.85% of the market revenue in 2023. In-vitro protein labeling methods are the ones when the sample which is supposed to be analyzed or researched is collected and then processed in the lab. Both enzymes, dyes, and nanopaitricles are used as probes or tags in in-vitro labeling through co-translational and site-specific methods. Unfortunately, due to the highly-specific impact of the enzymes, they dominated the segment.

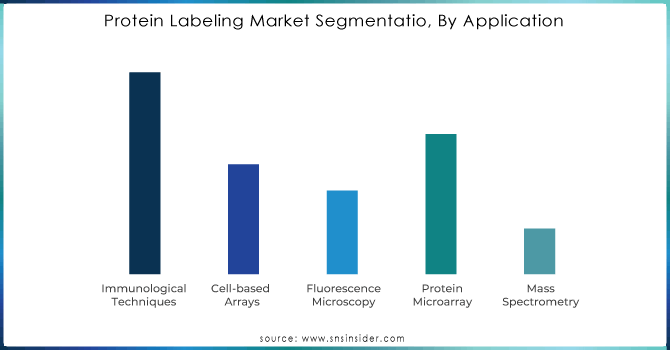

By Application

The immunological techniques segment was the market leader in 2023 with a share of 39.88%, which is attributed to the higher prevalence of chronic diseases. Further, growth in R&D expenditure by biotechnology & biopharmaceutical companies to formulate complex biologics including monoclonal antibodies & vaccines supports the sector growth. Increased research activities in areas including genomics and proteomics also contribute to the demand for protein labeling techniques & reagents.

Need any customization research on Protein Labeling Market - Enquiry Now

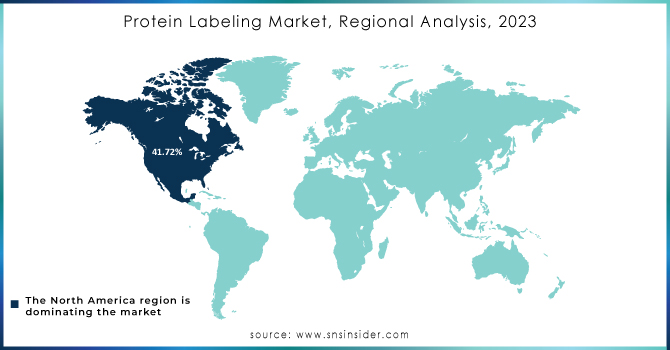

REGIONAL ANALYSES

North America protein labeling market dominated globally with a revenue share of 41.72% in 2023. The region experiences market growth due to the substantial investment in research and development, rise in healthcare expenditure, and technological innovations enhancing the accuracy and efficiency of protein analysis.

Asia Pacific protein labeling market is anticipated to witness the fastest CAGR of 10.52% from 2024 to 2032 globally. The Asia Pacific regional market is expected to be driven by the increasing research and development activities, rising biotechnology and pharmaceutical industries, advancements in proteomic research, and increasing prevalence of chronic diseases.

KEY PLAYERS

The major players are Thermo Fisher Scientific, Inc., Merck KGaA, Revvity Inc., Promega Corporation., F. Hoffmann-La Roche Ltd, LGC Ltd, New England Biolabs., LI-COR, Inc., Danaher (Cytiva), Jena Bioscience GmbH and others

RECENT DEVELOPMENTS

In March 2024: ImmunoPrecise Antibodies Ltd. announced the acquisition of Carterra's LSA instrument platform. This strategic move aims to enhance ImmunoPrecise Antibodies' capacity for high-throughput surface plasmon resonance-based antibody characterizations, significantly boosting its capabilities in various label-free protein interaction analyses.

In December 2023: PerkinElmer, a global provider of analytical services and solutions, completed the acquisition of Covaris, a prominent developer of solutions driving advancements in life sciences. This merger is poised to boost Covaris' growth opportunities while extending PerkinElmer's life sciences portfolio into the rapidly expanding diagnostics end market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.39 Billion |

| Market Size by 2032 | USD 4.83 Billion |

| CAGR | CAGR of 8.14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Reagents [Proteins, Enzymes, Probes/Tags, Monoclonal Antibodies, Other Reagents], Kits, Services) • By Method (In-vitro Labeling Methods [Enzymatic Labeling, Dye-based Labeling, Co-translational Labeling, Site-specific Labeling, Nanoparticle Labeling, Others], (In-vivo Labeling Methods, Photoreactive Labeling, Radioactive Labeling, Others) • By Application (Immunological Techniques, Cell-based Arrays, Fluorescence Microscopy, Protein Microarray, Mass Spectrometry) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific, Inc., Merck KGaA, Revvity Inc., Promega Corporation., F. Hoffmann-La Roche Ltd, LGC Ltd, New England Biolabs., LI-COR, Inc., Danaher (Cytiva), Jena Bioscience GmbH |

| Key Drivers | •Technological advancements in protein labeling, such as new fluorophores, tags, and detection methods, enhance accuracy and sensitivity, thus driving market growth. •The rising prevalence of chronic diseases is increasing the demand for advanced diagnostic tools and personalized medicine, including protein labeling technologies. |

| RESTRAINTS | • The high cost of advanced protein labeling technologies and reagents can restrict their accessibility and hinder widespread adoption, especially for smaller labs and institutions. |