Psoriatic Arthritis Treatment Market Report Scope & Overview:

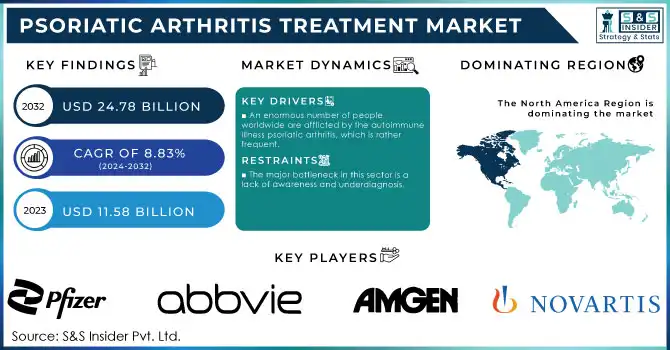

The Psoriatic Arthritis Treatment Market was valued at USD 11.08 billion in 2023 and is expected to reach USD 25.41 billion by 2032, growing at a CAGR of 9.70% from 2024-2032.

Get more information on Psoriatic Arthritis Treatment Market - Request Sample Report

The psoriatic arthritis treatment market report presents unique insights by taking a deeper dive into critical data points, including the incidence and prevalence of psoriatic arthritis in 2023, with the regional variations and disease burden. It analyzes prescription trends across regions and, more specifically, focuses on drug utilization patterns and preferred therapies. The report also assesses healthcare spending by region, where discrepancies in expenditure and access to treatment are depicted. It also offers an in-depth review of drug development and approval trends, with emerging therapies and regulatory milestones. The report also looks into patient demographics and treatment adherence, with a focus on the impact of age, gender, and compliance on therapeutic outcomes.

Market Dynamics

Drivers

-

The increasing global prevalence of psoriatic arthritis (PsA) is a significant driver for the treatment market.

The increasing global prevalence of psoriatic arthritis (PsA) is significantly driving the Psoriatic Arthritis Treatment Market. Approximately 125 million people worldwide live with psoriasis, and about 30% of these individuals develop PsA, which equates to over 37 million people globally. In the U.S., around 1.5 million individuals are affected by PsA. With the aging population and rising incidence of chronic conditions, the prevalence is expected to continue to grow. Advances in biologic treatments, such as Janssen’s TREMFYA and Otezla (apremilast), which was FDA-approved for PsA, offer more effective management options, propelling further market expansion. Additionally, the growing awareness of PsA among healthcare providers and patients, along with ongoing research and development of targeted therapies, is contributing to increased diagnosis rates and treatment adoption. The expanding pipeline of novel therapies further boosts treatment options, driving market growth.

-

The rising awareness about PsA and its impact on patient's quality of life is leading to better early diagnosis and more timely treatments.

Rising Knowledge about Psoriatic Arthritis (PsA) and its effect on patient quality of life Driving Psoriatic Arthritis Treatment Market. Psoriatic arthritis (PsA) is an autoimmune disease that negativrly effects joints with potential for deformaties. According to studies, timely diagnosis and treatment can prevent joint damage by up to 70%, making timely interventions critical. As such, organizations like the American College of Rheumatology (ACR) and and outreach initiatives from pharmaceutical companies, such as Novartis, have been more proactive in raising awareness and encouraging early detection. In addition, emerging treatments (the FDA recently approved intravenous Cosentyx [secukinumab] in 2023) will only further refine the already wide range of effective treatments and enhance overall patient outcomes. The increasing emphasis on personalized medicine and biologic therapies by moderate-to-severe PsA cases is also driving an increase in treatment penetration. Continued market growth is expected as awareness increases and patients are diagnosed earlier, leading to increased patient demand for advanced treatment options such as biologics and targeted therapies. Together, along with the support from healthcare professionals, patient advocacy groups, and regulatory approvals, will aid in boosting the overall market dynamics.

Restraint

-

One of the significant restraints in the Psoriatic Arthritis Treatment Market is the high cost of advanced biologic therapies and treatments.

The high cost of advanced biologic therapies is a significant restraint in the Psoriatic Arthritis Treatment Market as it is an income generator and this limits the access to treatment for a large number of patients. Medications such as Otezla (apremilast) and TREMFYA (guselkumab), while effective at managing plaque psoriasis symptoms, come with surprisingly high price tags, upwards of USD 10,000 to 40,000 yearly. Though they provide clinically meaningful improvements in patient outcomes, these therapies are not always fully reimbursed by the insurance in some markets, especially in low- to middle-income territories. Besides the expense that patients have to face, high costs burden health systems, worsening the issue. Due to the restricted access to these therapies, the effective management of PsA is not achievable in a larger population, which limits the overall potential of market expansion. Over time, attempts to expand insurance coverage, lower drug prices, and improve patient access to biologics could lessen this restraint, but in the near term it is a major market barrier.

Opportunities

-

Expansion in Emerging Markets in various regions, making space for the Psoriatic Arthritis Treatment Market

The psoriatic Arthritis Treatment Market holds huge growth opportunities in emerging markets, including Asia-Pacific, Latin America, and the Middle East & Africa. Improved health infrastructures are leading to enhancements of healthcare systems in these regions. Raised disease awareness is influenced by increased disposable incomes and the ever-growing prevalence of psoriatic arthritis in these geographies that push demand for advanced therapies. For example, efforts to push for early detection and biosimilar adoption are gradually making treatments available and affordable. According to the GaBI 2024 report mentioned that biosimilars in biologic treatments have entered India and Brazil. This is also a great challenge for pharmaceutical giants to expand into these untapped markets.

Challenges

-

Lack of awareness about the disease among patients and healthcare providers, which usually results in late diagnosis and treatment.

One of the major challenges in the Psoriatic Arthritis Treatment Market is the lack of awareness among the patients and the healthcare professionals leading to delayed diagnosis and treatment. Clinical studies suggest that up to 30% of psoriasis patients who have psoriatic arthritis fail to get diagnosed because those early signs like stiffness and mild swelling are often mistakenly linked with other issues or ignored altogether. As a result, this delay in identifying such disorders can cause irreversible joint damages, a higher economic burden (more healthcare costs), and a drastic loss of quality of life for patients. Furthermore, the diagnosis is also delayed which may render potential treatment options less effective (the sooner the treatment, the lesser the chances of the disease to progress.) This is a problem that can be tackled only with educational campaigns targeting both patients and health care professionals and with improved screening methods.

Psoriatic Arthritis Treatment Market Segmentation

By Drugs Class

The biologics segment dominated the psoriatic arthritis treatment market with 31.54% market share in 2023. These drugs offer efficacy that cannot be matched, focusing on the pathways of the underlying immune processes. Biologics, for instance, including TNF inhibitors, IL-17 inhibitors, and IL-12/23 inhibitors, present meaningful clinical benefits for patients with psoriatic arthritis, including reductions in inflammation and prevention of damage to joints as well as amelioration of skin manifestations. Their use is backed by robust clinical evidence as well as regulatory approvals for first-line treatment in mild to severe instances. Furthermore, more patients have been gaining access to biologics due to the reimbursement policies of governments, as well as improvement in healthcare infrastructure across developed markets.

The DMARDs segment is expected to have the fastest growth rate during the forecast years with the help of cost-effectiveness and the capability to manage cases of mild to moderate psoriatic arthritis. The increasing utilization of both conventional and targeted synthetic DMARDs, such as methotrexate and JAK inhibitors, is primarily on account of greater awareness among both healthcare providers and patients about the importance of early disease management. The adoption rate of DMARDs is especially high in emerging economies, where biologics may not be as accessible due to cost barriers. Additionally, research into novel DMARD formulations with fewer side effects and improved efficacy is an ongoing process, which contributes to the robust growth trajectory of this segment.

By Route of Administration

The injectable segment dominated the psoriatic arthritis treatment market with a 42.13% market share in 2023. This is primarily because biological therapies, highly effective for the management of moderate-to-severe cases, are administered via this route. Injectable formulations ensure that the drugs directly enter the bloodstream, thereby causing rapid relief of symptoms and greater adherence in patients requiring long-term disease control. TNF inhibitors and IL-17 inhibitors are the leading biologics in injectable forms, further fueling the dominance of this segment. Besides, self-injection devices in the form of pre-filled syringes and auto-injectors improve patient convenience and thus widely adopted injectables in managing psoriatic arthritis.

The oral segment is expected to grow the fastest, with 11.42% CAGR during the forecast period, due to the increased popularity of drugs for small molecules, including JAK inhibitors and PDE4 inhibitors. Oral drugs are convenient options that don't require hospital visits or even administration by highly trained professionals. The trend is further being accelerated by growing interest in the approach of patient-centric treatment options and the availability of effective oral drugs, such as Otezla (apremilast). Moreover, this rapidly expanding segment is also expected to be fueled by the growing pipeline of oral therapeutics targeting novel pathways and the affordability of generic oral drugs in emerging markets.

By Distribution Channel

In 2023, The hospital pharmacies segment dominated the market with the highest market share. This is mainly because most of the advanced biologics and specialty drugs are dispensed centrally from these pharmacies. These are equipped with complex drugs that need to be stored in cold conditions and under strict protocols. Patients suffering from severe psoriatic arthritis prefer hospital pharmacies since treatments are generally received under the care of specialists in hospital settings. Hospital pharmacies also offer extensive support services, which include educating patients and providing them with an avenue for reimbursement from their respective insurance companies, thus dominating the market.

The online pharmacies segment is expected to grow at the fastest rate during the forecast years, primarily due to increasing demand for convenience and accessibility in medication procurement. Online platforms provide a cost-effective alternative to traditional brick-and-mortar pharmacies, especially for patients requiring long-term medications like DMARDs or biologics. Growth is further fueled by advancements in digital health infrastructure, improved e-commerce penetration, and the rising adoption of telemedicine services. This shift to online healthcare services was also hastened by the COVID-19 pandemic, and regulatory approvals for e-prescriptions in many regions have also provided a good environment for online pharmacies to expand.

Regional Analysis

North America dominated the psoriatic arthritis treatment market with a 39.46% market share in 2023 due to its superior healthcare infrastructure, higher awareness levels, and availability of novel therapies. The region enjoys a substantial burden of psoriatic arthritis, with more than 2 million affected people in the U.S. alone, thereby fueling the demand for appropriate treatment modalities. For instance, the presence of key market players- Amgen, Johnson & Johnson, and AbbVie has promoted a good pipeline of biologics and DMARDs in the region. Favorable reimbursement policies and high healthcare spending further support the adoption of expensive biologics and combination therapies, which supports North America's leading position in the market.

Asia Pacific is expected to grow the fastest with 11.18% CAGR during the forecast period due to several factors, including an increasing prevalence of psoriatic arthritis and rising healthcare investments. Awareness about early diagnosis and treatment, along with improving access to healthcare in countries like India, China, and other Southeast Asian countries, increases the demand for psoriatic arthritis therapies. Other than that, in the cost-sensitive markets, the adoption of biosimilars has helped in cutting the cost for greater patient access to biologics and DMARDs. Another factor in this region is that the government is undertaking initiatives that would expand coverage to healthcare while there is increased investment in telemedicine and online pharmacy services.

Need Any Customization Research On Psoriatic Arthritis Treatment Market - Inquiry Now

Some of the major key players in the Psoriatic Arthritis Treatment Market

-

AbbVie (Humira, Rinvoq)

-

Amgen (Enbrel, Aimovig)

-

Johnson & Johnson (Stelara, Tremfya)

-

Novartis (Cosentyx, Kisqali)

-

Merck & Co. (Remicade, Jemperli)

-

Pfizer (Xeljanz, Enbrel)

-

Bristol-Myers Squibb (Orencia, Otezla)

-

Eli Lilly and Company (Taltz, Olumiant)

-

Sanofi (Kevzara, Dupixent)

-

Gilead Sciences (Biktarvy, Veklury)

-

UCB Pharma (Cimzia, Kusabri)

-

Abbott Laboratories (Humira, Simulect)

-

Horizon Therapeutics (Tepezza, Krystexxa)

-

Boehringer Ingelheim (Olumiant, Actemra)

-

Roche (Actemra, Venclexta)

-

Celltrion Healthcare (Remsima, Truxima)

-

Mylan (Renflexis, Biosimilars in Development)

-

Teva Pharmaceutical Industries (Copaxone, Ajovy)

-

Samsung Biologics (Renflexis, Biosimilars Pipeline)

-

AstraZeneca (Fasenra, Imfinzi)

Suppliers (These suppliers provide key components, biosimilars, or support for biologic and pharmaceutical treatments in the market for psoriatic arthritis.)

-

Baxter International

-

Medtronic

-

Fresenius Kabi

-

Sandoz (a Novartis division)

-

Mylan (now part of Viatris)

-

Cipla

-

Amgen

-

Pfizer

-

Bristol-Myers Squibb

-

Samsung Biologics

Recent Developments

-

March 2024: Amgen announced the results from the global Phase 4 FOREMOST study, evaluating Otezla (apremilast) in patients with early oligoarticular psoriatic arthritis. This is the first placebo-controlled study specifically designed to assess individuals with oligoarticular psoriatic arthritis and early disease duration of five or fewer years.

-

November 7, 2024: Johnson & Johnson revealed that 43 presentations showcasing the company’s rheumatology pipeline and portfolio would be featured at the American College of Rheumatology (ACR) 2024 Annual Meeting. The presentations will include three oral sessions and a plenary session, highlighting new data on the investigational drug nipocalimab for Sjögren’s disease and new research on the impact of TREMFYA in psoriatic arthritis (PsA).

-

October 6, 2023: Novartis, a global leader in immuno-dermatology and rheumatology, announced that the US Food and Drug Administration (FDA) had approved an intravenous (IV) formulation of Cosentyx (secukinumab) for the treatment of adults with psoriatic arthritis (PsA), ankylosing spondylitis (AS), and non-radiographic axial spondyloarthritis (nr-axSpA).

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 11.08 Billion |

| Market Size by 2032 | US$ 25.41 Billion |

| CAGR | CAGR of 9.70% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Class (NSAIDs, DMARDs, Biologics, Others) • By Route of Administration (Topical, Oral, Injectable) • By Distribution Channel (Hospital Pharmacies, Online Pharmacies, Retail Pharmacies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AbbVie, Amgen, Johnson & Johnson, Novartis, Merck & Co., Pfizer, Bristol-Myers Squibb, Eli Lilly and Company, Sanofi, Gilead Sciences, UCB Pharma, Abbott Laboratories, Horizon Therapeutics, Boehringer Ingelheim, Roche, Celltrion Healthcare, Mylan, Teva Pharmaceutical Industries, Samsung Biologics, AstraZeneca, and other players. |