Colorectal Cancer Screening Market Size Analysis

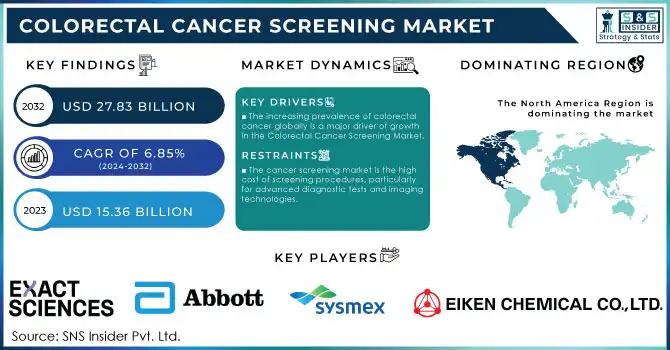

The Colorectal Cancer Screening Market Size was valued at USD 15.36 billion in 2023 and is expected to reach USD 27.83 billion by 2032 and grow at a CAGR of 6.85% from 2024-2032.

Get More Information on Colorectal Cancer Screening Market - Request Sample Report

The colorectal cancer screening market is growing very robustly due to the increasing incidence of colorectal cancer, particularly in regions like China and Canada. For instance, in Canada, colorectal cancer has emerged as one of the top causes of cancer diagnoses, and the cases are increasingly found in younger populations. In 2023, in the United States, approximately 153,020 individuals will be diagnosed with CRC and 52,550 will die from the disease, including 19,550 cases and 3750 deaths in individuals younger than 50 years. Technological advancement with genetic testing and AI-assisted devices, such as GI Genius, is improving the detection and efficiency of screening. This FDA-approved AI-based device helps clinicians detect lesions and polyps during the colonoscopy procedure.

Screening methods, such as stool-based tests, colonoscopies, and CT colonography, are constantly evolving and applied on a wider scale across all strata. Government and private sector initiatives, such as the Ohio Colorectal Cancer Prevention Initiative, are further encouraging screening efforts, especially among those with genetic predispositions like Lynch syndrome. Increased awareness campaigns and government mandates, such as the U.S. Preventive Services Task Force (USPSTF) lowering the recommended age for screening of colorectal cancer to 45 also help to increase the pool of people eligible for screening.

Despite these developments, screening costs are still high, and access to healthcare is still not available in developing countries. Nevertheless, the colorectal cancer screening market will continue to grow steadily as the infrastructure of healthcare improves and the technologies used become more efficient. Non-invasive methods, like liquid biopsies and biomarker-based tests, are expected to increase patient compliance due to their comfort over traditional colonoscopies. Also, pharmaceutical companies are now using targeted therapies as well as preventive therapies, so complete approaches to the management of colorectal cancer keep surging.

Colorectal Cancer Screening Market Dynamics

Drivers

-

The increasing prevalence of colorectal cancer globally is a major driver of growth in the Colorectal Cancer Screening Market.

According to the American Cancer Society, colorectal cancer ranks the third most common type among both men and women in the United States, accounting for an estimated 106,000 new cases of colon cancer and 44,000 new cases of rectal cancer in the U.S. alone in 2023. Therefore, considering the increasing incidence, of the aging population, there is a greater demand for more widespread and accessible screening options that could make early detection easier.

Agencies such as the USPSTF have also reduced the age recommendation for screening for colorectal cancer from 50 to 45 years in those without known risk factors, thereby targeting an increased population and thus again driving the market forward. The latest studies have shown that this disease is on the rise among young people, especially in well-to-do countries, and thereby again emphasizes the need for early detection and regular follow-ups. Through screening initiatives, governments have taken more aggressive measures to fight the disease. For example, in Ohio, the Colorectal Cancer Prevention Initiative is a program that enhances public health campaigns that eventually increase the screening rate for people who are predisposed to colorectal cancer by genetic factors.

Age and Gender Distribution of Colorectal Cancer Cases and Deaths in the United States, 2023

The bar graph depicts the projected prevalence of new cases of colorectal cancer and deaths by age group and gender across the United States in 2023. The highest prevalence occurred among individuals aged 65 years and older, where they accounted for 56% of all new cases and 68% of all deaths, consistent with a higher risk for old age. Men also comprised slightly more than women of this age group. The 50–64 age group is second with 32% cases and 25% deaths, indicating an added necessity for increased screening interventions among middle-aged groups. Those aged less than 50 years are only 13% of cases and 7% of deaths, although there has been a progressive rise, especially in males, making the interventions crucial among all age groups.

-

Technological advancements are improving the effectiveness and accessibility of screening for colorectal cancer.

New tools, such as the FDA-approved AI-powered GI Genius device, help clinicians make more accurate diagnoses of colorectal lesions and polyps during a colonoscopy. The device uses machine learning algorithms to examine images in real time, which makes the screening process faster and less likely to result in missed diagnoses.

In addition, the development of non-invasive screening methods, such as liquid biopsies and biomarker-based tests, is providing patients with more comfortable alternatives to traditional colonoscopy. These advances are expected to increase patient compliance and expand the adoption of screening programs globally. For instance, liquid biopsy tests like Cologuard, which analyze stool samples for genetic markers of colorectal cancer, have been gaining popularity due to their ease of use and non-invasive nature.

Restraint

-

The cancer screening market is the high cost of screening procedures, particularly for advanced diagnostic tests and imaging technologies.

Technologies such as liquid biopsies, AI-based diagnostic tools, and genomic testing have a high potential for early cancer detection, but their costs are often out of reach, particularly in low-resource settings or developing countries. According to a report, many of these advanced screening methods require significant infrastructure and skilled healthcare providers, making them less accessible to disadvantaged populations.

In addition, a lack of large-scale healthcare infrastructure across some region’s limits cancer screening programs. Even standardized screenings such as colonoscopies and mammograms, which are standard, become unavailable in some regions when healthcare facilities are not nearby, especially in rural or remote areas. Patients may then receive delayed diagnosis and less favorable outcomes by not receiving screenings at the recommended frequencies, which in turn bounds the growth of the market.

Moreover, in some countries, healthcare insurance coverage for cancer screenings is limited, and out-of-pocket costs for patients can be a barrier to widespread screening adoption. This financial burden impacts both the patients who need screening and the healthcare systems that must allocate resources for these high-cost procedures. These economic challenges create significant obstacles to achieving universal screening goals and improving early detection rates globally.

Colorectal Cancer Screening Market Segmentation Insights

By Type

The Colonoscopy segment dominated the market with a 50% market share, thstandard of screening for colorectal cancer because it can detect precancerous lesions and early stages of cancer, which immediately leads to intervention. This is a procedure where the interior of the colon can be visualized directly, thus allowing the removal of polyps during the process with a chance of preventing actual cancer. Despite its invasive nature and requirement for trained personnel, colonoscopy dominates the market due to its all-inclusive diagnostic ability and established position in routine screening guidelines, particularly in developed regions. It remains the first choice in hospital settings and is strongly recommended for those with an average or high risk of colorectal cancer.

In 2023, the Stool-based segment had the fastest growth and contributed with a market share of 38%. The Fecal Immunochemical Test (FIT), is the most rapidly expanding segment in the colorectal cancer screening market. FIT has gained popularity due to its non-invasive nature, ease of use, and affordability, making it an appealing option for widespread screening. These tests detect blood in the stool, which have shown high specificity, thus increasing their adoption. More expensive, stool DNA tests are gaining popularity because they can detect mutations that are genetically linked to colorectal cancer. The growth is so rapid in this segment owing to the preference for the non-invasive method, mostly preferred by those who refuse to undergo colonoscopies. Home tests where patients collect samples themselves and send them to a laboratory for analysis have increasingly resulted in a rise in the demand for stool-based tests, due to the convenience thereof. This shift is all also based on the healthcare industry's efforts toward early detection and hence complying with the screening of diverse population groups.

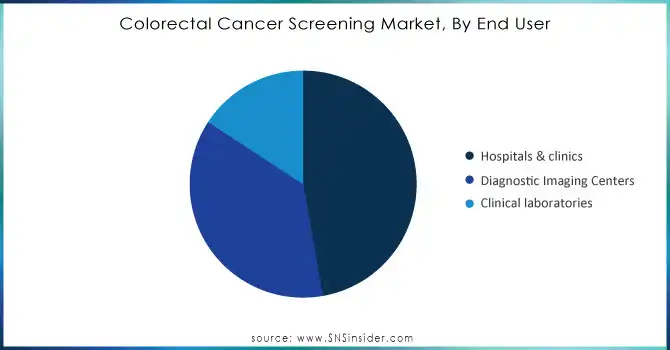

By End-User

The Hospitals & Clinics segment dominated the colorectal cancer screening market, mainly because these establishments offer a wide range of diagnostic services. They are well-staffed with advanced medical instruments, including colonoscopes, and highly skilled personnel that can perform polypectomy and biopsy procedures within a colonoscopy. Hospitals and clinics are important sites of colorectal cancer detection; these institutions are where a significant proportion of colonoscopies are conducted, thus forming the gold standard for screenings. Furthermore, many national screening guidelines encourage frequent screenings in hospitals and clinics, thus indicating an essential role for them in the early detection of cancers and interventions.

Diagnostic Imaging Centers are the fastest-growing segment in the market and are expected at a CAGR of 7.82% throughout the forecast period. This growth is due to the increasing adoption of non-invasive imaging techniques, specifically CT colonography, which is less invasive than the traditional colonoscopy method. Advanced imaging technologies also enable diagnostic imaging centers to provide a more accurate diagnostic result with greater patient comfort and lower risk. As a result, these centers are expanding their services to meet growing demand, particularly among patients seeking alternatives to invasive procedures. This segment's rapid expansion reflects the shift toward more patient-friendly options in colorectal cancer screening.

Need Any Customization Research On Colorectal Cancer Screening Market - Inquiry Now

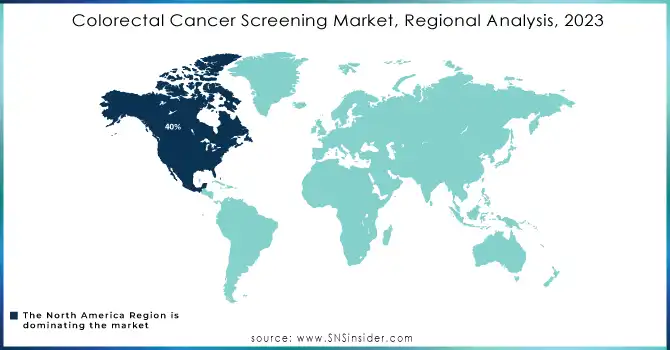

Regional Outlook

In 2023, North America dominated the colorectal cancer screening market with a market share of 40%. This region is the biggest revenue generator in the market, due to the high incidence rates of colorectal cancer in the region. Cases are especially very high in the United States, where colorectal cancer is the third most common cancer. Advanced healthcare infrastructure, robust government initiatives for screening, and widespread adoption of innovative screening technologies like genetic tests and AI-assisted tools have supported North America's strong market position.

Asia Pacific is the fastest-growing region for colorectal cancer screening because of the rapidly increasing prevalence of this condition in countries such as China, Japan, and India. The demographic impact of an aging population, along with the introduction of national screening programs, is making a well for screening services. Improvements in healthcare infrastructure along with the expansion of sophisticated diagnostic tools in these countries are supporting rapid market growth. For instance, in China, which has recorded a sharp rise in cases, widespread screening efforts have been initiated to combat the rise of this disease.

Key Players in the Colorectal Cancer Screening Market

-

Exact Sciences Corporation (Cologuard, Oncotype DX Colon Cancer Assay)

-

Abbott Laboratories (RealTime IDH1 Assay, mS9 Biomarker Screening Test)

-

Qiagen (Therascreen KRAS RGQ PCR Kit, PreAnalytiX PAXgene Stool Kit)

-

Roche Diagnostics (Elecsys CEA Assay, Cobas EGFR Mutation Test)

-

Sysmex Corporation (HISCL Tumor Marker Test, Colon Cancer Screening FOBT)

-

Eiken Chemical Co., Ltd. (OC-Sensor FIT System, LAMP DNA Amplification Test)

-

Fujirebio Diagnostics (Lumipulse G CEA, Lumipulse G FOB Plus)

-

Thermo Fisher Scientific (Oncomine Dx Target Test, QuantStudio Dx Real-Time PCR System)

-

Hologic, Inc. (Aptima KRAS Mutation Assay, Panther Fusion Assay)

-

Bio-Techne Corporation (ACD RNAscope Assay, Tumor Microenvironment Panel)

-

Guardant Health (Guardant360 Liquid Biopsy, Reveal Test for Minimal Residual Disease)

-

Natera, Inc. (Signatera, Prospera Transplant Assessment Test)

-

Siemens Healthineers (ADVIA Centaur CEA Assay, Atellica IM Tumor Marker Assay)

-

Invitae Corporation (Comprehensive Hereditary Cancer Panel, Genetic Risk Assessment for Colon Cancer)

-

PerkinElmer Inc. (LabChip GX Touch Nucleic Acid Analyzer, GSP Neonatal Screening Platform)

-

Epigenomics AG (Epi proColon, Epi proLung BL Reflex Assay)

-

Beckman Coulter, Inc. (Access CEA Tumor Marker Test, DxH 900 Hematology Analyzer)

-

Becton, Dickinson and Company (BD MAX Molecular Diagnostics System, FIT Hemoccult Test)

-

Illumina, Inc. (TruSight Oncology 500, NovaSeq Sequencing Platform)

-

Myriad Genetics, Inc. (myRisk Hereditary Cancer Test, myChoice CDx for Genetic Testing)

Key Suppliers

These suppliers provide essential components or materials for the products used in the colorectal cancer screening market:

-

Thermo Fisher Scientific Suppliers

-

Merck KGaA Suppliers

-

Integrated DNA Technologies (IDT) Suppliers

-

Agilent Technologies Suppliers

-

Bio-Rad Laboratories Suppliers

-

PerkinElmer Life Sciences Suppliers

-

Sigma-Aldrich (a subsidiary of Merck) Suppliers

-

Promega Corporation Suppliers

-

GE Healthcare Life Sciences Suppliers

-

Corning Incorporated Suppliers

Recent Developments in the Colorectal Cancer Screening Market

-

September 2024: Exact Sciences chairman and CEO Kevin Conroy said: “We took a unique scientific approach to develop this test by combining a novel panel of markers. This led to data that improved upon what we previously thought was possible with a blood-based colorectal cancer screening test

-

November 2024: Qiagen is a key player in the colorectal cancer diagnostics market, emphasizing its role in developing advanced molecular diagnostic solutions. Qiagen’s innovations, particularly in non-invasive screening methods like stool-based DNA tests and its leadership in liquid biopsy technologies, position it strongly in this growing market. These contributions align with the global push for early cancer detection and personalized medicine.

-

October 2024: Roche Diagnostics Enhances Colorectal Cancer Screening with AI Owkin, in collaboration with Roche Diagnostics, launched MSIntuit CRC v2, an advanced AI-powered diagnostic for colorectal cancer (CRC). Integrated with Roche’s navify Digital Pathology software, it offered improved analysis of biopsies and resections, enhancing detection and treatment. This next-generation tool used cutting-edge machine learning and staining techniques to improve diagnostic precision, enabling tailored treatments and advancing pathology workflows.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 15.36 Billion |

| Market Size by 2032 | US$ 27.83 Billion |

| CAGR | CAGR of 6.85% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Stool-based, Colonoscopy, Others) •By End-User (Hospitals & Clinics, Clinical Laboratories, Diagnostic Imaging Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Exact Sciences Corporation, Abbott Laboratories, Qiagen, Roche Diagnostics, Sysmex Corporation, Eiken Chemical Co., Ltd., Fujirebio Diagnostics, Thermo Fisher Scientific, Hologic Inc., Bio-Techne Corporation, Guardant Health, Natera Inc., Siemens Healthineers, Invitae Corporation, PerkinElmer Inc., Epigenomics AG, Beckman Coulter Inc., and other players. |

| Key Drivers | •The increasing prevalence of colorectal cancer globally is a major driver of growth in the colorectal cancer screening market. •Technological advancements are improving the effectiveness and accessibility of screening for colorectal cancer. |

| Restraints | •The cancer screening market is the high cost of screening procedures, particularly for advanced diagnostic tests and imaging technologies. |