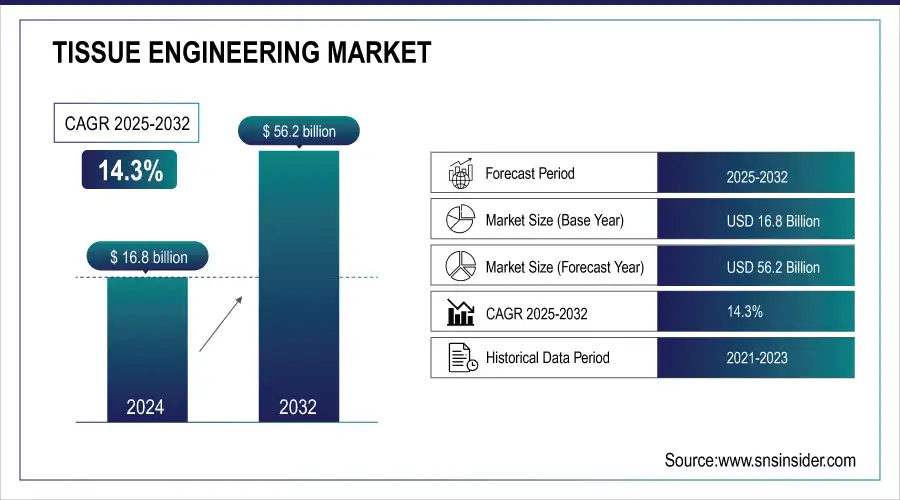

Tissue Engineering Market Size Analysis:

The Tissue Engineering Market size was valued at USD 16.8 Billion in 2024 and will reach USD 56.2 Billion by 2032, with a growing CAGR of 14.3% Over the Forecast Period of 2025-2032.

The increasing prevalence of chronic diseases such as cardiovascular conditions, diabetes, and orthopedic disorders has significantly driven the demand for advanced tissue engineering solutions capable of repairing or replacing damaged tissues. Reflections from an Indian Context" published in May 2022, reported that between 250,000 to 500,000 people worldwide suffer from spinal cord injuries (SCI) annually. Additionally, the National Spinal Cord Injury Statistical Center noted approximately 18,000 new cases of traumatic spinal cord injury (tSCI) in the U.S. each year. As chronic diseases remain the leading global causes of death and disability, their rising incidence is expected to propel the growth of the tissue engineering market.

Get More Information on Tissue Engineering Market - Request Sample Report

The rising popularity of tissue regeneration technology is attributed to its effective products and low rejection rates. There is an increasing trend towards developing more regenerative treatments, with pre-clinical research focusing on tissue-engineered vascular grafts for cardiovascular surgeries. Tissue-engineered bladders have also shown successful implantation in clinical trials.

Stem cell therapies present significant promise for treating various clinical conditions, leading to considerable global investment in research and clinical trials. As the prevalence of cancer, diabetes, and other chronic diseases increases, the emphasis on stem cell research has intensified, enhancing disease management.

Key Tissue Engineering Market Trends

-

Growing adoption of 3D bioprinting and scaffold-based technologies for regenerative medicine.

-

Rising demand for stem cell therapies and autologous tissue implants.

-

Increasing investments in R&D and clinical trials for advanced tissue-engineered products.

-

Expansion of bioinks, hydrogels, and biomaterials for improved cell growth and tissue regeneration.

-

Integration of AI and machine learning for personalized tissue engineering solutions.

-

Rising prevalence of chronic wounds, orthopedic injuries, and organ failures is driving market demand.

-

Regulatory support and evolving approval pathways for regenerative therapies globally.

-

Strategic mergers, acquisitions, and partnerships among tissue engineering companies to strengthen market position.

Tissue Engineering Market Growth Drivers

- Increasing global shortage of organ donation increases the demand for tissue engineering solutions in response to organ failure.

Chronic diseases of the kind caused by lifestyle choices — such as diabetes, heart disease, and kidney failure — and the growing number of older patients also feed into the need. More than 103,000 people are waiting for organs in the U.S. alone, emphasizing the shortage. There are potential solutions, such as the creation of bioengineered organs and tissues through tissue engineering, which may decrease reliance on organ donations. Introduction: The return to physiologic condition and regular functionality is the most basic goal of regenerative medicine, which promotes the repair or replacement of damaged tissues and organs. Other include allografts, and transplants like face hands, and abdominal wall.

- 3D Bioprinting and Stem Cell Technology Advancement propel tissue engineering market growth.

It coupled with 3D bioprinting and fat stem cell ologies is changing the tissue engineering scene and helping tissue engineering in all aspects by creating and having complex functional tissues. 3D bioprinting technology enables greater accuracy and scalability of tissue production. Together with stem cell research, such technologies allow for the generation of tissues that more closely resemble their functions found in nature such as applications to regenerative medicine and personalized therapies. These developments are advancing tissue engineering’s ability to treat diseases previously considered impossible to intervene.

Tissue Engineering Market Restraints

- The high cost of development and execution of procedures, core innovations, and the manufacturing of the tissue-engineered product are some of the major restraints that limit the market growth.

The complexity of tissues and organs as well as the requirements for advanced technologies, such as 3D bioprinting, stem cell research, and others, requires a lot of investment. The high costs associated with production may lead to expensive therapeutic agents, thereby restricting patient and healthcare system access to them, particularly in middle to low-income regions.

Regulatory challenges are another barrier to breaking down. Regulatory authorities such as the FDA and EMA require high-quality approval processes for all components involved in these very innovative and highly specialized tissue engineering products. This entails lengthy clinical trials and adherence to safety and efficacy protocols. These factors can slow the introduction of new therapies and drive up their cost to market. The regulatory challenges also make it hard for newcomers to get into the game as the market can be slower to grow.

Tissue Engineering Market Segment Analysis

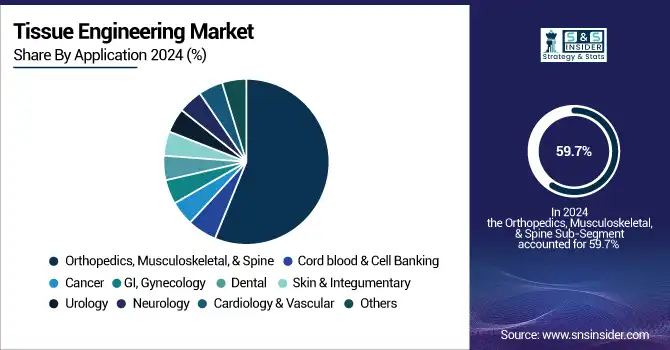

By Application

In 2024, the orthopedics, musculoskeletal, and spine segments held the largest revenue share of 59.7%, driven by the increasing incidence of musculoskeletal disorders. Tissue engineering has become a vital therapeutic approach for orthopedic surgeons treating various musculoskeletal conditions, including meniscal injuries and osteochondral defects. According to the World Health Organization (WHO), over 23 million people globally suffer from rheumatoid arthritis. Additionally, a study published in May 2021 revealed that between 1980 and 2019, there were 460 cases of rheumatoid arthritis per 100,000 people worldwide. The segment's growth is expected to be supported by innovative product launches and strategies by market players. For instance, in October 2022, LifeNet Health showcased ViviGen MIS, an advanced cellular allograft delivery device for minimally invasive surgeries, at the North American Spine Society (NASS) 2022 Annual Meeting in Chicago.

The cardiology and vascular segment is projected to achieve the highest CAGR of 25.9% during the forecast period due to the rising prevalence of cardiovascular diseases. Industry leaders are focused on developing stem cell therapies aimed at repairing, restoring, and revascularizing damaged heart tissues. Ongoing research in gene therapy, advanced biologics, and small molecules is further supporting the segment's growth.

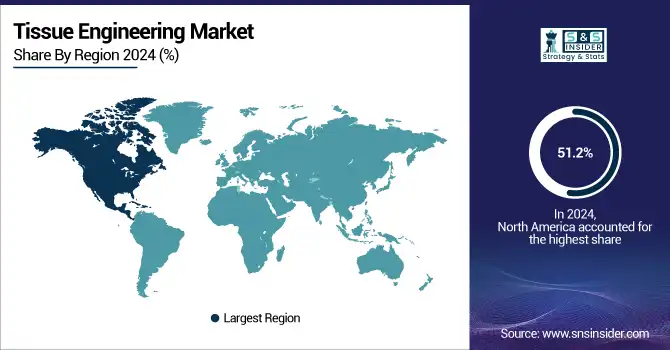

Tissue Engineering Market Regional Analysis

North America Tissue Engineering Market Insights

In 2024, North America led the tissue engineering market with a revenue share of 51.2%, driven by increasing awareness of stem cell therapy, a growing geriatric population, and a rising incidence of chronic diseases. Advanced diagnostic and treatment technologies, along with significant private and government funding and high healthcare spending, contribute to the region's dominance. Key growth drivers also include advancements in 3D tissue engineering technology and the presence of major market players. For instance, in April 2022, Organogenesis showcased innovations in wound care products such as PuraPly AM, Affinity, Apligraf, and Organogenesis Physician Solutions at the Symposium on Advanced Wound Care Conference in Phoenix, Arizona.

Need any customization research on Tissue Engineering Market - Enquiry Now

Asia Pacific Tissue Engineering Market Insights

The Asia Pacific tissue engineering market is anticipated to register the fastest CAGR of 15.8% during the forecast period. Japan leads in technological advancements in the field, with growth fueled by the increasing prevalence of clinical disorders like cancer, the development of 3D bioprinting, and the expansion of medical tourism in Asian countries.

Europe Tissue Engineering Market Insights

Europe holds a 27% share of the market, with Germany, the UK, and France at the forefront. The region’s growth is fueled by strong regulatory frameworks supporting regenerative medicine, increasing investments in biomaterials and tissue-engineered scaffolds, and the adoption of advanced bioprinting technologies in hospitals and research institutions. Initiatives to integrate tissue engineering into clinical practice further strengthen the European market.

Latin America Tissue Engineering Market Insights

Latin America holds an 8% market share in 2024, with Brazil and Mexico leading adoption. Growth is supported by the modernization of healthcare infrastructure and the rising awareness of tissue engineering’s therapeutic benefits. However, budget constraints and limited technological readiness across countries continue to slow broader adoption.

Middle East & Africa Tissue Engineering Market Insights

MEA accounts for 7% of the global market, with the UAE, Saudi Arabia, and South Africa driving growth through smart healthcare initiatives and partnerships with international biotech firms. While regulatory barriers and limited technical expertise pose challenges, increasing investments in hospitals and urban healthcare infrastructure are expected to boost the adoption of tissue-engineered products.

Tissue Engineering Market Competitive Landscape

Organogenesis Inc.

Organogenesis Inc. is a U.S.-based leader in regenerative medicine and advanced wound care solutions, specializing in tissue-engineered products.

-

In April 2024, Organogenesis launched PuraPly AM, an advanced wound care product designed to enhance chronic wound treatment, improve healing rates, and support patient recovery through innovative tissue engineering technology.

Sartorius AG

Sartorius AG, headquartered in Germany, provides laboratory and bioprocess solutions, with a focus on enabling tissue engineering and regenerative medicine advancements.

-

In June 2024, Sartorius announced a strategic partnership with BICO to advance tissue engineering solutions through digital integration and bioprinting technology, aiming to streamline R&D workflows and improve precision in biofabrication.

Tissue Regeneration Technologies LLC

Tissue Regeneration Technologies LLC is a U.S.-based biotech company specializing in bioengineered implants and regenerative cardiovascular solutions.

-

In July 2024, the company introduced a new bioengineered vascular graft for cardiovascular surgeries, offering enhanced durability, biocompatibility, and improved patient outcomes through advanced tissue engineering methodologies.

Cytori Therapeutics Inc.

Cytori Therapeutics Inc., based in the U.S., develops regenerative cell therapies for orthopedic, cardiovascular, and aesthetic applications.

-

In August 2024, Cytori reported successful results from a clinical trial of its Adipose-Derived Regenerative Cells (ADRCs) technology for orthopedic injuries, demonstrating safety, efficacy, and potential to accelerate recovery in patients with musculoskeletal conditions.

Tissue Engineering Market Key Players

-

Organogenesis Inc. (Apligraf, Dermagraft)

-

Allergan (an AbbVie Company) (Juvederm Voluma XC, Alloderm Regenerative Tissue Matrix)

-

Integra LifeSciences Corporation (Integra Dermal Regeneration Template, NeuraGen Nerve Guide)

-

Medtronic (INFUSE Bone Graft, NuVent EM Sinus Dilation System)

-

Zimmer Biomet Holdings, Inc. (Trabecular Metal Bone Void Filler, Grafton, Demineralized Bone Matrix)

-

Stryker Corporation (Vitoss Bone Graft Substitute, HydroSet Injectable Bone Substitute)

-

MiMedx Group, Inc. (EpiFix Amniotic Membrane Allograft, AmnioFix Injectable Amniotic Tissue Matrix)

-

Baxter International Inc. (Tisseel Fibrin Sealant, Actifuse Bone Graft Substitute)

-

Cook Biotech Incorporated (OASIS Wound Matrix, Surgisis Biodesign Hernia Graft)

-

Vericel Corporation (MACI Autologous Cultured Chondrocytes, Epicel Cultured Epidermal Autografts)

-

Acelity (now part of 3M) (GRAFTJACKET Regenerative Tissue Matrix, V.A.C. Therapy Systems)

-

Smith & Nephew plc (PICO Single-Use Negative Pressure Wound Therapy, RENASYS Foam Dressing Kit)

-

LifeNet Health (OsteoCleanse Demineralized Bone Matrix, DermACELL Regenerative Tissue Matrix)

-

Orthofix Medical Inc. (Trinity ELITE Cellular Bone Allograft, OsteoCove Demineralized Bone Matrix)

-

ThermoGenesis Holdings Inc. (X-Series BioArchive System, PXP Bone Marrow Aspirate Concentrate System)

-

Cytori Therapeutics, Inc. (Celution System, PureGraft System)

-

CollPlant Biotechnologies (rhCollagen-based BioInk for 3D Printing, VergenixSTR)

-

Advanced BioMatrix, Inc. (PureCol Collagen Solutions, HyStem Hydrogel Kits)

-

Aspect Biosystems Ltd. (RX1 Bioprinting Platform, Tissue-Specific BioInks)

-

TissueTech Inc. (AmnioBand Membrane, BioDfactor Injectable Allograft)

Key Suppliers

These suppliers are integral to the manufacturing and distribution of products in the tissue engineering market:

-

AlloSource Suppliers

-

BioTek Instruments Suppliers

-

Merz Pharmaceuticals Suppliers

-

Huadong Medicine Company Suppliers

-

Bone Therapeutics Suppliers

-

Biomedical Structures Suppliers

-

Kensey Nash Corporation Suppliers

-

Baxter Healthcare Suppliers

-

Synthes USA Suppliers

-

Orthovita Suppliers

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 19.21 Billion |

| Market Size by 2032 | US$ 56.20 billion |

| CAGR | CAGR of 14.36% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Cord blood & Cell Banking, Cancer, GI, Gynecology, Dental, Skin & Integumentary, Urology, Orthopedics, Musculoskeletal, & Spine, Neurology, Cardiology & Vascular, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Organogenesis Inc., Allergan, Integra LifeSciences Corporation, Medtronic, Zimmer Biomet Holdings, Inc, Stryker Corporation, MiMedx Group, Inc., Baxter International Inc., Cook Biotech Incorporated, Vericel Corporation, Acelity, Smith & Nephew plc, LifeNet Health, Orthofix Medical Inc., ThermoGenesis Holdings Inc., Cytori Therapeutics, Inc., CollPlant Biotechnologies, Advanced BioMatrix, Inc., Aspect Biosystems Ltd., TissueTech Inc. |