Pyridine & Pyridine Derivatives Market Size & Overview:

The Pyridine & Pyridine Derivatives Market size was USD 736.67 million in 2023 and is expected to reach USD 1139.72 million by 2032 and grow at a CAGR of 4.97% over the forecast period of 2024-2032.

To Get more information on Pyridine & Pyridine Derivatives Market - Request Free Sample Report

The report includes a comprehensive analysis of global production capacity and utilization rates by key manufacturers and product types as of 2023. The report provides a detailed examination of feedstock pricing trends and fluctuations across major producing regions. It highlights the regulatory environment affecting pyridine applications in agrochemicals and pharmaceuticals, with country-specific assessments. Environmental performance is evaluated through emissions metrics and sustainable practices adopted by key players. R&D innovation trends are also covered, emphasizing advancements in bio-based pyridine and greener synthesis methods. Furthermore, the report assesses adoption of digital tools and process optimization software within the manufacturing segment, along with compliance tracking for regional regulatory frameworks.

The United States held the largest share in the Pyridine & Pyridine Derivatives Market in 2023, with a market size of USD 128.77 million, projected to reach USD 206.70 million by 2032, growing at a CAGR of 5.40% during 2024–2032. This dominance is primarily attributed to the country’s robust pharmaceutical and agrochemical industries, which are key end-users of pyridine-based compounds. The presence of major market players, strong research and development infrastructure, and consistent regulatory support for innovation in crop protection chemicals and drug formulation further bolster demand. Additionally, the U.S. benefits from advanced chemical synthesis technologies, a highly skilled workforce, and well-established supply chains, all contributing to higher production efficiency and faster commercialization of new derivatives. Strategic collaborations and investments in green chemistry also support the market's growth trajectory across the forecast period.

Pyridine & Pyridine Derivatives Market Dynamics

Drivers

-

Rising use of pyridine in agrochemical formulations and active ingredients accelerates pyridine & pyridine derivatives market growth.

The global demand for agrochemicals has surged significantly due to the rising need for crop protection and improved agricultural productivity. Pyridine and its derivatives are key intermediates in the synthesis of herbicides, insecticides, and fungicides, especially chlorpyrifos and paraquat. As developing countries increase their agricultural output to meet food security demands, the consumption of pyridine-based chemicals continues to rise. Moreover, pyridine's role in enhancing the efficacy and bioavailability of crop protection chemicals makes it a preferred compound among agrochemical manufacturers. Government support for modern farming practices and the introduction of advanced pest management solutions in countries like India and Brazil are further boosting demand. The rising pressure on farmers to achieve higher yields in shrinking arable lands is projected to continue fueling the market's growth over the forecast period.

Restrain

-

Fluctuations in raw material prices and feedstock availability hinder pyridine & pyridine derivatives market expansion.

The production of pyridine is heavily dependent on key petrochemical-based feedstocks such as acetaldehyde, ammonia, and formaldehyde. Volatility in the prices of these raw materials due to crude oil price fluctuations and geopolitical tensions poses a serious challenge for pyridine manufacturers. Additionally, supply chain disruptions and limited availability of high-purity feedstocks can impact production capacity and overall cost structures. These fluctuations affect profitability, especially for small and mid-sized enterprises that rely on steady input costs to remain competitive. Furthermore, the adoption of stricter environmental regulations related to emissions and chemical waste disposal adds compliance costs, thereby intensifying the impact of feedstock price changes. These factors collectively hinder smooth production cycles and can limit the ability of companies to meet growing demand effectively.

Opportunity

-

Expansion of bio-based pyridine and green chemistry pathways opens up new market opportunities globally.

The growing focus on sustainable chemical manufacturing and reducing dependency on fossil-based resources is opening new avenues for the pyridine & pyridine derivatives market. Manufacturers are increasingly investing in the development of bio-based pyridine derived from renewable feedstocks such as glucose, agricultural waste, and other biomass sources. This shift aligns with the global green chemistry movement and regulatory pressure to reduce carbon emissions in the chemical sector. Companies such as Genomatica and Rennovia are already exploring such eco-friendly production methods. The transition to bio-based synthesis not only reduces the environmental footprint but also addresses the issue of feedstock price volatility. With increasing support from government policies and consumer preference for environmentally responsible products, the commercial viability of green pyridine production is expected to improve significantly in the coming years.

Challenge

-

Stringent environmental and safety regulations on pyridine derivatives pose significant challenges for market growth.

Despite its widespread applications, pyridine is classified as a hazardous compound due to its flammability, volatility, and toxicity concerns, especially in large-scale handling. Regulatory bodies such as the U.S. EPA, REACH (EU), and China's MEE have imposed stringent environmental and occupational safety guidelines for pyridine production, storage, and transportation. Compliance with these regulations requires substantial investment in infrastructure, monitoring, and waste treatment facilities, especially for companies operating in developing regions with limited resources. Non-compliance can lead to hefty penalties, product recalls, and reputational damage. Moreover, stricter norms are being introduced to control volatile organic compound (VOC) emissions, directly impacting pyridine-based processes. These evolving regulatory frameworks increase operational costs and may deter new entrants from participating in the market, ultimately slowing down its growth potential.

Pyridine & Pyridine Derivatives Market Segmentation Analysis

By Product

Pyridine held the largest market share around 41.01% in 2023. It is due to the versatile chemical properties and industrial applications of pyridine. Pyridine, a simple heterocyclic organic compound, is used as a key intermediate for the commercial synthesis of a variety of agrochemicals, pharmaceuticals, and food additives. The dominance of the market can be largely attributed to its high demand in pesticide formulations, notably herbicides such as paraquat and insecticides such as chlorpyrifos. The commercial value of pyridine is also extended through its function as a solvent and reagent for organic synthesis and utilization in vitamin B3 (niacin) and antihistamine agents. This has further increased its demand because of the relatively low cost of production of the compound and ability for the compound to be utilized through both synthetic and bio-based paths. Demand for pyridine remains strong primarily due to essential usages in core chemical synthesis used in the growing pharmaceutical and agricultural output of emerging economies.

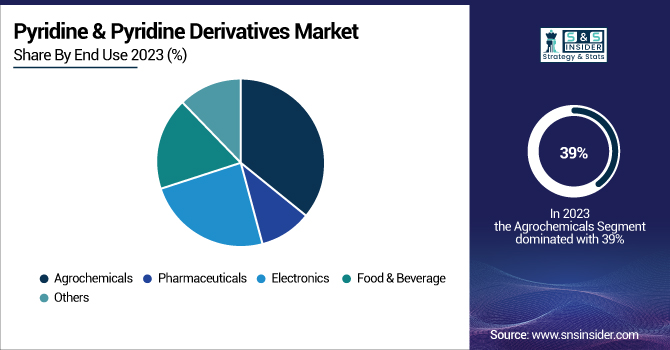

By End -Use

Agrochemicals held the largest market share around 39% in 2023. It is due to usage of a variety of pyridine-based intermediates in the preparation of herbicides, insecticides, and fungicides. Pyridine is an important building block in the manufacture of globally used crop protection chemicals including paraquat, diquat, and chlorpyrifos. As per the growing populations, demand for larger crop yields is required and with the dearth of a larger arable land, the ever-present usage of agrochemicals has expended, especially in the developing economies. Moreover, increasing interest in the development of more efficient formulations of agrochemicals and site-specific, cost-effective compounds has led to the demand for pyridine derivatives due to the beneficial traits provided by the pyridine moiety. It has been dominated due to the regulatory support for advanced agricultural inputs as well as increasing awareness about modern farming practices.

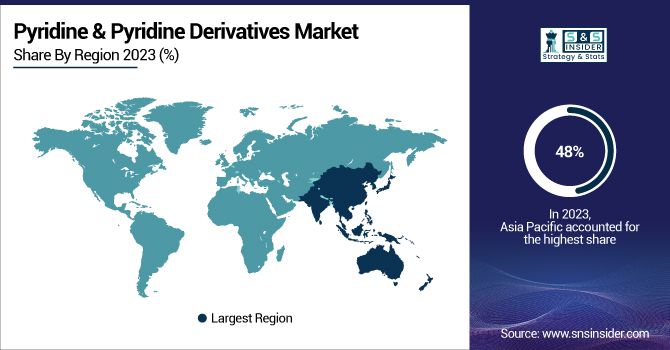

Pyridine & Pyridine Derivatives Market Regional Outlook

Asia Pacific held the largest market share around 48% in 2023. It is owing to the well-established manufacturing base, burgeoning agricultural sector, and increasing pharmaceutical and chemical industries in this region. Pyridine is predominantly consumed and produced in countries like China and India due to the high local consumption of agrochemicals and intermediates for pesticide production. Market growth has further been boosted by the region being able to produce cost-effective units, the abundance of raw materials in the region and government initiatives to promote growth in the industrial sector. In addition, the increasing food demand coupled with further penetration of modern agricultural practices in Southeast Asia has boosted the demand for pyridine-based crop protection products. Moreover, the regional demand is directly driven by the booming pharmaceutical industry and the nutritional supplement industry as pyridine derivatives are vital for demand owing to their application as a raw material in several applications across these industries. The market in the Asia Pacific is driven by these factors along with strong industrial infrastructure and investments in R&D.

North America held a significant market share. It is due to the established pharmaceutical, agrochemical, and chemical manufacturing sector in the region. China and the USA have most of the pyridine derivatives R & D infrastructure, which is beneficial for the population as the derivatives are used in drugs formulation, crop protection chemicals and food additives. Additional market growth is attributed to regulatory approvals and growing demand for nutraceuticals and vitamin B3 produced using pyridine. This is especially true due to the presence of key players, technology enhancements in chemical synthesis, and enhanced focus on sustainable production practices across the world including in Europe. Demand for high-efficiency agrochemicals in the U.S. and Canada stemming from precision farming techniques and large-scale agricultural practices also maintains stable consumption of pyridine-based intermediates, positioning North America as a key market in the global landscape.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Vertellus

-

Jubilant Ingrevia

-

Resonance Specialties

-

Red Sun Group

-

LONZA

-

BASF SE

-

Shandong Luba Chemical Co., Ltd.

-

Hubei Sanonda Co., Ltd.

-

Weifang Sunwin Chemicals Co., Ltd.

-

Shandong Xinhua Pharmaceutical Co., Ltd.

-

Jiangsu Huaxing Chemical Co., Ltd.

-

Puyang Huicheng Electronic Material Co., Ltd.

-

Zhejiang Realsun Chemical Co., Ltd.

-

Nantong Acetic Acid Chemical Co., Ltd.

-

Nova Molecular Technologies

-

Seidler Chemical Co., Inc.

-

Toronto Research Chemicals

-

VIVAN Life Sciences

Recent Development:

-

In January 2025, Shandong Xinhua Pharmaceutical secured approval from the National Medical Products Administration for its Rosuvastatin calcium tablets, following a technology transfer agreement established with Suzhou Dongrui Pharmaceutical Company Limited in May 2024.

-

In November 2023, Jubilant Ingrevia launched a cutting-edge multipurpose agro-intermediate plant at its Bharuch facility in Gujarat. This facility is designed to meet the rising global demand for agro intermediates by leveraging the company’s fully backward-integrated pyridine production capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 736.67 Million |

| Market Size by 2032 | USD 1139.72 Million |

| CAGR | CAGR of 4.97% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Pyridine, Beta Picoline, Alpha Picoline, Gamma Picoline, Others) •By End Use Industry (Agrochemicals, Pharmaceuticals, Electronics, Food & Beverage, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, INVISTA, Ascend Performance Materials, Evonik Industries AG, Radici Group, Toray Industries Inc., Solvay, LANXESS, DSM Engineering Materials, UBE Corporation, Shandong Haili Chemical Industry Co., Ltd., Genomatica, Inc., Asahi Kasei Corporation, DOMO Chemicals, Mitsubishi Chemical Corporation, LANXESS AG, UBE Industries Ltd., Liaoning Shuangyi Chemical Co., Ltd., Hengshui Haoye Chemical Co., Ltd., Rennovia Inc. |