Volatile Organic Compound Gas Sensor Market Size:

Get more information on Volatile Organic Compound Gas Sensor Market - Request Free Sample Report

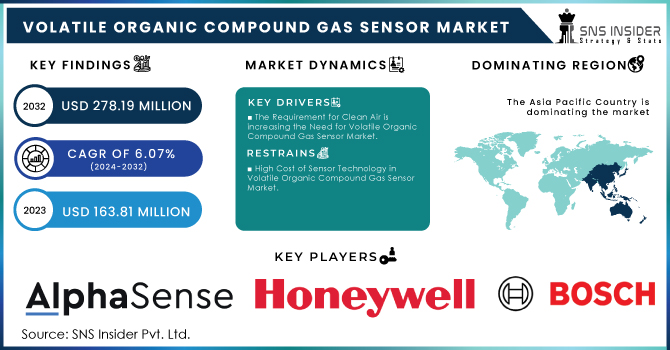

The Volatile Organic Compound Gas Sensor Market Size was valued at USD 163.81 million in 2023, and is expected to reach USD 278.19 million by 2032, and grow at a CAGR of 6.07% over the forecast period 2024-2032.

The increasing use of VOC gas sensors in various sectors is mainly driven by the growing enforcement of strict regulations by government agencies. Organizations like the EPA and MSHA have played a crucial role in pushing this trend forward. In the United States, the Environmental Protection Agency (EPA) monitors VOC regulation through 40 CFR 59, establishing nationwide emission standards for consumer and commercial goods. Additionally, in January 2022, Canada enacted regulations on limits for volatile organic compound concentrations in specific products. These rules require importers and manufacturers to follow precise VOC concentration restrictions in 130 different product categories. Regulatory attention has been specifically on the oil and gas industry. In July 2023, the EPA suggested major alterations to the industry's greenhouse gas emission reporting standards. If approved, these changes will appear in the 2025 reports and must be submitted by March 2026.Moreover, the EPA's recent regulation from December 2023 focused on reducing methane and VOC emissions in the oil and gas industry by establishing new source performance standards (NSPS) for new or updated sources, as well as emission guidelines for states to adhere to with regards to existing sources. In January 2024, the EPA proposed the Waste Emission Charge (WEC) as an additional incentive for reducing methane emissions. This fee imposed on surplus methane releases in the oil and gas industry is meant to prevent pollution and incentivize reductions in emissions. The fee will rise in the coming years, beginning at USD 900 per metric ton in 2024 and escalating to USD 1,500 per ton in 2026.The combined effect of these rules has led to an increased need for VOC gas sensors as industries work to meet environmental regulations and reduce emissions.

The VOC gas sensor market is experiencing rapid growth fueled by its integration with IoT technology. This synergy enables real-time air quality monitoring and control, expanding sensor applications across various sectors. Advancements in sensing materials have enhanced detection capabilities, exemplified by Sensirion AG's SGP41 sensor, which combines VOC and NOx detection with smart switch functionality. While supply chain challenges hindered IoT growth in 2023, the industry is poised for resurgence with 5G adoption, intelligent data analysis, and increased semiconductor production driving lower device costs. Key factors propelling the VOC gas sensor market include AI integration for enhanced data analysis, expanded connectivity for real-time monitoring, decreasing component costs for wider adoption, and technological advancements in computer architecture, chip design, and memory. As IoT matures, the demand for air quality monitoring, early warning systems, and smart city applications will drive the VOC gas sensor market, leading to more sophisticated solutions for environmental and human health challenges. The projected 27 billion connected IoT devices by 2025 underscore the immense potential of IoT to revolutionize industries and improve quality of life.

Market Dynamics

Drivers

-

The Requirement for Clean Air is increasing the Need for Volatile Organic Compound Gas Sensor Market

The growing global focus on air quality is a powerful motivator for the VOC gas sensor sector. As awareness grows about the health risks associated with poor air quality, individuals and businesses are placing greater emphasis on enhancing environmental health indoors and outdoors. This rise in awareness has caused a greater demand for reliable air quality monitoring choices, pushing the utilization of VOC gas sensors in residential, commercial, and industrial sectors. Moreover, ongoing media coverage and health campaigns have raised the importance of air quality, creating a favorable environment for the expansion of the sensor market. Therefore, manufacturers are driven to develop updated, user-friendly, and affordable VOC gas detectors to meet the growing demand and encourage better living and working environments. The AQS, previously known as AIRS, is where the EPA stores information about ambient air quality in the United States. AQS holds information from more than 10,000 monitors, with 5,000 of them being currently in use. Air quality measures have been implemented in all 50 states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands. The release of air pollutants remains a significant factor in several air quality concerns. Around 66 million tons of pollutants were released into the air in the United States in 2022.

-

Regulatory Push for Methane Emissions Reduction in Volatile Organic Compound Gas Sensor Market

The growing worldwide emphasis on addressing climate change and decreasing greenhouse gas emissions is a major factor driving the demand for VOC gas sensors in the oil and gas sector. Methane, a strong contributor to climate change, plays a large role in global warming, with the oil and gas industry being a significant emitter of this gas. The increasing regulatory pressure on the industry is emphasized by the proposed methane regulations in the United States and the European Union, as shown in the data provided. These rules require enhanced supervision, identification, and fixing of methane leaks, increasing the need for sophisticated VOC gas sensors. In order to meet these regulations, companies must invest in advanced sensor technology to monitor and decrease methane emissions. The additional proposal builds upon the EPA's 2021 proposal for oil and gas methane regulations, which received over 470,000 public comments. It consists of several modifications compared to the previous edition. Furthermore, stricter methane performance standards and import requirements in the European Union may increase the demand for VOC gas sensors among gas exporters aiming to comply with the new criteria. Roughly 66 million tons of pollutants were released into the air in the United States in 2022, underscoring the critical importance of implementing efficient strategies to reduce emissions. VOC gas sensors are essential tools for the oil and gas industry to meet environmental compliance and sustainability objectives by monitoring and controlling emissions.

Restraints

-

High Cost of Sensor Technology in Volatile Organic Compound Gas Sensor Market

Significant financial resources are required for the creation and implementation of VOC gas sensors. The significant financial obstacles involved in developing and producing VOC gas sensors include expenses for advanced sensor technology, specialized materials, manufacturing processes, and integration into current systems. Substantial research and development investments are required to create sensors with a high level of sensitivity and specificity. Additionally, the complex production processes contribute to increased manufacturing expenses. As a result, the end product is frequently too expensive for a large number of prospective buyers, particularly in markets that prioritize affordability. This economic obstacle prevents widespread adoption and restricts the complete potential of VOC gas sensor technology.

Segment Analysis

Based on Technology, Metal oxide semiconductor (MOS) dominated the Volatile Organic Compound Gas Sensor market share with 39% in 2023. These sensors operate by sensing variations in electrical resistance when they come into contact with VOCs. MOS sensors are well-known for being cost-effective, durable, and effective at detecting different gases, making them popular in industries like automotive, petrochemical, and healthcare. Figaro Engineering Inc., Alpha Sense, and Honeywell International are major players in this sector, providing various MOS-based VOC gas sensors.

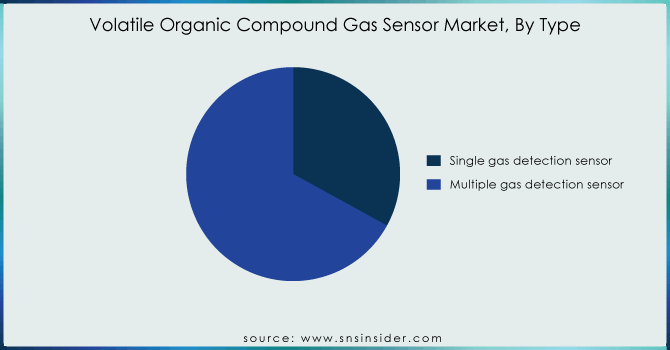

Based on Type, Multiple gas detection sensor dominated the global Volatile Organic Compound Gas Sensor market share with 67% in 2023. These portable and cost-effective devices are indispensable tools for industries like oil and gas, where they monitor pipelines for a wide range of gases including benzene, methylene chloride, and formaldehyde. Beyond leak detection, these sensors function as efficient VOC analyzers, safeguarding equipment and personnel. Employing technologies such as Metal Oxide Semiconductors (MOS), Infrared (IR) sensors, and Photoionization Detectors (PID), these sensors accurately measure VOC concentrations. Driven by stringent regulations and heightened public awareness about air pollution, the demand for multiple gas detection sensors is on the rise. Leading manufacturers such as Honeywell Analytics, Dragerwerk AG & Co. KGaA, and RKI Instruments are at the forefront of developing advanced solutions for diverse applications spanning automotive, manufacturing, and smart building management.

Get Customized Report as per your Business Requirement - Request For Customized Report

Regional Analysis

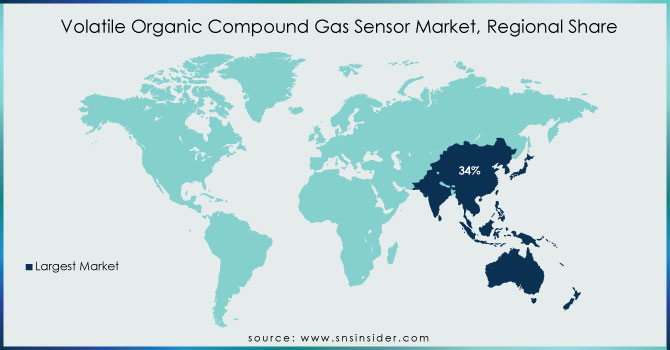

Asia Pacific is dominated the Volatile Organic Compound Gas Sensor market with a share of 34% in 2023. The increasing market is a result of the rising need for environmental and industrial monitoring solutions in the area. The area includes various developing nations like India, Japan, Australia, and Taiwan, experiencing fast urban growth and industrial development, leading to excessive air pollution and environmental decline. This increase in popularity of VOC gas sensors is due to the high demand for them in industries like automotive and manufacturing, where they are used for air quality monitoring and pollution control purposes. The VOC gas sensor market is experiencing growth due to the rising use of IoT and smart technologies in the region.

North America is fastest growing in Volatile Organic Compound Gas Sensor market with a share of 26% in 2023. The United States leads in the VOC gas sensor market. Stringent environmental rules and increased public awareness of air quality have led to a notable increase in the need for advanced VOC detection technologies. The automotive and industrial industries are making significant investments in conformity solutions. Government backing for infrastructure growth, particularly in the energy industry, has opened up significant market possibilities. The DOE's recent allocation of USD 25 million towards natural gas infrastructure advancements, such as low-cost retrofit technologies and integrated sensors, highlights the region's dedication to emission reduction and creating a positive environment for VOC gas sensor manufacturers.

Key Players

Some of the major key players in Volatile Organic Compound Gas Sensor are Alpha sense ,Honeywell International Inc. ,Bosch Sensortech GmbH ,ABB Ltd. , Siemens AG ,Ion Science Ltd. ,SGX Sensortech , Renesas Electronics Corporation ,Eco Sensor , Sensirion AG ,ams AG, Figaro Engineering Inc. and others.

Recent Development

-

In May 2023, Honeywell unveiled a range of intelligent VOC gas detectors aimed at commercial and industrial uses in applications. This technology provides practical information and immediate tracking of air quality levels using cloud-based platforms and advanced analytics. The sensors are aimed at sectors like manufacturing, healthcare, and hospitality to enhance workplace safety and meet environmental regulations.

-

In February 2022, Sensirion released a small VOC gas sensor module designed for consumer electronics and IoT devices in The SGP40 module's high sensitivity and low power usage make it ideal for integration into wearable tech and smart home devices.

| Report Attributes | Details |

| Market Size in 2023 | USD 163.81 Million |

| Market Size by 2032 | USD 278.19 Million |

| CAGR | CAGR of 6.07% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Photoionization detectors (PID), Metal oxide semiconductor (MOS), Electrochemical Sensors, Infrared-based Detection, Others) • By Type (Single gas detection sensor, multiple gas detection sensor) • By Application (Oil & Gas, Agriculture, Automotive, Chemical Industry, Manufacturing, Food & Beverages, Metals & Mining, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alpha sense ,Honeywell International Inc. ,Bosch Sensortech GmbH ,ABB Ltd. , Siemens AG ,Ion Science Ltd. ,SGX Sensortech , Renesas Electronics Corporation ,Eco Sensor , Sensirion AG ,ams AG, Figaro Engineering Inc. and others. |

| Key Drivers | • The Requirement for Clean Air is increasing the Need for Volatile Organic Compound Gas Sensor Market • Regulatory Push for Methane Emissions Reduction in Volatile Organic Compound Gas Sensor Market |

| RESTRAINTS | • High Cost of Sensor Technology in Volatile Organic Compound Gas Sensor Market |