Pyridine Market Report Scope & Overview

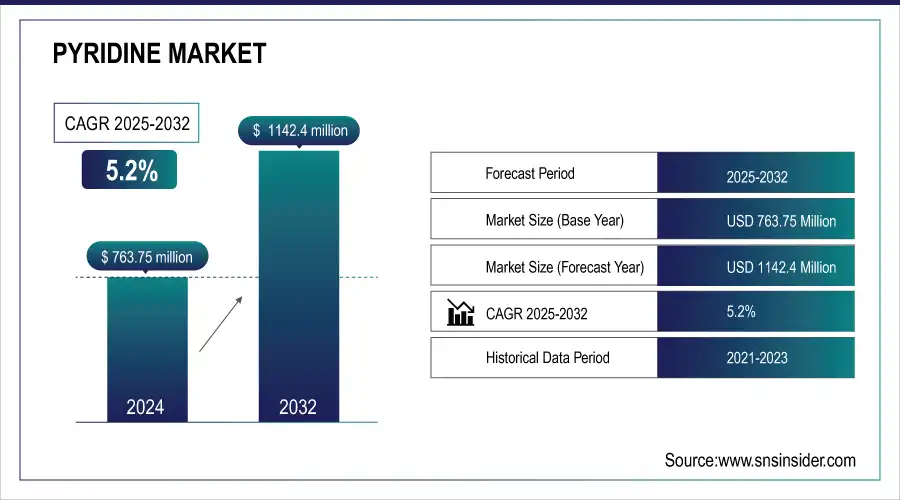

The Pyridine Market Size was valued at USD 763.75 million in 2025E and is expected to reach USD 1142.4 million by 2033, and grow at a CAGR of 5.2% over the forecast period 2026-2033.

The pyridine market represents the sphere of dynamic changes that have occurred within recent years under the impact of different factors, influencing the growth and development of the market. Pyridine is a heterocyclic organic compound, the field of application of which is very extensive. It is indispensable at the stages of agrochemicals, pharmaceuticals, and industrial chemicals synthesis. Its significance in manufacturing herbicides, fungicides, and various pharmaceuticals, such as vitamins and anti-tuberculosis drugs, positions it in several key industries. The main driving force for market growth comes from the increasing demand originating within the agrochemical industry, basically a result of the growing global demand for efficient crop protection.

Pyridine Market Size and Forecast:

-

Market Size in 2025E: USD 763.75 Million

-

Market Size by 2033: USD 1,142.4 Million

-

CAGR: 5.2% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get E-PDF Sample Report on Pyridine Market - Request Sample Report

The U.S. Pyridine market size was valued at an estimated USD 295.60 million in 2025 and is projected to reach USD 445.30 million by 2033, growing at a CAGR of 4.8% over the forecast period 2026–2033. Market growth is driven by increasing demand for pyridine and its derivatives in agrochemicals, pharmaceuticals, and food additives. Rising agricultural activities, expanding use of crop protection chemicals, and growing pharmaceutical manufacturing are key factors supporting market expansion. Additionally, increasing applications in vitamins, solvents, and specialty chemicals, along with steady investments in domestic chemical production and R&D, further strengthen the growth outlook of the U.S. pyridine market during the forecast period.

Key Trends for the Pyridine Market:

-

Rising demand for pyridine in pharmaceutical intermediates and active pharmaceutical ingredients (APIs).

-

Increasing use of pyridine in agrochemicals, including herbicides, insecticides, and fungicides.

-

Growing adoption of pyridine-based solvents in chemical synthesis and industrial applications.

-

Expansion of pyridine derivatives in specialty chemicals and fine chemicals markets.

-

Rising focus on sustainable and green production methods for pyridine manufacturing.

-

Increasing investments in R&D for high-purity pyridine and functional derivatives.

-

Growth in demand from emerging markets due to expanding chemical and pharmaceutical industries.

-

Integration of pyridine in coatings, dyes, and resin manufacturing processes.

-

Technological advancements improving pyridine yield and production efficiency.

-

Stringent regulatory compliance driving adoption of safer handling and production practices.

The other major reason for the changing landscape in the pyridine market involves pharmaceutical applications. Pyridine and its derivatives are used in the manufacture of drugs like anti-histaminic, anti-cholesterol, tuberculosis, and cancer. The factors have driven demand for pharmaceutical products, hence encouraging companies to invest in research and development by developing new pyridine-based pharmaceuticals that can effectively address the emerging healthcare needs. For instance, during the last two decades, pharmaceutical firms focused their effort on creating a new generation of pyridine-based compounds targeting specific therapies. This once again highlights the versatility and importance of this compound in contemporary medicine.

-

Recent growth by major players in the pyridine market further depicts a changing landscape. The global chemical company Lonza, for example, has made great improvement in the production processes of pyridine. Their innovations are pegged on the improvement in the yield of the pyridine with limited waste products and little energy usage. In India, the largest chemical producer, Shreeji Chemicals, has scaled up their capacity in producing pyridines and its derivatives to meet growing demand from both local and global markets. This points to strategic efforts within the industry regarding rising demand and changes in market trends.

Furthermore, the growing attention being attached to sustainability issues has driven companies toward seeking alternative feedstocks and production methods. The development of greener, more sustainable production technologies is showing rapid growth. For example, testing of renewable feedstocks and waste materials as feedstocks in pyridine synthesis is being conducted; this would decrease the dependence on fossil fuels and generally lower the environmental impact. This will represent a shift towards sustainability in concert with global environmental objectives and one which will also create new market opportunities and drive innovation.

Pyridine Market Drivers:

-

Increasing demand for pyridine-based agrochemicals due to the need for effective crop protection solutions.

The rapidly growing demand for pyridine-based agrochemicals is one of the major drivers in the pyridine market, reflecting the enormous role played by these chemicals in modern agriculture. The creation of several herbicides, fungicides, and insecticides crucial in crop protection against pests, diseases, and weeds is impossible without pyridine derivatives. With agriculture being at the forefront of challenges such as climate change, soil degradation, and increased food demand, the need for healthy and productive means of crop protection is felt more intensely. For instance, pyridine is an important ingredient in the manufacture of herbicides, notably picloram, and triclopyr, used to prevent the infestation of jutting plant species that would eventually reduce crop production. The efficacy of such chemicals in enhancing yield encourages demand for such, and in turn propels the pyridine market. Besides, pyridine-based fungicides, such as pyrimethanil, are also deployed to combat fungal infestation that could wipe out crops and cause enormous economic loss. This growth in agriculture, through more intensified farming and genetically modified crops, increases the demand for more sophisticated and highly effective agrochemicals, thus setting up a bigger demand for pyridine. Accompanying this trend is the increase in its use in developing economies, where there is a gravitation toward increased agricultural productivity to meet food security concerns and adjoining economic growth.

-

Growing pharmaceutical applications for pyridine in the synthesis of treatments for chronic diseases and various health conditions.

The pharmaceutical applications for pyridine are growing, hence giving it a significant push within the market. The main fact is that pyridine is a versatile compound; its place in the development of a great range of therapeutic agents has targets for chronic diseases and health conditions. Because of certain specific chemical properties, pyridine acts as an important building block in the synthesis of several pharmaceuticals since it has the advantage of building complex molecules with high potency. For example, derivatives of pyridine are indispensable during the manufacturing of medications against diseases like hypertension, diabetes, and even cancer. An important application includes the synthesis of some anti-tuberculosis medicines such as isoniazid, which is one of the cornerstones during tuberculosis treatment for decades. Another major use of pyridine pertains to the synthesis of nicotinamide adenine dinucleotide analogs implicated in metabolic disorders and age-related diseases. This, in addition to increasing healthcare needs around the world, an ever-growing pharmaceutical industry, and rising incidence of chronic diseases, generates a demand for pyridines as building blocks in the development of drugs. About this, the rising interest in pharmaceutical research and innovation supplies clear and logical reasoning as to why, in consequence, the demand for pyridine will only continue to grow due to the newer and more effective treatments the compound helps develop. That this trend will go on is most evident due to investment in the development of novel pyridine-based molecules that address unmet medical needs, improve patient outcomes, and further give evidence to this compound's critical role in the advancement of modern medicine.

Pyridine Market Restraints:

-

Environmental regulations and concerns over the sustainability of traditional pyridine production methods.

One of the major restraints in the pyridine market is environmental regulations and debate over the sustainability of conventional pyridine manufacturing processes. Most traditional methods of pyridine synthesis are hazardous by-product-emitting, besides being energy-intensive, and they lead to environmental pollution and depletion of natural resources. Conventional processes, for example, in the manufacture of pyridine, use either high-temperature processes or toxic chemicals. This contributes to environmental degradation and health risks to communities where production facilities may be located. These have thus spurred regulations from regulatory bodies in enforcing a tightening of regulations and standards to reduce emissions and ensure that the processes become more sustainable. There is also an influence on companies to employ greener technologies and develop greener production methods. This shift toward sustainability not only involves investment in new technologies that reduce waste and limit energy consumption but also the following of very strict environmental policies. As a result, the need to balance economic viability with environmental responsibility represents a significant challenge for the pyridine market, impacting production costs and operational practices.

Pyridine Market Opportunities:

-

Development of green and sustainable pyridine production technologies to reduce environmental impact and meet regulatory requirements.

The development of green and sustainable technologies of pyridine production opens a very promising perspective on the pyridine market, since there is an improvement of ecological requirements and the fulfillment of legislative needs. In most of the classical syntheses of pyridine, work with hazardous chemicals is involved, accompanied by high energy consumption and resulting in environmental pollution and high production costs. Companies can drastically reduce their ecological footprint by investing in innovative and cleaner modes of production, such as renewable feedstocks or energy-efficient catalysts. For example, some researchers are looking at different synthesis routes, which involve minimized waste and less harm to substances; again, this would help fulfill the stern environmental regulations and reduce overall production costs. It will not only align with global sustainability goals but provide a competitive advantage to the firms that can adapt quickly to such newer technologies that would turn their operations efficient and more environmentally responsible. If implemented well, the deployment of such green technologies can further facilitate market growth by attracting environmentally-conscious investors and consumers who set new bars in industries regarding sustainability.

Pyridine Market Challenges:

-

Volatility in raw material prices affecting the cost stability and profitability of pyridine production.

Volatility in the prices of raw materials constitutes one of the main deterring factors affecting the pyridine market, as it will directly influence the cost stability and profitability of producing pyridines. Pyridine is produced by complex chemical manufacturing processes typically, which are dependent on different types of raw materials-such as petrochemical by-products and other chemical feedstock. A combination of these raw materials into their final products may result in rather unpredictable production costs since commodity price fluctuations are driven by global market dynamics, geopolitical tension, or supply chain disruption. For instance, sharp rises in the cost of crude oil or other essential feedstocks increase production expenses that may not always be easily absorbed by manufacturers. This makes the profit margin and pricing strategy somewhat volatile; this could translate to higher consumer costs and less competitiveness in the marketplace. In addition, fluctuating prices create difficulties in long-term planning and investing in production facilities due to uncertainty over volatile raw material costs. This calls for diversification of raw material sources, optimization of production processes, and setting up of cost controls that can either minimize or reduce the impact of raw material price volatility in the pyridine market.

Pyridine Market Segmentation Analysis:

By Type, Beta Picoline Leads Pyridine Market Driven by Agrochemical and Pharmaceutical Applications

In 2025, Beta Picoline dominated and held the largest share in the pyridine market, at about 35%. Beta Picoline is an important segment because it finds very wide application in the manufacture of various key agrochemicals and pharmaceuticals for instance, Beta Picoline is a key feedstock in the synthesis of Vitamin B6, pyridoxine, which enjoys very high demand in nutritional supplements and the fortification of food. The principal application of the chemical is in the production of herbicides like Picloram, an agrochemical that plays a great role in crop protection and weed control. The massive area of application of Beta Picoline and the important role it plays in both the agro-based and pharmaceutical industries explain its leading market share. The demand for these products propels the huge market share of Beta Picoline, signifying its prominence within the pyridine segment.

By Application, Pesticide Segment Dominates Pyridine Market with Key Role in Crop Protection

In 2025, the pesticide segment is leading in the pyridine market and accounts for approximately 40% of the market. Pyridine is a raw material for the manufacture of certain key pesticides, including herbicides, fungicides, and insecticides. The demand for these forms of pesticides treads on grounds of driving this dominance. As a specific example, pyridine is used as a building block for major herbicides such as Picloram and Triclopyr, which form a fundamental backbone for the effective control of weeds and pests in agriculture. The growth in demand for high-end crop protection chemicals to enhance agricultural yields and for better management of pests has, therefore, greatly enhanced the demand for pyridine in this segment. Hence, due to these factors, the massive application of pyridine-based chemicals in agriculture contributes to the high market share of the pesticide segment, which indicates that the pesticide segment is critical in the pyridine market.

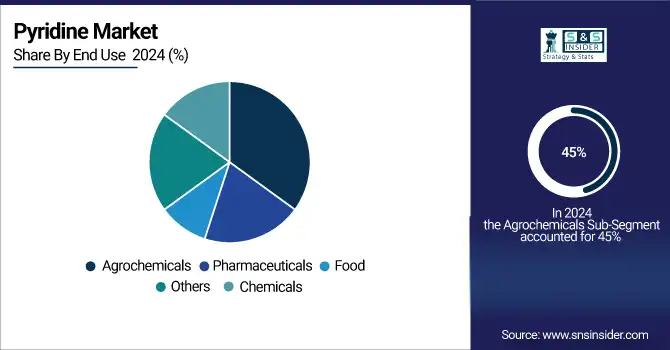

By End-use, Agrochemicals Segment Holds Largest Share in Pyridine Market Due to Extensive Crop Protection Use

The Agrochemicals segment dominated and accounted for about 45% of the largest share of the pyridine market in 2025. The applications of pyridine and its derivatives to different formulation products, such as herbicides, fungicides, and insecticides, can be quite huge. Pyridine is classified as an important starting material in the manufacture of many herbicides, including Picloram and Triclopyr. These are very commonly used in the field with the view of boosting agricultural productivity by controlling weeds and pests. Another major consumer is the agrochemical industry, mainly because of the high demand for effective and efficient methods of crop protection against pests, diseases, and soil degradation. Hence, the agrochemical industry uses a wide range of pyridine-based products in carrying out protection on crops; therefore, it accounts for the leading position.

Pyridine Market Regional Analysis:

North America Dominates the Pyridine Market in 2025

In 2025, North America holds an estimated 35% share of the pyridine market, primarily due to its robust pharmaceutical and agrochemical industries. Pyridine is widely used as a key intermediate in the production of vitamins, APIs, and crop protection chemicals, driving consistent demand. Advanced manufacturing infrastructure, strong R&D capabilities, and regulatory frameworks supporting safe chemical production further strengthen the market. Additionally, growing requirements for herbicides, insecticides, and fungicides in agriculture contribute to sustained pyridine consumption, reinforcing North America’s dominant position in the global market.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

-

United States Leads North America’s Pyridine Market

The U.S. dominates due to its large pharmaceutical and agrochemical industries. Pyridine is extensively used as a key intermediate in vitamins, APIs, and crop protection chemicals. Advanced manufacturing infrastructure, robust R&D capabilities, and regulatory frameworks supporting safe chemical production strengthen its position. Rising demand for efficient herbicides, insecticides, and fungicides further drives pyridine utilization. Leading producers maintain high-quality standards and consistent supply chains, reinforcing the U.S. as the dominant market player in North America in 2024.

Asia Pacific is the Fastest-Growing Region in the Pyridine Market in 2025

The Asia Pacific pyridine market is expected to grow at a CAGR of 6.8% from 2026 to 2033, driven by rapid industrialization and expanding chemical manufacturing capabilities. Increasing agricultural activities in the region are boosting demand for pyridine-based agrochemicals such as herbicides, insecticides, and fungicides. Rising investments in pharmaceuticals further amplify the need for pyridine as a key intermediate in APIs and vitamins. Cost-effective production, supportive government policies, and growing industrial infrastructure collectively contribute to strong market growth, positioning Asia Pacific as the fastest-growing pyridine market.

-

China Leads Asia Pacific’s Pyridine Market

China dominates due to its large chemical and agrochemical manufacturing base. Pyridine is a critical raw material in herbicides, insecticides, fungicides, and pharmaceutical intermediates. Favorable government policies, cost-effective production, and industrial investment drive high utilization. Rising agricultural mechanization and demand for crop protection chemicals to boost yields, coupled with a thriving pharmaceutical sector, strengthen China’s market leadership. Strong infrastructure and large-scale production capabilities allow China to supply both domestic and global markets, establishing it as the top market in Asia Pacific.

Europe Pyridine Market Insights, 2025

Europe shows steady growth in the Pyridine Market in 2025, fueled by demand from pharmaceutical and agrochemical industries and specialty chemical applications. Germany’s advanced chemical and pharmaceutical industries increase pyridine utilization, enhancing Europe’s market growth and industrial output.

-

Germany Leads Europe’s Pyridine Market

Germany dominates due to its strong chemical manufacturing, pharmaceutical R&D, and high-quality standards. Pyridine is widely used in specialty chemicals, crop protection, and pharmaceuticals. Technological innovation, strong industrial infrastructure, and export capabilities support steady market growth. Germany’s leadership in chemical production, combined with stringent quality compliance and global supply chain integration, establishes it as the key contributor to Europe’s pyridine market in 2024.

Middle East & Africa and Latin America Pyridine Market Insights, 2025

The Pyridine Market in the Middle East & Africa and Latin America is experiencing moderate growth in 2025, supported by agricultural expansion and rising demand for crop protection chemicals. In the Middle East, countries like Saudi Arabia and South Africa drive adoption through increasing agrochemical usage. In Latin America, Brazil and Mexico lead with growing agricultural production and modernization. Emerging pharmaceutical sectors and government incentives in both regions further support pyridine market adoption, positioning these regions as secondary yet promising markets for global pyridine manufacturers.

Competitive Landscape for the Pyridine Market:

Jubilant Life Sciences Ltd.

Jubilant Life Sciences Ltd. is an India-based global leader in specialty chemicals and pharmaceutical intermediates, with a strong focus on pyridine production. The company manufactures high-purity pyridine and derivatives used in agrochemicals, pharmaceuticals, and specialty chemical applications. With decades of experience, Jubilant Life Sciences operates integrated production facilities, ensuring quality, consistency, and scalability. Its role in the pyridine market is vital, providing critical raw materials for vitamin synthesis, crop protection chemicals, and pharmaceutical intermediates, supporting both domestic and international demand. The company also emphasizes innovation and sustainable chemical manufacturing practices to maintain market leadership.

-

Jubilant Life Sciences recently expanded its pyridine production capacity to meet rising demand from pharmaceutical and agrochemical industries, reinforcing its global market position.

Lonza Group Ltd.

Lonza Group Ltd. is a Switzerland-based leader in life sciences and specialty chemicals, specializing in high-quality pyridine and derivatives for pharmaceutical and agrochemical applications. The company leverages advanced R&D capabilities and state-of-the-art production facilities to supply high-purity intermediates and solvents. Its role in the pyridine market is central, offering reliable, scalable solutions for vitamin synthesis, active pharmaceutical ingredients, and crop protection chemicals. Lonza’s emphasis on quality assurance and regulatory compliance ensures that its pyridine products meet stringent international standards, supporting global chemical and pharmaceutical supply chains.

-

In 2024, Lonza enhanced its production technology for pyridine derivatives, improving yield and purity for key agrochemical and pharmaceutical applications.

Vertellus Holdings LLC

Vertellus Holdings LLC is a U.S.-based manufacturer of specialty chemicals, including pyridine and related derivatives for pharmaceuticals, agrochemicals, and industrial applications. The company combines chemical engineering expertise with robust production capacity to meet global market demand. Its role in the pyridine market is significant, providing intermediates for vitamin production, crop protection formulations, and specialty chemical synthesis. Vertellus emphasizes innovation, sustainability, and customer-focused solutions, ensuring high-quality products and reliable supply chains for industrial and pharmaceutical clients worldwide.

-

Vertellus recently introduced advanced pyridine-based intermediates for agrochemical and pharmaceutical applications, enhancing efficiency and reducing environmental impact.

Resonance Specialties Limited

Resonance Specialties Limited is an India-based manufacturer and supplier of pyridine and specialty chemical intermediates for pharmaceuticals, agrochemicals, and fine chemicals. The company operates high-capacity production facilities and focuses on delivering high-purity pyridine products to meet global industry standards. Its role in the pyridine market is vital, serving as a key supplier for herbicides, insecticides, fungicides, and vitamin synthesis, enabling agrochemical and pharmaceutical industries to scale efficiently. Resonance Specialties emphasizes sustainable production practices, process optimization, and customer-centric solutions to strengthen its competitive position.

-

In 2024, Resonance Specialties expanded its global distribution network for pyridine, increasing accessibility for pharmaceutical and agrochemical manufacturers.

Pyridine Market Key Players:

-

Jubilant Life Sciences Ltd.

-

Lonza Group Ltd.

-

Vertellus Holdings LLC

-

Resonance Specialties Limited

-

Shandong Luba Chemical Co., Ltd.

-

Koei Chemical Co., Ltd.

-

Red Sun Group

-

Weifang Sunwin Chemicals Co., Ltd.

-

Mitsubishi Chemical Corporation

-

BASF SE

-

C-Chem Co., Ltd.

-

Nanjing Redsun Co., Ltd.

-

Chang Chun Petrochemical Co., Ltd.

-

Hubei Sanonda Co., Ltd.

-

Labex Corporation

-

Novasyn Organics Pvt. Ltd.

-

ProChem, Inc.

-

Alfa Aesar

-

Merck KGaA

-

National Analytical Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 763.75 Million |

| Market Size by 2033 | US$ 1142.4 Million |

| CAGR | CAGR of 5.2% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Alpha Picoline, Gamma Picoline, 2-Methyl-5-Ethylpyridine, Beta Picoline, Pyridine N-Oxide) •By Application (Medicines, Rubber, Paints and Dyes, Pesticides, Solvent, Food Flavouring, Others) •By End-use (Pharmaceuticals, Agrochemicals, Food, Chemicals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Trineso, Lonza Group Ltd, Resonance Specialties Ltd, Shandong Luba Chemical Co Ltd, Weifang Sunwin Chemicals Co Ltd, Jubilant Life Sciences Ltd, Vertellus Specialties Inc, Red Sun Group, Koei Chemical Co Ltd, Bayer AG and other key players |