Sandstone Market Report Scope & Overview

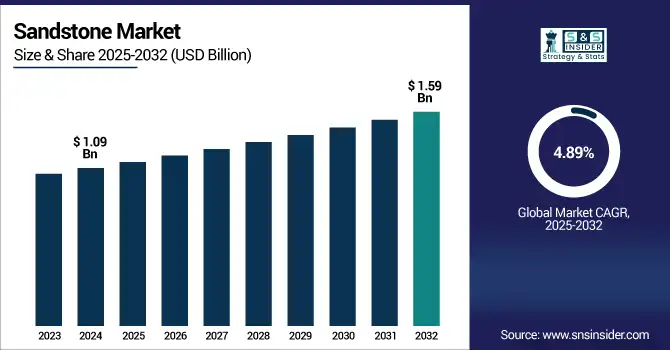

The Sandstone Market size was USD 1.09 billion in 2024 and is expected to reach USD 1.59 billion by 2032, growing at a CAGR of 4.89% over the forecast period of 2025-2032.

To Get more information on Sandstone market - Request Free Sample Report

Sandstone Market Analysis highlights that increasing demand from the construction and infrastructure sectors is a key factor driving market growth. The increasing demand in the construction and infrastructure sector is a key driver of market growth. Sandstone is very popular for its high strength, looks, and weather resistance, which is why it is one of the preferred choices of material used for flooring, wall cladding, pavements, and facades, among others. Natural stones, such as sandstone are used for a wide range of purposes along with the current trends of marginal urbanization, rapid development of infrastructure by governments focusing more on developing economies. Moreover, an increase in the use of sandstone for structural and ornamental purposes in commercial and residential real estate projects is also expected to propel the growth of the market. Such a rise in construction activities significantly boosts the expansion of sandstone market growth.

Under the 2021 Infrastructure Investment and Jobs Act, the U.S. Department of Transportation is providing grants to the tune of USD 5.4 billion for the construction, replacement, and repair of bridges. Such funding goes toward large public infrastructure projects that often have natural stone materials, such as sandstone, specified in the aesthetic and durability sections.

Market Dynamics:

Drivers:

-

Increasing Construction and Infrastructure Development Drive the Market Growth

Growing global construction and infrastructure development can thus be used to drive sandstone industry activity. With governments and private developers continuing to pour money into urban sprawl, days away from opening roads, airports, and public buildings too, the need for long-lasting quality materials, such as sandstone remains in high demand. This is an inherent attribute in stone, which makes it a natural choice for external cladding and natural stone is strong, stable, and weather resistant, so is used in landscaping and paving. This increase is mainly driven by emerging economies, particularly in Asia and the Middle East. Restoration of heritage sites and public monuments also creates an additional demand. Sandstone remains a commercial and architecturally invaluable commodity due to the increasing built environment.

Restraints:

-

Environmental and Quarrying Regulations May Hamper the Market Growth

The sandstone market is adversely affected due to strict environmental regulations on quarrying operations. In any ecologically sensitive region mining activities are subjected to heavy scrutiny if they disrupt habitat, generate dust pollution, or use a lot of water. Governments are imposing stricter controls for environmental protection, which makes permits and operating licenses less accessible and more expensive for producers. These regulations may place restrictions on the volume of production, and increase operational costs. Sustainability-oriented developers may opt for alternative materials that leave a smaller ecological footprint. This poses a particular challenge to growth, especially in lands where modern quarrying infrastructure does not exist.

Opportunities:

-

Growing Demand for Sustainable and Natural Materials Creates Opportunities in the Market

A major opportunity for the sandstone market is a shift toward sustainable building materials. Sandstone is a recyclable, natural, and low-impact building material that is becoming in demand as architects and developers strive to achieve green certifications, such as LEED and BREEAM. More designers and consumers are drawn to natural materials because of their beauty and environmental advantages. Sandstone delivers high-end style with environmental sustainability and is widely used in landscaping, public works, and luxury real estate. On top of that, technology could improve sustainability and variety in quarrying and finishing. That puts green suppliers in a better competitive position, which drives the Sandstone market trends.

In 2024, LafargeHolcim introduced EcoCycle aggregates a new eco-friendly product line consisting entirely of recycled construction materials. The use of these low-carbon aggregates is now more than 10% of the European aggregates sales, and they are being used extensively in urban low-carbon building projects.

Segmentation Analysis:

By Application

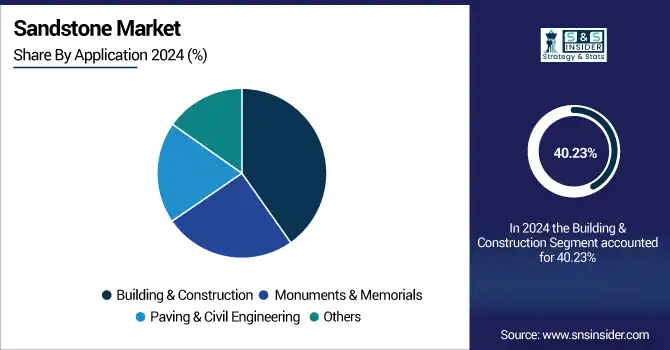

Building & Construction held the largest Sandstone market share, around 40.23%, in 2024 as sandstone material is largely used as a building material, and it is also widely used for structural and decorative purposes for the building stone market. Rich, hardy, easy to shape, and resilient, sandstone is irreplaceable in construction for various reasons. Marble is commonly used for flooring, wall cladding, facades, pavements, and landscape elements in both residential and commercial buildings. With the volume of construction increasing rapidly globally, particularly in developing countries and urban infrastructure, the market for high-grade natural building products like sandstone has experienced a substantial rise in demand.

Monuments & Memorials held a significant Sandstone market share due to its strength, workability, and ageing over time, sandstone is widely used in making statues, gravestones, memorials, and heritage monuments. It has a natural grain and warm color tones, giving it a dignified and ancient-looking appearance, important for any commemorative architecture. To preserve historical authenticity, many governments and private institutions globally still invest in repairing and building monuments using sandstone. Mild demand from the residential sector considerably impacts the overall sandstone market, particularly in European, Asian, and Middle Eastern regions, where cultural aspects drive infrastructure development.

Regional Analysis:

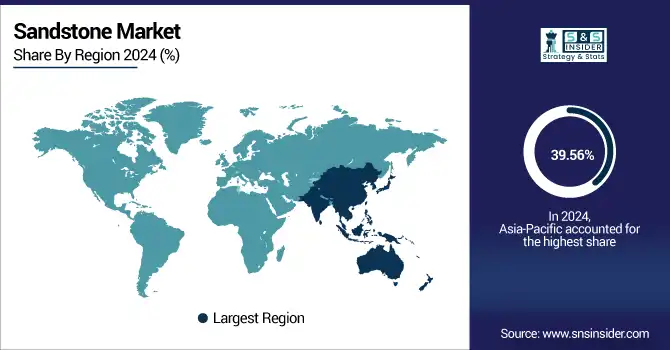

Asia-Pacific held the largest market share, around 39.56%, in 2024 due to the increasing urbanization, growing construction activities, and high availability of natural stone reserves in the region. India, China, and Australia are some of the leading sandstone-producing and exporting nations that serve both domestic and international demands of sediment stone. Sandstone holds a significant cultural part of India, and therefore, it finds wide application in residential, commercial, and religious buildings. In parallel, as China continues to build out large-scale infrastructure projects and urbanization, demand for natural materials, which are durable and low in cost, remains strong. Furthermore, government initiatives towards smart cities and renovation of heritage sites, along with sustainable construction practices, are propelling the consumption of sandstone across the Asia-Pacific region, thus rendering it the highest market share.

North America Sandstones market held a significant market share and is the fastest-growing segment in the forecast period. It is owing to steady demand from construction, landscaping, as well as historical reconstructions. Sandstone has a long history of use in modern and classical architecture, and this is especially true for government buildings, universities, and memorials in the United States. Sandstone strengthens its position in the region due to rising investments in residential and commercial infrastructure, and growing preference for natural, sustainable building materials. Parallelly, an increase in heritage conservation activities as well as landscape-based projects has propelled steady market demand.

The U.S Sandstone market size was USD 210 million in 2024 and is expected to reach USD 341 million by 2032 and grow at a CAGR of 6.26% over the forecast period of 2025-2032 as it is extensively utilized in commercial construction, urban landscaping, and heritage preservation. In the U.S., sandstone is a popular choice found primarily in government buildings, museums, memorials, or high-end residential buildings due to its aesthetics, durability, and versatility. It has an excellent quarrying and well-structured supply chain integrated with domestic use and exports. Also, growing spending on the expansion of infrastructure and energy-efficient construction, such as the green-registered items movement has raised the call for sandstone.

Europe held a significant market share in the forecast period. It is owing to the heavy focus on heritage preservation, sustainable construction, and architectural appeal, Europe represented a major share of the global demand for sandstone. There are many historical buildings, cathedrals, and monuments in the area, which were constructed from sandstone, with demand for these sorts of restoration and conservation projects ongoing. While other Euro-zone nations such as Germany, France, Italy, and the United Kingdom have much more mature quarrying industries and a long tradition of natural stone usage in the buildings and structures they build.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major sandstones companies are, Levantina, Lafarge Canada, Graymont, Stonemart, Vetter Stone, Antolini, Pakistan Onyx Marble, Mumal Marbles, Xiamen Wanli Stone, and Kangli Stone Group.

Recent Developments:

-

In 2025, Sandvik Rock Processing partnered with S&R Enterprises in South Africa to assist locals in the rural areas with mobile crushing units, alongside superior parts availability rolled out in 2025.

-

In 2023, Levantina, a large Spanish producer of natural stone, announced its introduction of a new line of precut and finished sandstone products. Through the commercial launch, the company is making installation easier in commercial and landscaping application.

| Report Attributes | Details |

| Market Size in 2024 | USD 1.09 Billion |

| Market Size by 2032 | USD 1.59 Billion |

| CAGR | CAGR of4.89% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Building & Construction, Monuments & Memorials, Paving & Civil Engineering, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Levantina, Lafarge Canada, Graymont, Stonemart, Vetter Stone, Antolini, Pakistan Onyx Marble, Mumal Marbles, Xiamen Wanli Stone, Kangli Stone Group. |