Isobutyl Stearate Market Size Analysis

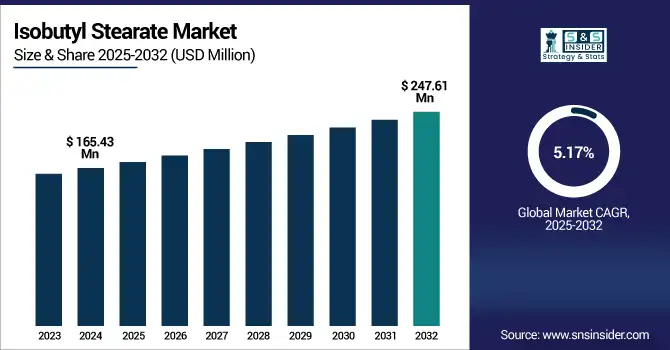

The Isobutyl Stearate Market size was valued at USD 165.43 million in 2024 and is expected to reach USD 247.61 million by 2032, growing at a CAGR of 5.17% over the forecast period of 2025-2032.

Isobutyl stearate market analysis highlights that increasing demand in metalworking fluids is propelling market growth. Due to its good lubricity and low volatility, and good antioxidants, Isobutyl stearate is frequently used in metalworking formulations. Besides, there is increasing demand for high-performance metalworking and machining solutions as global industrialization speeds up in areas like Automotive, Aerospace, and Heavy machinery. As they improve tool life and surface finish quality, isobutyl stearate improves cutting oil performance as well as forming fluid and rust preventive performance.

To Get more information on Isobutyl Stearate Market - Request Free Sample Report

Also, being compatible with synthetic and semi-synthetic formulations makes it a popular additive in the modern, eco-friendly metalworking fluids. The increasing need for effective lubrication solutions in industrial manufacturing is one of the major drivers driving the isobutyl stearate market growth. According to a U.S. technical fabricator across the nation regularly consume a staggering yearly total of roughly 175 million gallons of metalworking fluids with a combined value of about USD 800 million, according to a U.S. technical guide on pollution prevention in machining and metal fabrication.

Isobutyl Stearate Market Dynamics

Drivers

-

Rising Use in Cosmetics and Personal Care Products Drives the Market Growth

Growth in the isobutyl stearate market is significantly driven by rising use in cosmetic and personal care products, which is prized for its good emollient, spreading, and lubricating properties. This use is found in lotions, creams, sunscreens, and lipsticks, in which they provide a smooth, non-greasy feel and improve product texture and skin penetration. Driven by demand for lightweight, fast-absorbing skincare and the move toward milder global markets with gentler skin-positive ingredients, formulators are seeking isobutyl stearate to use as a workhorse ester. In addition, it is compatible with other active ingredients and is stable in a wide pH range, enhancing its versatility in cosmetic formulation.

According to the U.S. Environmental Protection Agency (EPA), fabricators purchased about 175 million gallons of metalworking fluids annually (worth approximately USD800 million), which equaled 15% of the total industrial oils market.

Restrain

-

Fluctuating Raw Material Prices May Hamper the Market Growth

The isobutyl stearate market growth is expected to be hindered due to volatile prices of raw materials, as the production of isobutyl stearate relies on key inputs and raw materials such as stearic acid and isobutanol, which are derived from natural fats and oils or petrochemical sources. Manufacturing costs are heavily influenced by the volatility in the prices of these raw materials, which are affected by crude oil price fluctuations, seasonal variation in feedstock availability, supply chain disruptions, and geopolitical tensions. The factors of instability of price create a challenge in prolonging the average cost and procurement of said product for producers. In addition, an unexpected spike in costs can result in higher prices for end products, which will eventually temper demand from price-sensitive industries like metalworking, personal care, and industrial lubricants.

Opportunities

-

Expansion into Pharmaceutical Applications Creates Opportunities in the Market

The isobutyl stearate industry is generating tremendous opportunities due to the expanding pharmaceutical applications, resulting in extensive manufacturing and formulation opportunities for drug delivery systems, ointments, and topical formulations. Isobutyl stearate is increasingly used as a pharmaceutical excipient, renowned for its high spreading capacity, good emollience, and solvent characteristics, e.g., in dermatological and cosmetic–medical products. A high degree of compatibility with a large number of active pharmaceutical ingredients (APIs) also means that it is an important component in creams, gels, and lotions as IMOL delivers good skin-feel, texture, and skin absorption. Furthermore, the continuous trend of clean-label, non-toxic, and skin-friendly formulations in the healthcare space is pushing pharmaceutical companies to use ester-based compounds such as isobutyl stearate, driving the isobutyl stearate market trends.

Jiangsu Yoke Technology developed a halogen-free BTPP substitute in 2022 for auto-grade plastics to meet the needs of OEMs looking for safer, high-performance polymer solutions.

Isobutyl Stearate Market Segmentation Analysis

By Application

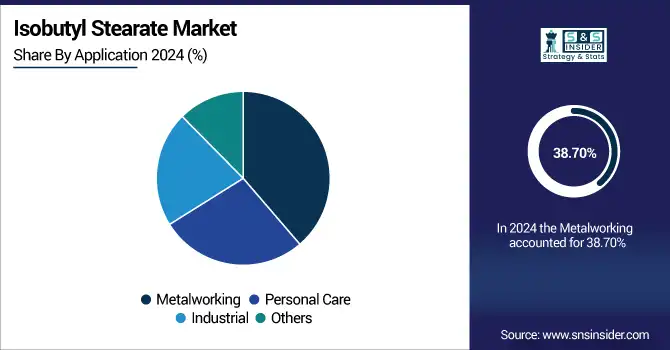

Metalworking held the largest isobutyl stearate market share, around 38.70%, in 2024. It is due to the widespread use of isobutyl stearate as a lubricating and anti-wear additive in metalworking fluids. Isobutyl stearate has good properties such as lubricity, thermal stability, and oxidation resistance, which make it an excellent choice for cutting oils, drawing compounds, and machining fluids. Such properties have a role to play in reducing friction, preventing the wearing of the tooling, and enabling the surface finish of the metal part, all necessary components in high-precision manufacturing.

Personal care held a significant isobutyl stearate market share. It is due to its very light and non-greasy feel, spread ability, and skin-smoothing characteristics, isobutyl stearate is an excellent additive ingredient in a variety of applications, including lotion, cream, makeup removers, sunscreens, and lipstick. As consumer demand for high-quality, skin-friendly products with natural skin-feel continues to increase, formulators are using more esters, such as isobutyl stearate, to improve the texture and penetration. On the increasingly popular clean beauty and dermatologically tested products side, therefore, also multifunctional, mild esters gain ground over classic actives that are both effective and mild to the skin.

Isobutyl Stearate Market Regional Outlook

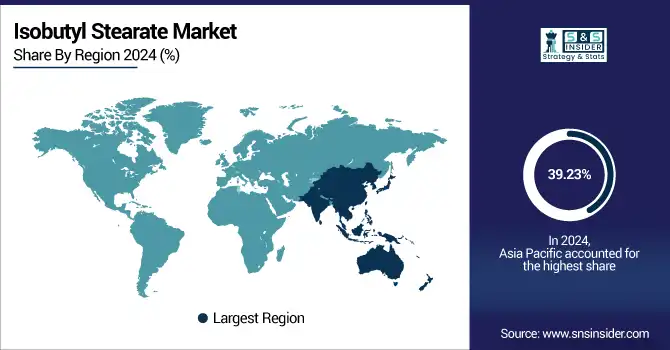

Asia-Pacific held the largest market share, around 39.23%, in 2024. It is due to the rapidly growing manufacturing and the rising industrial base in this region for the global Isobutyl Stearate market. Metalworking, personal care, and industrial processing are the major end-use segments for isobutyl stearate with respective applications in CRO, GHG, and M&A sales area/region, especially in China, India, South Korea and Japan. Demand for high-performance lubricants and additives, like isobutyl stearate, in metalworking fluids, a key application, is driven by the region's emerging automotive and machinery industries, with consistent demand due to extensive lubricity and thermal stability. Additionally, increasing usage of isobutyl stearate as an emollient and spreading agent in the cosmetics and personal care industry is further boosting the market growth. Asia-Pacific stands out as a key regional market, supported by a large consumer base and rising disposable incomes, which continue to fuel demand in this sector.

In April 2023, Ashland Inc. has increased China's domestic capacity in polyacrylamide will experience a major increase this year, with the upgrade set to finish at the end of 2023 to complement local industry demand for supply

North America isobutyl stearates market held a significant market share and is the fastest-growing segment in the forecast period. It is owing to the growing demand from its end-use industries, including well-established metalworking, cosmetics, and industrial manufacturing sectors in the region. Metalworking fluids are widely adopted in metalworking industries for lubrication, corrosion, and cooling applications, with the automotive and aerospace industries majorly driving the demand for metalworking fluids in the United States, in particular. Isobutyl stearate offers low viscosity, high lubricity, and excellent sulphur and thermal stability has led to its use as a desirable additive in these applications.

The U.S. isobutyl stearate market size was USD 31.81 million in 2024 and is expected to reach USD 51.54 million by 2032 and grow at a CAGR of 6.22% over the forecast period of 2025-2032. It is owing to the strong presence of metalworking, cosmetics, and industrial lubricants industries in the country, which are the major end-use industries generating demand for this ester-based lubricant & emollient. The metalworking fluids industry in the U.S. is perhaps the most sophisticated in the world, backed by manufacturing strengths in automotive, aerospace, and heavy equipment. In this segment, isobutyl stearate is promoted due to its superior lubricity, thermal stability, and biodegradability, which are in harmony with the changing regulatory landscape emphasizing workplace safety and environmental sustainability.

Europe held a significant market share in the forecast period. It is owing to the presence of major automotive, industrial manufacturing, and personal care sectors, which are some of the main application areas for isobutyl stearate in the region. Isobutyl stearates are widely consumed in metalworking fluids and lubricants, especially in Europe, including Germany, Italy, and France, driven by its good lubricity, thermal & oxidative stability, and biodegradability. In addition, the high presence of leading cosmetics & personal care brands in the region is driving demand for isobutyl stearate as an emollient used in skin care & hair care applications. Regulations in Europe, which are pushing for greener and low-toxicity esters in industrial applications, have further convinced producers to move to isobutyl stearate-based formulations.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Isobutyl Stearate Market

The major isobutyl stearate companies are Emery Oleochemicals, Oleon, Croda International Plc, KLK OLEO, A&A Fratelli Parodi Spa, Alnor Oil Co., Inc., Hangzhou DayangChem Co., Ltd., Syntechem Co., Ltd., IOI Oleo GmbH, and Triveni Chemicals.

Recent Development in the Isobutyl Stearate Market

-

In March 2025: Croda opened a new plant designed to manufacture integrated lipids in Lamar, Pennsylvania. In addition to drug-delivery lipids, the facility bolsters Croda's high-purity branched and branched and/or esterified fatty ingredient supply chain, such as isobutyl stearate, for personal care and pharma end-uses.

-

In September 2024: Evonik also commissioned a plant in its existing Steinau site for cosmetic emollients, such as stearate esters, using its new enzymatic process technology. This double-digit-million-euro investment increases capacity, reduces CO2 footprint, and enhances the sustainable “biosolutions” portfolio in the esters segment.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 165.43 Million |

| Market Size by 2032 | USD 247.61 Million |

| CAGR | CAGR of 5.17% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Metalworking, Personal Care, Industrial, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Emery Oleochemicals, Oleon, Croda International Plc, KLK OLEO, A&A Fratelli Parodi Spa, Alnor Oil Co., Inc., Hangzhou DayangChem Co., Ltd., Syntechem Co., Ltd., IOI Oleo GmbH, Triveni Chemicals |