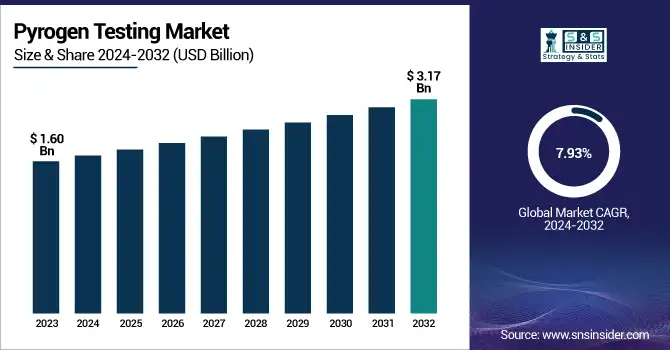

Pyrogen Testing Market Size Analysis:

The Pyrogen Testing Market size was valued at USD 1.60 Billion in 2023 and is expected to reach USD 3.17 Billion by 2032, growing at a CAGR of 7.93% over the forecast period 2024-2032.

Get More Information on Pyrogen Testing Market - Request Sample Report

The pyrogen testing market is growing due to the expansion of pharmaceutical and biotechnology. The fast pace of progress in the pharmaceutical and biotech industries as well as the rise in new therapeutics are the main factors driving the pyrogen testing market. Additionally, the increase in the investment of the government and manufacturing firms favor the growth of the market. According to the European Federation of Pharmaceutical Industries and Associations, the research-based pharmaceutical industry in Europe invested approximately USD 48.65 billion in R&D in 2022. The need for pyrogen testing is heightened by the growing new drug approvals, as the FDA has approved 55 new drugs in 2023.

Pyrogen testing is employed in ensuring that there are safety and quality in parenteral pharmaceutical products. Pyrogen tests help in the identification of the presence of pyrogens, which can stimulate fevered reactions in patients, indicating production issues. This is even if drugs are confirmed to be sterile, as sterility does not guarantee that the drug does not have pyrogens. regulatory bodies and states encourage awareness and training in pyrogen testing. In an online session held in February 2023, the European Directorate for the Quality of Medicines & Healthcare and the European Partnership for Alternative Approaches to Animal Testing emphasized on getting rid of the rabbit pyrogen test. The growth in the demand for biologics has led to the rise of biopharmaceutical companies necessitating advanced biological testing practices. This trend fuels the growth of the pyrogen testing market.

Pyrogen Testing Market Dynamics

Drivers

-

The growth in the biopharmaceutical industry is driving the need for pyrogen testing to ensure the safety and efficacy of therapeutic products, especially those administered via intravenous routes.

-

Regulatory bodies like the FDA and EMA mandate rigorous pyrogen testing for pharmaceuticals and medical devices, ensuring high safety standards and thus fueling market growth.

-

Innovations such as the Limulus Amebocyte Lysate (LAL) test and recombinant Factor C (rFC) assays offer more accurate and faster results, boosting the adoption of pyrogen testing.

-

Increasing awareness of the importance of pyrogen testing in preventing febrile reactions and ensuring patient safety is driving demand across various sectors, including pharmaceuticals and medical devices.

The escalating demand in the pyrogen testing market is the growing appeal of biopharmaceuticals. Biopharmaceuticals such as monoclonal antibodies, vaccines, gene therapies, growth hormones, and interferons have become increasingly popular, with the given trend being caused by the advancements in biotechnology. Furthermore, the rise of chronic diseases and the growing number of elderly patients in need of assistance and constant maintenance have provided considerable support to the chosen science. As the use of biopharmaceuticals in clinical settings increased, the scope of pyrogen testing was no doubt about the safety of biopharmaceuticals.

In 2023, FDA published new pyrogen testing guidelines requiring must be provided for every new biopharmaceutical product. The given changes in the legislative perspective confirmed the relevance of pyrogen testing as a medium for spotting endotoxins that could be infecting the given product and leading to conditions causing fever and other symptoms in patients. Despite their occasional inertness, the introduction of reacting agents in the bloodstream is not only inadvisable but outright life-threatening. Therefore, the standards of safety for injectables and intravenous biopharmaceuticals were raised significantly, encouraging new advancements in pyrogen testing to meet the demand generated by the given trend.

Restraints

-

The cost associated with pyrogen testing, including the procurement of specialized reagents and equipment, can be significant, potentially limiting access for smaller companies and startups.

-

The testing process can be complex and time-consuming, which may delay product development and increase time-to-market for biopharmaceuticals and medical devices.

-

Navigating the regulatory landscape for pyrogen testing can be challenging due to varying standards and requirements across different regions, potentially leading to compliance issues and additional costs.

The high cost of testing is major restraint in the pyrogen testing market. Pyrogen testing requires specialized reagents and procedures. For instance, the LAL (Limulus Amebocyte Lysate) kits and recombinant Factor C (rFC) assays are not only expensive but also necessary for the execution of the process. Moreover, an organization seeking to conduct the pyrogen testing must have the appropriate equipment as well as staff with relevant skills. The different factors contribute to the overall cost of the exercise. Most of the smaller organizations and startups are not able to afford the cost of executing the technological processes during testing. The high costs escalate the operation costs of biopharmaceuticals and medical devices thus affecting the overall prices charged. As a result, the restraint limits the accessibility of the testing process, negatively affecting the companies that require it but have tight budgets.

Pyrogen Testing Market Segmentation Insights

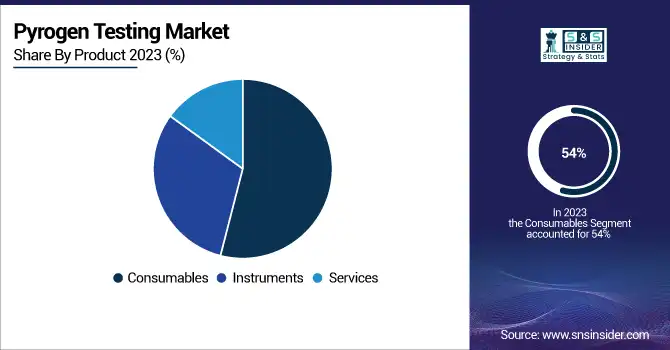

By Product

In 2023, the consumables segment accounted for the largest share of more than 54% of the overall market, this segment is expected to dominate the market across the forecast years. The growing prevalence of chronic diseases has increase the consumption of pharmaceuticals, biologics, and medical devices. According to the World Health Organization, in September 2023, about 4 million deaths worldwide, annually, are caused by chronic respiratory disease. This high prevalence is encouraging the consumption of pyrogen testing consumables, such as kits and reagents, required during the process of drug production.

The instrument segment is expected to gain the highest CAGR due to the ongoing industry advancements over the upcoming years. For instance, Charles Rivers, a major marketing company, launched an innovative PyroDetect System, which can replace the rabbit test. This new system offers high-quality in vitro detection with a vector for both endotoxin and non-endotoxin contaminations.

By Test Type

In 2023, the LAL tests segment captured the significant share of the market more than 44%. It will continue to dominate the sector, primarily due to the rising demand for animal-free detection methods that are highly reproducible and reliable. For instance, Pharmafeira Lifesciences shared that in February 2023, the European Pharmacopoeia had introduced 59 texts for public consultation in the Pharmeuropa 35.1. The goal was to facilitate the replacement of the rabbit pyrogen test. The LAL tests are broken down into turbidimetric, chromogenic, and gel clot tests.

By End-use

In 2023, the pharmaceutical and biotechnology companies segment led the market and accounted for 60% of the pyrogen testing market share. The reason is the fact that the pharmaceutical companies, as well as biopharmaceutical and biologic product manufacturers, are increasingly broadening their production. The parenteral pharmaceutical products are assessed for the presence of pyrogens, and the testing is mandatory as it helps to avoid severe fever reactions due to the administration of pyrogenic substances. As a result, the demand for consumables and instruments used for pyrogen testing is increasing in these areas.

A significant rise is expected in the medical devices sector. The requirement is caused by the necessity to perform pyrogen tests on devices that come into contact either directly or indirectly with human blood or other bodily fluid. Thus, products getting in touch with the blood circulation or cerebrospinal fluid or lymphatic system and the products influencing the bodys whole system are required to pass the pyrogenicity test. The officially accepted means and ways of pyrogenicity assessment for medical devices and materials are in vitro bacterial endotoxin tests and in vivo rabbit pyrogenicity tests, which are widely used.

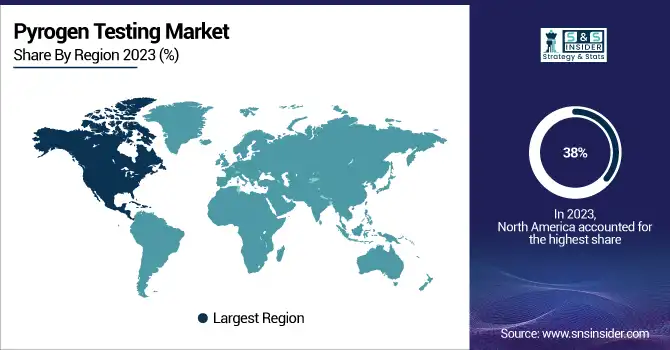

Pyrogen Testing Market Regional Outlook

In 2023, the North American pyrogen testing market leads, capturing the largest revenue share over 38%. This development is driven by the high number of health chronic diseases, which demand advances in medication. Additionally, the testing growth is contributed to by the region’s well-established health facilities and research infrastructure. North America puts a lot of emphasis on the creation of new medications which has also been a driving factor behind this market’s growth. Over the forecast period, the U.S. region is expected to continue performing well as a pyrogen testing market. This trend is linked to the presence of major players in the region such as Pfizer Inc., F. Hoffmann-La Roche AG, Merck Group, Celgene Corp., and Amgen Inc. These companies are largely involved in this market, contributing to its expected growth in the future. The existence of a large number of pharmaceutical manufacturers in the U.S. also supports the increased use of pyrogen testing.

The biotechnology and pharmaceutical industry are Europe is growing very fast contributing to the region’s significant share of the market. In 2021, European Pharmacopoeia Commission commenced a five-year process to discontinue the rabbit pyrogen test contribution to the advancement of testing and improved standards for industries. The growth of this market in Europe is also contributed to by the increasing preference for animal-free testing methods.

Need any customization research on Pyrogen Testing Market - Enquiry Now

Pyrogen Testing Market Key Players

The major players are Associates of Cape Cod, Inc., Ellab A/S, Merck KGaA, GenScript, bioMérieux SA, Charles River Laboratories, Lonza, FUJIFILM Wako Chemicals U.S.A. Corporation (Pyrostar), Thermo Fisher Scientific, Inc., Hyglos GmbH, WuXi AppTec. and others players

Recent Developments in the Pyrogen Testing Market

- Lonza has introduced two new monocyte activation test systems since 2023. Those are the PyroCell MAT Human Serum Rapid System and the PyroCell MAT Rapid System.

- In September 2023, Intravacc partnered with Sanquin Diagnostic Services to boost the in vitro Monocyte Activation Test and substitute animal pyrogen test for OMV vaccines.

- In June 2023, Ellab A/S was acquired by Novo Holdings. This decision was aimed at extending Novo Holdings’ presence on the market of pyrogen testing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.60 Billion |

| Market Size by 2032 | USD 3.17 Billion |

| CAGR | CAGR of 7.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Consumables, Instruments, Services • By Test Type (LAL test, {Chromogenic test, Turbidimetric test, Gel clot test}, In vitro pyrogen test, Rabbit test) • By End-use (Pharmaceutical and biotechnology companies, Medical devices companies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Associates of Cape Cod, Inc., Ellab A/S, Merck KGaA, GenScript, bioMérieux SA, Charles River Laboratories, Lonza, FUJIFILM Wako Chemicals U.S.A. Corporation (Pyrostar), Thermo Fisher Scientific, Inc., Hyglos GmbH, WuXi AppTec. |

| Key Drivers | • The growth in the biopharmaceutical industry is driving the need for pyrogen testing to ensure the safety and efficacy of therapeutic products, especially those administered via intravenous routes. • Regulatory bodies like the FDA and EMA mandate rigorous pyrogen testing for pharmaceuticals and medical devices, ensuring high safety standards and thus fueling market growth. |

| RESTRAINTS | • The cost associated with pyrogen testing, including the procurement of specialized reagents and equipment, can be significant, potentially limiting access for smaller companies and startups. |