Quick Service Restaurants (QSR) Market Report Scope & Overview:

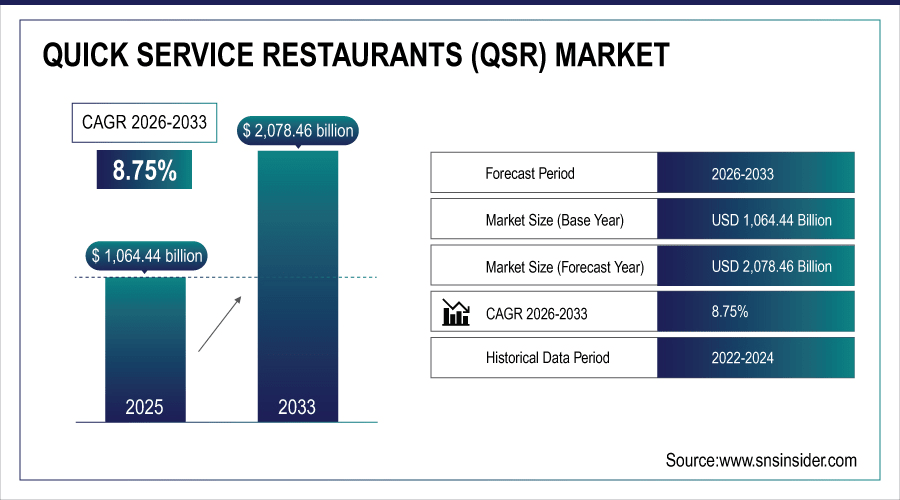

The Quick Service Restaurants (QSR) Market Size was valued at USD 1,064.44 Billion in 2025 and is projected to reach USD 2462.71 Billion by 2035, growing at a CAGR of 8.75% during the forecast period 2026–2035.

Quick Service Restaurants (QSR) Market analyzes the changing dining trends and what is driving such a shift, featuring a mix of service types including dine-in, take-away, drive-thru, and home delivery. Featuring popular foods like burgers, pizza, fried chicken and Asian menus, the market is centered on franchisees and company owned establishments that serve breakfast, lunch, dinner and snacking items. Faster urbanization, digital ordering, delivery platforms are driving growth, changing consumer tastes and sparking global expansion in major markets.

Online delivery and takeaway services accounted for nearly 48% of QSR sales in 2025, driven by convenience, rapid urbanization, and growing digital ordering platforms across urban and semi-urban regions.

To Get More Information On Quick Service Restaurants (QSR) Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 1,064.44 Billion

-

Market Size by 2035: USD 2462.71 Billion

-

CAGR: 8.75% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

Quick Service Restaurants (QSR) Market Trends:

-

Digital ordering and delivery are changing the quick-service-restaurant landscape so that consumers can get fast, convenient food from just about anywhere.

-

Drive-thru and contactless service is taking off, in response to both on-the-go lifestyles and safety-focused customers.

-

The global reach is broadening with franchise expansion and brand diversification, taking popular cuisines into new markets.

-

Mobile apps and loyalty programs are also changing customer engagement, providing customized promotions and easy ordering.

-

Asia-Pacific and Latin America are rapidly driving QSR expansion with increasing urbanization and altering eating habits.

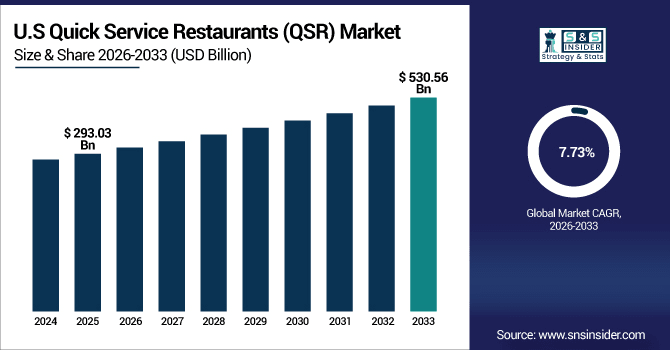

U.S. Quick Service Restaurants (QSR) Market Insights:

U.S. Quick Service Restaurants Market to USD 293.03 Billion by 2025, growing at a CAGR of 7.73%, from USD 616.99 Billion in 2035. The growth is powered by online ordering, delivery service, contactless dining, franchise expansion and changing consumer habits with digital platforms and menu innovations helping to fuel adoption across the country

Quick Service Restaurants (QSR) Market Growth Drivers:

- Increasing consumer preference for convenient, fast, and digitally-enabled dining boosts global Quick Service Restaurants expansion.

Quick Service Restaurants (QSR) are expanding at a rapid rate due to the consumer demand for online ordering, delivery, and contactless dining that makes it easy to grab what you want right now. The global QSR online ordering will surpass 120 billion transactions by 2025 due to urbanization, mobile penetration, and the centralized delivery platform. This expansion is fueled by the changing consumer behavior, technology-enabled ordering, and expansion as restaurants learn how to operate safely (and keep up with the increased demand for quick, convenient, and safe food).

Rising preference for online ordering and delivery drove 42% of global QSR sales in 2025, reflecting strong demand for convenience, speed, and digitally-enabled dining experiences.

Quick Service Restaurants (QSR) Market Restraints:

- Rising Operational Costs and Supply Chain Challenges Limit Quick Service Restaurants’ Profitability and Slower Expansion Globally.

QSR industry is facing headwinds due to growing cost of operations and supply chain interruption. Margins of 27.9% of QSR outlets are being pressurised by increased food, labour and logistics costs and one in five are suffering as deliveries are cut or ingredient shortages prevent them from delivering a consistent service, the figures suggest. Small franchisees and mom-and-pop operators feel these constraints particularly acutely. Further, erratic commodity prices, excessive compliance burden and intense competition restrict growth opportunities amidst rising eating out demand for fast and on-the-go culinary services globally.

Quick Service Restaurants (QSR) Market Opportunities:

- Expansion of Online Food Delivery and Digital Ordering Platforms Unlocks Significant Growth Potential for Quick Service Restaurants Globally.

The rise in the number of on-demand food delivery and technology orders is triggering a massive growth in the global QSR market. Over 50 billion digital orders were placed in the global QSR market in 2025, and nearly a third of them were placed through mobile applications and combined delivery platforms. The rising consumer behavior of preferring convenience, contactless payment options, and diverse food options is increasing the demand for platforms. It is expected that such trends will continue to be in action at least until 2033, as digital technology is changing the face of the global quick-service restaurant market.

Expansion of online ordering and digital delivery platforms accounted for 32% of global QSR sales in 2025, reflecting rising demand for convenience, speed, and app-based dining experiences.

Quick Service Restaurants (QSR) Market Segmentation Analysis:

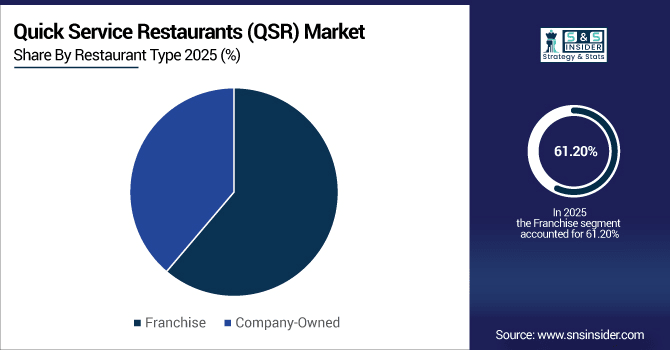

-

By Restaurant Type, Franchises captured the largest share of 61.20% in 2025, while Company-Owned outlets are anticipated to grow at the fastest CAGR of 9.25%, supported by brand expansion strategies and localized offerings.

-

By Service Type, Dine-in held the largest market share of 38.25% in 2025, while Online Delivery is expected to grow at the fastest CAGR of 12.15%, reflecting the rising consumer preference for convenience and contactless ordering.

-

By Cuisine, Burgers & Sandwiches dominated with a 32.75% share in 2025, while Asian cuisine is projected to expand at the fastest CAGR of 11.88%, driven by growing demand for diverse and exotic flavors.

-

By Meal Type, Lunch accounted for the dominant 35.50% share in 2025, while Snacks are forecasted to grow at the fastest CAGR of 10.45%, fueled by rising on-the-go consumption and snacking habits.

By Restaurant Type, Franchises Lead While Company-Owned Expand Fast:

There were more than 50,000 franchise outlets around the world in 2025 with a very strong presence and brand image. Company-owned restaurants numbered about 32,000 and are growing faster with local menus, app-based orders and direct consumer outreach. This will give more operational flexibility and freedom to innovate with the menu as company-owned stores extend their reach into new urban markets and adapt quickly to changing consumer tastes, while franchisees continue to sit atop that scale along with brand cachet.

By Service Type, Dine-in Leads While Online Delivery Surges:

In 2025, Dine-in had already served more than 400 million customers worldwide, still leading in traditional social dining. On the other hand, digital delivery had processed 220 million orders, showing the rapid adoption of mobile apps and delivery services. As the pace of urbanization and technology adoption continues to accelerate, the trend in digital ordering is expected to continue to enable restaurants to meet the growing demand of consumers for fast and convenient dining.

By Cuisine, Burgers & Sandwiches Dominate While Asian Grows Rapidly:

Burgers and sandwiches were each eaten by about 350 million consumers globally in 2025, leading the way for quick-service menus. Asian foods served some 200 million customers, spurred by a growing appetite for exotic flavors and varied meals. Crossing into fusion and ethnic menus, Asian fare is positioned for especially fast growth, spurring QSR chains to broaden product lines and store counts as they entice urban millennials and younger diners looking heretofore non-existent distinctive flavors.

By Meal Type, Lunch Dominates While Snacks Gain Traction:

The lunch meal remained the most consumed meal that was to be eaten at a QSR in the year 2025, with over 380 million consumers worldwide, underlining its relevance to workers and students. A total of 230 million snacks and small meals were consumed, triggered by the lifestyles of people on the move and the convenience of mobile ordering. With the increase in urbanization and the snacking culture, quick-service restaurants are introducing new and innovative on-the-go and healthy food options to cater to the next-gen and on-the-move consumer.

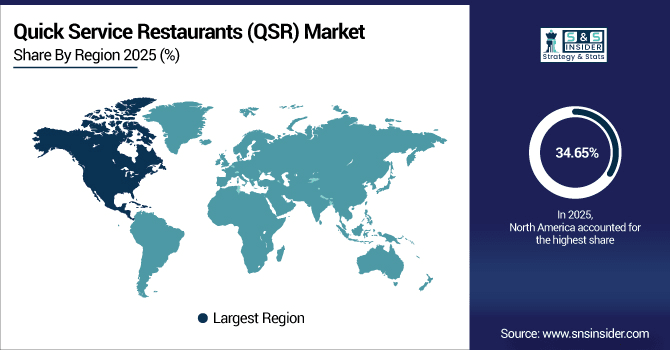

Quick Service Restaurants (QSR) Market Regional Analysis:

North America Quick Service Restaurants (QSR) Market Insights:

In 2025, North America accounted for 34.65% of the global Quick Service Restaurants market, serving over 370 million customers. Franchises accounted for the largest portion off that pie, with some 210,000 outlets in the region, while company-owned units comprised 160,000 locations. Dine-in was still a hit, but online delivery took in 180 million orders, evidence of increasing digital adoption. Burgers and sandwiches were all over the menu, as Asian food continued to build. The market is projected to grow steadily through 2035 as urbanization, digital ordering and changing consumer tastes propel adoption.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Quick Service Restaurants (QSR) Market Insights:

As of 2025, the U.S. QSR market served more than 370 million meals 190 million were dine-in visits and online delivery processed orders for 180 million customers. Franchises equalled 210,000 units, while company-owned units covered some 160,000 outlets. Growth is underpinned by digital ordering, contactless services, app-based reward programs and changing urban consumer tastes.

Asia-Pacific Quick Service Restaurants (QSR) Market Insights:

The Asia-Pacific Quick Service Restaurants (QSR) market, the fastest-growing region, is projected to expand at a CAGR of 9.96% through 2035. By 2025, it provided more than 420 million customers primarily in China (180 million) and India (140 million). Dine-in represented 230 million visits, online delivery had 190 million orders. Growth is being fed by urbanization, increasing digital ordering and app-based loyalty programs, as well as changing consumer taste preferences in everything from pizza to Mexican food.

China Quick Service Restaurants (QSR) Market Insights:

China’s Quick Service Restaurants 180 million premises in 2025 served over 100 million customers on a dine-in basis and roughly 80 million transactions were delivery orders. Meanwhile there were some 95,000 franchises and 85,000 company-owned units. Mobile ordering, app-based loyalty programs, urbanization, and a growing appetite among consumers for fast, convenient and digitally-enabled dining experiences expected to spark growth through 2035.

Europe Quick Service Restaurants (QSR) Market Insights:

In 2025, Europe’s Quick Service Restaurants market fed more than 225 million customers, Germany being the largest with 60 million, followed closely by the UK at 55 million and France on 50 million. Dine-in visits amounted to 130 million, and online delivery processed 95 million orders. There were 115,000 franchise outlets and 110,000 company-owned units. The market is propelled due to the digital ordering, mobile apps, urbanization and changing consumer preferences for quick, convenient and contactless dining till 2035.

Germany Quick Service Restaurants (QSR) Market Insights:

Overview Based on over 60 million customer visits the dining in quick service restaurants market delivered 35 million order and online delivery turned out 25 million orders. Franchise units totaled about 32,000 and company-owned locations 28,000. Growth is going to be propelled by digital ordering, mobile apps and urbanization and increasing consumer appetite for fast, easy and contactless dining through 2035.

Latin America Quick Service Restaurants (QSR) Market Insights:

Quick Service Latin America Quick Service Restaurants market in 2025 served more than 80 million customers with Brazil, Mexico, and Argentina being leading contributors. Visits to dine in topped 45 million, while 35 million orders were placed online for delivery. Franchise outlets totaled 40,000 and company-owned units hit 25,000. Urbanization, behaviour changes toward mobile ordering, and app-based loyalty programs will also mean strong market growth to 2035.

Middle East and Africa Quick Service Restaurants (QSR) Market Insights:

The Middle East & Africa Quick Service Restaurants market in 2025 prepared food for more than 25 million customers including dine-in visits of about 15 million and provided delivery services for nearly 10 million orders. The chain had 12,000 franchised outlets and another 8,500 owned by the company. Urbanization, mobile ordering, digital loyalty programs and increased demand for fast convenient dining will all fuel through 2035.

Quick Service Restaurants (QSR) Market Competitive Landscape:

McDonald’s, which started from a modest beginning in 1940, has grown into a quick-service giant with over 40,000 outlets across the globe as of 2025. It leads the market through its efficient menu items and innovative digital ordering solutions. With a massive number of customers every day, the brand is leading the way in the QSR market with its loyalty programs and purpose-driven marketing campaigns, influencing consumer behavior across the globe, apart from entering new markets at a rapid pace with the quality of products that consumers trust.

-

In March 2025, McDonald’s announced a new digital menu offering worldwide, incorporating AI-based decision technology and self-service ordering on its mobile app to provide customers with quicker service at the drive-thru.

Subway Founded in 1965, is one of the largest QSR chains with nearly 38,000 locations around the world. Best known for its custom subs and health-conscious choices, Subway provides an option that everyone can enjoy. Its digital ordering and delivery tie-in has helped to build customer loyalty, while its franchise-heavy system also allows it to grow quickly. The brand has successfully blended affordability, customization, and convenience for the contemporary consumer on-the-go.

-

In June 2025, Subway rolled out its “Fresh Forward” store redesign, including sandwich-making kiosks and app-driven pre-ordering in an effort to speed up service and improve the customer experience.

KFC, established in 1952, has franchises with over 25,000 restaurants worldwide, selling their specialty fried chicken and the ‘secret recipe’ spice blend. The company’s major market share is due to its fast expansion of franchises and the ability to modify its menu to meet the local preferences. Through online ordering applications, delivery discounts, and marketing campaigns, KFC continues to be a major player in the global market. The company’s customer loyalty, value, and convenience make it one of the major brands in the competitive market.

-

In April 2025, KFC launched meat-free chicken offerings in some markets, as well as a new AI-optimized delivery network to master routes and minimize the time online orders spend sitting around.

Quick Service Restaurants (QSR) Market Key Players:

-

McDonald’s

-

Subway

-

KFC

-

Starbucks

-

Burger King

-

Domino’s Pizza

-

Yum! Brands

-

Dunkin’

-

Pizza Hut

-

Wendy’s

-

Taco Bell

-

Chipotle Mexican Grill

-

Papa John’s

-

Tim Hortons

-

Dairy Queen

-

Sonic Drive-In

-

Panera Bread

-

Little Caesars

-

Five Guys

-

Shake Shack

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 1064.44 Billion |

| Market Size by 2035 | USD 2462.71 Billion |

| CAGR | CAGR of 8.75% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Dine-in, Takeaway, Drive-Thru, Online Delivery) • By Cuisine (Burgers & Sandwiches, Pizza & Pasta, Fried Chicken, Asian, Mexican, Others) • By Restaurant Type (Franchise, Company-Owned) • By Meal Type (Breakfast, Lunch, Dinner, Snacks) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | McDonald’s, Subway, KFC, Starbucks, Burger King, Domino’s Pizza, Yum! Brands, Dunkin’, Pizza Hut, Wendy’s, Taco Bell, Chipotle Mexican Grill, Papa John’s, Tim Hortons, Dairy Queen, Sonic Drive-In, Panera Bread, Little Caesars, Five Guys, Shake Shack |