Gluten-free flours Market Report Scope & Overview:

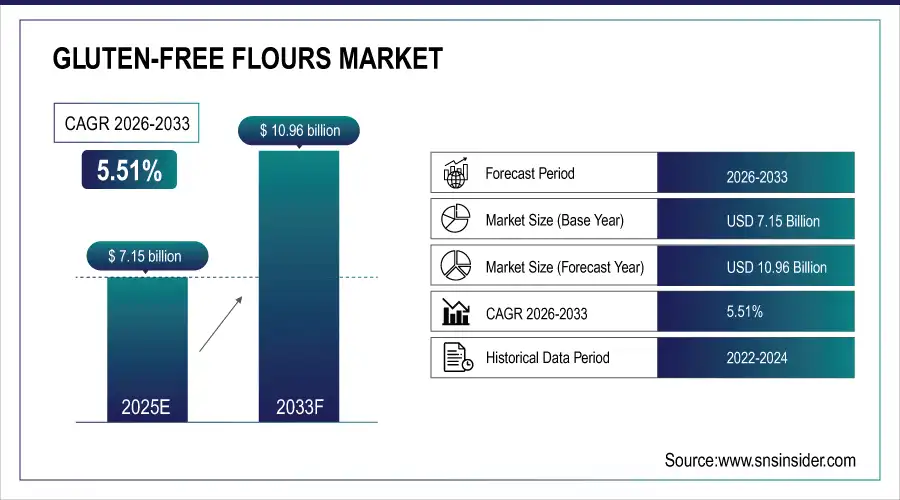

The Gluten-free flours Market Size was valued at USD 7.15 Billion in 2025E and is expected to reach USD 10.96 Billion by 2033 and grow at a CAGR of 5.51% over the forecast period 2026-2033.

The Gluten-free flours Market analysis, driven by Growing health consciousness, the high incidence of celiac disease and gluten intolerance, and demand for clean-label and allergen-free products. Consumers are looking for healthier products in the baking, cooking and breakfast categories. According to study, Celiac & Gluten Sensitivity Prevalence: Approximately 1 in 100 people globally are affected by celiac disease, driving demand for gluten-free flours.

Market Size and Forecast:

-

Market Size in 2025: USD 7.15 Billion

-

Market Size by 2033: USD 10.96 Billion

-

CAGR: 5.51% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Gluten-free flours Market - Request Free Sample Report

Gluten-free flours Market Trends:

-

Rising health awareness fuels gluten-free flour demand among urban and millennial consumers.

-

Increasing prevalence of celiac disease drives adoption of allergen-free flour products.

-

Consumers prefer clean-label, natural ingredient gluten-free flours for baking applications.

-

E-commerce growth enables direct-to-consumer sales of specialty gluten-free flours efficiently.

-

Subscription-based delivery models expand accessibility and convenience for gluten-free product buyers.

-

Innovative flours, including rice-based and nut-based, gain traction in new product launches.

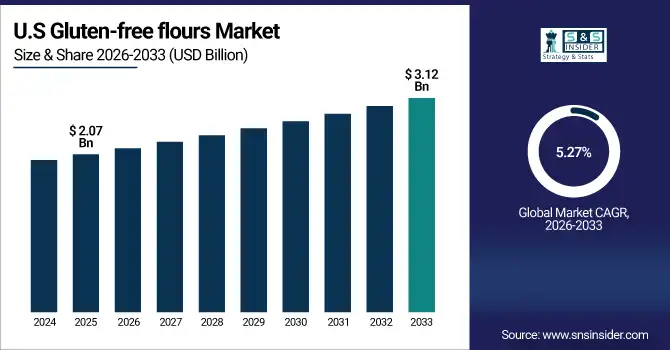

The U.S. Gluten-free flours Market size was USD 2.07 Billion in 2025E and is expected to reach USD 3.12 Billion by 2033, growing at a CAGR of 5.27% over the forecast period of 2026-2033, driven by strong health awareness, widespread celiac disease prevalence, and growing demand for allergen-free and clean-label products. Retail and e-commerce channels support accessibility, while millennials increasingly adopt gluten-free diets, fueling market growth.

Gluten-free flours Market Growth Drivers:

-

Health Awareness Boosts Gluten-Free Flour Demand Globally and Rapidly

The Gluten-free flours Market growth driven by Growing health awareness among people and an increase in the incidence of cases of celiac disease and gluten sensitivity. Consumers are restoring for baking and breakfast as well healthier, allergen free options. Specifically urban consumers and millennials are concerned with balanced diet options, seeking products with clean labels made from simple, natural ingredients low in allergens. This change in consumer behaviour is driving the market for rice-based flours, nut-based flours and ancient grains as well leading to a steady growth of the overall market.

Product Preference, Rice-based, nut-based, and ancient grain flours represent over 60% of consumer purchases in gluten-free baking.

Gluten-free flours Market Restraints:

-

Higher Costs Limit Gluten-Free Flour Adoption Among Price-Sensitive Consumers

Despite of benefits, Expensive Gluten-Free Flours Restraining Uptake Among Price-Conscious Consumers Generally, gluten-free flours are costlier than conventional wheat flour as they require specialized processing and raw material sourcing, while the allergen-free certifications further escalate their prices. As a result, its relatively high cost can make it unfeasible for price-sensitive customers, particularly in less-developed areas. Microbakeries and the Horeca would not be willing to go for full gluten-free alternatives due to higher production costs that can retard market growth despite growing health consciousness.

Gluten-free flours Market Opportunities:

-

E-Commerce Expansion Drives Wider Reach for Gluten-Free Flours

The rapid rise in e-commerce offers great Opportunities for producers of gluten-free flour. Online offers manufacturers an opportunity to speak directly to health-conscious consumers, with the added convenience of a subscription-type delivery model and access for more niche or specialist flours. As digital penetration and urban internet users rise the online channel can aid swift market expansion, showcase new products for innovations, and create targeted marketing at consumers educating them about benefits of gluten-free.

Consumer Engagement, Targeted online campaigns increase awareness, with ~50% higher engagement compared to offline promotions.

Gluten-free flours Market Segmentation Analysis:

-

By Flour Type: In 2025, Rice-based flours led the market with a share of 38.50%, while Nut and seed flours is the fastest-growing segment with a CAGR of 7.20%.

-

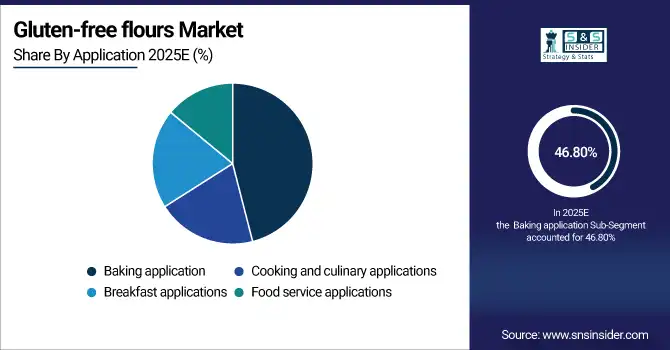

By Application: In 2025, Baking application led the market with a share of 46.80%, while Breakfast applications is the fastest-growing segment with a CAGR of 7.04%.

-

By Distribution Channel: In 2025, Retail distribution led the market with a share of 48.20%, while Online and e-commerce is the fastest-growing segment with a CAGR of 7.40%.

-

By End Use Industry: In 2025, Household and consumer use led the market with a share of 42.60%, while Foodservice industry is the fastest-growing segment with a CAGR of 7.12%.

By Flour Type, Rice-based flours Lead Market and Nut and seed flours Fastest Growth

The Rice-based flours lead the market in 2025, due to their versatile, have a mild taste and find application across the baking and cooking. Due to their widespread use, and availability and low cost, they are a frequent choice for both commercial now-discontinued domestic use. Meanwhile, nut and seed flours are the fastest-growing segment, due to growing consumer demand for high-protein, nutrient-dense and low-carb options. Growing health awareness, anti-allergic offerings and advances in the development of products for baking and breakfast applications are some of the factors that can further propel this segment’s growth.

By Application, Baking application Lead Market and Breakfast applications Fastest Growth

The Baking application lead the market in 2025, due to extensive usage of gluten-free flours in bread, cakes, pastries, and other baked products. For their consistency and the potential to mimic the texture and structure of traditional wheat flours, commercial bakeries along with home consumers have eagerly adopted them. Meanwhile, Breakfast applications is the fastest-growing segment, driven by growing demand for healthy, convenient and allergen-free breakfast options including pancakes, waffles and porridge. Growth is supported by increasing health consciousness, lifestyle-based food choices and a growing market for ready to eat gluten-free foods.

By Distribution Channel, Retail distribution Lead Market and Online and e-commerce Fastest Growth

The Retail distribution leads the market in 2025, due to wide availability of gluten-free type of flour in supermarket, hypermarkets, and grocery stores which gives an easy access to consumers in urban and semi-urban areas. Traditional retail channels are still being used for bulk purchases and instant access. Meanwhile, online and e-commerce is the fastest-growing segment, driven by growing digital inclusion, convenience and subscription-based delivery. Through online channels, specialty and niche flours can be accessed, directed marketing campaigns initiated, consumer education occurs, enabling market growth to happen more quickly and brands to become better established.

By End Use Industry, Household and consumer use Lead Market and Foodservice industry Fastest Growth

The Household and consumer use leads the market in 2025, driven by growing health consciousness, home-baking trends and urbanisation and millennials demand for gluten free diets. Consumers favors rice-based, nut-based and ancient grain flours in daily cooking and breakfast recipes which bodes well for demand through retail outlets. Meanwhile, the foodservice industry is the fastest-growing segment, driven by increasing penetration of gluten-free in restaurants, cafes and other catering establishments. The rising consumption of allergen-free menus, ready to eat solutions and premium grade special flours is driving the growth.

Gluten-free flours Market Regional Analysis:

North America Gluten-free flours Market Insights:

The North America dominated the Gluten-free flours Market in 2025E, with over 40.20% revenue share, due to large customer awareness to health, wellness, and dietary limitations such as celiac disease or gluten intolerance. The area enjoys well-established retail and e-commerce circuits, wide product reach, and the presence of key brands dealing with rice-based flour, nut-based flour and ancient grain flour. Increasing consumer demand from both home bakers and the commercial foodservice provider also helps bolster growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Gluten-free flours Market Insights

The U.S. and Canada lead the gluten-free flours market due to high health awareness, widespread prevalence of celiac disease and gluten intolerance, strong retail and e-commerce infrastructure, growing demand for allergen-free and clean-label products, and increasing adoption of gluten-free diets among urban populations.

Asia Pacific Gluten-free flours Market Insights:

The Asia-Pacific region is expected to have the fastest-growing CAGR 6.98%, owing to escalating health awareness, improving lifestyle along with increasing awareness of celiac disease and gluten intolerance. Urban populations and millennials are turning to gluten-free diets in growing numbers, increasing the demand for healthier alternatives free from allergens. Growth of online retail and modern retail formats helps to increase the sales potential of specialty flours such as rice, nut and ancient grain flour.

China and India Gluten-free flours Market Insights

China and India are the fastest-growing markets for gluten-free flours due to rising health consciousness, increasing disposable incomes, urbanization, growing awareness of gluten intolerance, expanding e-commerce and modern retail channels, and the rising popularity of healthier, allergen-free alternatives among millennials and working professionals.

Europe Gluten-free flours Market Insights

In Europe, the gluten-free flours market is well-established and steadily growing owing to high health awareness, celiac disease prevalence and the preference of consumers towards clean label products free from allergen ingredients. The area has great retail infrastructure and an ever-growing e-commerce society, which enables availability of rice flour based, nut-based and ancient grain flours. There’s a growing trend towards adding gluten-free flours to baking, cooking and breakfast formulations. Furthermore, new product introductions, lifestyle-based eating habits and the strong demand from households and foodservice operators are still fuelling market growth in Europe.

Germany and U.K. Gluten-free flours Market Insights

The U.K. and Germany are experiencing steady growth in the gluten-free flours market due to high consumer awareness of health and wellness, increasing prevalence of celiac disease, strong retail and online distribution networks, demand for clean-label products, and rising adoption of gluten-free diets.

Latin America (LATAM) and Middle East & Africa (MEA) Gluten-free flours Market Insights

The Latin America (LATAM) and Middle East & Africa (MEA) Gluten-free flours Market are emerging regions showing steady growth, owing to increasing health consciousness, urbanization, and adoption of gluten-free diets. Growing retail and e-commerce networks provide consumers with easier access to rice-based, nut-based and ancient grain flours. Furthermore, rising consumption from household, bakery and foodservice companies coupled with launch of new products with no allergy are likely to supplement market growth. Although these markets are price-sensitive and vary in awareness levels, they represent a great opportunity for companies looking to expand their footprint.

Gluten-free flours Market Competitive Landscape:

The Hain Celestial Group has been expanding its gluten-free product portfolio to cater to the growing demand for allergen-free and clean-label options. In March 2011, the company announced new gluten-free offerings, including All Purpose Baking Mix, Vanilla Cake Mix, and Chocolate Chip Cookie Mix. These products aim to provide consumers with convenient and delicious alternatives that align with their dietary preferences.

-

In March 2025, The Hain Celestial Group Launched a new line of gluten-free products, including All Purpose Baking Mix, Vanilla Cake Mix, and Chocolate Chip Cookie Mix, catering to the growing demand for allergen-free and clean-label options in the market.

Amy's Kitchen, Inc. offers a diverse range of gluten-free products, including frozen meals and snacks, catering to consumers with dietary restrictions. The company's commitment to providing convenient and nutritious options has contributed to the growth of the gluten-free food products market in the U.S. Amy's Kitchen's offerings align with the increasing demand for gluten-free alternatives among health-conscious consumers.

-

In March 2025, Amy's Kitchen, Inc. Introduced a new line of gluten-free frozen meals and snacks, expanding their product offerings to cater to the increasing demand for convenient, allergen-free, and clean-label options among health-conscious consumers.

Archer Daniels Midland Company (ADM) has introduced HarvestEdge Gold gluten-free flour blends, crafted for manufacturers seeking to address flavor and texture challenges in gluten-free formulations. These blends incorporate high-quality ancient grain sorghum flour, buckwheat flour, and tapioca starch, offering clean-label ingredients suitable for various applications. ADM's focus on innovation and quality positions it as a key player in the gluten-free flours market.

-

In April 2024, Archer Daniels Midland Company (ADM) Introduced a new line of organic gluten-free flour blends, catering to the increasing consumer preference for organic and allergen-free products. This launch aligns with ADM's commitment to innovation in the gluten-free market.

Gluten-free flours Market Key Players:

Some of the Gluten-free flours Market Companies are:

-

Bob's Red Mill Natural Foods, Inc.

-

General Mills, Inc.

-

Ardent Mills

-

Associated British Foods plc

-

Archer Daniels Midland Company (ADM)

-

King Arthur Baking Company, Inc.

-

The Scoular Company

-

To Your Health Sprouted Flour Co.

-

Hometown Food Company

-

Shipton Mill Ltd.

-

Canyon Bakehouse LLC (Flowers Foods Inc.)

-

The Hain Celestial Group

-

Enjoy Life Foods

-

Arrowhead Mills (Hain Celestial Group)

-

Ancient Harvest (Quinoa Corporation)

-

Cargill, Inc.

-

Amy's Kitchen, Inc.

-

Barilla G. e R. Fratelli S.p.A

-

Blue Diamond Growers

-

Dr. Schär AG/SpA

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 7.15 Billion |

| Market Size by 2033 | USD 10.96 Billion |

| CAGR | CAGR of 5.51% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Flour Type (Rice-based flours, Nut and seed flours, Root vegetables and tuber flours, Ancient grain flours, Legume and bean flours, Corn-based flours, Specialty and blend flours) • By Application (Baking application, Cooking and culinary applications, Breakfast applications, Food service applications) • By Distribution Channel (Retail distribution, Online and e-commerce, Wholesale and B2B distribution, Alternative distribution channels) • By End Use Industry (Household and consumer use, Commercial food manufacturing, Foodservice industry, Institutional foodservice, Industrial applications) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Bob's Red Mill Natural Foods, Inc., General Mills, Inc., Ardent Mills, Associated British Foods plc, Archer Daniels Midland Company (ADM), King Arthur Baking Company, Inc., The Scoular Company, To Your Health Sprouted Flour Co., Hometown Food Company, Shipton Mill Ltd., Canyon Bakehouse LLC (Flowers Foods Inc.), The Hain Celestial Group, Enjoy Life Foods, Arrowhead Mills (Hain Celestial Group), Ancient Harvest (Quinoa Corporation), Cargill, Inc., Amy's Kitchen, Inc., Barilla G. e R. Fratelli S.p.A, Blue Diamond Growers, Dr. Schär AG/SpA, and Others. |