Railway Maintenance Machinery Market Report Scope & Overview:

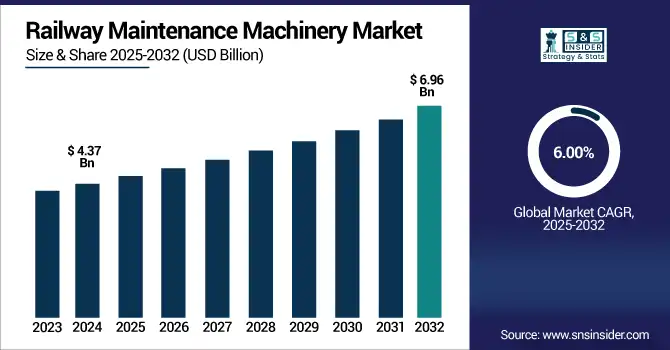

The Railway Maintenance Machinery Market size was valued at USD 4.37 billion in 2024 and is expected to reach USD 6.96 billion by 2032, growing at a CAGR of 6.00% over the forecast period of 2025-2032.

To Get more information on Railway Maintenance Machinery Market - Request Free Sample Report

The global railway maintenance machinery market is growing at a healthy CAGR, propelled by quick rail infrastructure development, focus on safety and increase demand for efficient, reliable transport systems. The increasing global urbanization and rapid freight transportation are expected to fuel the growth of the market during the forecast period, thus, pushing the demand for advanced track maintenance machines such as tamping machines, ballast regulators, and rail grinders. They help minimize downtime, minimize manual labor, and maintain the track in peak condition. Technological innovations such as automated inspection systems, AI-powered diagnostics, and predictive maintenance tools are reshaping operational efficiency as they revolutionize the railway maintenance machinery industry. This is leading to significant R&D investment by the key players to unveil various intelligent and eco-friendly solutions in adherence to the green transportation aims.

Additionally, the market dynamics are accelerated due to various strategic collaborations and robust government policies supporting rail modernization. This report focuses on the global railway maintenance machinery market trends, future forecast, growth opportunity, key market, and key players. In conclusion, the growth potential of the railway maintenance machinery market growth driven will remain foreseeable future owing to global efforts toward high-speed rail systems, digitalization, and resilient infrastructure.

In June 2025, Indian Railways introduced drone-based cleaning at Assam's Kamakhya Station, using high-pressure water jets to sanitize coach rooftops and elevated structures. Launched as a pilot in April 2024, the initiative boosts efficiency and safety by reducing manual labor. It aligns with the Swachh Bharat mission and may expand to other stations nationwide.

Railway Maintenance Machinery Market Dynamics:

Drivers

-

Urbanization And Global Rail Investments Are Boosting Demand for Advanced Railway Maintenance Machinery

There has been a rise in railway maintenance machinery demand, primarily due to rapid urbanization and massive global investment in metro, suburban, and high-speed railway corridors. From Asia to Europe and Latin America, governments are pouring significant budgetary resources into extending and upgrading rail networks. For example, the UK has announced a USD 144 billion capex plan which will help fund a USD 3.05 billion metro extension in Birmingham and a Manchester–Liverpool rail link. Keeping the integrity of such large-scale projects requires the use of modern maintenance machinery such as automated tampers, specialized rail grinders, and track inspection vehicles to ensure safety, effectiveness, and minimal service disruptions. Simply put, the growth and development of infrastructure will drive the demand for and evolution of maintenance equipment, keeping rail systems dependable and effective.

June 2025 – UK Chancellor Rachel Reeves announced a major investment in a new rail line between Manchester and Liverpool as part of a USD 143 billion infrastructure plan. The initiative aims to boost regional productivity, with additional transport spending allocated to Birmingham, West Yorkshire, and the Midlands. This move is part of the government's broader strategy to rebalance the economy beyond London.

Restraint

-

High Capital Costs Limit The Adoption Of Advanced Railway Maintenance Machinery

The railway maintenance machinery market continues to be restrained by high capital expenditure. Some highly advanced equipment, like automated tampers, rail grinders, and robotic inspection wagons, costs a lot of money, millions of dollars in some cases. The massive upfront investments required to get started are often hard to justify or afford for many smaller or capital-constrained rail operators, especially in the developing world. Moreover, the cost of importing such equipment adds up even more, as the implementation of such machinery requires trained personnel, setting up necessary infrastructure, and other operational needs. Consequently, operators postpone or minimize modernization initiatives and depend on antiquated or manual procedures. This cost impediment has a ripple effect to delay the adoption of advanced maintenance technology, eventually impacting the performance the reliability, and safety of railway infrastructure.

In April 2024, Network Rail committed around USD 3.5 billion over five years to protect Britain’s railways from climate risks, as part of a larger USD 57.4 billion upgrade plan. The investment includes drainage improvements, embankment reinforcements, and a “weather academy,” reflecting the high capital costs of modern railway maintenance.

Railway Maintenance Machinery Market Segmentation Outlook:

By Product Type

The tamping machines segment dominated the market and accounted for 42% of the railway maintenance machinery market share. Whether high-speed or freight, they play an indispensable role in stabilizing track geometry and allowing trains to run smoothly, quickly, and safely. Demand is being primarily driven by the growing utilization of mechanized tamping for track stability, coupled with growing investments in rail infrastructure, especially in Asia-Pacific and Europe. The attributes like proven operational efficiency, long-term durability, and proven integration into automated systems have helped rail head machining machines in solidifying their position as the most utilized railway maintenance machinery across the globe.

Ballast maintenance machines are projected to be the fastest-growing product segment due to rising emphasis on track stability, drainage improvement, and noise control. These machines facilitate work such as maintaining the transferring ballast roughness and setting the ballast bed elevation, which are all critical to extending the life of the rail tracks and minimizing safety risks during rail operations. With the emergence of technology like sensor-based ballast profiling and autonomous operations, they are increasingly being used. The focus of countries like India and China on high-density rail operations is resulting in a rapid and booming investment in high-density railway rolling stock assets for sustained and long-term asset sustainability, driving the segment to a double-digit growth rate.

By End-user

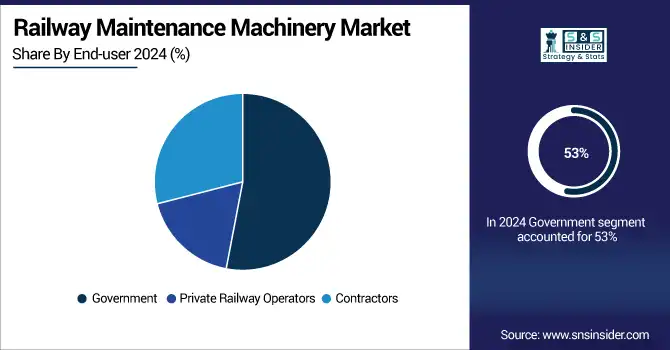

In 2024, government entities dominate the end-user segment with a 53% market share, primarily because of government control of national- and regional-level railway networks. Public sector investments to modernize railways, safety improvements, and infrastructure rehabilitation are critical enabling factors. High-speed lines and electrification are being heavily funded by governments in Europe, China, and the Middle East, leading to a requirement for advanced maintenance solutions. The public ownership of aging track networks means frequent and intensive maintenance, driving more regular purchases of reliable machinery at a higher rate than private equivalents.

Contractors represent the fastest-growing end-user segment in the railway maintenance machinery market. The need for special rail contractors is growing, as governments and private operators outsource maintenance services to save on operational expenditures and to improve overall efficiency. These companies invest in high-performance machinery to obey rigid safety and quality standards. This is likely to drive contractors' interest at a faster pace through Public–Private Partnerships (PPPs) as seen in few countries including Australia, the UK, and the U.S., which allow them to expand capabilities and procurement of machinery, which in turn will boost the growth of the market over the forecast period.

By Sales Type

New sales account for the majority of the market, with a 64% share in 2024. This is attributed to the boost in railway expansion and modernization projects witnessed across the globe, toward the need for advanced machinery in operations. Modern technologies with automation, AI integration, and better fuel efficiency are a priority for buyers. But they also need new track laying equipment to construct new tracks and replace ageing stock. This segment is attributed to the dominance of emerging economies Brazil, South Africa, and ASEAN countries, which are making bulk purchases of fresh machinery to widen their rail network.

Aftermarket sales are emerging as the fastest-growing segment, fueled by the increasing demand for spare parts, refurbishment, and upgrade services. With the increase in the number of rail operators who are aiming to extend the life cycle of existing machinery, aftermarket services become an economical option. Increasing adoption of predictive maintenance strategies and diagnostics enabled by sensors is also expected to support demand for replacement parts and maintenance contracts. In regions with significant railway infrastructure that consists of aging assets, OEMs and third-party providers are leveraging this opportunity and providing service packages, component upgrades, and retrofitting services.

Railway Maintenance Machinery Market Regional Analysis:

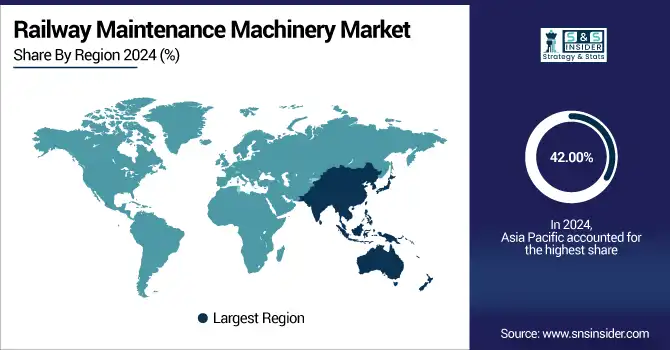

In 2024, Asia-Pacific emerged as the leading region in the global railway maintenance machinery market, accounting for 42.00% of the total market share. This dominance stems from significant advancements in railway infrastructure in countries such as China, India, and Japan. The demand for better maintenance machinery gained an extremely high pace due to the implementation of government-led modernization programs, as well as high-speed rail expansion in the country, along with a high budget for railway safety and automation. The accelerating pace of urbanization, population growth, and a transformation to more efficient public transport also fuels the increasing demand for timely maintenance of the railways and precision tools. Cost-efficient solutions from regional manufacturers, in turn, can enhance the pace of adoption across emerging economies and will help to maintain Asia-Pacific dominance within this segment.

China dominates the railway maintenance machinery market. With the world’s largest high-speed rail network and ongoing expansion of both passenger and freight lines, China holds a significant market share. The high public infrastructure spending, strong government backing, and push for advanced maintenance technologies are due to urbanization in the country. Moreover, by focusing on automation, digital inspection systems, and the electrification of railways, China is reinforcing its leadership position in the regional market.

North America is projected to be the fastest-growing region in the railway maintenance machinery market. The region is witnessing substantial investments in upgrading aging rail infrastructure, especially in the U.S. and Canada. Increased freight transportation, expansion of commuter rail services, and emphasis on safety compliance are creating strong demand for automated tamping machines, rail grinders, and smart inspection systems. Federal infrastructure plans and public-private partnerships are accelerating modernization efforts, with a focus on predictive maintenance and sustainability. Furthermore, technological advancements and the presence of major industry players are enhancing the region’s capacity for innovation, helping North America outpace other regions in market growth over the forecast period.

The U.S. railway maintenance machinery market is set to grow from USD 0.68 billion in 2024 to USD 1.12 billion by 2032, at a CAGR of 6.40%. Investments in rail modernisation, high-speed networks, and freight efficiency are driving growth. Demand for advanced machines such as tampers and rail grinders is being stimulated by government support in the form of the IIJA (Infrastructure Investment and Jobs Act). Advancing safety considerations and the aging infrastructure are also forcing automated maintenance technology.

Europe holds a significant share in the global railway maintenance machinery market due to its highly developed and interconnected rail networks. Countries like Germany, France, and other European countries invest billions in these electrified high-speed rail systems, where consistent, high-precision maintenance is essential. Sustained demand for efficient machines is driven by strict EU regulations on rail safety, rail emissions, and rail infrastructure quality. Besides, due to the emphasis on sustainable transport and alleviating road congestion, the region is driving us to use more rail, which will ultimately require advanced maintenance tools. A wide range of well-known global manufacturers based within the region combined with a relatively high-technology rail workforce, will continue to contribute to Europe as an important and competitive market, but one that is being further challenged by strong global competition from Asia-Pacific and North America.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Railway Maintenance Machinery Market are:

Railway maintenance machinery companies are Plasser & Theurer, Loram, Geismar, Speno International SA, China Railway Construction Corp., Nordco, Inc., ENVIRI CORPORATION (Harsco Rail), Rhomberg Sersa Rail Holding GmbH, ROBEL Bahnbaumaschinen GmbH, Salcef Group S.p.A.

Recent Development:

-

In June 2025, at the IAF 2025 exhibition in Münster, Plasser & Theurer unveiled 13 advanced rail maintenance machines, highlighting innovations in automation and sustainability. Key displays included the electric Unimat 09-2X for Norway and the CompactFlex 2×4 for metro lines. The event emphasized digital control, obstacle detection, and eco-friendly solutions shaping the future of railway maintenance.

-

In September 2024, at InnoTrans 2024, Plasser & Theurer and HYPERION unveiled the DURFOG system to reduce particulate pollution during railway maintenance. The technology uses fine water mist to bind dust at the source without additives, offering a cleaner and more efficient alternative to traditional systems. It enhances worker safety, lowers power and water usage, and is available as both a retrofit and factory-installed option.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.37 Billion |

| Market Size by 2032 | USD 6.96 Billion |

| CAGR | CAGR of 6.00% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Tamping Machine, Ballast Maintenance Machines, Rail Grinders, Track Lifting and Handling Machines, Others [Track Inspection Machines, etc.]) • By End-user (Government, Private Railway Operators, Contractors) • By Sales Type (New Sales, Aftermarket Sales) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Plasser & Theurer, Loram, Geismar, Speno International SA, China Railway Construction Corp., Nordco, Inc., ENVIRI CORPORATION (Harsco Rail), Rhomberg Sersa Rail Holding GmbH, ROBEL Bahnbaumaschinen GmbH, Salcef Group S.p.A. |